Post by : Sam Jeet Rahman

When it comes to investing, two asset classes that often dominate conversations are gold and mutual funds. Both serve distinct purposes in an investment portfolio, and each has advantages depending on your financial goals, risk tolerance and time horizon. In 2026, many smart investors continue to use a balanced mix of both, but understanding the key differences — including risk, returns, liquidity and cost — helps you decide where your money should go.

Gold is often seen as a safe-haven asset — a store of value when economic uncertainty rises. Throughout history, gold has held psychological appeal during market volatility, currency fluctuations and geopolitical disruptions. Investors hold gold to preserve purchasing power rather than to generate high returns.

Inflation Hedge

Gold often rises in value when inflation accelerates. Unlike currency or fixed-income assets, it is not directly tied to interest rates or government debt, so its value tends to hold up when purchasing power declines.

Crisis Protection

During market downturns, gold typically shows relative strength compared to equities or debt instruments. This makes it attractive during recessions, wars, or financial stress.

Diversification

Gold has historically low or negative correlation with stocks and bonds. Holding some gold in a diversified portfolio can reduce overall volatility and risk.

• Physical Gold – Jewellery, coins, bars (requires storage and purity checks)

• Sovereign Gold Bonds (SGBs) – Issued by governments, earn interest, no storage issues

• Gold ETFs / Digital Gold – Traded on exchanges, easy to buy/sell, no physical handling

• Gold Funds – Funds that invest in gold or gold-related assets

Strengths:

• Stable store of value

• Hedge against inflation and currency risk

• Good diversification asset

Limitations:

• No rental or dividend income

• Price can be volatile short-term

• Physical gold has storage/cost issues

Mutual funds are pooled investment vehicles managed by professionals. They invest in equities, bonds, money market instruments or hybrid assets based on a predefined strategy. Unlike gold, mutual funds aim for growth and income, making them core wealth-building tools.

Equity Funds:

• Invest primarily in stocks

• Best suited for long-term growth

• Includes large-cap, mid-cap, multi-cap, sector funds

Debt Funds:

• Invest in bonds and fixed-income instruments

• Lower volatility than equities

Hybrid Funds:

• Mix of equity and debt

• Built-in diversification

Index Funds & ETFs:

• Passive funds tracking market indices

• Lower costs and broad market exposure

Compounding & Growth

Equity mutual funds have historically delivered higher returns than traditional assets over long periods (10+ years) because of corporate earnings growth and reinvested profits.

Professional Management

Fund managers make investment decisions, reducing the burden on individual investors.

Diversification

Mutual funds spread risk across multiple securities, reducing single-stock risk.

Flexibility & Liquidity

Mutual funds can be bought/sold on any business day, and investors can set up SIPs (Systematic Investment Plans) to invest progressively.

Strengths:

• Potential for higher long-term returns

• Diversification and professional management

• Choice of risk levels (equity, debt, hybrid)

Limitations:

• Returns are market-linked, not guaranteed

• Subject to market volatility

• Costs (expense ratios, exit loads) affect net returns

To decide where smart money is being placed in 2026, it helps to compare gold and mutual funds across essential investment metrics:

• Gold: Lower risk in crisis compared to equities but limited return potential over long periods

• Mutual Funds: Equity funds carry higher risk but higher long-term return potential; debt funds are lower risk but lower returns

• Gold: Generally no regular income (excluding SGB interest)

• Mutual Funds: Certain funds provide dividends or income distributions (especially debt and hybrid)

• Gold ETFs & Mutual Funds: High liquidity; can be sold any trading day

• Physical Gold: Less liquid; may involve making/transaction costs

• Gold: Historically an inflation hedge

• Mutual Funds: Equity funds often outpace inflation over long horizons

• Gold: Physical gold taxed as a collectible, often higher capital gains tax; SGB interest is taxable

• Mutual Funds: Equity funds enjoy favorable long-term capital gains tax; debt funds follow normal capital gains tax

In 2026, many informed investors prefer a balanced portfolio that uses both gold and mutual funds strategically:

Gold is used as a risk mitigator — hedging against inflation, currency risk and downturns. It is rarely the main growth driver but adds stability when markets wobble.

Mutual Funds — especially equity funds and index funds — are used as the primary engine for long-term wealth creation. Investors often use SIPs to benefit from rupee cost averaging and compounding.

Example Allocation:

• 20–30% in Gold & Diversifiers: Via SGBs and Gold ETFs

• 60–80% in Mutual Funds: With a mix of equity and hybrid funds based on risk profile

• 0–20% in Debt and Safe Assets: For stability and emergency planning

Your personal financial goals help define where your money should go:

Emergency or Safety First: Higher gold and debt allocation

Long-Term Growth: Larger equity mutual fund exposure

Retirement Planning: Mix of equity funds, debt funds and some gold

Portfolio Stability during Volatility: Gold, debt funds, balanced funds

• Start Early: Time in the market compounds wealth beyond timing the market

• Diversify: Never rely on a single asset class

• Stay Disciplined: Use SIPs and avoid emotional decisions

• Review Regularly: Rebalance your portfolio annually

Gold and mutual funds serve different purposes. Gold offers safety and diversification, especially in uncertain economic conditions. Mutual funds — particularly equity funds — drive long-term growth for investors willing to tolerate short-term volatility. In 2026, smart investors balance both assets according to their financial goals, risk tolerance and investment horizon.

Disclaimer: This is for informational purposes only and does not constitute financial advice. Investment decisions should be made based on individual goals, risk tolerance and professional consultation.

US Stocks Slide as AI Fears, Inflation and Oil Surge Weigh

US stocks dropped as AI disruption fears hit tech firms, inflation rose above forecasts, and oil pri

Pacific Prime Wins Top Honors at Cigna Awards 2026

Pacific Prime secured Top Individual Broker and Top SME Broker awards at Cigna’s Annual Broker Award

QatarEnergy Halts LNG Output After Military Attack

QatarEnergy has stopped LNG production after military attacks hit its facilities in Ras Laffan and M

Strong 6.1 Magnitude Earthquake Hits West Sumatra, No Damage

A 6.1 earthquake struck off West Sumatra, Indonesia. No casualties, damage, or tsunami alert reporte

Saudi Confirms Drone Strike on US Embassy Riyadh

Two drones hit the US Embassy in Riyadh, causing a small fire and minor damage. No injuries were rep

UAE Restarts Limited Flights as Regional Airspace Disruptions Continue

UAE restarts limited flights from Dubai as US-Israel attacks on Iran disrupt regional airspace, forc

Asia Faces Energy Shock After Iran Closes Strait

Iran shuts Strait of Hormuz amid US-Israel strikes, sending oil prices higher and raising serious en

Bank of Baroda Faces Abu Dhabi Legal Battle over NMC Collapse

Bank of Baroda’s involvement in Abu Dhabi litigation tied to the NMC Healthcare collapse raises repu

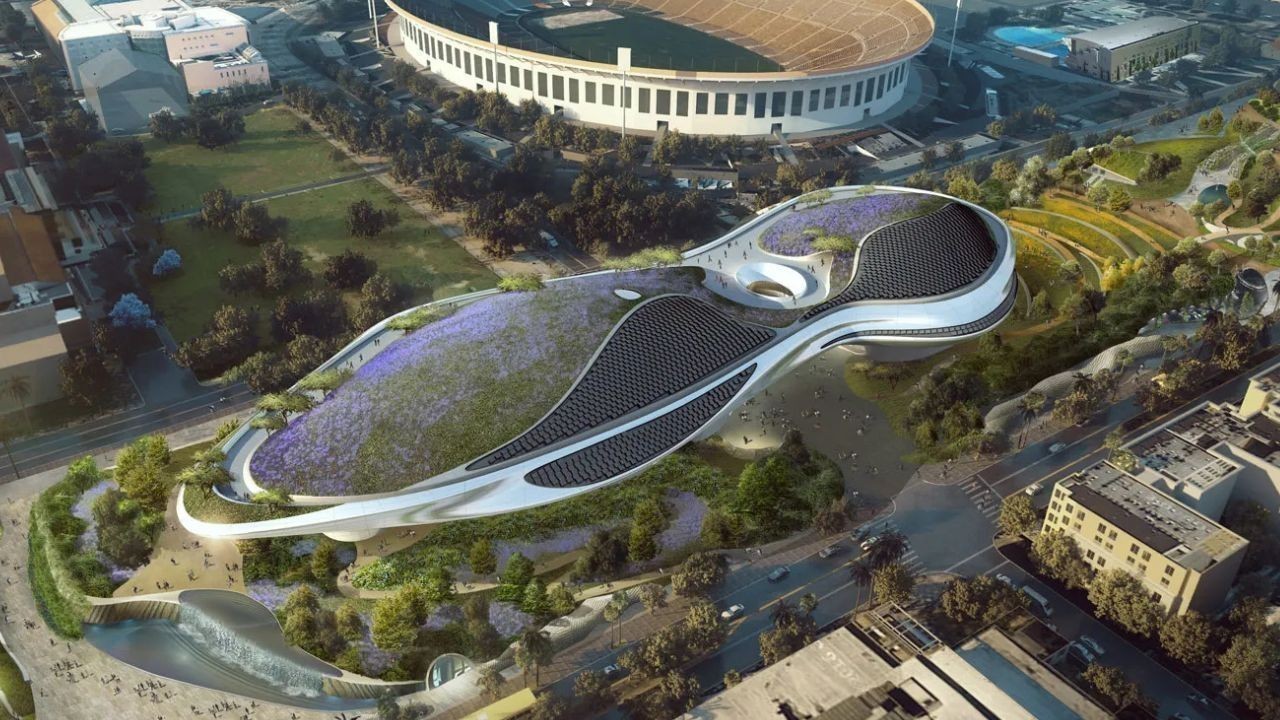

Top Museum Openings of 2026 Set to Transform Global Tourism

From Los Angeles to Abu Dhabi and Brussels, 2026 brings major museum launches—Lucas Museum, Guggenhe

UAE Tour Highlights UAE’s Strength in Hosting Global Sports Events

Abu Dhabi Sports Council says the successful UAE Tour reflects the UAE’s leading role in hosting maj

EU Seeks Clarity from US After Supreme Court IEEPA Ruling

European Commission urges full transparency from the US on steps after Supreme Court ruling, emphasi

SpaceX Launches 53 New Satellites for Expanding Starlink Network

SpaceX launches 53 Starlink satellites in two Falcon 9 missions, breaking reuse records and expandin

RTA Awards Contract for Phase II of Hessa Street Upgrade in Dubai

Phase II of Hessa Street Development to add bridges, tunnel, and upgraded intersections, doubling ca

UAE Gold Prices Today, Monday 16 February 2026: Dubai & Abu Dhabi Updated Rates

Gold prices in UAE on 16 Feb 2026 updated: 24K around AED 599.75/gm, 22K AED 555.25/gm, and 18K AED

Over 25 Ahmedabad Schools Receive Bomb Threat Email, Authorities Investigate

More than 25 schools in Ahmedabad evacuated after bomb threat emails mentioning Khalistan. Authoriti