Post by : Zayd Kamal

In today’s world of economic uncertainty, building a diversified investment portfolio has become more critical than ever. Whether you're navigating market volatility, geopolitical instability, or inflation, having a diversified portfolio can help reduce risks and enhance the long-term stability of your investments. How to Build a Diversified Portfolio in Uncertain Times is a question many investors are asking, seeking ways to protect their wealth and grow it despite unpredictable economic conditions. This article will walk you through the essential steps of diversification and how you can make informed decisions during uncertain times to secure your financial future.

Diversification is a strategy designed to reduce investment risk by allocating investments across different asset classes, sectors, and regions. When you spread your investments in this way, the risk of significant losses in any one area is reduced, as different types of investments perform differently under varying market conditions. The core idea behind diversification is simple: don’t put all your eggs in one basket. How to Build a Diversified Portfolio in Uncertain Times requires recognizing that concentrating investments in one asset or sector exposes you to higher risks. For example, if you only invest in stocks, your portfolio might suffer during a market downturn. On the other hand, by diversifying into bonds, real estate, commodities, and even international markets, you minimize the impact of any one asset’s poor performance on your overall portfolio.

Before diving into building a diversified portfolio, it’s important to assess your risk tolerance. Risk tolerance refers to your ability to endure potential losses in your investments, and it’s influenced by factors like your age, financial goals, investment horizon, and personal comfort with risk. If you’re planning for retirement decades down the line, you may have a higher risk tolerance since you have more time to recover from any market downturns. However, if you're closer to retirement or need quick access to your funds, your risk tolerance may be lower, and you’ll likely prefer a more conservative approach to investing. How to Build a Diversified Portfolio in Uncertain Times starts with understanding your risk tolerance because it determines the proportion of higher-risk investments, like stocks, versus lower-risk investments, like bonds, in your portfolio.

A well-diversified portfolio includes a mix of asset classes. Stocks, or equities, are one of the most common components of a diversified portfolio. They offer growth potential but also come with volatility. By diversifying your stock investments across different sectors and regions, you can help reduce the risk associated with a single market or industry. While stocks are essential for long-term growth, they are also riskier during uncertain times.

Bonds, or fixed-income investments, provide more stability and are generally less volatile than stocks. They offer regular income through interest payments and can be a buffer during market downturns. Government bonds, especially from stable economies, or high-quality corporate bonds, are considered safer investments. During periods of economic uncertainty, having a larger portion of your portfolio in bonds can offer a more predictable return and reduce your overall risk exposure.

Another great option for diversification is real estate. Real estate investments can offer both income generation and long-term appreciation. Real estate can be accessed through direct ownership of properties or through real estate investment trusts (REITs), which offer exposure to real estate markets without the need to manage properties directly. Real estate often performs well during periods when other asset classes, like stocks, are underperforming. It can also act as a hedge against inflation, which is particularly important in uncertain times.

Commodities, such as gold, oil, and agricultural products, are another valuable asset class for diversification. Precious metals like gold are often seen as a safe-haven investment during times of economic instability or inflation. Commodities tend to perform well when traditional investments, like stocks and bonds, are struggling, making them a useful tool in balancing out a portfolio that may be vulnerable to market volatility.

Cash or cash equivalents, such as money market funds, also play an important role in diversification. Although these investments generally offer lower returns, they provide liquidity and stability, particularly when other asset classes are underperforming. Having cash available also allows you to take advantage of opportunities when market conditions improve or when you want to rebalance your portfolio.

In addition to asset-class diversification, How to Build a Diversified Portfolio in Uncertain Times includes the importance of geographic diversification. Investing only in one region, particularly in your home country, can expose you to regional risks. For example, if the U.S. market declines due to a recession or other economic challenges, a portfolio concentrated in U.S. stocks may suffer significant losses. By including international investments, either directly in foreign stocks or through international funds, you reduce the risks tied to a single country’s economic performance.

Geographic diversification not only helps protect your portfolio from country-specific risks, but it also provides access to growth in emerging markets or economies that may be less affected by the challenges facing more developed nations. By investing in a range of global assets, you tap into a broader array of opportunities for growth, while also reducing the overall risk of your portfolio.

Once you’ve built a diversified portfolio, it’s crucial to rebalance it regularly to ensure it remains aligned with your financial goals and risk tolerance. Over time, some investments will perform better than others, which can lead to an imbalance in the asset allocation. For example, if stocks have had a strong performance, they may make up a larger percentage of your portfolio than originally intended, increasing your risk exposure.

Rebalancing involves selling some of the over-performing assets and purchasing more of the under-performing ones to restore your original asset allocation. This ensures your portfolio stays aligned with your long-term objectives, whether they are focused on growth, income, or preservation of capital. Regularly reviewing your portfolio and adjusting it based on market conditions and your personal situation is a key part of How to Build a Diversified Portfolio in Uncertain Times.

Finally, when building a diversified portfolio, it’s important to maintain a long-term perspective. Uncertain times can lead to market volatility, but trying to time the market by making short-term moves can often lead to poor results. Instead, stay focused on your long-term goals and continue contributing to your diversified portfolio. The key to success during periods of uncertainty is to maintain discipline and avoid making emotional decisions based on temporary market movements.

This article focuses on How to Build a Diversified Portfolio in Uncertain Times by explaining the importance of diversification as a key strategy to reduce investment risk. It highlights the need for spreading investments across different asset classes, including stocks, bonds, real estate, commodities, and cash equivalents. Understanding your risk tolerance, balancing your asset allocation, and considering geographic diversification are essential steps in building a resilient portfolio. The article also emphasizes the significance of regular portfolio rebalancing and maintaining a long-term focus to navigate uncertain financial environments. By following these principles, investors can protect and grow their wealth even during times of economic uncertainty.

The information provided in this article is for general informational purposes only and does not constitute financial advice. DXB News Network does not guarantee the accuracy, completeness, or reliability of the content. All investments involve risks, and the strategies discussed may not be suitable for every individual. Readers are encouraged to consult with a licensed financial advisor before making any investment decisions based on the information provided. The views expressed in this article are based on current market conditions and trends, and may change over time.

Iran Strikes UAE, Qatar & Saudi Arabia After US-Israel Attacks

Iran launches missile strikes on Abu Dhabi, Dubai, Doha & Riyadh after US-Israel attacks, killing 1

Dhruti Vrajesh Shah: Painting Confidence, Culture, and Courage from Dubai

Discover the inspiring journey of Dubai based young artist Dhruti Vrajesh Shah and her rise as a con

UAE Condemns Missile Attacks, Warns of Response

UAE strongly condemns missile attacks on its territory and regional nations, reaffirms right to resp

UAE Education Experts Call for Responsible AI in Schools

On Emirati Education Day 2026, UAE experts said AI must support learning, not replace thinking, as s

UAE Foils Iranian Missile Attack, One Civilian Dies

UAE air defenses intercepted Iranian missiles. Debris caused minor damage and one civilian death. Si

UAE on High Alert, Ensures Public Safety Nationwide

UAE Ministry of Interior confirms highest readiness level, urges public to rely on official sources

Trump Announces Major US Combat Operations in Iran

President Donald Trump says US forces have launched major combat operations in Iran to destroy missi

Bank of Baroda Faces Abu Dhabi Legal Battle over NMC Collapse

Bank of Baroda’s involvement in Abu Dhabi litigation tied to the NMC Healthcare collapse raises repu

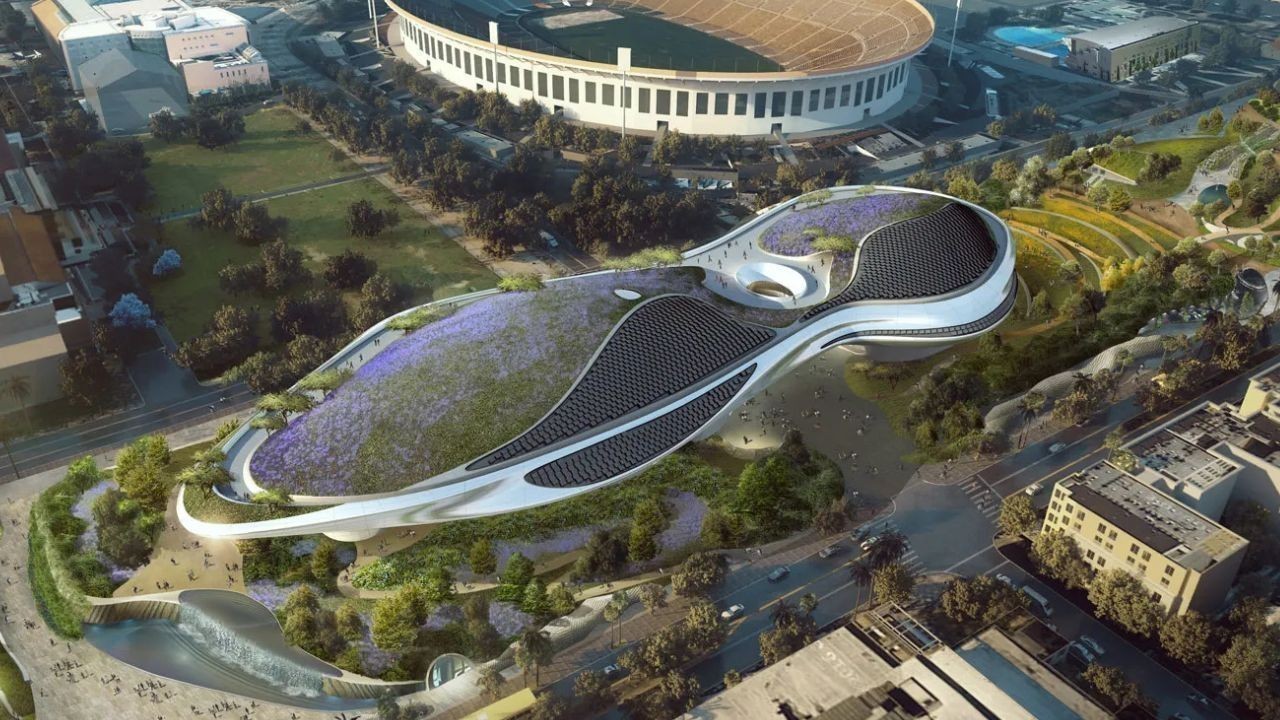

Top Museum Openings of 2026 Set to Transform Global Tourism

From Los Angeles to Abu Dhabi and Brussels, 2026 brings major museum launches—Lucas Museum, Guggenhe

UAE Tour Highlights UAE’s Strength in Hosting Global Sports Events

Abu Dhabi Sports Council says the successful UAE Tour reflects the UAE’s leading role in hosting maj

EU Seeks Clarity from US After Supreme Court IEEPA Ruling

European Commission urges full transparency from the US on steps after Supreme Court ruling, emphasi

SpaceX Launches 53 New Satellites for Expanding Starlink Network

SpaceX launches 53 Starlink satellites in two Falcon 9 missions, breaking reuse records and expandin

RTA Awards Contract for Phase II of Hessa Street Upgrade in Dubai

Phase II of Hessa Street Development to add bridges, tunnel, and upgraded intersections, doubling ca

UAE Gold Prices Today, Monday 16 February 2026: Dubai & Abu Dhabi Updated Rates

Gold prices in UAE on 16 Feb 2026 updated: 24K around AED 599.75/gm, 22K AED 555.25/gm, and 18K AED

Over 25 Ahmedabad Schools Receive Bomb Threat Email, Authorities Investigate

More than 25 schools in Ahmedabad evacuated after bomb threat emails mentioning Khalistan. Authoriti