Post by : Anis Karim

On January 7, the trading atmosphere on Dalal Street hints at a move from overall buying towards more selective approaches. Following a lengthy rally, traders are now focusing on firms with potential short-term catalysts. Today's lineup features an interesting array of companies across various sectors. Leading the way is Titan, which continues to rise even amidst a market pullback. In pharmaceuticals, Biocon grapples with growth visibility versus cost concerns, while Godrej Construction is tied to infrastructure developments. The Lodha Group reflects the confidence in the premium housing market, and YES Bank is under scrutiny as investors assess its asset quality and credit performance.

As investors approach the session, they are torn between optimism from robust domestic flows through systematic investment plans and caution due to rising valuations. This tension results in certain stocks shining while others drag down market averages. Understanding the dynamics behind each stock movement becomes necessary. This article will delve into these companies, the sectors they impact, and how traders might navigate the day ahead.

Titan has positioned itself as a leading consumer brand in India, with operations spanning jewelry, watches, eyewear, and emerging lifestyle sectors. Recent sessions have seen the stock gaining traction, reflecting trust from long-term investors. Market observers link this enthusiasm to anticipated strong sales during the wedding season and expanding store network in smaller locations, mitigating reliance on metropolitan areas. The business thrives as consumers gravitate towards reputable brands ensuring quality and customer service.

Being directly intertwined with precious metals, particularly gold, Titan faces pressure when bullion prices fluctuate. The company has been proactive in hedging these risks through strategic inventory management and focusing on high-margin studded products. Today, traders are keen to see if Titan can maintain its recent three percent increase and keep the positive momentum going, as strong performances often boost overall consumer sentiment.

Titan's stock chart has shown resilience compared to broader market trends, maintaining positions above key moving averages. This suggests a lack of control from sellers, making it attractive for momentum traders looking for fresh entries. A surge in trading volume could catalyze further gains, making it a key focus for January 7.

Biocon stands at the forefront of the new-age pharmaceutical sector, particularly in biologics and contract research. Recently, the sector has faced tightening as investors express concern over pricing in international markets. However, Biocon’s product pipeline offers promising revenue prospects, albeit accompanied by rising research costs. Market watchers will be attentive to any news regarding product approvals or collaborations.

Pharmaceutical exporters like Biocon gain when the dollar appreciates against the rupee, though inflation in input costs has softened past gains. Today's trading may reveal if Biocon can uphold its position amid dips in larger pharmaceutical stocks like Cipla, signaling a possible rotation within the sector.

Biocon has seen spikes in trading volumes that attract short-term traders. The current technical setup shows consolidation near vital support levels, and a bounce from these spots could see quick positioning. Many traders are preferring a wait-and-see stance until clarity on earnings and margins emerges.

Tied to the infrastructure and urban development narrative, Godrej Construction is expected to see increased activity as the Indian economy announces major projects across roads, metro systems, and commercial spaces. Stakeholders expect the company to gain from both government initiatives and private project inflows. Traders today will look to see if the stock can benefit from this positive sentiment.

The construction sector faces direct risk from rising cement, steel, and energy prices. High crude oil prices typically inflate logistics and operational expenses. Godrej Construction needs to show navigation through these cost pressures with efficient procurement strategies to maintain their margins.

Recent chart movements indicate a slow recovery after a consolidation phase. Traders often interpret such patterns as early accumulation signs. With supportive volume, Godrej Construction could see active participation, positioning it as a notable watchlist entry for the day.

Lodha, a prominent name in real estate, reflects growing confidence in the premium housing segment. Urban buyers are increasingly drawn to larger living spaces and better amenities post-pandemic. The group's focus remains on organized developments in Mumbai and other major cities. Today, sales performances and upcoming project announcements may significantly impact stock performance.

The health of the real estate market is heavily influenced by home loan interest rates. Rising bond yields complicate affordability, impacting stock valuations. Weak signals from ONGC due to crude price fluctuations also pose inflation concerns. Lodha must exhibit strong cash flows to keep investor confidence intact.

The stock has been moving within a consolidation phase with attempts at breakout. Chart analysts believe that overcoming immediate resistance could signal a new upward trend. Today's volume will be crucial for its trajectory, marking Lodha as a key player in organized real estate.

YES Bank continues to draw focus as trading volumes surge. While major private banks have remained flat, YES Bank presents a narrative where valuation comfort aligns with a turnaround story. Observers are presently assessing asset quality improvement and credit growth. Today's trading activity will indicate if this optimism translates into stock performance.

The success of banking stocks often hinges on their non-performing asset metrics. Reductions in slippages can quickly enhance profitability. YES Bank must consistently demonstrate recovery in asset quality to capture long-term institutional interest. Until this clarity arises, the stock is more appealing to short-term traders over conservative investors.

YES Bank has recently exhibited sideways price movements, with robust support evident near lower averages. Mixed signals from momentum oscillators are common. Traders frequently leverage such patterns for strategies focused on range trading, keeping YES Bank at the forefront of interest for today's market.

The previous lengthy rally on Dalal Street has elevated valuations across many sectors. As January 7 approaches, traders are opting for more selective strategies focusing on price-earnings ratios. Consumer brands such as Titan maintain their premium valuations thanks to solid cash flow insights, while firms like Biocon require clearer earnings details before stronger market positions are assumed.

Strong retail engagement via systematic investment plans continues to buoy the market, staving off panic. Even with the Sensex dropping 120 points, mid-caps have displayed resilience. Traders anticipate that domestic investment will persist in buying dips among quality stocks, potentially supporting Titan and technology stocks. Meanwhile, allocations in pharmaceuticals and energy are kept lighter.

Recent volatility in Asian and European markets due to tariff discussions and commodity stability cannot be overlooked. Crude prices impact energy stocks like ONGC and have indirect effects elsewhere. Market participants will assess whether domestic stocks can withstand these external signals. The gentle dip in indices should be considered an alignment with global trends rather than an isolated event.

Experts believe the next upward movement of the market may necessitate participation from IT and consumer sectors. Titan's still-rising channel could continue to attract attention, while technology valuations seem more appealing compared to pharmaceuticals and energy sectors. As a result, traders may shift portions of their investments from pharmaceuticals to IT on cautious days like January 7.

Biocon’s performance remains a bellwether to determine if rotation within pharmaceuticals is completed. Escalating research and compliance costs have emerged as pressing issues. Though export demand and currency factors traditionally help, the uplift from input costs continues to temper the overall advantage. Without clearer earnings trajectories, many traders are inclined to remain observational.

Names in construction such as Lodha and Godrej Construction directly feel the impacts of energy price fluctuations. Recent declines in ONGC due to high crude have negatively influenced many paired sectors. Until clearer policy adjustments are signaled on subsidies, traders are advised to maintain minimal exposure. January 7 is key to assessing whether energy stocks will recover.

YES Bank must illustrate consistent asset quality recovery. The stock draws significant interest from short-term participants rather than conservative investors. Chart analysts often rely on sideways patterns for strategic trading. While larger banking stocks have remained stable, YES Bank presents a unique blend of valuation appeal and turnaround potential.

January 7 offers a rich variety of trading possibilities drawn from multiple sectors. Titan shines at the forefront of the consumer market with brand loyalty and seasonal demand, while Biocon reflects the pharmaceutical landscape with visibility challenges. Godrej Construction and Lodha resonate with infrastructure and premium property trends, influenced by macroeconomic factors. YES Bank finds itself in the spotlight due to active trading and appealing valuations. Despite the volatility projected for the session, promising opportunities will arise within businesses showcasing solid operational metrics and cash flow assurance.

Disclaimer

The content in this article is intended for informative purposes regarding market movements and company narratives. It should not serve as financial advice to buy or sell any securities. Investing in equities carries risks, and decisions should involve personal research or consultation with certified advisors.

Predictheon Wins WHX Xcelerate Innovation Champion 2026

Predictheon won WHX 2026 Xcelerate, earning US$12,000, WHX 2027 space and global exposure for its AI

Omantel Launches Otech to Drive Oman’s Future Tech Vision

Omantel launches Otech to accelerate Oman’s digital transformation, strengthen data sovereignty, exp

Daimler Truck MEA Honors Top Distributors at EliteClass 2025

Daimler Truck MEA hosted EliteClass Awards 2025 in Dubai, honoring top distributors across 19 catego

King Mohammed VI Launches Safran Landing Gear Plant in Morocco

Morocco strengthens its aerospace leadership as King Mohammed VI launches Safran’s €280M landing gea

Qatar Emir Sheikh Tamim Arrives in UAE on Fraternal Visit

Qatar’s Emir Sheikh Tamim bin Hamad Al Thani arrived in Abu Dhabi on Saturday. UAE President Sheikh

Shaidorov Wins Stunning Olympic Gold as Malinin Falters

Kazakhstan’s Mikhail Shaidorov won men’s figure skating gold after US star Ilia Malinin fell twice.

Shakira’s 5-Show El Salvador Residency Boosts Bukele Image

Shakira’s five sold-out concerts in San Salvador highlight El Salvador’s security shift under Bukele

Why Drinking Soaked Chia Seeds Water With Lemon and Honey Before Breakfast Matters

Drinking soaked chia seeds water with lemon and honey before breakfast may support digestion hydrati

Morning Walk vs Evening Walk: Which Helps You Lose More Weight?

Morning or evening walk Learn how both help with weight loss and which walking time suits your body

What Really Happens When You Drink Lemon Turmeric Water Daily

Discover what happens to your body when you drink lemon turmeric water daily including digestion imm

DXB News Network Presents “Ctrl+Alt+Wim”, A Bold New Satirical Series Starring Global Entertainer Wim Hoste

DXB News Network premieres Ctrl+Alt+Wim, a bold new satirical micro‑series starring global entertain

High Heart Rate? 10 Common Causes and 10 Natural Ways to Lower It

Learn why heart rate rises and how to lower it naturally with simple habits healthy food calm routin

10 Simple Natural Remedies That Bring Out Your Skin’s Natural Glow

Discover simple natural remedies for glowing skin Easy daily habits clean care and healthy living ti

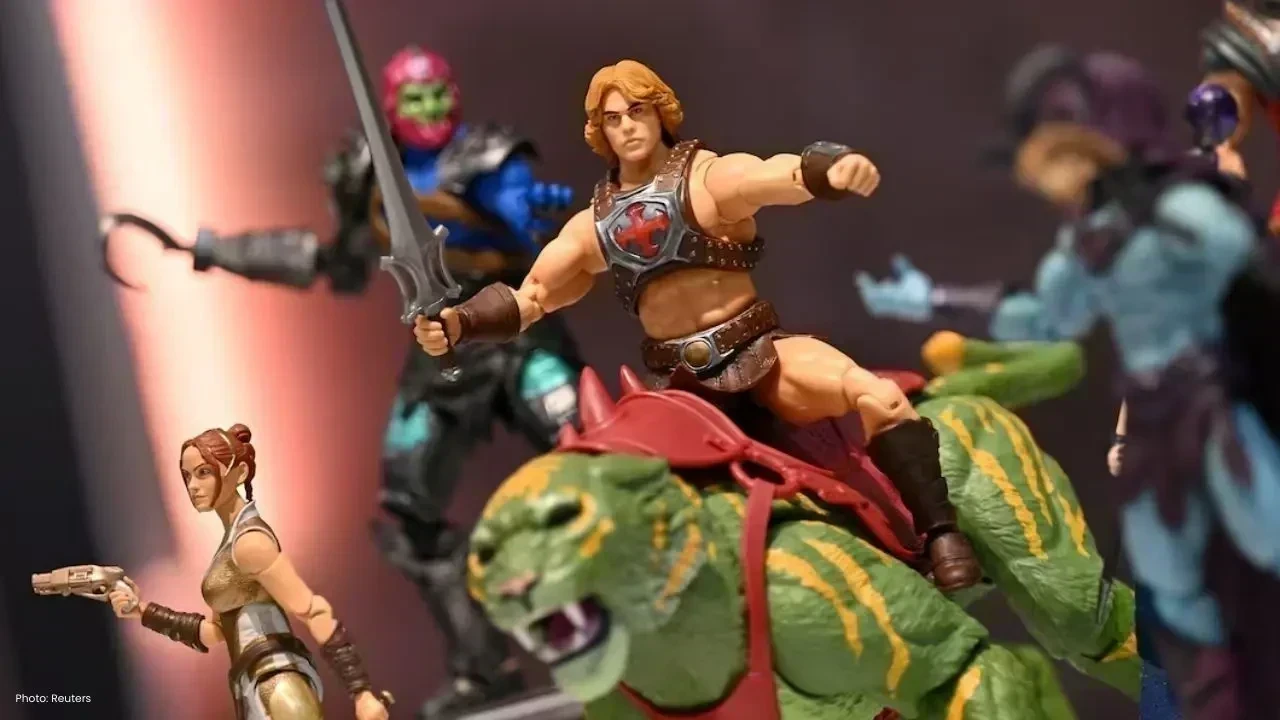

Mattel Revamps Masters of the Universe Action Figures for Upcoming Film

Mattel is set to revive Masters of the Universe action figures in sync with their new movie, ignitin

China Executes 11 Members of Infamous Ming Family Behind Myanmar Scam Operations

China has executed 11 Ming family members, linked to extensive scams and gambling in Myanmar, causin