Post by : Anis Karim

The Indian stock market is set to begin on a positive note as GIFT Nifty offers encouraging signals. Benchmarks like Sensex and Nifty are catching the eye of investors once more, showing resilience amidst recent market shifts and indicating cautious optimism.

GIFT Nifty serves as a futures indicator for the broader Indian market, with activity anticipated before the official trading session on the National Stock Exchange. The rising trend in GIFT Nifty suggests the possibility of a higher opening for Indian markets, as traders closely analyze pre-market metrics influenced by global market conditions.

Amidst this optimistic outlook, investors must also consider a variety of factors that present both support and challenges.

GIFT Nifty acts as an offshore benchmark for India’s Nifty 50 index, facilitating trading in GIFT City, Gujarat, beyond typical Indian market hours. This allows international investors to take positions when local markets aren't active, making it a vital gauge of market sentiment, particularly during overnight shifts.

Historically, GIFT Nifty movements can predict how the Indian indices will respond once trading opens, with increases often indicating buying interest and declines signifying caution. This offshore indicator is essential for understanding the connectivity between overseas market trends and local performance.

Recent sessions have shown mixed outcomes in global equity markets. U.S. markets, including pivotal indices like the S&P 500 and Dow Jones, have displayed varied movements impacted by economic reports, earnings announcements, and sector-specific challenges. Similarly, Asian markets are experiencing irregular trends, with certain indices rising and others falling, reflecting broader concerns linked to macroeconomic data and shifts in investor sentiment.

Such mixed international signals often prompt careful trading decisions among Indian investors, especially when preceding cues lack clarity. As global capital flows and portfolio adjustments evolve, the interaction between international markets and Indian equities becomes increasingly significant.

In India, investor sentiment remains somewhat tentative, particularly with the Union Budget announcement looming, which can shape expectations for earnings, fiscal policies, and sector outlooks. This period usually incites selective buying as traders assess how policy changes may affect their positions.

Continuous outflows from foreign investors add pressure, making the market more reactive to international news and amplifying short-term fluctuations. Institutional and retail sentiment also varies based on inflation, interest rates, and corporate earnings trends.

Early indicators suggest that both Sensex and Nifty might see a higher or stable opening today. The Sensex, representing 30 key stocks, along with Nifty 50, which includes 50 of the largest and most traded stocks, is highly responsive to both domestic and global conditions. Positive activity from GIFT Nifty hints at trading confidence across essential sectors.

Nonetheless, sharp price fluctuations are expected. Traders might observe significant movements in individual stocks and sectors, especially if global market behavior continues to oscillate. This is particularly relevant for areas like technology, finance, and commodities that are closely linked to international trends.

Sector trends in Indian markets typically reflect broader economic forecasts, and recent performances suggest a nuanced picture. Strong corporate reports and sector fundamentals have buoyed financial services, metals, and energy stocks, while other segments like consumer staples and IT services have seen erratic performances dependent on earnings outcomes and demand projections.

Investors observe that, even amid stable indices, sector-specific variations may yield trading insights or investment possibilities.

Key economic indicators, inflation rates, interest rate forecasts, and shifts in global commodity prices are vital drivers affecting stock behaviors. For instance, inflation trends and central bank messages can significantly influence interest rate expectations.

A stronger rupee can alleviate import costs and support capital inflows, while a weaker currency may spur inflation concerns, impacting foreign investment dynamics.

Market experts advocate for a vigilant yet flexible approach during this period. With global signals mixed and domestic factors evolving, selective strategies are emphasized. Certain market segments, such as midcap stocks or those targeting local consumption, may present unique opportunities, whereas broader indices might see fluctuations.

Long-term strategies focus on fundamental valuations and corporate growth trajectories to navigate short-term instability. Quality stocks with strong earnings and cash flows are often favored in uncertain times.

In light of fluctuating global cues and local sensitivities, traders typically implement varied strategies to balance risks and rewards, including:

Position Hedging: Utilizing derivatives or structured products to shield portfolios against potential downturns.

Sector Rotation: Moving investments from less favorable sectors to those with favorable fundamentals.

Liquidity Management: Ensuring sufficient liquidity to accommodate unexpected market fluctuations.

Technical and Sentiment Analysis: Deploying technical indicators and sentiment measures to optimize trading timings.

These strategies are crafted to counterbalance downside risks while seizing potential upsides in fluctuating markets.

Overnight movements in Asian and U.S. markets significantly influence Indian pre-market scenarios. Strong U.S. index performances can enhance global risk appetite, resulting in elevated GIFT Nifty levels and optimism for Indian equities.

Conversely, weak U.S. or Asian market conditions may deter positive openings, urging traders to react to shifts driven by economic data or geopolitical events. The interconnectedness of global markets often translates overseas sentiments into Indian trading via flows and derivative metrics.

Investors remain vigilant about international earnings trends, central bank notes, and economic indicators to align their trading strategies.

Volatility in the market presents both challenges and opportunities. While price swings can lead to immediate losses, they also create chances for strategic investors to acquire quality assets at favourable prices.

Utilizing risk management tactics such as stop-loss orders, diversification, and regular reviews can mitigate exposure. Temporary sector weaknesses can rebound due to positive earnings or rebounds in global stability.

For many, the fluctuations are not merely risks but also dynamic chances for informed trading and positioning.

Current investor sentiment influenced by GIFT Nifty suggests a balanced start. Positive pre-market indicators hold promise for price gains, yet mixed global trends and domestic uncertainties call for a cautious approach.

Investors are keenly observing upcoming economic releases, policy changes, and corporate results, which could greatly affect short-term trading patterns. As India’s market landscape continues to shift, both short-term and long-term strategies are adapting to this evolving sentiment and seeking new opportunities.

Disclaimer: This content is based on current market analysis and pre-market indicators solely for informational usage and does not serve as investment guidance. Financial markets are volatile and subject to swift changes; readers are urged to conduct personal research or seek professional advice.

Thousands March in Caracas, Demand Maduro’s Release

Thousands of Maduro supporters marched in Caracas, one month after a deadly US raid ousted him, dema

Sheikh Mohammed Visits WGS 2026 Media, Cybersecurity Centres

Sheikh Mohammed visited the WGS 2026 media and cybersecurity centres in Dubai, highlighting media’s

Sitharaman Meets World Bank President Ajay Banga on Viksit Bharat Plan

Finance Minister Nirmala Sitharaman met World Bank President Ajay Banga to discuss the new Country P

PM Shehbaz Meets WBG President Ajay Banga to Boost Pakistan Reforms

PM Shehbaz Sharif meets World Bank President Ajay Banga, discussing economic reforms, development pr

Italy’s Unemployment Hits Record Low of 5.6% in December

Italy’s unemployment fell to a historic 5.6% in December, the lowest since 2004, with employment at

Australian Open Champ Rybakina Headlines Dubai Tennis Elite Field

Fresh from her Australian Open triumph, Elena Rybakina returns to Dubai as a resident and WTA 1000 c

Deloitte Champions Enterprise & Public Sector Innovation at Web Summit Qatar

Deloitte leads masterclasses on in-country cloud, AI, and tech governance at Web Summit Qatar 2026,

Why Drinking Soaked Chia Seeds Water With Lemon and Honey Before Breakfast Matters

Drinking soaked chia seeds water with lemon and honey before breakfast may support digestion hydrati

Morning Walk vs Evening Walk: Which Helps You Lose More Weight?

Morning or evening walk Learn how both help with weight loss and which walking time suits your body

What Really Happens When You Drink Lemon Turmeric Water Daily

Discover what happens to your body when you drink lemon turmeric water daily including digestion imm

DXB News Network Presents “Ctrl+Alt+Wim”, A Bold New Satirical Series Starring Global Entertainer Wim Hoste

DXB News Network premieres Ctrl+Alt+Wim, a bold new satirical micro‑series starring global entertain

High Heart Rate? 10 Common Causes and 10 Natural Ways to Lower It

Learn why heart rate rises and how to lower it naturally with simple habits healthy food calm routin

10 Simple Natural Remedies That Bring Out Your Skin’s Natural Glow

Discover simple natural remedies for glowing skin Easy daily habits clean care and healthy living ti

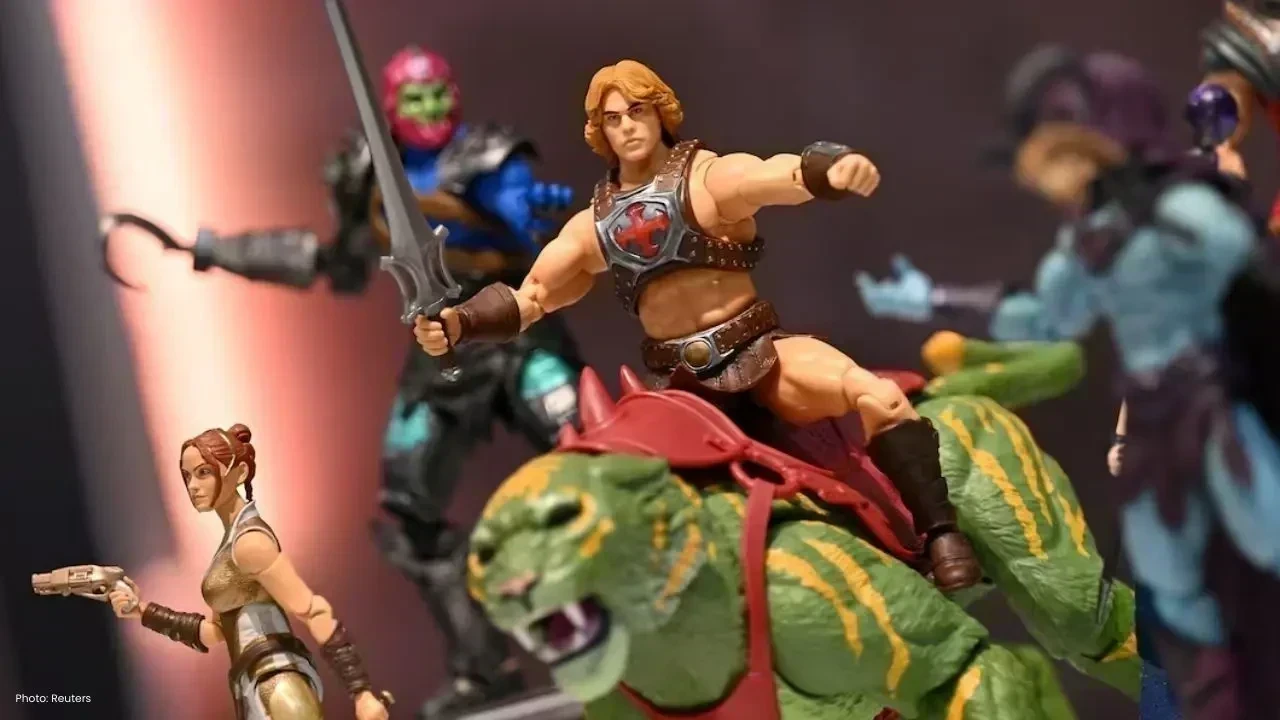

Mattel Revamps Masters of the Universe Action Figures for Upcoming Film

Mattel is set to revive Masters of the Universe action figures in sync with their new movie, ignitin

China Executes 11 Members of Infamous Ming Family Behind Myanmar Scam Operations

China has executed 11 Ming family members, linked to extensive scams and gambling in Myanmar, causin