Post by : Sam Jeet Rahman

Long-term investing is often presented as a simple idea: invest regularly, stay patient, and let time do the work. While this principle is true, the reality is more complex. Many people invest for years yet fail to achieve meaningful wealth because of avoidable mistakes made at the planning stage. These mistakes don’t usually cause immediate damage. Instead, they quietly reduce returns, increase risk, and delay financial goals.

This article explains the most common long-term investment mistakes, why they happen, and how to avoid them with clarity and discipline. Understanding these errors early can protect your money, your peace of mind, and your future lifestyle.

One of the biggest mistakes investors make is investing without knowing why they are investing.

Without a defined goal, you won’t know:

How much risk to take

How long to stay invested

When to rebalance or exit

Whether your investments are performing correctly

Money invested without direction often ends up misused or withdrawn prematurely.

Clearly define:

Short-term goals (1–3 years)

Medium-term goals (3–7 years)

Long-term goals (7+ years)

Each goal should have a purpose, timeline, and approximate value adjusted for inflation.

Many investors focus only on nominal returns and forget inflation entirely.

If your investment earns 6 percent but inflation is 7 percent, your purchasing power is shrinking even though your balance grows.

Always calculate real returns after inflation

Use inflation-beating assets for long-term goals

Avoid parking long-term money in low-return instruments

Inflation is invisible, but its impact is permanent.

Playing too safe can be as harmful as taking excessive risk.

Fear of market volatility pushes investors toward guaranteed products even for long-term goals.

Missed compounding opportunities

Inability to meet future goal costs

Increased pressure to invest aggressively later

Match risk with time horizon. Long-term goals can tolerate short-term volatility because time reduces risk naturally.

Choosing investments solely because they performed well recently is a classic error.

Market cycles change

Top-performing assets often revert to average

Past returns don’t guarantee future results

This approach usually leads to buying high and selling low.

Focus on:

Consistency across market cycles

Asset allocation rather than individual winners

Fundamentals and long-term suitability

Putting all money into a single asset class increases vulnerability.

Different assets behave differently during economic cycles. A balanced mix reduces volatility and improves risk-adjusted returns.

Allocate investments across:

Growth-oriented assets

Stability-oriented assets

Liquidity-focused assets

Review allocation periodically based on life stage and goals.

Many investors either check investments daily or ignore them completely.

Over-monitoring leads to emotional decisions

No monitoring allows underperformance to continue unnoticed

Review portfolio once or twice a year

Rebalance when allocations drift significantly

Align investments with evolving goals

Consistency beats constant reaction.

Fear and greed are the most expensive emotions in investing.

Panic selling during market crashes

Overinvesting during market highs

Switching strategies frequently

Markets reward patience, not prediction.

Create a written investment plan and follow it regardless of headlines. Discipline protects returns better than intelligence.

Returns don’t matter if taxes consume them.

Frequent buying and selling increases tax liability and reduces compounding power.

Prefer tax-efficient investment structures

Hold investments long-term where possible

Understand tax implications before investing

Post-tax returns are what actually matter.

Time is the most powerful wealth-building tool.

Even small delays significantly reduce compounding impact.

Start with whatever amount is possible

Increase contributions gradually

Focus on consistency, not timing

Starting early matters more than starting big.

Some investors believe they can beat markets easily, while others blindly follow advice without understanding it.

Overconfidence leads to excessive risk

Blind trust leads to unsuitable investments

Understand the basics of what you invest in. You don’t need expertise, but you do need awareness.

Locking all money into long-term investments can create stress during emergencies.

Unexpected expenses force premature withdrawals, damaging long-term plans.

Maintain:

Emergency funds

Short-term liquidity

Clear separation between long-term and short-term money

Liquidity equals flexibility.

Markets don’t grow in straight lines.

Temporary losses feel like failure and trigger wrong exits.

Accept volatility as part of long-term growth. Focus on direction, not short-term movement.

Life evolves, and investments must evolve too.

Marriage

Parenthood

Career change

Business expansion

Nearing retirement

Ignoring life changes leads to misaligned portfolios.

Complexity does not guarantee better returns.

Easier to monitor

Lower costs

Clearer objectives

Complex products often hide risks and fees.

Many investors compare themselves to others instead of their own goals.

Progress toward personal goals

Risk-adjusted consistency

Financial peace of mind

Success is personal, not competitive.

Long-term investing rewards clarity, patience, and discipline, not shortcuts. Most investment failures happen not because markets perform badly, but because investors make avoidable planning mistakes. Avoiding these errors doesn’t require perfect timing or advanced knowledge—just awareness and consistency.

A good investment plan is not one that looks impressive today, but one that works quietly for years.

This article is intended for informational and educational purposes only and should not be considered financial, investment, or tax advice. Investment outcomes depend on individual goals, risk tolerance, and market conditions. Readers should consult a qualified financial advisor before making long-term investment decisions.

Predictheon Wins WHX Xcelerate Innovation Champion 2026

Predictheon won WHX 2026 Xcelerate, earning US$12,000, WHX 2027 space and global exposure for its AI

Omantel Launches Otech to Drive Oman’s Future Tech Vision

Omantel launches Otech to accelerate Oman’s digital transformation, strengthen data sovereignty, exp

Daimler Truck MEA Honors Top Distributors at EliteClass 2025

Daimler Truck MEA hosted EliteClass Awards 2025 in Dubai, honoring top distributors across 19 catego

King Mohammed VI Launches Safran Landing Gear Plant in Morocco

Morocco strengthens its aerospace leadership as King Mohammed VI launches Safran’s €280M landing gea

Qatar Emir Sheikh Tamim Arrives in UAE on Fraternal Visit

Qatar’s Emir Sheikh Tamim bin Hamad Al Thani arrived in Abu Dhabi on Saturday. UAE President Sheikh

Shaidorov Wins Stunning Olympic Gold as Malinin Falters

Kazakhstan’s Mikhail Shaidorov won men’s figure skating gold after US star Ilia Malinin fell twice.

Shakira’s 5-Show El Salvador Residency Boosts Bukele Image

Shakira’s five sold-out concerts in San Salvador highlight El Salvador’s security shift under Bukele

Why Drinking Soaked Chia Seeds Water With Lemon and Honey Before Breakfast Matters

Drinking soaked chia seeds water with lemon and honey before breakfast may support digestion hydrati

Morning Walk vs Evening Walk: Which Helps You Lose More Weight?

Morning or evening walk Learn how both help with weight loss and which walking time suits your body

What Really Happens When You Drink Lemon Turmeric Water Daily

Discover what happens to your body when you drink lemon turmeric water daily including digestion imm

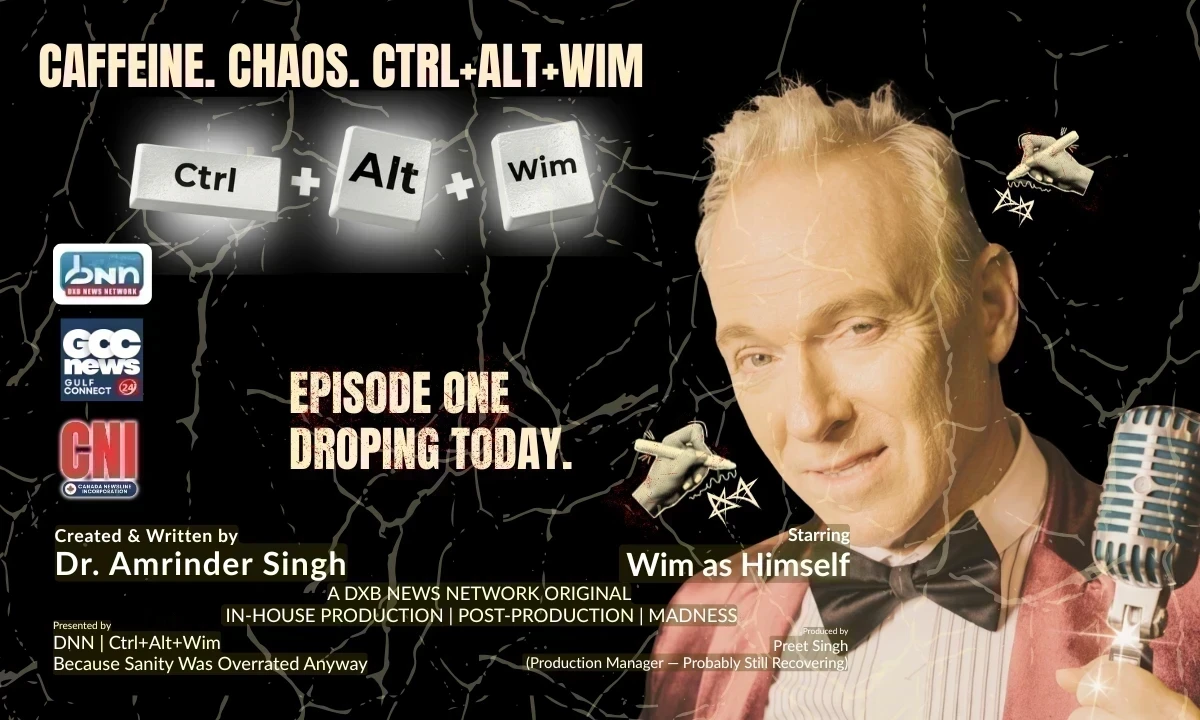

DXB News Network Presents “Ctrl+Alt+Wim”, A Bold New Satirical Series Starring Global Entertainer Wim Hoste

DXB News Network premieres Ctrl+Alt+Wim, a bold new satirical micro‑series starring global entertain

High Heart Rate? 10 Common Causes and 10 Natural Ways to Lower It

Learn why heart rate rises and how to lower it naturally with simple habits healthy food calm routin

10 Simple Natural Remedies That Bring Out Your Skin’s Natural Glow

Discover simple natural remedies for glowing skin Easy daily habits clean care and healthy living ti

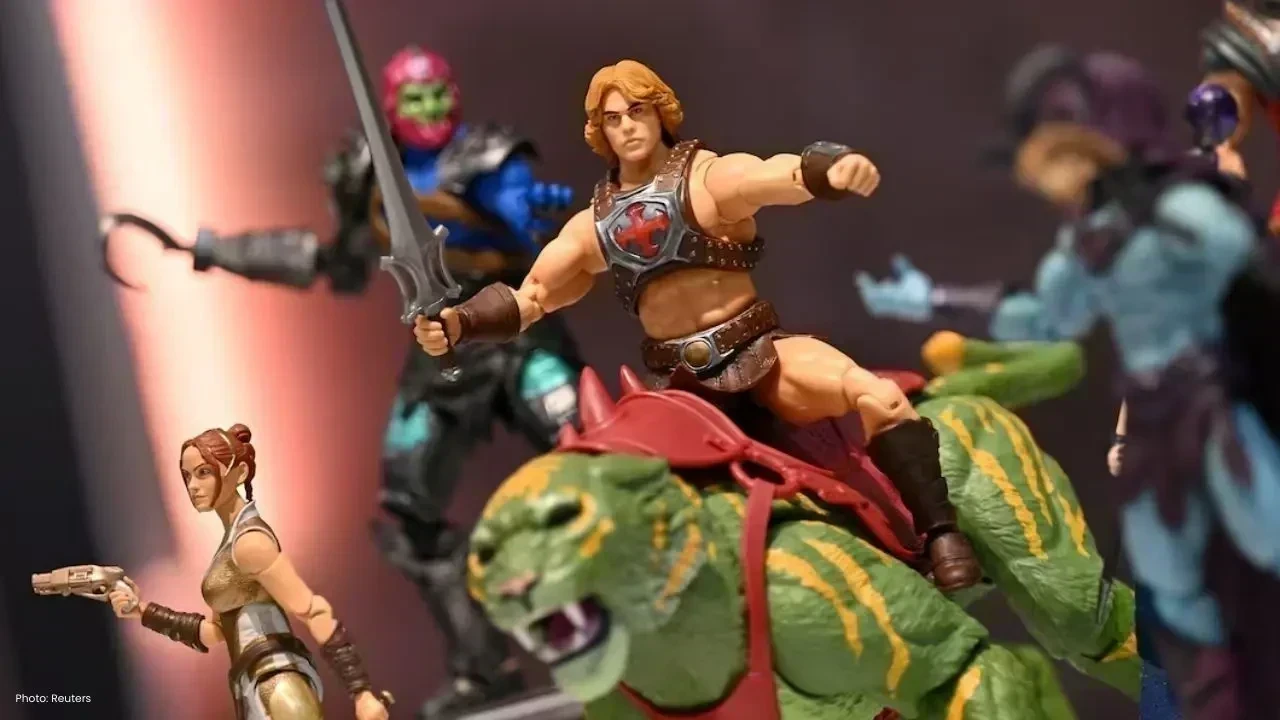

Mattel Revamps Masters of the Universe Action Figures for Upcoming Film

Mattel is set to revive Masters of the Universe action figures in sync with their new movie, ignitin

China Executes 11 Members of Infamous Ming Family Behind Myanmar Scam Operations

China has executed 11 Ming family members, linked to extensive scams and gambling in Myanmar, causin