Post by : Sam Jeet Rahman

Most people don’t struggle with money because they earn too little—many struggle because their entire financial life runs from a single bank account. Salary comes in, bills go out, subscriptions auto-renew, impulse spending happens, and at the end of the month the balance looks nothing like what they expected.

A 2-account system solves this problem instantly by giving your money clear direction. It separates your expenses, your responsibilities, and your lifestyle spending in a way that feels natural, not restrictive. It’s one of the simplest personal finance systems you can implement, and it works regardless of income level.

The system divides your financial life into:

Account 1 → Essentials & Commitments

Account 2 → Spending & Personal Freedom

The beauty of this system is that you don’t need budgeting apps, spreadsheets, or financial trackers. You only need two bank accounts and a habit of transferring money once a month.

This is where your salary arrives. This account is strictly for bills, responsibilities, and survival expenses. You do not use this account for food delivery, movies, shopping, or random online purchases.

It protects you from:

Overspending

Missed EMI payments

Bill shocks

Running out of money for essentials

When essentials are separated from lifestyle spending, money becomes predictable and stress-free.

Rent or home loan EMIs

Electricity & water bills

Internet & mobile plans

Groceries & household supplies

School fees

Insurance premiums

Medical expenses

Transport & fuel

Any mandatory subscriptions or payments

This account covers everything you must pay to live a stable life. There should be no emotional or impulse spending here.

Once you know the total cost of your essentials, you’ll immediately understand:

How much your life realistically costs

How much is safe to spend

How much you can save or invest

This financial clarity alone reduces stress by more than half.

This is the account you use for everything you enjoy, from shopping to eating out to online subscriptions. It is your guilt-free spending space.

A fixed monthly transfer—your personal spending allowance. This number doesn’t need to be perfect on day one. It can be adjusted based on your lifestyle.

Eating out & cafes

Movies or streaming platforms

Shopping

Travel & weekend plans

Personal grooming or salon visits

Subscriptions you enjoy (music, OTT, tools)

Impulse purchases

Anything that is not essential belongs here.

You never overspend because the amount is fixed

You don’t feel guilty spending because it's already allocated

You can enjoy lifestyle expenses without hurting your bills

You build natural discipline without forcing yourself

Most people save more money within the first month of shifting to this system.

The biggest question people have is: How much should I move into Account 2?

This includes everything in Account 1. Add up rent, EMIs, food, utilities, monthly fees, and any recurring payments.

Check your last 2–3 months of spending. How much did you spend on fun, travel, food delivery, subscriptions, etc.? This gives you a realistic baseline.

If you normally spend ₹15,000 per month on personal expenses but want to save more, start with ₹12,000 and see how it feels.

Once the money in Account 2 is gone, you stop spending for the month.

No transfers from Account 1.

No excuses.

No “just this one purchase.”

This is how discipline becomes automatic.

This is very common in the first month. Instead of transferring more money, do this:

Too much eating out?

Too many small online purchases?

Impulsive weekend plans?

If you ran out because your allowance was too low, increase it slightly. If you overspent impulsively, stay disciplined. The goal is honest self-assessment, not perfection.

This is the best part of the system: leftover money means you have naturally built savings without effort.

Emergency fund

Travel savings

A future purchase fund

Short-term investments

An FD or high-interest account

Small leftover amounts compound into large cushions over time.

Once you master the 2-account system, you can add a third:

This is for:

Investments

Retirement

Emergency fund

Child education planning

Long-term goals

This account grows quietly in the background while your lifestyle stays comfortable.

To make this system bulletproof, automate everything.

Salary arrives in Account 1

Automatic transfer to Account 2 on the same day

Automatic loan EMIs & bills from Account 1

Automatic savings from Account 1 to investment accounts

When you automate your money, discipline becomes effortless.

This system is successful worldwide because it gives you:

Clarity on what you can truly afford

Control over your lifestyle spending

Consistency in bill payments

Confidence that you’re not destroying your savings

Comfort because you never feel restricted

It’s simple, flexible, and psychologically effective.

This destroys the system. Keep Account 1 off your UPI apps if needed.

Increase only if you genuinely need more.

These quietly drain your Account 2 balance.

This breaks discipline. Stick to the rules.

The 2-account system is the easiest way to take control of your financial life. It requires no apps, no complex budgeting, and no lifestyle changes. By separating essential commitments from personal spending, you create a structure that protects your stability while giving you the freedom to enjoy your money guilt-free.

Once you try it, you’ll wonder how you ever managed money without it.

This article provides general personal finance guidance based on common money management practices. It should not be considered financial, legal, or investment advice. Individual financial situations may vary depending on income, lifestyle, debts, and personal goals. Readers should consult a qualified financial advisor for personalized recommendations.

US Stocks Slide as AI Fears, Inflation and Oil Surge Weigh

US stocks dropped as AI disruption fears hit tech firms, inflation rose above forecasts, and oil pri

Pacific Prime Wins Top Honors at Cigna Awards 2026

Pacific Prime secured Top Individual Broker and Top SME Broker awards at Cigna’s Annual Broker Award

QatarEnergy Halts LNG Output After Military Attack

QatarEnergy has stopped LNG production after military attacks hit its facilities in Ras Laffan and M

Strong 6.1 Magnitude Earthquake Hits West Sumatra, No Damage

A 6.1 earthquake struck off West Sumatra, Indonesia. No casualties, damage, or tsunami alert reporte

Saudi Confirms Drone Strike on US Embassy Riyadh

Two drones hit the US Embassy in Riyadh, causing a small fire and minor damage. No injuries were rep

UAE Restarts Limited Flights as Regional Airspace Disruptions Continue

UAE restarts limited flights from Dubai as US-Israel attacks on Iran disrupt regional airspace, forc

Asia Faces Energy Shock After Iran Closes Strait

Iran shuts Strait of Hormuz amid US-Israel strikes, sending oil prices higher and raising serious en

Bank of Baroda Faces Abu Dhabi Legal Battle over NMC Collapse

Bank of Baroda’s involvement in Abu Dhabi litigation tied to the NMC Healthcare collapse raises repu

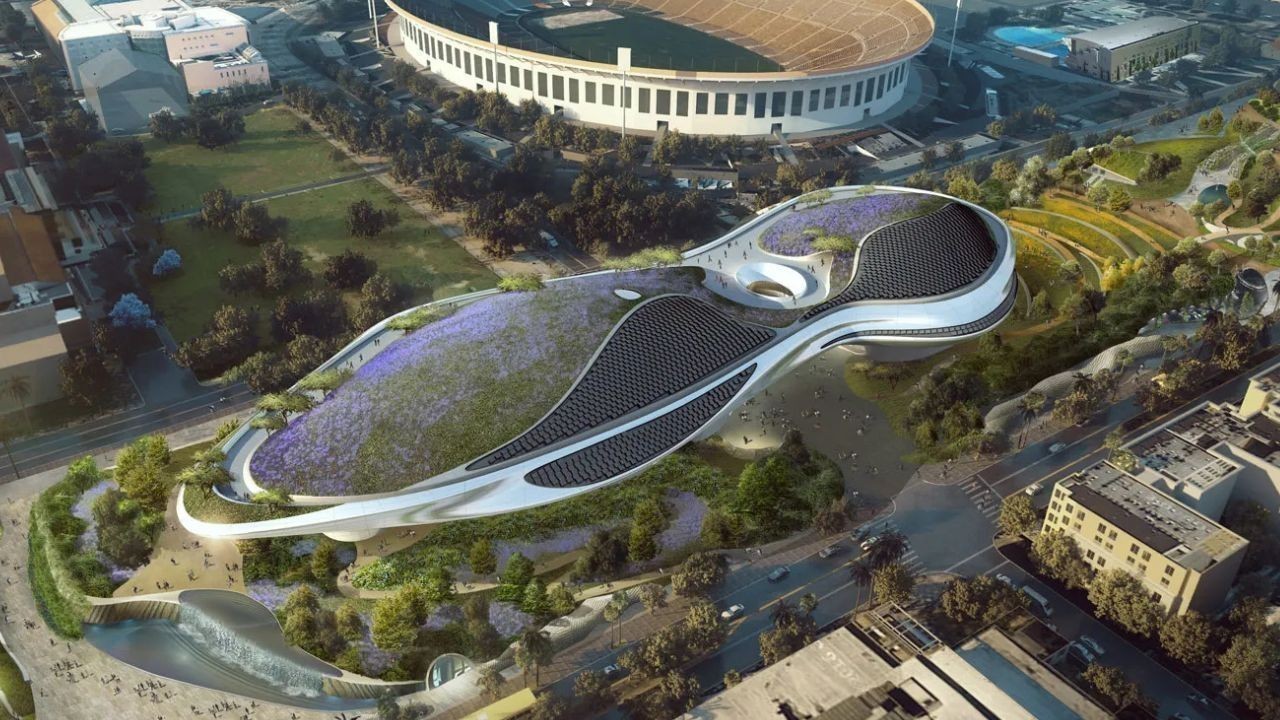

Top Museum Openings of 2026 Set to Transform Global Tourism

From Los Angeles to Abu Dhabi and Brussels, 2026 brings major museum launches—Lucas Museum, Guggenhe

UAE Tour Highlights UAE’s Strength in Hosting Global Sports Events

Abu Dhabi Sports Council says the successful UAE Tour reflects the UAE’s leading role in hosting maj

EU Seeks Clarity from US After Supreme Court IEEPA Ruling

European Commission urges full transparency from the US on steps after Supreme Court ruling, emphasi

SpaceX Launches 53 New Satellites for Expanding Starlink Network

SpaceX launches 53 Starlink satellites in two Falcon 9 missions, breaking reuse records and expandin

RTA Awards Contract for Phase II of Hessa Street Upgrade in Dubai

Phase II of Hessa Street Development to add bridges, tunnel, and upgraded intersections, doubling ca

UAE Gold Prices Today, Monday 16 February 2026: Dubai & Abu Dhabi Updated Rates

Gold prices in UAE on 16 Feb 2026 updated: 24K around AED 599.75/gm, 22K AED 555.25/gm, and 18K AED

Over 25 Ahmedabad Schools Receive Bomb Threat Email, Authorities Investigate

More than 25 schools in Ahmedabad evacuated after bomb threat emails mentioning Khalistan. Authoriti