Post by : Sam Jeet Rahman

Retirement planning is often misunderstood as something meant for people in their 40s or 50s. In reality, the earlier you start planning for retirement, the easier, safer, and more stress-free your financial future becomes. Planning retirement from an early age is not about sacrificing your present life; it is about building freedom, flexibility, and long-term security.

This guide explains why early retirement planning matters, how to start step by step, what mistakes to avoid, and how to build a retirement plan that grows with you over time, even if your income is currently limited.

Time is the most powerful tool in financial planning.

When you start early:

Your money gets more time to grow

You can take lower risk later in life

Small monthly contributions become meaningful wealth

Financial stress reduces dramatically

Most people delay retirement planning because it feels distant. Unfortunately, delayed planning often leads to rushed decisions, higher risk-taking, and dependency during later years.

Retirement is not just about stopping work. It is about financial independence.

A well-planned retirement allows you to:

Maintain your lifestyle without depending on others

Handle medical expenses comfortably

Support family without stress

Choose whether to work, not be forced to

Early planning gives you control over how and when you retire.

Delaying retirement planning has hidden costs.

You need to invest more money later to reach the same goal

You take higher risks to compensate for lost time

Inflation eats away purchasing power

Emergencies disrupt long-term goals

Starting early allows lower monthly effort with higher long-term reward.

Before numbers, define clarity.

At what age would you like financial independence?

What kind of lifestyle do you want?

Where do you plan to live?

Will you continue working part-time or fully retire?

Your retirement plan should support your life goals, not generic assumptions.

Many people underestimate retirement costs.

Housing and maintenance

Food and daily living

Healthcare and insurance

Travel and leisure

Inflation-adjusted lifestyle costs

Healthcare expenses usually rise faster than inflation, making early planning essential.

Compounding rewards patience.

When you invest early:

Returns generate returns

Growth accelerates over time

You rely less on aggressive investments

For example, someone starting at 25 with small contributions often outperforms someone starting at 40 with larger contributions.

Retirement should not compete with short-term goals.

Emergency fund for unexpected needs

Short-term savings for travel or purchases

Long-term investments reserved only for retirement

This prevents premature withdrawals that damage compounding.

Before aggressive investing, protect yourself.

Prevent debt during crises

Avoid selling long-term investments

Provide mental peace

Aim for 6 months of essential expenses in a safe, liquid option.

You do not need a high income to begin.

Consistency beats amount.

Start with what you can afford

Increase contributions as income grows

Automate investments to avoid missed months

Early habits matter more than early wealth.

Time allows you to tolerate volatility.

Long-term growth

Inflation protection

Diversification

Avoid overly conservative options early, as they may fail to beat inflation over decades.

Risk tolerance changes with age.

Early years allow higher growth exposure

Mid-career requires balance

Pre-retirement focuses on stability

Gradual adjustment protects wealth without sacrificing growth.

Unexpected events can derail plans.

Health insurance

Life insurance (if dependents exist)

Disability protection

Insurance protects your retirement savings from being used during crises.

As income increases, expenses often rise.

Fixed costs become hard to reduce

Savings rate stagnates

Retirement goals drift further away

Maintain controlled lifestyle upgrades and prioritize long-term freedom.

Retirement planning requires patience.

Adjust for income changes

Rebalance investments

Update goals

Avoid reacting emotionally to short-term market movements.

Inflation quietly erodes purchasing power.

Increasing contributions over time

Choosing inflation-beating assets

Avoiding excessive idle cash

A retirement plan that ignores inflation is incomplete.

Relying on a single income stream increases risk.

Skill-based side income

Business income

Passive income streams

Additional income accelerates retirement savings and improves security.

Healthcare is one of the biggest retirement expenses.

Choose adequate coverage

Avoid future premium shocks

Build medical emergency reserves

Medical inflation rises faster than general inflation.

Financial systems evolve.

Tax rules change

Investment options expand

Economic cycles shift

Staying informed allows adjustments without panic.

Waiting for “perfect income”

Ignoring inflation

Overreacting to market downturns

Mixing retirement money with short-term spending

Skipping insurance

Discipline matters more than complexity.

Early planners experience:

Lower financial anxiety

Better decision-making

Higher confidence during uncertainty

Freedom to take career risks

Money becomes a tool, not a burden.

Focus on habits, consistency, and growth.

Increase contributions and diversify.

Balance growth with protection.

Preserve capital and ensure income stability.

Early planning simplifies every later stage.

Retirement planning from an early age is not about predicting the future—it is about preparing for flexibility. The goal is not just to retire, but to retire with dignity, independence, and choice.

Starting early allows you to build wealth calmly, adjust gradually, and live confidently—no matter how life changes.

This article is intended for informational and educational purposes only and does not constitute financial, investment, or legal advice. Retirement planning strategies vary based on individual income, goals, risk tolerance, and market conditions. Readers should consult a qualified financial advisor before making long-term financial decisions.

US Stocks Slide as AI Fears, Inflation and Oil Surge Weigh

US stocks dropped as AI disruption fears hit tech firms, inflation rose above forecasts, and oil pri

Pacific Prime Wins Top Honors at Cigna Awards 2026

Pacific Prime secured Top Individual Broker and Top SME Broker awards at Cigna’s Annual Broker Award

QatarEnergy Halts LNG Output After Military Attack

QatarEnergy has stopped LNG production after military attacks hit its facilities in Ras Laffan and M

Strong 6.1 Magnitude Earthquake Hits West Sumatra, No Damage

A 6.1 earthquake struck off West Sumatra, Indonesia. No casualties, damage, or tsunami alert reporte

Saudi Confirms Drone Strike on US Embassy Riyadh

Two drones hit the US Embassy in Riyadh, causing a small fire and minor damage. No injuries were rep

UAE Restarts Limited Flights as Regional Airspace Disruptions Continue

UAE restarts limited flights from Dubai as US-Israel attacks on Iran disrupt regional airspace, forc

Asia Faces Energy Shock After Iran Closes Strait

Iran shuts Strait of Hormuz amid US-Israel strikes, sending oil prices higher and raising serious en

Bank of Baroda Faces Abu Dhabi Legal Battle over NMC Collapse

Bank of Baroda’s involvement in Abu Dhabi litigation tied to the NMC Healthcare collapse raises repu

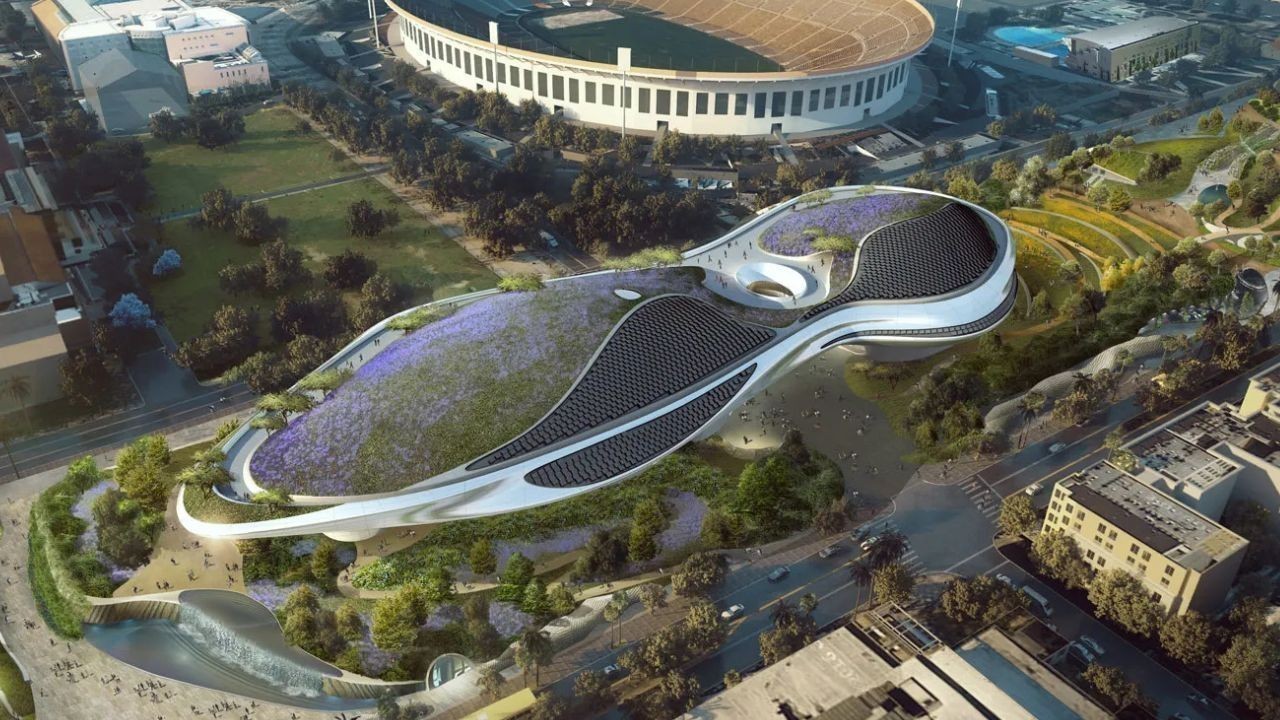

Top Museum Openings of 2026 Set to Transform Global Tourism

From Los Angeles to Abu Dhabi and Brussels, 2026 brings major museum launches—Lucas Museum, Guggenhe

UAE Tour Highlights UAE’s Strength in Hosting Global Sports Events

Abu Dhabi Sports Council says the successful UAE Tour reflects the UAE’s leading role in hosting maj

EU Seeks Clarity from US After Supreme Court IEEPA Ruling

European Commission urges full transparency from the US on steps after Supreme Court ruling, emphasi

SpaceX Launches 53 New Satellites for Expanding Starlink Network

SpaceX launches 53 Starlink satellites in two Falcon 9 missions, breaking reuse records and expandin

RTA Awards Contract for Phase II of Hessa Street Upgrade in Dubai

Phase II of Hessa Street Development to add bridges, tunnel, and upgraded intersections, doubling ca

UAE Gold Prices Today, Monday 16 February 2026: Dubai & Abu Dhabi Updated Rates

Gold prices in UAE on 16 Feb 2026 updated: 24K around AED 599.75/gm, 22K AED 555.25/gm, and 18K AED

Over 25 Ahmedabad Schools Receive Bomb Threat Email, Authorities Investigate

More than 25 schools in Ahmedabad evacuated after bomb threat emails mentioning Khalistan. Authoriti