Post by : Sam Jeet Rahman

Over the past few years, families across income levels have felt increasing pressure on their monthly budgets. Rising costs of essentials such as food, housing, education, healthcare, and utilities have changed how households manage money. Expenses that were once predictable now fluctuate frequently, making traditional budgeting methods less effective. Families are being forced to reassess priorities, adjust lifestyles, and adopt more flexible financial planning approaches to maintain stability.

Monthly budget planning has always been an important part of family financial management, but rising expenses have made it more complex than ever. Inflation, higher service charges, increased school fees, medical costs, and lifestyle-related expenses are reshaping how families allocate their income. What worked five years ago may no longer be practical today. This article explains how rising expenses are changing monthly budget planning for families, the challenges involved, and the smart adjustments households are making to stay financially secure.

Everyday necessities now consume a larger share of family income.

Impact on household budgets

Groceries, cooking gas, electricity, water, and transportation costs have steadily increased, leaving less room for discretionary spending.

Key changes families are noticing

• Higher monthly grocery bills

• Increased fuel and transport expenses

• Rising utility charges across seasons

As essentials take priority, families are cutting back on non-essential spending to balance their budgets.

Housing has become one of the largest budget stress points.

Why housing costs are rising

• Increased rental demand

• Higher maintenance and service fees

• Rising property-related expenses

Budget adjustments families are making

• Choosing smaller homes

• Relocating to affordable areas

• Sharing accommodation costs

Housing expenses now require long-term planning rather than short-term budgeting.

Education costs have increased significantly, especially for families with children.

Common education-related expenses

• School and tuition fees

• Online learning tools and devices

• Transport and extracurricular activities

How families are adapting

• Planning education funds early

• Reducing spending in other categories

• Comparing schools and learning options

Education is increasingly treated as a fixed, non-negotiable expense in monthly budgets.

Healthcare expenses are no longer occasional; they are now regular budget items.

Rising healthcare-related costs

• Medical consultations

• Medicines and preventive care

• Health insurance premiums

Budgeting changes

Families are setting aside a dedicated healthcare fund to avoid sudden financial strain during medical emergencies.

Traditional fixed budgets are becoming harder to maintain.

Why flexibility matters

Prices of essentials change frequently, making rigid budget categories ineffective.

New budgeting approaches

• Adjustable spending limits

• Monthly expense reviews

• Buffer amounts for variable costs

Flexible budgeting helps families respond quickly to changing expenses.

Non-essential spending is often the first area to be adjusted.

Common cuts families are making

• Dining out less frequently

• Limiting entertainment expenses

• Postponing major purchases

Families are becoming more conscious of value rather than convenience.

Saving money has become more challenging but also more important.

Why savings still matter

• Emergency preparedness

• Financial security during uncertainty

• Long-term goals

How families are managing to save

• Automating small savings amounts

• Reducing impulse spending

• Prioritising emergency funds

Even modest savings provide psychological and financial relief.

Families are paying closer attention to where money goes.

Popular tracking methods

• Monthly expense lists

• Budgeting apps

• Manual tracking for essentials

Awareness helps identify unnecessary spending and improve decision-making.

Rising expenses are also changing lifestyle choices.

Lifestyle shifts

• Choosing experiences over luxury items

• Opting for home-based entertainment

• Cooking more meals at home

These changes help families maintain quality of life while controlling costs.

Money discussions are becoming more open within households.

Positive outcomes

• Shared financial responsibility

• Better understanding of priorities

• Reduced financial stress

Involving all family members encourages mindful spending habits.

Families are thinking beyond monthly budgets.

Long-term planning areas

• Retirement savings

• Children’s future expenses

• Insurance coverage

Rising costs have highlighted the importance of forward-looking financial strategies.

The effect of rising expenses varies by household type.

Dual-income families

• Better income stability

• Higher lifestyle-related expenses

Single-income families

• Greater budget pressure

• More cautious spending habits

Both types require careful planning to maintain balance.

Families are actively seeking cost-saving opportunities.

Common strategies

• Comparing prices before purchases

• Using discounts and offers

• Buying in bulk for essentials

Value-driven spending has become a core budgeting principle.

Rising expenses affect more than just numbers.

Common emotional challenges

• Anxiety about future costs

• Stress over monthly commitments

• Fear of unexpected expenses

Acknowledging emotional impact helps families approach budgeting with compassion and realism.

Financial goals are being adjusted rather than abandoned.

New goal-setting approach

• Smaller, achievable milestones

• Short-term financial wins

• Regular goal reassessment

This approach keeps families motivated despite financial challenges.

Although rising expenses bring challenges, they also encourage financial awareness.

Positive outcomes

• Better money management skills

• Reduced wasteful spending

• Stronger financial discipline

Families who adapt effectively often emerge more financially resilient.

Rising expenses have fundamentally changed how families approach monthly budget planning. Essentials now take up a larger share of income, while flexibility, tracking, and conscious spending have become essential tools. Families are adjusting lifestyles, prioritising savings, and engaging in open financial discussions to cope with changing economic realities. While the pressure is real, thoughtful budgeting, realistic goal-setting, and adaptive planning can help families maintain stability and build long-term financial resilience.

This article is for informational purposes only. Financial situations vary based on income, location, and personal circumstances. Readers are encouraged to assess their own financial needs and consider professional financial advice when making major budgeting or investment decisions.

US Stocks Slide as AI Fears, Inflation and Oil Surge Weigh

US stocks dropped as AI disruption fears hit tech firms, inflation rose above forecasts, and oil pri

Pacific Prime Wins Top Honors at Cigna Awards 2026

Pacific Prime secured Top Individual Broker and Top SME Broker awards at Cigna’s Annual Broker Award

QatarEnergy Halts LNG Output After Military Attack

QatarEnergy has stopped LNG production after military attacks hit its facilities in Ras Laffan and M

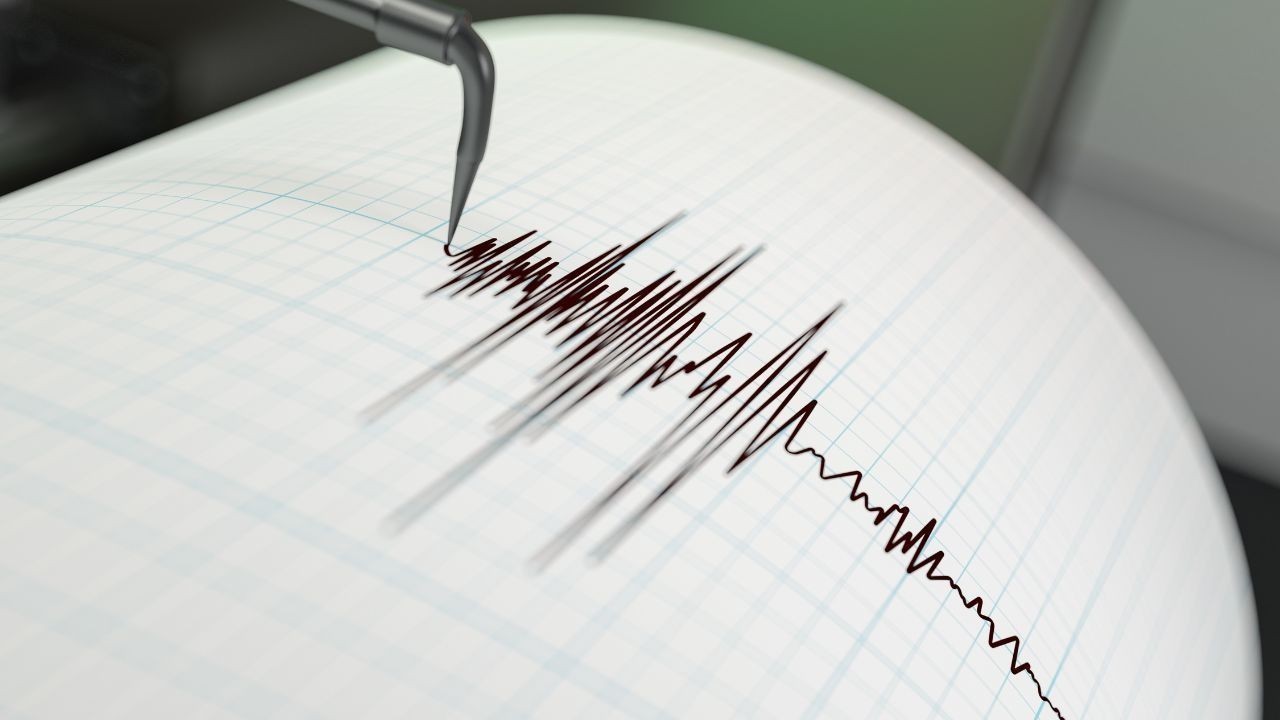

Strong 6.1 Magnitude Earthquake Hits West Sumatra, No Damage

A 6.1 earthquake struck off West Sumatra, Indonesia. No casualties, damage, or tsunami alert reporte

Saudi Confirms Drone Strike on US Embassy Riyadh

Two drones hit the US Embassy in Riyadh, causing a small fire and minor damage. No injuries were rep

UAE Restarts Limited Flights as Regional Airspace Disruptions Continue

UAE restarts limited flights from Dubai as US-Israel attacks on Iran disrupt regional airspace, forc

Asia Faces Energy Shock After Iran Closes Strait

Iran shuts Strait of Hormuz amid US-Israel strikes, sending oil prices higher and raising serious en

Bank of Baroda Faces Abu Dhabi Legal Battle over NMC Collapse

Bank of Baroda’s involvement in Abu Dhabi litigation tied to the NMC Healthcare collapse raises repu

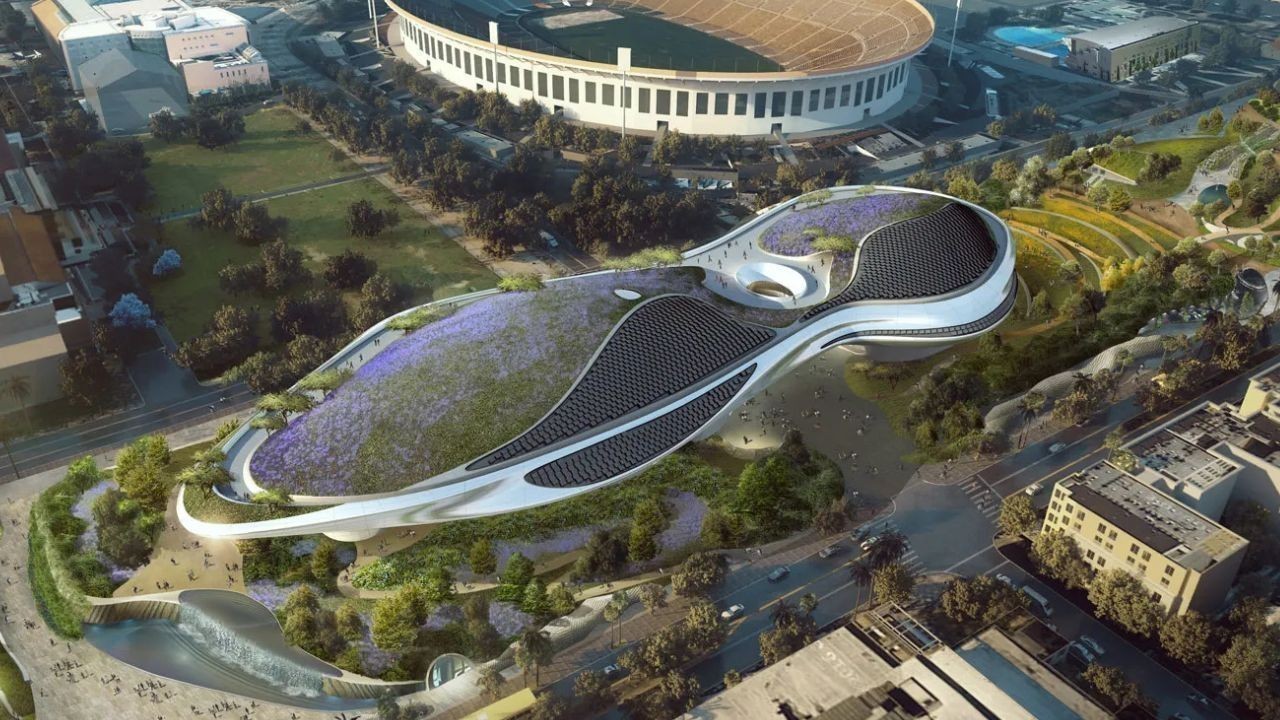

Top Museum Openings of 2026 Set to Transform Global Tourism

From Los Angeles to Abu Dhabi and Brussels, 2026 brings major museum launches—Lucas Museum, Guggenhe

UAE Tour Highlights UAE’s Strength in Hosting Global Sports Events

Abu Dhabi Sports Council says the successful UAE Tour reflects the UAE’s leading role in hosting maj

EU Seeks Clarity from US After Supreme Court IEEPA Ruling

European Commission urges full transparency from the US on steps after Supreme Court ruling, emphasi

SpaceX Launches 53 New Satellites for Expanding Starlink Network

SpaceX launches 53 Starlink satellites in two Falcon 9 missions, breaking reuse records and expandin

RTA Awards Contract for Phase II of Hessa Street Upgrade in Dubai

Phase II of Hessa Street Development to add bridges, tunnel, and upgraded intersections, doubling ca

UAE Gold Prices Today, Monday 16 February 2026: Dubai & Abu Dhabi Updated Rates

Gold prices in UAE on 16 Feb 2026 updated: 24K around AED 599.75/gm, 22K AED 555.25/gm, and 18K AED

Over 25 Ahmedabad Schools Receive Bomb Threat Email, Authorities Investigate

More than 25 schools in Ahmedabad evacuated after bomb threat emails mentioning Khalistan. Authoriti