Post by : Sam Jeet Rahman

The introduction of corporate tax in the UAE marks a major shift for businesses that were previously used to a largely tax-free environment. While the tax structure remains competitive compared to global standards, small business owners must now understand how corporate tax works to avoid penalties, ensure compliance, and plan finances properly. Many misconceptions exist, and clarity is essential to make confident business decisions.

UAE corporate tax is a federal tax applied to business profits, not revenue. This means tax is calculated on net profits after allowable expenses, not on total income. The system is designed to align with international standards while remaining business-friendly, especially for startups and small enterprises.

Corporate tax applies to financial years starting on or after 1 June 2023. Businesses are required to assess tax liability based on their financial year, not the calendar year. Understanding your company’s financial year is essential to determine when tax filing obligations begin.

Corporate tax applies to most businesses operating in the UAE, including mainland companies, free zone entities under certain conditions, partnerships, and sole proprietors with business income. Individuals earning income from employment are not subject to corporate tax on their salaries. Freelancers and self-employed professionals may be subject to corporate tax if their income qualifies as business income above the exemption threshold.

The UAE corporate tax structure is straightforward. Businesses with taxable profits up to AED 375,000 are taxed at 0 percent. Profits above AED 375,000 are taxed at 9 percent. This threshold is designed to support small businesses and startups by reducing their initial tax burden.

Taxable income includes profits from regular business activities, service income, trading income, and certain investment-related earnings. It excludes personal income, such as salaries earned as an employee, and certain exempt income categories. Accurate accounting records are essential to correctly identify taxable profits.

One of the most important aspects of corporate tax planning is understanding allowable deductions. Expenses that are wholly and exclusively incurred for business purposes are generally deductible. This includes rent, salaries, utilities, marketing costs, professional fees, and office expenses. Personal expenses cannot be claimed, even if paid through the business account.

Free zone companies may continue to benefit from 0 percent corporate tax on qualifying income if they meet specific conditions. However, not all income may qualify for exemption. Free zone businesses must still register for corporate tax and comply with reporting requirements, even if their effective tax rate remains zero.

Small businesses benefit significantly from the AED 375,000 profit threshold. Many small enterprises will either pay no corporate tax or a minimal amount. However, registration, record-keeping, and filing requirements still apply regardless of tax payable. Ignoring compliance obligations can lead to penalties.

Businesses must register for corporate tax with the relevant authority within the specified timelines. Registration is mandatory even if the business expects to pay zero tax. Delayed registration may result in fines, making early compliance essential.

Corporate tax returns must be filed annually. Businesses are required to submit accurate financial statements and calculate taxable income correctly. Returns are filed after the end of the financial year, and taxes must be paid within the prescribed deadlines. Late filing or incorrect reporting can lead to penalties.

Maintaining accurate books of accounts is no longer optional. Businesses must keep records of income, expenses, invoices, and supporting documents. These records form the basis of tax calculations and may be reviewed during audits. Poor record-keeping increases the risk of errors and penalties.

Corporate tax and VAT are separate obligations. VAT applies to sales and is collected from customers, while corporate tax applies to business profits. Paying VAT does not reduce corporate tax liability directly, although VAT-related expenses may be deductible as business costs.

Small business owners may need to review pricing strategies to maintain profitability. While the 9 percent rate is relatively low, ignoring tax impact can affect cash flow. Planning profit margins with tax obligations in mind ensures long-term sustainability.

Many believe that corporate tax applies to total revenue rather than profit, which is incorrect. Others assume that free zone companies are completely exempt from all tax obligations, which is also inaccurate. Another misconception is that small businesses do not need to register if they earn below the threshold, which is false.

Separate personal and business finances clearly.

Track expenses consistently throughout the year.

Understand your profit position well before year-end.

Consult professionals when needed for clarity.

Avoid last-minute compliance to reduce errors.

Freelancers operating under a trade license may fall under corporate tax if their business income exceeds the exemption threshold. Maintaining clear records and understanding deductible expenses helps reduce taxable profits legally and efficiently.

Failure to register, file returns, or pay taxes on time can result in penalties. The UAE emphasizes compliance and transparency, making it essential for businesses to take corporate tax obligations seriously from the beginning.

While tax introduces additional responsibilities, it also strengthens business credibility. Proper compliance improves financial discipline, transparency, and investor confidence. It positions businesses for sustainable growth and easier access to banking and funding opportunities.

UAE corporate tax is designed to be simple, competitive, and supportive of small businesses. With a high exemption threshold and a low standard rate, the system encourages compliance without excessive burden. Understanding the basics, maintaining proper records, and planning ahead allow small business owners to operate confidently in the evolving UAE business environment.

This article is for informational purposes only and does not constitute legal or tax advice. Corporate tax rules may vary based on business structure and activity. Business owners should assess their individual situation or seek professional guidance before making tax-related decisions.

Predictheon Wins WHX Xcelerate Innovation Champion 2026

Predictheon won WHX 2026 Xcelerate, earning US$12,000, WHX 2027 space and global exposure for its AI

Omantel Launches Otech to Drive Oman’s Future Tech Vision

Omantel launches Otech to accelerate Oman’s digital transformation, strengthen data sovereignty, exp

Daimler Truck MEA Honors Top Distributors at EliteClass 2025

Daimler Truck MEA hosted EliteClass Awards 2025 in Dubai, honoring top distributors across 19 catego

King Mohammed VI Launches Safran Landing Gear Plant in Morocco

Morocco strengthens its aerospace leadership as King Mohammed VI launches Safran’s €280M landing gea

Qatar Emir Sheikh Tamim Arrives in UAE on Fraternal Visit

Qatar’s Emir Sheikh Tamim bin Hamad Al Thani arrived in Abu Dhabi on Saturday. UAE President Sheikh

Shaidorov Wins Stunning Olympic Gold as Malinin Falters

Kazakhstan’s Mikhail Shaidorov won men’s figure skating gold after US star Ilia Malinin fell twice.

Shakira’s 5-Show El Salvador Residency Boosts Bukele Image

Shakira’s five sold-out concerts in San Salvador highlight El Salvador’s security shift under Bukele

Why Drinking Soaked Chia Seeds Water With Lemon and Honey Before Breakfast Matters

Drinking soaked chia seeds water with lemon and honey before breakfast may support digestion hydrati

Morning Walk vs Evening Walk: Which Helps You Lose More Weight?

Morning or evening walk Learn how both help with weight loss and which walking time suits your body

What Really Happens When You Drink Lemon Turmeric Water Daily

Discover what happens to your body when you drink lemon turmeric water daily including digestion imm

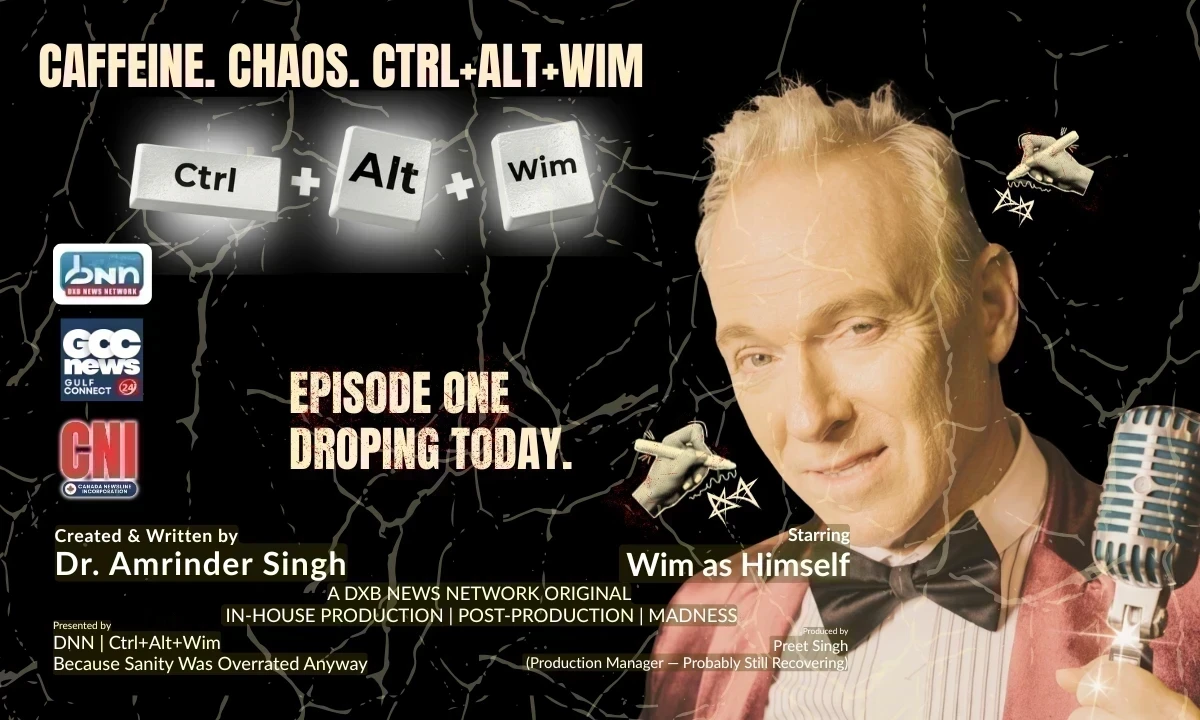

DXB News Network Presents “Ctrl+Alt+Wim”, A Bold New Satirical Series Starring Global Entertainer Wim Hoste

DXB News Network premieres Ctrl+Alt+Wim, a bold new satirical micro‑series starring global entertain

High Heart Rate? 10 Common Causes and 10 Natural Ways to Lower It

Learn why heart rate rises and how to lower it naturally with simple habits healthy food calm routin

10 Simple Natural Remedies That Bring Out Your Skin’s Natural Glow

Discover simple natural remedies for glowing skin Easy daily habits clean care and healthy living ti

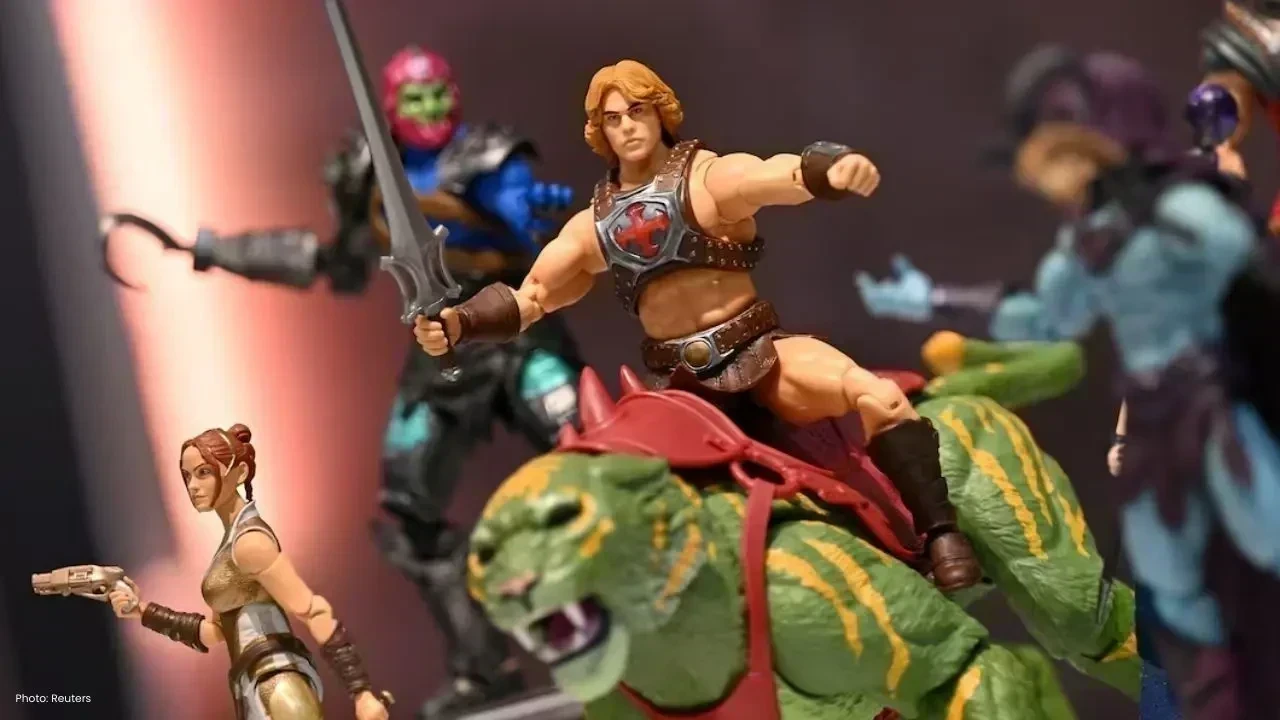

Mattel Revamps Masters of the Universe Action Figures for Upcoming Film

Mattel is set to revive Masters of the Universe action figures in sync with their new movie, ignitin

China Executes 11 Members of Infamous Ming Family Behind Myanmar Scam Operations

China has executed 11 Ming family members, linked to extensive scams and gambling in Myanmar, causin