Post by : Anis Karim

Most households today juggle rising expenses, unpredictable bills and the constant pressure of managing both long-term goals and day-to-day spending. Whether it’s groceries that cost more each month, irregular utility bills, or last-minute medical or repair expenses, financial planning has become more stressful than ever. Many people attempt budgeting for a week or two, only to find themselves slipping back into old habits due to complicated methods or tools that don’t fit their lifestyle.

That’s where practical, easy-to-use budgeting tools make a real difference. Not the overwhelming spreadsheets or complex financial apps that require too much input, but tools tested in real homes—tools that genuinely help people track spending, stay disciplined and actually save money. This article dives deep into household-friendly budgeting tools that have been tested for reliability, simplicity and real-world effectiveness. Each tool listed here fits into an average home’s routine without causing stress or demanding advanced financial knowledge.

If you’ve been looking for a straightforward way to regain control over your money, this guide lays out exactly what works, why it works, and how you can implement it starting this week.

Before exploring the tools that work, it’s important to understand why budgeting often collapses despite good intentions.

Many people start budgeting with strict rules that don’t match their lifestyle. When they fall behind once or twice, the entire plan collapses.

Even the best apps or spreadsheets fail when they demand too many inputs or daily updates. People abandon them quickly.

Budgets work only when you instantly see how much you've spent and how far you are from your limit. Delayed tracking leads to lost control.

A budgeting method must blend into daily life. If it feels like homework, it won’t last beyond a few weeks.

The tools covered below solve these issues because they focus on simplicity, visibility, habit-building and long-term sustainability.

The envelope method remains one of the simplest and most powerful budgeting tools. It works whether you use actual envelopes with cash or digital categories inside a budgeting app.

Create envelopes for key spending categories: groceries, fuel, daily expenses, medical, eating out.

Allocate a fixed amount for each envelope every month.

Once an envelope runs out, spending in that category stops until the next cycle.

It restricts overspending naturally—there’s no confusion about remaining money.

It forces prioritisation: if groceries exceed the allocation, eating-out money must remain untouched.

It builds spending discipline without needing detailed records.

Families with irregular incomes, individuals trying to stop impulse purchases, and anyone who needs visible boundaries.

This classic budgeting tool categorises monthly income into three parts:

50% essentials

30% lifestyle

20% savings

It gives a clear structure while allowing freedom. Essentials are fixed, lifestyle has breathing room and savings are non-negotiable.

Households using this method often find they control discretionary spending better and reach savings targets faster because the rule prevents aggressive or unrealistic budgeting.

Maintain a notebook or simple digital tracker with three columns.

Write down your expenses weekly, not daily.

Review at month-end to adjust proportions if needed.

Instead of monthly budgets, this tool breaks spending into weekly caps. It is one of the most effective systems for people who overspend early in the month.

Weekly limits give frequent resets.

Easy to monitor without detailed tracking.

Reduces the “mid-month panic zone” when most money is already spent.

Identify your total monthly spending budget.

Divide it by four.

Withdraw that amount in cash or set a digital cap.

At the end of each week, review what remains.

Students, working couples, and households with fluctuating grocery and lifestyle expenses.

Not the complicated financial sheet—just a 15-minute monthly sheet with minimal inputs.

Create five columns:

Date

Expense category

Amount spent

Mode of payment

Notes (optional)

It tracks spending patterns without overwhelming details.

Helps identify “leak categories” such as snacks, subscriptions or unplanned travel.

Encourages consistent tracking without complexity.

After two months, most people find 2–3 categories where they overspend unknowingly. Adjusting those saves real money.

In this system, every rupee you earn is allocated a purpose. Nothing remains unassigned.

Allocate income to all needs, wants and savings categories until the balance becomes zero.

Money gets directed intentionally instead of getting spent randomly.

Prevents leftover money being wasted.

Builds financial discipline by ensuring every rupee has a job.

Helps families prioritise essentials and savings.

These tools are extremely helpful in households with multiple earners or shared expenses.

Tracks who paid for what.

Balances expenses automatically.

Reduces conflict or confusion.

It removes the stress of mental accounting and makes the monthly review simple and fair.

Joint families, roommates, married couples sharing bills.

Most homes waste money on forgotten subscriptions. A subscription tracker prevents this.

A simple sheet or app listing OTT apps, broadband, gym memberships, cloud storage, digital tools.

The renewal dates and monthly cost.

People cancel unused services the moment they see how much they’re losing each year.

Impulse spends shoot up on weekends. Using only cash during weekends is a powerful tool to regain control.

Cash visibly leaves your hand, making you more mindful.

Reduces wasteful spending on outings and takeaways.

Helps families stay within lifestyle budgets.

Savings get split into specific buckets:

Emergency

Travel

Education

Home upgrades

Long-term investments

You clearly see progress toward each goal. This motivates consistency and reduces the temptation to dip into savings.

Families report smoother planning for vacations, school fees and health emergencies because money is segregated intentionally.

A physical budget board on a wall or refrigerator provides constant visibility.

A whiteboard with monthly goals

Expenses broken into essentials and non-essentials

A progress bar for savings

You see your budget every day, making you less likely to overspend.

Families with children, as it creates awareness and healthy habits for everyone.

Monthly reviews feel heavy and often come too late. Weekly mini reviews help you stay on track early.

Switching methods every month creates confusion. Stick to one tool for at least two full cycles.

Budgets must match your lifestyle. Overly strict limits cause burnout.

Savings must be treated as a monthly bill—pay it first.

These include electronics, furniture, appliances, and repair costs. Tracking separately prevents monthly budgets from looking distorted.

Families understand where money actually goes instead of guessing.

Clear tracking prevents end-of-month panic.

Even households with modest incomes report higher savings within two to three months.

For shared households, clarity in expenses reduces misunderstandings.

People become more conscious of impulse purchases and recurring waste.

A single tool works well, but combining a couple of them creates a well-rounded system.

Envelope system + Weekly limit tracker

Zero-balance budgeting + Savings buckets

Spreadsheet + Subscription tracker

Visual budget board + Envelope system

Weekly tracker + Cash-only weekends

These combinations maintain both structure and flexibility.

Pick the weekly spend-limit tracker or envelope system.

Zero-balance budgeting is ideal.

Use an expense-sharing app and a subscription tracker.

Start with a simple category sheet.

The cash-only weekend rule and weekly limit tracker work best.

Budgeting isn’t about restricting your life; it’s about controlling your money so it works for you instead of against you. The tools listed here focus on practicality, ease and everyday use—no complicated calculations, no overwhelming dashboards, just clean, simple systems that genuinely help households save more while stressing less.

Whether you choose the envelope system, a weekly tracker, bucket-based savings or subscription monitoring, the key is consistency. When you use one method regularly for even two months, the change becomes visible in spending habits, savings growth and overall financial clarity.

With rising costs and shifting lifestyles, effective budgeting is no longer optional—it is a necessity. Fortunately, the right tools make the process not just manageable, but surprisingly empowering.

This article provides general budgeting guidance for everyday households. Individual results may vary based on income patterns, responsibilities and financial goals.

US Stocks Slide as AI Fears, Inflation and Oil Surge Weigh

US stocks dropped as AI disruption fears hit tech firms, inflation rose above forecasts, and oil pri

Pacific Prime Wins Top Honors at Cigna Awards 2026

Pacific Prime secured Top Individual Broker and Top SME Broker awards at Cigna’s Annual Broker Award

QatarEnergy Halts LNG Output After Military Attack

QatarEnergy has stopped LNG production after military attacks hit its facilities in Ras Laffan and M

Strong 6.1 Magnitude Earthquake Hits West Sumatra, No Damage

A 6.1 earthquake struck off West Sumatra, Indonesia. No casualties, damage, or tsunami alert reporte

Saudi Confirms Drone Strike on US Embassy Riyadh

Two drones hit the US Embassy in Riyadh, causing a small fire and minor damage. No injuries were rep

UAE Restarts Limited Flights as Regional Airspace Disruptions Continue

UAE restarts limited flights from Dubai as US-Israel attacks on Iran disrupt regional airspace, forc

Asia Faces Energy Shock After Iran Closes Strait

Iran shuts Strait of Hormuz amid US-Israel strikes, sending oil prices higher and raising serious en

Bank of Baroda Faces Abu Dhabi Legal Battle over NMC Collapse

Bank of Baroda’s involvement in Abu Dhabi litigation tied to the NMC Healthcare collapse raises repu

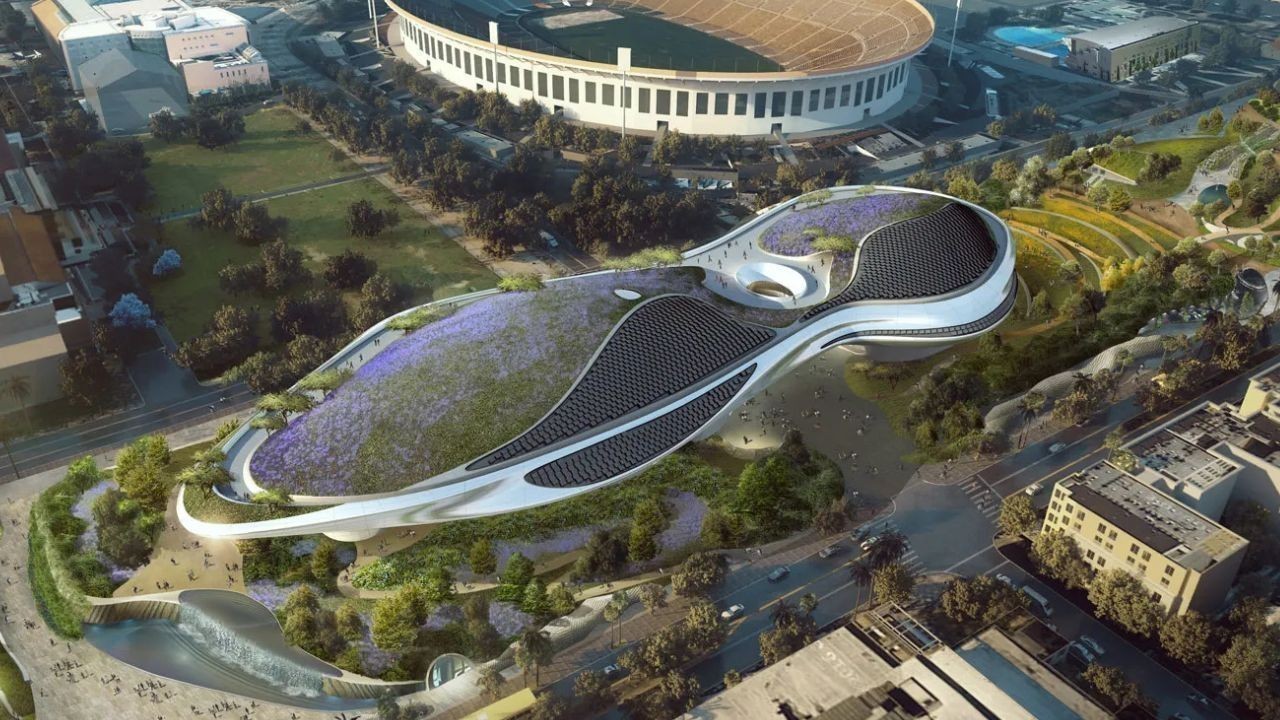

Top Museum Openings of 2026 Set to Transform Global Tourism

From Los Angeles to Abu Dhabi and Brussels, 2026 brings major museum launches—Lucas Museum, Guggenhe

UAE Tour Highlights UAE’s Strength in Hosting Global Sports Events

Abu Dhabi Sports Council says the successful UAE Tour reflects the UAE’s leading role in hosting maj

EU Seeks Clarity from US After Supreme Court IEEPA Ruling

European Commission urges full transparency from the US on steps after Supreme Court ruling, emphasi

SpaceX Launches 53 New Satellites for Expanding Starlink Network

SpaceX launches 53 Starlink satellites in two Falcon 9 missions, breaking reuse records and expandin

RTA Awards Contract for Phase II of Hessa Street Upgrade in Dubai

Phase II of Hessa Street Development to add bridges, tunnel, and upgraded intersections, doubling ca

UAE Gold Prices Today, Monday 16 February 2026: Dubai & Abu Dhabi Updated Rates

Gold prices in UAE on 16 Feb 2026 updated: 24K around AED 599.75/gm, 22K AED 555.25/gm, and 18K AED

Over 25 Ahmedabad Schools Receive Bomb Threat Email, Authorities Investigate

More than 25 schools in Ahmedabad evacuated after bomb threat emails mentioning Khalistan. Authoriti