Post by : Anis Karim

On January 28, Indian equity markets are bracing for a lively trading session, buoyed by early indicators pointing to heightened optimism. The offshore GIFT Nifty futures indicate a strong opening for the Nifty 50 index, reflecting an uplift in investor sentiment influenced by mixed global trends and the activity of domestic institutional investors. Today’s spotlight features a mix of large-cap and mid-cap stocks, with traders keenly anticipating movements related to earnings, strategic corporate changes, and overarching macroeconomic conditions.

Key players to watch include leaders in the resource and metal sectors, prominent industrial and automotive firms, a telecom operator on the rebound, as well as established consumer and engineering companies. This stock watch offers an overview of significant companies likely to attract attention in today’s trading and outlines the market influences likely to shape price movements.

To fully appreciate individual stocks, it's essential to consider the current market context. The previous trading day ended positively for Indian benchmark indices, with both the Sensex and Nifty 50 closing higher, driven by gains in financial sectors and banking stocks. Despite some net selling by foreign institutional investors, strong buying from domestic entities created a favorable balance that often encourages volatility while supporting the index’s resilience.

Global markets displayed mixed trends. Although some U.S. equities have achieved new highs, overall market reactions remain sensitive to macroeconomic data, central bank directives, and shifts in commodity prices. Asian markets have shown modest gains, contributing to a supportive atmosphere for Indian pre-market sentiment.

Investors should keep an eye on stocks exhibiting robust fundamentals and timely catalysts, preparing for corporate earnings reports and critical macroeconomic events such as the forthcoming Union Budget.

Vedanta Ltd., a diversified conglomerate engaged in metals, mining, oil, and gas, stands out as a large-cap stock to monitor. Shares of Vedanta, alongside its subsidiary Hindustan Zinc, have drawn interest following key corporate developments. Investors are particularly attentive to Vedanta’s planned stake sale through an Offer for Sale (OFS) in Hindustan Zinc, potentially affecting investor sentiment and liquidity dynamics in the metals sector.

Vedanta's extensive portfolio, which encompasses various mineral and energy assets, typically reflects commodity price shifts and global demand patterns. Traders are likely to analyze this stock’s movements in light of news and price trajectories for metals like zinc, aluminum, and oil. Recent participation from institutional investors in Vedanta shares indicates heightened interest in the company’s strategic restructuring, making it a notable contender for trading today.

Hindustan Zinc Ltd., a leading zinc producer operating under Vedanta, has experienced robust share price growth recently, supported by solid fundamentals and favorable metal prices. Over the past half-year, Hindustan Zinc has yielded considerable returns due to strong operational performance aligned with global metal demand.

With appealing revenue metrics, profitability, and a solid dividend yield, Hindustan Zinc stands out among its peers in the metals industry. As macroeconomic elements such as industrial demand and commodity pricing evolve, this stock is expected to capture significant trading interest on January 28.

Larsen & Toubro Ltd. (L&T), a top-tier engineering and infrastructure firm, stays in the limelight due to its varied project portfolio and substantial order book. L&T’s engagement across multiple sectors, including construction, power, defense, and technology services, helps bolster its revenue streams and shields it from sector-specific downturns.

Investors are keenly watching L&T for any near-term contract wins and execution performance. Historically perceived as an indicator of industrial and capital spending trends in India, L&T benefits from positive outlooks surrounding public sector investments, which could influence its stock movement today.

Maruti Suzuki India Ltd. is a key player in the automotive sector, especially with expectations for significant earnings growth in the December quarter. The company has consistently delivered strong volumes and expanded its product lines, catering to various passenger segments and emerging consumer preferences.

Market watchers are examining Maruti’s pricing strategies and cost management amidst inflation, as well as upcoming model launches, as vital indicators of future profitability. Being India’s largest passenger vehicle maker, Maruti often sets trends in the sector, making its stock a focal point for both short and long-term performance reflections.

Vodafone Idea Ltd. (Vi), the telecom operator grappling with debt, is making headlines following recent fiscal updates. The company has reported a reduced net loss for the quarter ending December 2025, attributed to enhancements in customer service and cost-cutting strategies.

While the broader telecom landscape faces challenges from competition and funding needs, Vodafone Idea’s latest performance hints at a potential turnaround, driven by restructuring measures and network upgrades. Investors are expected to react to further fundraising updates or any shifts in market share dynamics that could affect the company's profitability trajectory.

Cochin Shipyard Ltd., a public sector player in shipbuilding, is also under close observation as traders weigh opportunities linked to maritime infrastructure growth, defense contracts, and export orders. The prospects for the shipbuilding industry often align with government policies, global trade patterns, and strategic naval investment.

Investors may look for updates on Cochin Shipyard’s order book, contract wins, and government incentives aimed at enhancing domestic maritime capabilities. Given its government ties and a proven track record in project execution, this company could attract heightened trading activity.

Marico Ltd., a leading FMCG entity renowned for its beauty and wellness brands, has garnered trader interest. FMCG stocks often serve as indicators of domestic consumption patterns and resilience in consumer demand adjusted for inflation.

Key drivers for Marico's stock include its earnings trajectory, brand strength, and market share in core products. As consumer staples typically act defensively during market volatility, Marico’s stock could either maintain stability or achieve targeted gains amid positive consumption sentiment.

ABB India Ltd., part of a global engineering and automation group, is positioned for attention as investors consider industrial capital expenditures and technology adoption trends. Stocks in this niche often benefit from modernization efforts, renewable energy initiatives, and spending on automation in various manufacturing sectors.

ABB India's financial results, order intake, and focused strategies on efficiency and automation may influence trading decisions. With multiple industrial themes gaining traction, this stock offers exposure to broader technology-driven industrial growth.

Textile stocks like Titagarh Textile are emerging as compelling mid-cap options. The sector’s performance correlates with both domestic demand and export competitiveness, affected by currency fluctuations and raw material prices.

Titagarh Textile’s operational efficiency and balance sheet status are critical factors that may attract investor attention. A sector rotation toward textiles and consumer-centric mid-caps might be observed as markets seek diversification beyond large-cap dominance.

Metro Brands, a retail-focused company operating a nationwide footwear outlet network, is another stock to watch among small to mid-caps. The retail sector often provides early insights into consumer sentiment and spending behaviors.

Performance metrics for retail firms include same-store sales changes, expansion plans, product diversity, and seasonal demand trends. Investors examining retail stocks typically equate consumption patterns with valuation metrics to evaluate short-term performance potential.

A variety of market factors are shaping trading strategies on January 28. Activity from foreign institutional investors, domestic flows, and GIFT Nifty indicators set the stage for index movements. Upcoming economic data releases, critical policy decisions such as the Union Budget, and global central bank actions are all likely to sway market sentiment.

Commodity pricing trends, foreign exchange shifts, and earnings reports from significant companies play crucial roles in guiding traders’ risk profiles. Amid such conditions, a diversified approach across sectors coupled with balanced portfolios often mitigates volatility while enabling opportunities from thematic strengths.

As January 28 approaches, trading is set against a backdrop of mixed global signals and positive domestic trends. Stocks such as Vedanta, Hindustan Zinc, L&T, Maruti Suzuki, Vodafone Idea, Cochin Shipyard, Marico, ABB India, Titagarh Textile, and Metro Brands showcase a blend of large-cap reliability and mid-cap potential.

Investors should consider fundamental analysis, immediate catalysts, technical parameters, and broader market indicators when strategizing for the session. With current trends and anticipated economic data taken into account, a selective focus on high-conviction stocks might yield notable performance differentials.

Disclaimer: This article is based on an aggregation of market data and public information available at the time of writing. It serves informational purposes and should not be construed as financial advice. Investment decisions should be informed by your individual research or discussions with a qualified financial advisor.

Thousands March in Caracas, Demand Maduro’s Release

Thousands of Maduro supporters marched in Caracas, one month after a deadly US raid ousted him, dema

Sheikh Mohammed Visits WGS 2026 Media, Cybersecurity Centres

Sheikh Mohammed visited the WGS 2026 media and cybersecurity centres in Dubai, highlighting media’s

Sitharaman Meets World Bank President Ajay Banga on Viksit Bharat Plan

Finance Minister Nirmala Sitharaman met World Bank President Ajay Banga to discuss the new Country P

PM Shehbaz Meets WBG President Ajay Banga to Boost Pakistan Reforms

PM Shehbaz Sharif meets World Bank President Ajay Banga, discussing economic reforms, development pr

Italy’s Unemployment Hits Record Low of 5.6% in December

Italy’s unemployment fell to a historic 5.6% in December, the lowest since 2004, with employment at

Australian Open Champ Rybakina Headlines Dubai Tennis Elite Field

Fresh from her Australian Open triumph, Elena Rybakina returns to Dubai as a resident and WTA 1000 c

Deloitte Champions Enterprise & Public Sector Innovation at Web Summit Qatar

Deloitte leads masterclasses on in-country cloud, AI, and tech governance at Web Summit Qatar 2026,

Why Drinking Soaked Chia Seeds Water With Lemon and Honey Before Breakfast Matters

Drinking soaked chia seeds water with lemon and honey before breakfast may support digestion hydrati

Morning Walk vs Evening Walk: Which Helps You Lose More Weight?

Morning or evening walk Learn how both help with weight loss and which walking time suits your body

What Really Happens When You Drink Lemon Turmeric Water Daily

Discover what happens to your body when you drink lemon turmeric water daily including digestion imm

DXB News Network Presents “Ctrl+Alt+Wim”, A Bold New Satirical Series Starring Global Entertainer Wim Hoste

DXB News Network premieres Ctrl+Alt+Wim, a bold new satirical micro‑series starring global entertain

High Heart Rate? 10 Common Causes and 10 Natural Ways to Lower It

Learn why heart rate rises and how to lower it naturally with simple habits healthy food calm routin

10 Simple Natural Remedies That Bring Out Your Skin’s Natural Glow

Discover simple natural remedies for glowing skin Easy daily habits clean care and healthy living ti

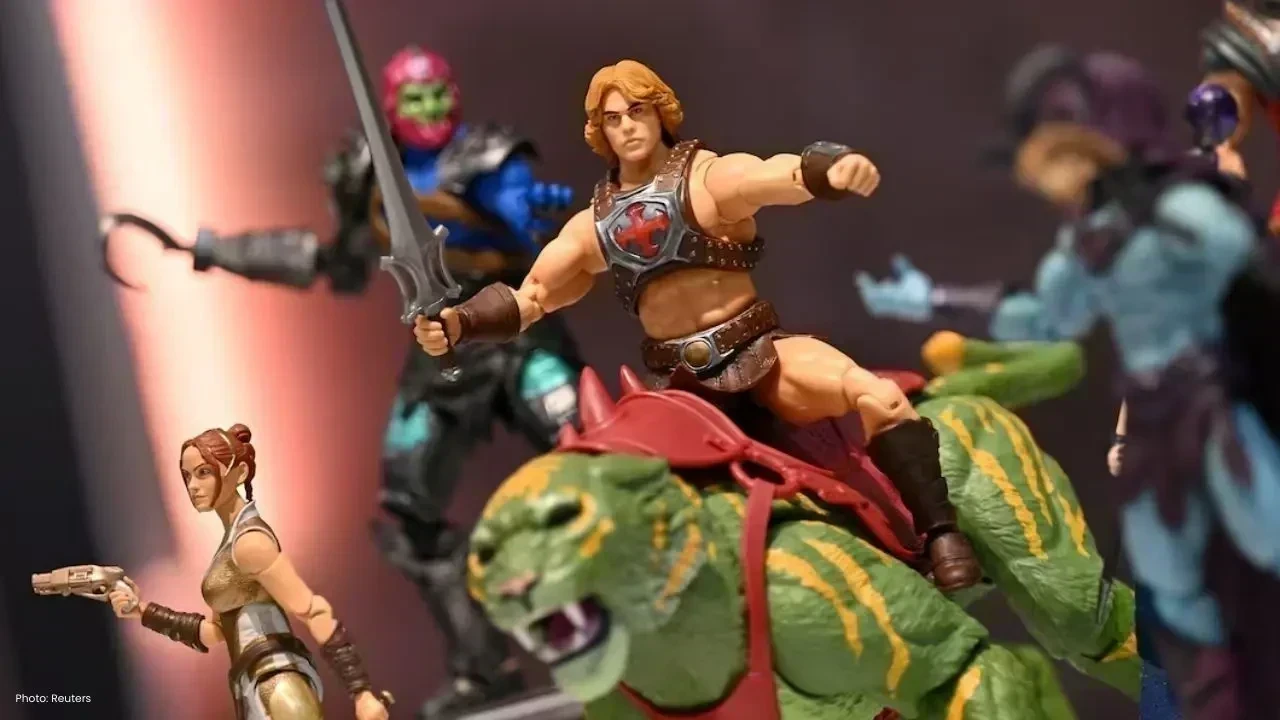

Mattel Revamps Masters of the Universe Action Figures for Upcoming Film

Mattel is set to revive Masters of the Universe action figures in sync with their new movie, ignitin

China Executes 11 Members of Infamous Ming Family Behind Myanmar Scam Operations

China has executed 11 Ming family members, linked to extensive scams and gambling in Myanmar, causin