Post by : Anis Karim

The Indian stock market kicked off the trading day on a tentative note, mirroring the caution permeating investor sentiment. Initial indicators showed traders hesitant to make substantial commitments, preferring instead to monitor global trends and technical benchmarks closely. The atmosphere on Dalal Street was influenced by offshore market signals, recent domestic performance, and a sense of unease that had begun to take hold.

A pivotal factor behind this cautious beginning was the subdued reading from GIFT Nifty, forecasting that benchmark indices may encounter selling pressure from the onset. This pre-market indicator—often reflecting overseas sentiment—coupled with mixed results from the United States and declines across Asian exchanges, reinforced the notion that risk appetite was diminishing.

Rather than indicative of a panic sell-off, the early downturn symbolized cautious restraint. Investors demonstrated awareness that markets are in a delicate state where any slight disturbance could amplify volatility. Consequently, the initial trading session shifted focus from momentum chasing to capital preservation and strategic reassessment.

GIFT Nifty has become crucial in gauging the anticipated opening of Indian markets. As it is traded outside regular market hours, it captures the offshore mood and often reacts quickly to global developments. This morning, GIFT Nifty showed a downward trend, suggesting a tepid opening for Indian stocks.

A decline in this indicator typically implies that global investors are more risk-averse. It can indicate worries ranging from foreign fund withdrawals to broader economic uncertainties. Market participants factor GIFT Nifty into their early trade plans, especially on days when international cues are not definitive.

The decrease in GIFT Nifty did not signal alarm but rather a cautious mentality. It indicated that participants were more inclined towards defensive positioning instead of aggressive buying, particularly in dominant index stocks.

As trading commenced, the initially cautious pre-market gauge translated into tangible weakness on the exchange. The breadth of the market leaned negative, with a greater number of stocks in the red compared to those making gains. This disparity signaled that selling was widespread, affecting various sectors.

Early movements saw benchmark indices dip, primarily due to declines in heavyweight stocks. The shift underscored that investors were offloading positions rather than selectively accumulating shares, indicating an underlying uncertainty rather than a reaction to specific news.

Overnight indicators from the United States did not offer robust directional support. Major indices experienced mixed outcomes, where gains in some areas were offset by declines elsewhere. This indecisive trend contributed to investor trepidation across Asia, including India.

US markets have been navigating concerns about interest rates, economic growth signals, and pressures in specific sectors. When Wall Street struggles for momentum, emerging markets often feel the effects, as global investors turn more selective about risk exposure.

The US market's mixed closing left Indian traders with little reassuring global support. Instead of feeling buoyed by a strong overseas rally, they braced for a day marked by caution.

Asian markets followed suit, trading lower due to pervasive risk-off sentiment. Major indices in the region faced selling pressure as concerns over global growth, commodity price shifts, and currency fluctuations came into play. This regional decline only added another layer of stress for Indian markets at the open.

Asian indices often serve as early indicators of global risk sentiment. When the majority of regional markets trend downwards, Indian stocks find it difficult to resist falling into the same pattern. The downward trend in Asia accentuated the belief that investors were retreating from riskier investments.

As the trading session unfolded, benchmark indices slid, breaching significant psychological thresholds. Such levels often serve as crucial confidence markers for traders, and any break below tends to invite additional selling or cautious positioning.

The early downturn in benchmark indices was fueled by drop-offs in large-cap stocks, which typically hold sway over overall market direction. Sectors like financials, technology, and industrials faced downward pressure, contributing to the bearish trend.

Though losses weren't drastic, the direction was unmistakable. The market was sowing discomfort, with traders closely watching intraday support levels.

The downturn wasn't confined to a single segment. Several sectors showed signs of sell-offs, indicating a sentiment driven by overall market feelings rather than specific sector issues. Information technology stocks faced challenges amid global uncertainties, with metals and consumer goods also under pressure.

Such extensive weakness typically suggests that investors are scaling back across their portfolios rather than making focused adjustments. Even fundamentally strong stocks can face scrutiny amid short-term risk aversion.

The hesitant start didn’t appear in a vacuum. Indian markets had been under pressure in preceding sessions, with indices relinquishing earlier gains. This ongoing decline heightened investor sensitivity to negative cues, increasing the risk of further selling following weak signals.

When markets falter over numerous sessions, confidence diminishes gradually. Traders become less inclined to buy into dips, preferring to wait for clearer signals of stability. This mindset was evident from the initial trade, where buying interest was noticeably muted.

Technical analysts closely scrutinized support zones that could dictate near-term market directions. Levels around significant round numbers often hold psychological weight, and any prolonged move below them may prompt additional selling.

As the day progressed, these crucial technical thresholds remained in focus. Traders were attentive to whether the market could maintain these levels or face new selling pressures, as the outcome was likely to shape the intraday sentiment.

The prevailing theme at the open centered around risk management. Investors appeared to be directing efforts towards protecting their gains and curbing potential losses rather than pursuing short-term plays. This strategy was mirrored in lower trading volumes and selective participation.

Such defensive positioning arises during uncertain times, particularly with unclear global cues. Investors often pivot toward relatively stable stocks or cut back on leverage, biding their time for a more favorable risk-reward setting.

Aggressive trading was conspicuously absent in the early hours. Even stocks demonstrating some strength saw cautious and restrained buying. This behavior suggested traders were not optimistic about a rapid recovery and chose instead to wait for clearer confirmations.

Such caution can mitigate significant intraday declines but also restrict the probability of robust rebounds unless sentiment significantly improves.

Macroeconomic factors continued to shape market sentiment. Inflation trends, interest rate forecasts, and central bank communications remained pivotal elements influencing equity markets. Any shifts in these areas can rapidly alter market trajectories.

Investors remained aware that forthcoming economic indicators could sway both domestic and global markets. Thus, many opted to remain cautious until clearer information was available.

Changes in currency rates and commodity prices also influenced sentiment. Movements in crude oil and currency valuation can affect corporate earnings forecasts, especially for sectors reliant on imports.

Ongoing uncertainty in these areas amplified the cautious mindset, reinforcing a preference for defensive approaches.

A pressing question for the session remained whether the market could find stability following its lackluster start or continue its decline. Initial downturns may invite value buying, but only when investors feel that the risks are limited.

Traders vigilantly observed intraday trends and volume metrics to evaluate whether the selling pressure was easing or amplifying. Any signs of stabilization could prompt selective buying, while ongoing weakness might lead to further caution.

Even amid a broader cautious tone, certain stocks may react based on company-specific news. Updates on earnings, corporate activities, or sector developments could spark pockets of activity, even in a weaker market.

Active traders often seek such opportunities; however, overarching sentiment can still temper any aggressive upswings.

Given the blend of weak global signals and tentative domestic sentiment, volatility is expected to remain high. Markets in these conditions often react sharply to various news, whether positive or negative.

For investors, this landscape demands discipline and patience. Unpredictable short-term movements necessitate a focus on risk management rather than seeking every fluctuation.

Though short-term sentiment faces pressure, long-term investors frequently view these phases as integral to the broader market cycle. Times of correction or consolidation can provide fertile ground for future opportunities, although timing remains essential.

Maintaining a balanced outlook aids investors in avoiding impulsive choices during volatile periods.

Today’s sluggish opening in the Indian stock market mirrored a confluence of negative pre-market signals, mixed global cues, and recent domestic disappointments. Rather than frenzied selling, early trading embodied measured caution, with investors prioritizing risk mitigation over aggressive strategies.

As the session advanced, markets remained sensitive to global updates, technical thresholds, and any forthcoming economic indicators. In such a climate, a careful and disciplined approach appeared to be the favored strategy, enabling investors to navigate uncertainty while remaining vigilant for emerging opportunities.

This article is meant for informational purposes only and does not constitute investment advice. Market dynamics are subject to fluctuation, and readers should pursue their own research or consult a qualified financial advisor prior to making investment decisions.

US Stocks Slide as AI Fears, Inflation and Oil Surge Weigh

US stocks dropped as AI disruption fears hit tech firms, inflation rose above forecasts, and oil pri

Pacific Prime Wins Top Honors at Cigna Awards 2026

Pacific Prime secured Top Individual Broker and Top SME Broker awards at Cigna’s Annual Broker Award

QatarEnergy Halts LNG Output After Military Attack

QatarEnergy has stopped LNG production after military attacks hit its facilities in Ras Laffan and M

Strong 6.1 Magnitude Earthquake Hits West Sumatra, No Damage

A 6.1 earthquake struck off West Sumatra, Indonesia. No casualties, damage, or tsunami alert reporte

Saudi Confirms Drone Strike on US Embassy Riyadh

Two drones hit the US Embassy in Riyadh, causing a small fire and minor damage. No injuries were rep

UAE Restarts Limited Flights as Regional Airspace Disruptions Continue

UAE restarts limited flights from Dubai as US-Israel attacks on Iran disrupt regional airspace, forc

Asia Faces Energy Shock After Iran Closes Strait

Iran shuts Strait of Hormuz amid US-Israel strikes, sending oil prices higher and raising serious en

Bank of Baroda Faces Abu Dhabi Legal Battle over NMC Collapse

Bank of Baroda’s involvement in Abu Dhabi litigation tied to the NMC Healthcare collapse raises repu

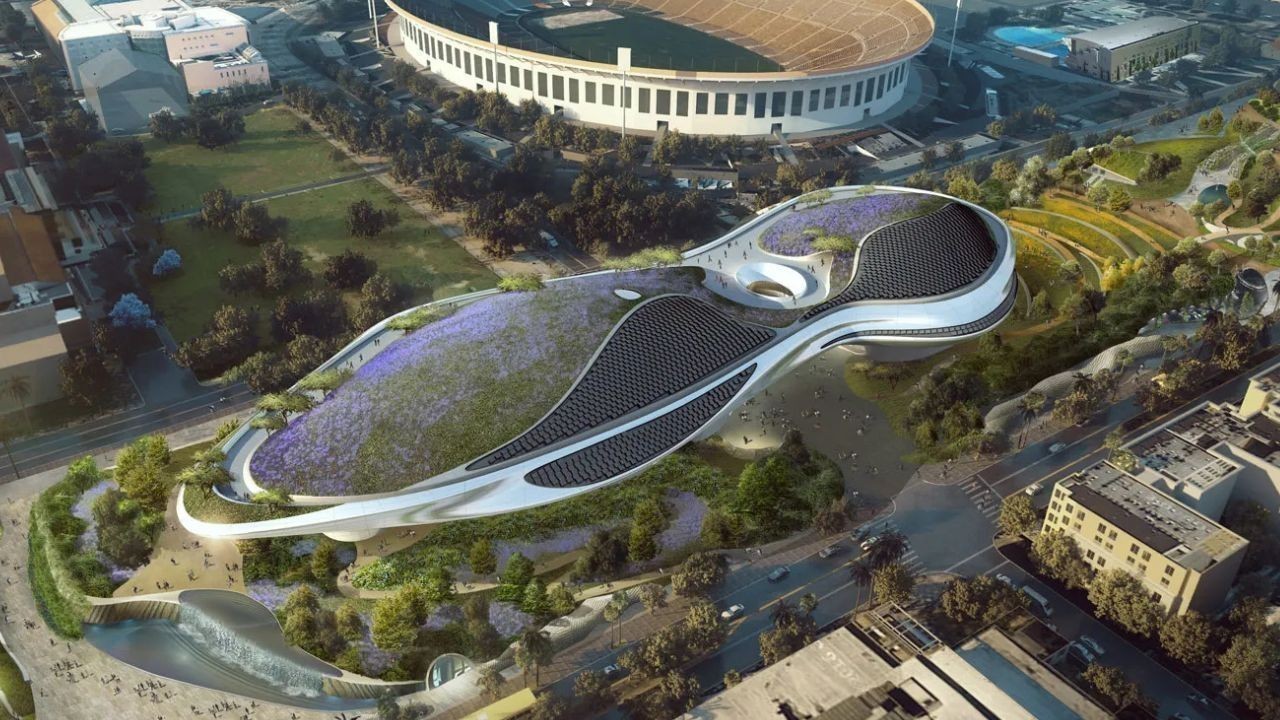

Top Museum Openings of 2026 Set to Transform Global Tourism

From Los Angeles to Abu Dhabi and Brussels, 2026 brings major museum launches—Lucas Museum, Guggenhe

UAE Tour Highlights UAE’s Strength in Hosting Global Sports Events

Abu Dhabi Sports Council says the successful UAE Tour reflects the UAE’s leading role in hosting maj

EU Seeks Clarity from US After Supreme Court IEEPA Ruling

European Commission urges full transparency from the US on steps after Supreme Court ruling, emphasi

SpaceX Launches 53 New Satellites for Expanding Starlink Network

SpaceX launches 53 Starlink satellites in two Falcon 9 missions, breaking reuse records and expandin

RTA Awards Contract for Phase II of Hessa Street Upgrade in Dubai

Phase II of Hessa Street Development to add bridges, tunnel, and upgraded intersections, doubling ca

UAE Gold Prices Today, Monday 16 February 2026: Dubai & Abu Dhabi Updated Rates

Gold prices in UAE on 16 Feb 2026 updated: 24K around AED 599.75/gm, 22K AED 555.25/gm, and 18K AED

Over 25 Ahmedabad Schools Receive Bomb Threat Email, Authorities Investigate

More than 25 schools in Ahmedabad evacuated after bomb threat emails mentioning Khalistan. Authoriti