Post by : Sam Jeet Rahman

Real estate buyers are often told one powerful line: “Buy early in a hyped location.” While location is undeniably important, not all popular locations deliver long-term value. In many cases, location hype artificially inflates property prices, creating short-term excitement but poor long-term returns. Buyers end up paying a premium for perception rather than fundamentals.

This article explains how location hype is created, why it pushes prices beyond real value, how it impacts long-term appreciation and rental returns, and how buyers can identify locations with real growth potential instead of temporary buzz.

Location hype refers to excessive market excitement around a particular area driven by announcements, marketing narratives, or speculative expectations rather than existing demand and infrastructure.

Hype-driven locations often experience:

Sudden price spikes

Aggressive marketing campaigns

Over-promised future development

Heavy investor speculation

These price increases are not always backed by economic activity, job creation, or livability.

Location hype rarely happens organically. It is often manufactured and amplified.

Planned metro lines, airports, highways, or smart city projects are frequently used to justify immediate price increases—even when completion is 8–10 years away.

Builders promote phrases like “next prime hub,” “future downtown,” or “upcoming IT corridor” to create urgency.

News articles, property portals, and influencer content repeat the same growth story, reinforcing buyer belief.

Early investors buy expecting quick appreciation, pushing prices higher and attracting more buyers.

This creates a self-fulfilling short-term price rise disconnected from present utility.

Even rational buyers are vulnerable to hype due to emotional and psychological factors.

Buyers worry prices will rise further, pushing them to buy before evaluating fundamentals.

Seeing others invest creates a sense of validation, even when data is weak.

Once prices rise, buyers assume higher prices equal higher value.

People overestimate how fast development will actually happen.

These biases cause buyers to pay tomorrow’s price for today’s reality.

In hyped locations, property prices rise faster than:

Rental demand

Job creation

Population movement

Infrastructure readiness

This gap creates a fragile pricing structure.

High purchase prices combined with low rental demand result in poor rental returns.

When hype fades, resale buyers disappear, making exits difficult.

Owners are forced to hold properties longer than planned just to break even.

Price without utility is not real value.

Most hyped locations rely heavily on future infrastructure promises.

Regulatory approvals

Funding issues

Political changes

Land acquisition challenges

Delays of 5–10 years are common, during which:

Capital remains locked

Opportunity cost increases

Maintenance costs add up

Buyers who priced in future growth early suffer from time value erosion.

When hype peaks, developers rush to launch projects.

Slower price appreciation

Rental competition

Discounted resale prices

Reduced negotiation power for sellers

Supply often outpaces real demand, weakening long-term returns.

Healthy real estate growth is driven by end users, not speculators.

Investors buying for appreciation

Minimal self-use demand

Short-term holding strategies

When speculative interest declines, prices stagnate or fall.

End-user demand creates stability; speculation creates volatility.

True appreciation is slow, consistent, and demand-driven.

Hyped locations often experience:

Sharp early rise

Long stagnation phase

Underperformance compared to fundamentals-based areas

In contrast, boring but functional areas with jobs, schools, hospitals, and transport often outperform quietly.

Rental demand depends on:

Job proximity

Daily commute convenience

Social infrastructure

Lifestyle amenities

Hyped locations often lack these in early years, leading to:

Vacant units

Lower-than-expected rents

Higher tenant turnover

Rental stress reduces cash flow and investor confidence.

Money locked into an overpriced property loses:

Alternative investment growth

Liquidity flexibility

Ability to upgrade or diversify

The biggest cost of hype is not loss—it’s missed opportunity elsewhere.

Avoid hype by focusing on fundamentals.

Areas with active residential occupancy, schools, hospitals, and offices show real usage.

Consistent rental demand indicates sustainable value.

Employment hubs drive long-term housing demand.

Completed roads, metros, and utilities matter more than planned ones.

If locals cannot afford to live there, growth will struggle.

Who lives here today?

Why would someone rent here now?

What happens if development is delayed?

Is demand organic or speculative?

Does price reflect utility or future promises?

Clarity protects capital.

Areas without hype often offer:

Stable appreciation

Strong rental demand

Better resale liquidity

Lower downside risk

Long-term wealth in real estate is built through patience, not excitement.

Avoid rushed decisions

Compare hype locations with established alternatives

Prioritize cash flow over appreciation stories

Negotiate aggressively in speculative zones

Invest where people already want to live

Location matters—but hype distorts reality. Paying inflated prices for future promises exposes buyers to stagnation, stress, and lost opportunity. Real estate success comes from understanding demand, timing, and utility—not chasing buzz.

In property investing, clarity beats excitement every time.

This article is intended for general informational purposes only and does not constitute real estate, legal, or financial advice. Property markets vary by region, timing, and economic conditions. Buyers and investors should conduct independent research and consult qualified professionals before making property purchase or investment decisions.

Predictheon Wins WHX Xcelerate Innovation Champion 2026

Predictheon won WHX 2026 Xcelerate, earning US$12,000, WHX 2027 space and global exposure for its AI

Omantel Launches Otech to Drive Oman’s Future Tech Vision

Omantel launches Otech to accelerate Oman’s digital transformation, strengthen data sovereignty, exp

Daimler Truck MEA Honors Top Distributors at EliteClass 2025

Daimler Truck MEA hosted EliteClass Awards 2025 in Dubai, honoring top distributors across 19 catego

King Mohammed VI Launches Safran Landing Gear Plant in Morocco

Morocco strengthens its aerospace leadership as King Mohammed VI launches Safran’s €280M landing gea

Qatar Emir Sheikh Tamim Arrives in UAE on Fraternal Visit

Qatar’s Emir Sheikh Tamim bin Hamad Al Thani arrived in Abu Dhabi on Saturday. UAE President Sheikh

Shaidorov Wins Stunning Olympic Gold as Malinin Falters

Kazakhstan’s Mikhail Shaidorov won men’s figure skating gold after US star Ilia Malinin fell twice.

Shakira’s 5-Show El Salvador Residency Boosts Bukele Image

Shakira’s five sold-out concerts in San Salvador highlight El Salvador’s security shift under Bukele

Why Drinking Soaked Chia Seeds Water With Lemon and Honey Before Breakfast Matters

Drinking soaked chia seeds water with lemon and honey before breakfast may support digestion hydrati

Morning Walk vs Evening Walk: Which Helps You Lose More Weight?

Morning or evening walk Learn how both help with weight loss and which walking time suits your body

What Really Happens When You Drink Lemon Turmeric Water Daily

Discover what happens to your body when you drink lemon turmeric water daily including digestion imm

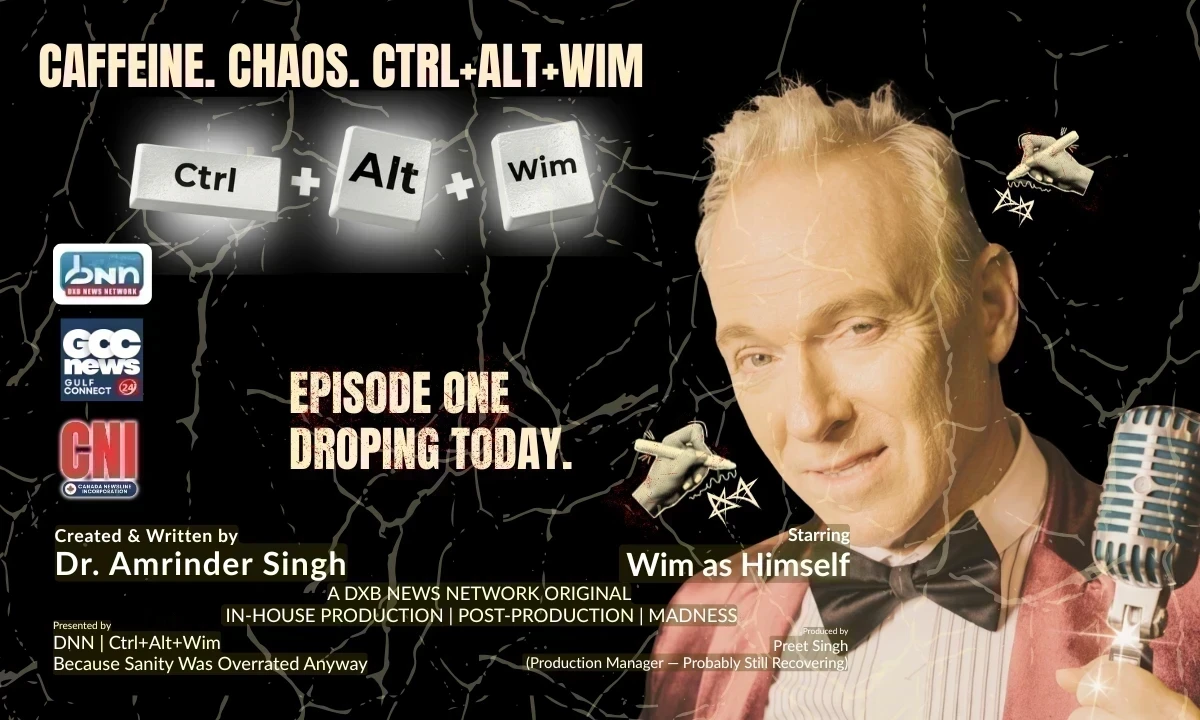

DXB News Network Presents “Ctrl+Alt+Wim”, A Bold New Satirical Series Starring Global Entertainer Wim Hoste

DXB News Network premieres Ctrl+Alt+Wim, a bold new satirical micro‑series starring global entertain

High Heart Rate? 10 Common Causes and 10 Natural Ways to Lower It

Learn why heart rate rises and how to lower it naturally with simple habits healthy food calm routin

10 Simple Natural Remedies That Bring Out Your Skin’s Natural Glow

Discover simple natural remedies for glowing skin Easy daily habits clean care and healthy living ti

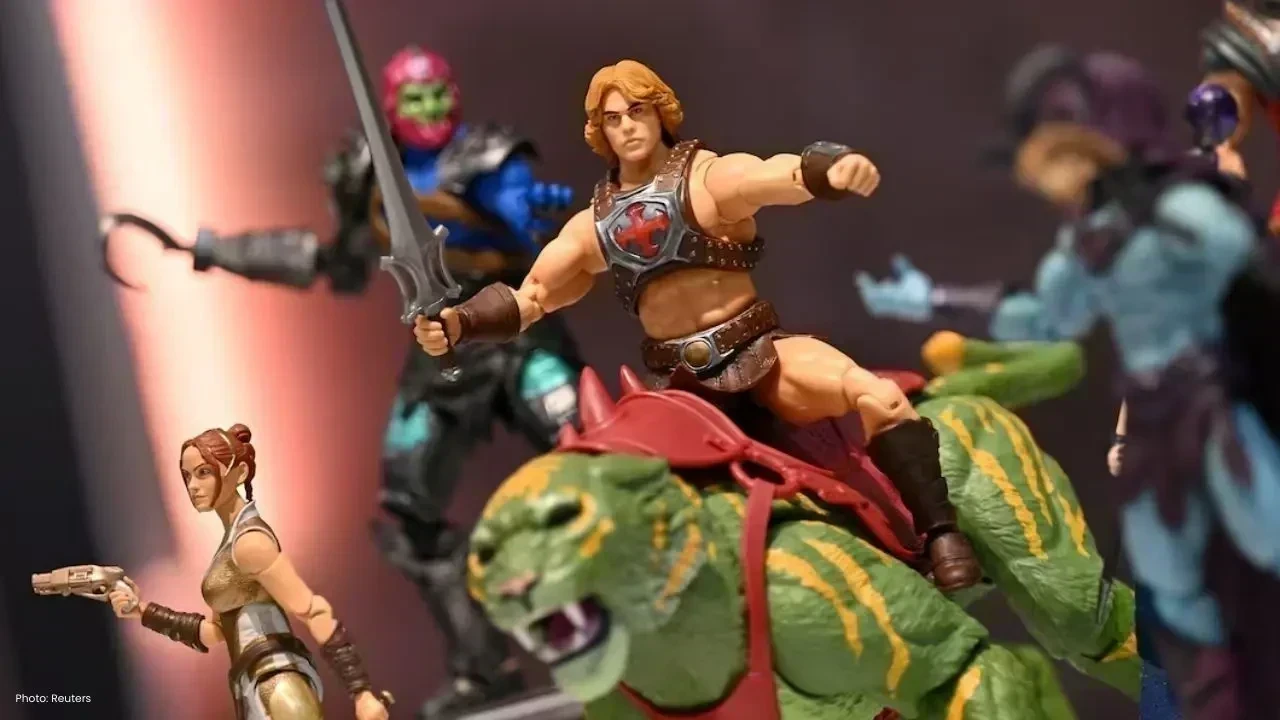

Mattel Revamps Masters of the Universe Action Figures for Upcoming Film

Mattel is set to revive Masters of the Universe action figures in sync with their new movie, ignitin

China Executes 11 Members of Infamous Ming Family Behind Myanmar Scam Operations

China has executed 11 Ming family members, linked to extensive scams and gambling in Myanmar, causin