Post by : Anis Karim

The equity markets open today with a mix of excitement and caution. Global indices show neutral trends, while domestic metrics remain stable, creating a fertile ground for sector-specific developments to shape trading dynamics. Heavyweights and mid-cap stocks are projected to influence today's trading rhythm significantly.

Traders are gearing up for a day filled with potential volatility, driven by corporate news, regulatory changes, and operational updates. Crucial stocks like Tata Steel, Adani Enterprises, State Bank of India, and Cipla are expected to steer sectoral movements and capture investor attention.

Today's trading narrative will pivot around these ten significant stocks, geared for notable intraday shifts influenced by investor sentiment, quarterly financial outlooks, and industry trends.

Tata Steel is in the spotlight as changes in global metal prices impact investor perception. The metals and mining industry remains sensitive to these fluctuations, directly affecting Tata Steel's position in the market.

Strengthening global steel prices alleviating margin pressures.

Updates regarding expansion endeavors in India and Europe.

Advancements in debt reduction and balance sheet fortification.

Commitment to sustainable steel production practices.

As industrial production trends stabilize globally, investor sentiment for Tata Steel appears cautiously optimistic. Traders will be keen on updates concerning production outlooks and export conditions as infrastructure spending rises in various economies.

Analysts predict active trading driven by volatility in the stock, influenced by futures and currency movements that affect raw material costs.

Adani Enterprises remains a central topic among conglomerates given its diversified operations in infrastructure, energy, mining, and logistics. Investors are evaluating important sectoral reforms and spending trends, keeping the stock in focus.

Renewable energy and green hydrogen expansion activities.

Progress on airport infrastructure developments.

Updates in mining activities and logistics advancements.

Investor outlook on the group's capital allocation strategies.

The company's comprehensive presence in high-growth sectors aligns it closely with macroeconomic reports. With renewed government focus on clean energy, Adani Enterprises appears poised for growth.

Traders are expected to adopt momentum-based strategies. Any significant operational updates could swing the stock’s performance in today’s session.

As the largest bank in India, State Bank of India tends to establish the mood for the financial sector. Investors today are keen on evaluating credit growth, interest rates, and asset quality.

Growth in retail and SME loan segments.

Diminishing non-performing assets enhancing market confidence.

Stable interest margins amidst fluctuating global rates.

Market responses to treasury performance variances.

SBI has positioned itself as a bellwether for the banking sector's resilience, frequently influencing overall market sentiment during its quarterly disclosures.

Traders will monitor trading volumes particularly as sentiment for financial stocks appears to be on the rise.

Cipla stands out on today's radar due to ongoing discussions about drug approvals, global market ventures, and its product pipeline evolution.

Recent approvals from worldwide pharmaceutical regulators.

Innovations in respiratory therapies and consumer healthcare.

Performance updates in the U.S. generics sector.

Enhancements in domestic sales for various therapies.

With an uptick in healthcare demand and supportive policy changes for pharma manufacture, Cipla is projected to deliver stable performance with promising growth prospects.

Any news related to product approvals, plant inspections, or compliance can evoke immediate market reactions, and volatility is expected throughout the trading session.

In addition to these key stocks, multiple others are likely to see movements tied to company news and wider market conditions.

L&T is anticipated to remain in focus as new order inflows strengthen its engineering and construction visibility.

Expectations of fresh project wins both domestically and internationally.

Strong performance in industrial and hydrocarbon sectors.

A solid order book providing clarity for growth over the coming years.

Investors are closely observing signals pertaining to capital expenditure from both public and private segments.

Reliance Industries remains a market influencer due to its varied operations across numerous sectors.

Updates on energy transition strategies.

Metrics relating to retail growth.

Trends in petrochemical margins.

Corporate updates are likely to shape not just the stock trajectory, but also the overall sentiment in the market.

HDFC Bank remains in demand due to its robust lending metrics and stable operational growth.

Tracking retail loan performance.

Assessing asset quality trends.

Market response to deposit growth disclosures.

Volume observations may rise in mid-session as institutional investors react to price shifts.

Maruti Suzuki is significant in observing the recovery in consumer demand within India.

Increasing sales in passenger vehicles.

Growing consumer interest in hybrid technologies.

Stable commodity costs helping preserve profit margins.

Notifications regarding pricing strategies or new offerings could result in significant price changes.

NTPC’s advancements in renewable energy make it a compelling watch today.

Renewable project updates.

Synergy in thermal generation with solar enhancements.

Anticipations for robust earnings outlook.

Trends in power demand are likely to heavily influence NTPC's stock performance.

HUL's performance is closely tied to spending patterns in both urban and rural markets.

Signs of recovery in volumes.

Pricing mechanisms amidst competitive landscapes.

Seasonal demand shifts in FMCG categories.

Stock movement may remain gradual unless significant demand information is released.

Investor sentiment remains cautiously optimistic, with selective buying expected across various sectors like auto, metals, pharma, and infrastructure. However, concerns regarding global fluctuations and currency impacts may keep broader movements in check.

Earnings announcements.

Policy updates from the government.

Trends in international markets.

Central banking updates.

The ten highlighted stocks are predicted to dominate trading activity today, with sharp shifts anticipated during the early trading window and close of business as institutional trading strategies adjust.

Today is set to be characterized by stock-specific movements rather than a sweeping market breakout. With so many key players in the limelight, traders will closely watch for developments that could present tactical opportunities, while long-term portfolios will likely take in the evolving fundamentals.

This article is intended for informational and editorial purposes only. It is based on publicly available information and does not constitute investment advice. Investors are encouraged to engage in independent research or consult finance professionals before making decisions.

Predictheon Wins WHX Xcelerate Innovation Champion 2026

Predictheon won WHX 2026 Xcelerate, earning US$12,000, WHX 2027 space and global exposure for its AI

Omantel Launches Otech to Drive Oman’s Future Tech Vision

Omantel launches Otech to accelerate Oman’s digital transformation, strengthen data sovereignty, exp

Daimler Truck MEA Honors Top Distributors at EliteClass 2025

Daimler Truck MEA hosted EliteClass Awards 2025 in Dubai, honoring top distributors across 19 catego

King Mohammed VI Launches Safran Landing Gear Plant in Morocco

Morocco strengthens its aerospace leadership as King Mohammed VI launches Safran’s €280M landing gea

Qatar Emir Sheikh Tamim Arrives in UAE on Fraternal Visit

Qatar’s Emir Sheikh Tamim bin Hamad Al Thani arrived in Abu Dhabi on Saturday. UAE President Sheikh

Shaidorov Wins Stunning Olympic Gold as Malinin Falters

Kazakhstan’s Mikhail Shaidorov won men’s figure skating gold after US star Ilia Malinin fell twice.

Shakira’s 5-Show El Salvador Residency Boosts Bukele Image

Shakira’s five sold-out concerts in San Salvador highlight El Salvador’s security shift under Bukele

Why Drinking Soaked Chia Seeds Water With Lemon and Honey Before Breakfast Matters

Drinking soaked chia seeds water with lemon and honey before breakfast may support digestion hydrati

Morning Walk vs Evening Walk: Which Helps You Lose More Weight?

Morning or evening walk Learn how both help with weight loss and which walking time suits your body

What Really Happens When You Drink Lemon Turmeric Water Daily

Discover what happens to your body when you drink lemon turmeric water daily including digestion imm

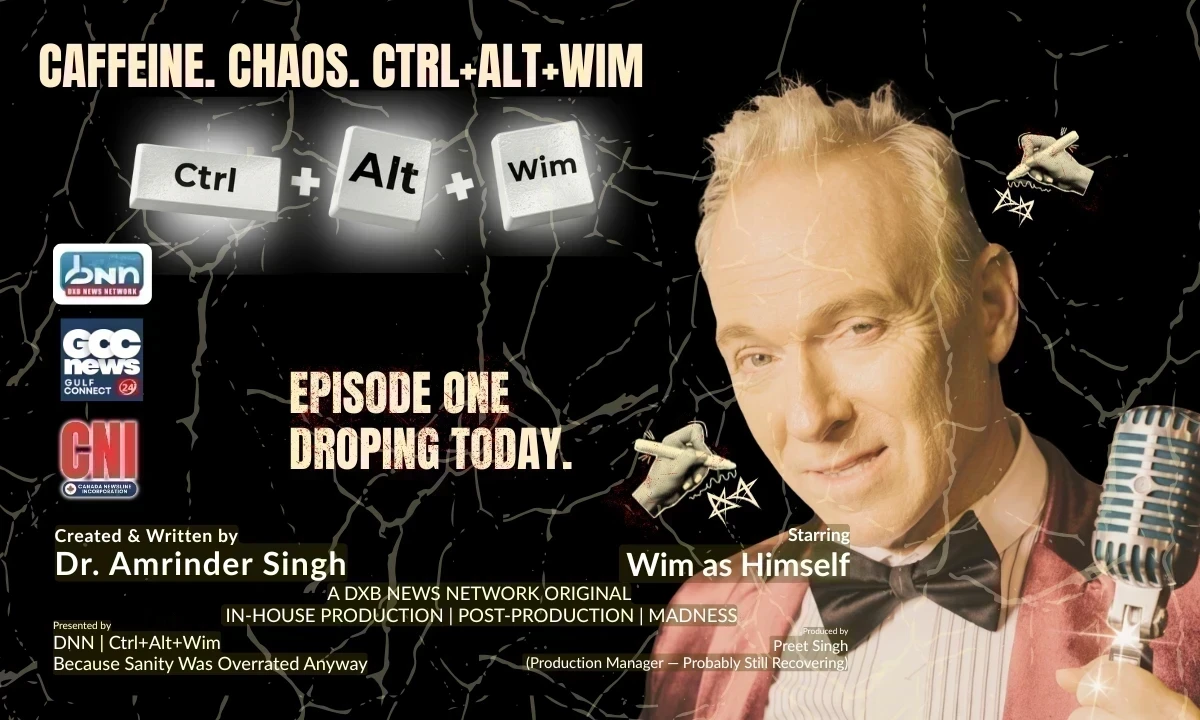

DXB News Network Presents “Ctrl+Alt+Wim”, A Bold New Satirical Series Starring Global Entertainer Wim Hoste

DXB News Network premieres Ctrl+Alt+Wim, a bold new satirical micro‑series starring global entertain

High Heart Rate? 10 Common Causes and 10 Natural Ways to Lower It

Learn why heart rate rises and how to lower it naturally with simple habits healthy food calm routin

10 Simple Natural Remedies That Bring Out Your Skin’s Natural Glow

Discover simple natural remedies for glowing skin Easy daily habits clean care and healthy living ti

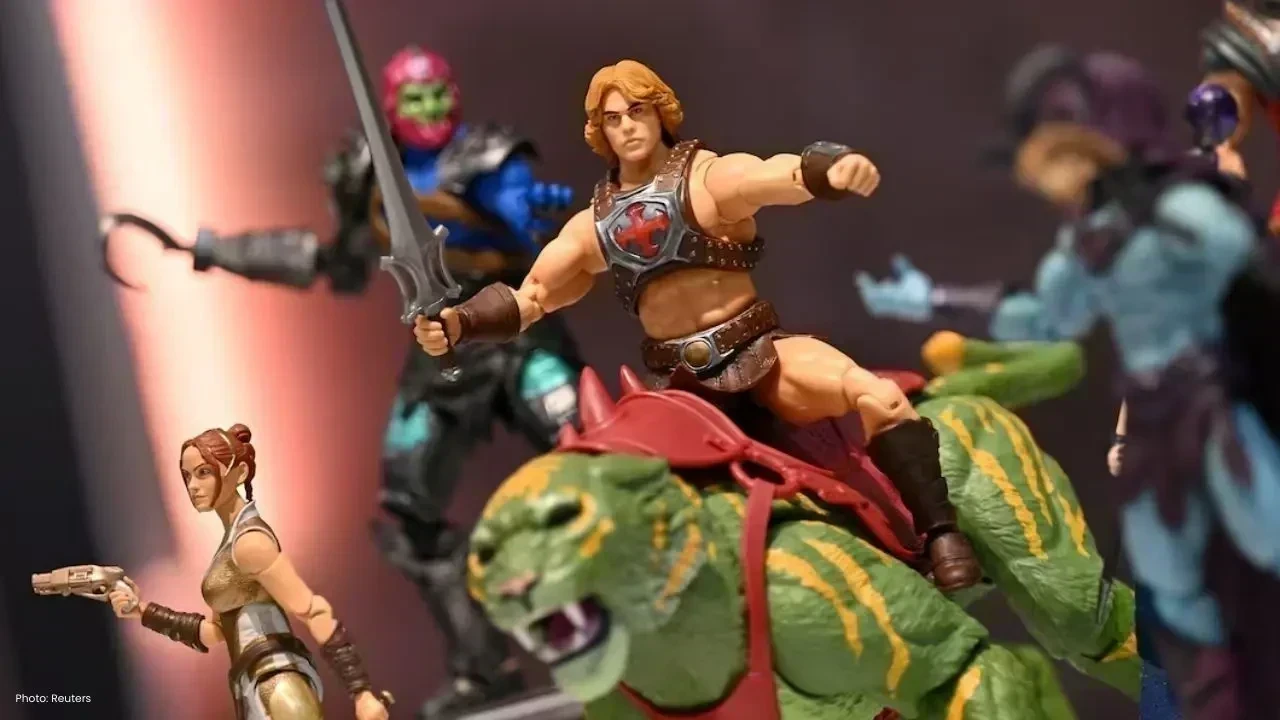

Mattel Revamps Masters of the Universe Action Figures for Upcoming Film

Mattel is set to revive Masters of the Universe action figures in sync with their new movie, ignitin

China Executes 11 Members of Infamous Ming Family Behind Myanmar Scam Operations

China has executed 11 Ming family members, linked to extensive scams and gambling in Myanmar, causin