Post by : Sam Jeet Rahman

Retail investors across markets are quietly but steadily reducing their equity exposure. This shift is not driven by panic alone, nor is it a sudden loss of faith in long-term wealth creation. Instead, it reflects a deeper change in how individual investors perceive risk, timing, liquidity, and uncertainty in the current economic environment.

Unlike institutional investors, retail participants react faster to lived realities—rising expenses, volatile headlines, job insecurity, and fluctuating portfolios. Understanding why this trend is happening helps investors make clearer, less emotional decisions rather than blindly following the crowd.

For years, retail investors were conditioned to believe that equities always recover and that staying invested is the only rational choice. While this is true over very long periods, short- to medium-term uncertainty has shifted priorities.

Many retail investors entered equity markets during strong bull phases. After seeing meaningful gains, the fear is no longer missing out—it is losing what has already been earned. Protecting gains feels more urgent than chasing new highs.

Frequent market swings exhaust retail investors mentally. Constant ups and downs make it harder to stay disciplined, especially for those without structured portfolios or professional guidance.

This emotional fatigue leads investors to reduce exposure not because equities are “bad,” but because mental comfort has become a priority.

One of the most significant drivers behind reduced equity exposure is higher interest rates.

When interest rates rise:

Borrowing costs increase for companies

Corporate profits face pressure

Future earnings are discounted more aggressively

This directly impacts equity valuations, especially growth stocks.

For years, equities dominated because safer instruments offered poor returns. Now, higher rates make capital-protection options look reasonable, pulling money away from equities.

Retail investors compare risk more carefully than before.

Inflation affects retail investors more directly than institutions.

Rising prices of essentials force investors to:

Maintain higher cash buffers

Avoid locking money into volatile assets

Prioritize flexibility

Equity investments, especially those without clear exit planning, feel restrictive during uncertain times.

Retail investors are increasingly aware that unexpected expenses can arise at any time. Reducing equity exposure improves liquidity and reduces dependency on selling assets during market downturns.

Not all retail investors are long-term by default.

Many investors are:

Planning home purchases

Funding education

Supporting families

Preparing for career transitions

For these investors, short- to medium-term goals matter more than long-term compounding.

Equities are excellent for long horizons, but misaligned timelines create stress, prompting partial exits.

Retail investors are becoming more informed.

Many portfolios are heavily tilted toward:

Equity mutual funds

Index funds

Tech or growth stocks

With market corrections, investors realize their portfolios lack balance.

Reducing equity exposure is often a step toward reallocation, not exit.

Retail investors react strongly to macro instability.

Geopolitical tensions

Supply chain disruptions

Policy uncertainty

Economic slowdown fears

While markets price risk dynamically, retail investors price peace of mind.

Global uncertainty encourages caution, especially among those without deep market experience.

Retail investors are exposed to constant financial news.

Conflicting expert opinions

Sensational headlines

Daily market predictions

This creates confusion and indecision.

When clarity disappears, reducing exposure feels like regaining control.

Retail memory is longer than often assumed.

Investors who lived through:

Sharp market crashes

Prolonged sideways markets

Slow recoveries

are less willing to stay fully exposed during uncertain phases.

Experience teaches that markets recover—but not always quickly.

Practical factors also play a role.

Some investors reduce exposure to:

Lock in gains

Optimize tax outcomes

Simplify compliance

This is not bearishness; it is financial housekeeping.

Modern retail investors are evolving.

Instead of asking “Will equities go up?”, investors ask:

How much risk am I carrying?

What happens if markets stay flat?

Can my portfolio survive stress?

Reducing equity exposure often improves portfolio resilience.

Retail investors increasingly align investments with goals.

When investors define:

Purpose

Time horizon

Required amount

they naturally reduce equity exposure for goals that are near or fixed.

This is discipline, not fear.

Retail investing is social.

When friends or online communities talk about:

Booking profits

Moving to safety

Waiting on sidelines

it reinforces similar actions.

Even informed investors are not immune to social validation.

Ease of access changes behavior.

With apps and instant execution, reducing exposure is no longer a complex decision.

Lower friction increases responsiveness—but also increases short-term reactions.

Not necessarily.

In many cases, investors are:

Rebalancing

De-risking

Improving liquidity

Matching investments to real-life needs

The real mistake is exiting without a plan.

It can be a rational move if:

Goals are near-term

Volatility causes stress

Portfolio is over-concentrated

Cash flow is uncertain

Emergency reserves are insufficient

Context matters more than market predictions.

It becomes harmful if driven by:

Panic selling

Short-term headlines

Fear without analysis

No reinvestment strategy

The cost of staying out too long is often higher than short-term losses.

Smart investors don’t ask whether to be “in” or “out” of equities. They ask:

How much exposure fits my life right now?

Can I stay invested without anxiety?

Is my portfolio diversified enough?

Reducing equity exposure can be a temporary adjustment, not a permanent decision.

Retail investors are not becoming risk-averse—they are becoming risk-aware. The reduction in equity exposure reflects maturity, experience, and alignment with real-world pressures.

Markets will always fluctuate. What matters is whether your portfolio allows you to sleep well while still working toward your future.

This article is intended for informational and educational purposes only and does not constitute investment, financial, or legal advice. Market conditions, risk tolerance, and financial goals vary for each individual. Readers should consult a certified financial advisor before making investment decisions or portfolio changes.

US Stocks Slide as AI Fears, Inflation and Oil Surge Weigh

US stocks dropped as AI disruption fears hit tech firms, inflation rose above forecasts, and oil pri

Pacific Prime Wins Top Honors at Cigna Awards 2026

Pacific Prime secured Top Individual Broker and Top SME Broker awards at Cigna’s Annual Broker Award

QatarEnergy Halts LNG Output After Military Attack

QatarEnergy has stopped LNG production after military attacks hit its facilities in Ras Laffan and M

Strong 6.1 Magnitude Earthquake Hits West Sumatra, No Damage

A 6.1 earthquake struck off West Sumatra, Indonesia. No casualties, damage, or tsunami alert reporte

Saudi Confirms Drone Strike on US Embassy Riyadh

Two drones hit the US Embassy in Riyadh, causing a small fire and minor damage. No injuries were rep

UAE Restarts Limited Flights as Regional Airspace Disruptions Continue

UAE restarts limited flights from Dubai as US-Israel attacks on Iran disrupt regional airspace, forc

Asia Faces Energy Shock After Iran Closes Strait

Iran shuts Strait of Hormuz amid US-Israel strikes, sending oil prices higher and raising serious en

Bank of Baroda Faces Abu Dhabi Legal Battle over NMC Collapse

Bank of Baroda’s involvement in Abu Dhabi litigation tied to the NMC Healthcare collapse raises repu

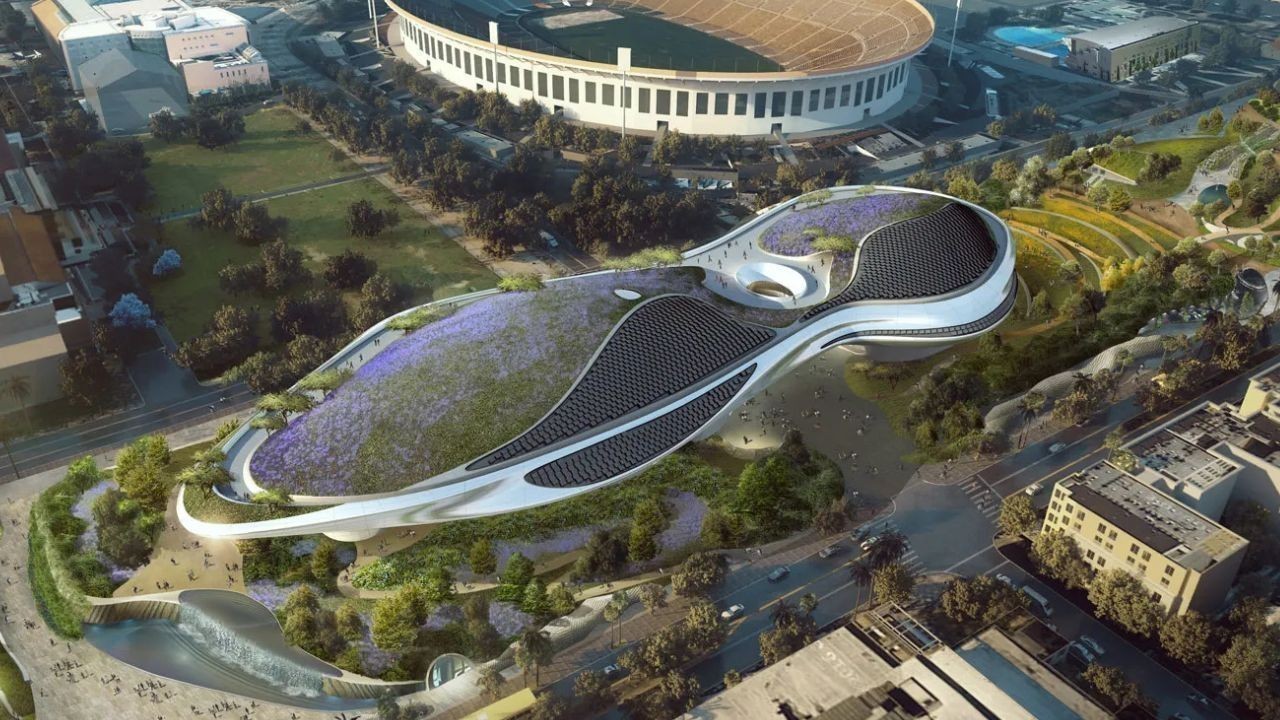

Top Museum Openings of 2026 Set to Transform Global Tourism

From Los Angeles to Abu Dhabi and Brussels, 2026 brings major museum launches—Lucas Museum, Guggenhe

UAE Tour Highlights UAE’s Strength in Hosting Global Sports Events

Abu Dhabi Sports Council says the successful UAE Tour reflects the UAE’s leading role in hosting maj

EU Seeks Clarity from US After Supreme Court IEEPA Ruling

European Commission urges full transparency from the US on steps after Supreme Court ruling, emphasi

SpaceX Launches 53 New Satellites for Expanding Starlink Network

SpaceX launches 53 Starlink satellites in two Falcon 9 missions, breaking reuse records and expandin

RTA Awards Contract for Phase II of Hessa Street Upgrade in Dubai

Phase II of Hessa Street Development to add bridges, tunnel, and upgraded intersections, doubling ca

UAE Gold Prices Today, Monday 16 February 2026: Dubai & Abu Dhabi Updated Rates

Gold prices in UAE on 16 Feb 2026 updated: 24K around AED 599.75/gm, 22K AED 555.25/gm, and 18K AED

Over 25 Ahmedabad Schools Receive Bomb Threat Email, Authorities Investigate

More than 25 schools in Ahmedabad evacuated after bomb threat emails mentioning Khalistan. Authoriti