Post by : Anis Karim

For over a decade, Bitcoin navigated a murky regulatory landscape—hailed by advocates as a beacon of financial liberty and critiqued by authorities as a potential risk. This phase is now shifting.

In 2026, Bitcoin's regulation is firmly proactive and unified. Nations across the globe are taking robust steps to assimilate the premier cryptocurrency into established legal structures. While methods may vary, a shared global intent is evident: to bring Bitcoin into formal financial systems rather than driving it underground.

This transformation signals one of the most critical eras in Bitcoin's journey.

Numerous factors have converged to drive rapid regulatory changes:

Bitcoin’s market volume has reached a point that cannot be ignored

A surge in institutional involvement has been notable

Ongoing concerns regarding money laundering, tax evasion, and consumer safety remain

Central banks are simultaneously crafting digital currencies in response to crypto growth

Bitcoin has evolved from being a niche pursuit to a significant consideration for global economic stability.

Most major economies are not implementing total bans on Bitcoin. Instead, they are regulating the surrounding ecosystem—covering exchanges, custodians, wallets, and reporting measures.

The aim here is oversight, not eradication.

In 2026, the United States significantly boosts its Bitcoin regulatory framework.

Enhanced tax reporting guidelines for cryptocurrency transactions

Stricter regulations on Bitcoin exchanges and custodians

Clear demarcations differentiating Bitcoin from securities

More vigilant scrutiny over high-value Bitcoin transfers

Regulators now lean towards transparency and consumer safeguards rather than ideological conflicts. Bitcoin itself is primarily recognized as a commodity rather than a security, providing the long-desired clarity to the markets.

The European Union has set forth one of the most far-reaching regulatory frameworks for crypto globally.

Obligatory licensing for Bitcoin service providers

Strict adherence to Know Your Customer and anti-money laundering laws

Uniform reporting standards throughout member countries

Restrictions on anonymous cryptocurrency transactions

Europe's regulatory stance prioritizes investor security and systemic integrity—even at the expense of faster innovation.

The United Kingdom has established a balanced regulatory framework.

Bitcoin's legality continues, but:

Greater oversight is imposed on exchanges

Marketing and promotional activities are strictly controlled

Custodial standards are being elevated

The UK aims to become a regulated crypto hub rather than just a market for speculation.

Japan continues to regard Bitcoin as legal property through stringent licensing regulations. Exchanges must adhere to high standards regarding security and transparency, positioning Japan as one of the safest Bitcoin markets globally.

South Korea has heightened its oversight of Bitcoin trading by concentrating on:

Investor protection

Exchange solvency

Preclusion of market manipulation

While speculation persists, it occurs under intensive scrutiny.

China maintains stringent limitations on Bitcoin trading and mining, yet full ownership remains challenging to curtail.

China’s focus remains on managing capital flows and promoting state-backed digital currency solutions rather than endorsing decentralized assets.

India has transitioned from ambiguity towards an organized regulatory framework.

Bitcoin trading is still lawful

High taxation on crypto earnings

Compulsory transaction reporting

Increased scrutiny regarding exchanges

India's strategy indicates a level of acceptance—though not encouragement—of Bitcoin usage.

Countries like the United Arab Emirates are positioning themselves as regulated cryptocurrency hubs.

Bitcoin trading is permitted, regulated, and progressively institutionalized, especially in financial free zones aimed at attracting international investment.

In various parts of Africa and Latin America, Bitcoin adoption continues to be spurred by economic instability and the quest for financial inclusion.

Governments are introducing:

Rules for exchange registration

Protections against fraud

Tax regulations

The focus is on leveraging Bitcoin's utility while curtailing systemic risks.

Bitcoin transactions are becoming traceable as exchanges heighten identity verification requirements. The previous era of completely anonymous trading is nearing its conclusion.

Governments across the globe are enhancing their capabilities to track Bitcoin profits. Autosynced data sharing between exchanges and tax agencies is increasingly common.

Neglecting to declare crypto income may now lead to serious repercussions.

Bitcoin service providers are now mandated to uphold better standards for:

Asset segregation

Cold storage provisions

Insurance coverage

This enhances investor security, albeit accompanied by increased operational costs.

A critical impetus for expanding Bitcoin regulations has been institutional involvement. Banks, asset managers, and investment funds seek legal clarity before committing resources.

Regulation, ironically, is rendering Bitcoin more attractive for investors, instead of the contrary.

Critics assert that regulations compromise Bitcoin's decentralized ethos. Supporters counter by saying:

The core Bitcoin protocol remains decentralized

Regulation primarily targets intermediaries, not the underlying network

Legal clarity bolsters long-term acceptance

Bitcoin is transitioning from a rebellious phase to a foundational infrastructure.

As regulations broaden:

Extreme price fluctuations are becoming less common

Market manipulation is increasingly difficult

Institutional trust is on the rise

While the trade-off may be slower speculative returns, the reward is enhanced durability.

As governments position their own digital currencies, Bitcoin retains its unique identity:

It remains decentralized

It isn't managed by any state

Its supply is capped

Rather than supplanting Bitcoin, CBDCs underscore the necessity for precise crypto regulations.

International organizations are striving for unified crypto standards, aiming to minimize regulatory loopholes.

This global collaboration reduces gaps while reinforcing market integrity.

In the coming years, anticipate:

Greater consistency in global regulations

Enhanced integration with institutional providers

Reduced tolerance for regulatory non-compliance

Clear distinctions between Bitcoin and more speculative tokens

Bitcoin is marking its territory as a regulated financial asset class.

The sweeping expansion of Bitcoin regulation represents a significant departure from its Wild West era. Governments are no longer questioning the existence of Bitcoin, but rather discussing its place in contemporary financial landscapes.

For investors, this translates into reduced uncertainty, diminished loopholes, and enhanced accountability. For Bitcoin itself, this transition means increased validity, resilience, and ongoing relevance.

Bitcoin has faced skepticism, downturns, and bans. Regulation may turn out to be its most pivotal chapter—not as a hindrance, but as a groundwork for evolution.

Disclaimer:

This material serves informational purposes solely and does not provide financial or legal counsel. Cryptocurrency regulations are subject to diverse jurisdictions and can frequently change.

Dubai Media Council Trains Executives in Madrid on Creativity & AI Innovation

Dubai Media Council conducted a global executive programme in Madrid, boosting media leadership, AI

Dubai Chambers Signs MoUs with FinTech Companies to Boost SME Growth

Dubai Chambers collaborates with Mamo, Qashio, Pemo, and Vault to provide SMEs with modern financial

Dubai Traders Teams Up with IQ Fulfillment to Strengthen SME Logistics & Scale

Dubai Traders partners with IQ Fulfillment, offering AI-powered logistics, robotics, and analytics t

Over 25 Ahmedabad Schools Receive Bomb Threat Email, Authorities Investigate

More than 25 schools in Ahmedabad evacuated after bomb threat emails mentioning Khalistan. Authoriti

16-Year-Old Girl’s Body Recovered from Crematorium Pond in Gurugram

A 16-year-old Gurugram girl went missing; body found in a pond. Diary note revealed her intentions.

Europe Reduces Reliance on U.S. Defence After Greenland Push

European leaders at Munich Security Conference vow stronger NATO role and self-defence as U.S. commi

Israel Strikes Gaza Following Hamas Ceasefire Violations, 11 Palestinians Dead

Israel launches airstrikes in Gaza killing 11 after Hamas violates ceasefire. Tensions rise ahead of

Over 25 Ahmedabad Schools Receive Bomb Threat Email, Authorities Investigate

More than 25 schools in Ahmedabad evacuated after bomb threat emails mentioning Khalistan. Authoriti

Ukraine Ex-Energy Minister Arrested in Corruption Case

Ukraine’s anti-corruption agency NABU arrested former Energy Minister German Galushchenko while he t

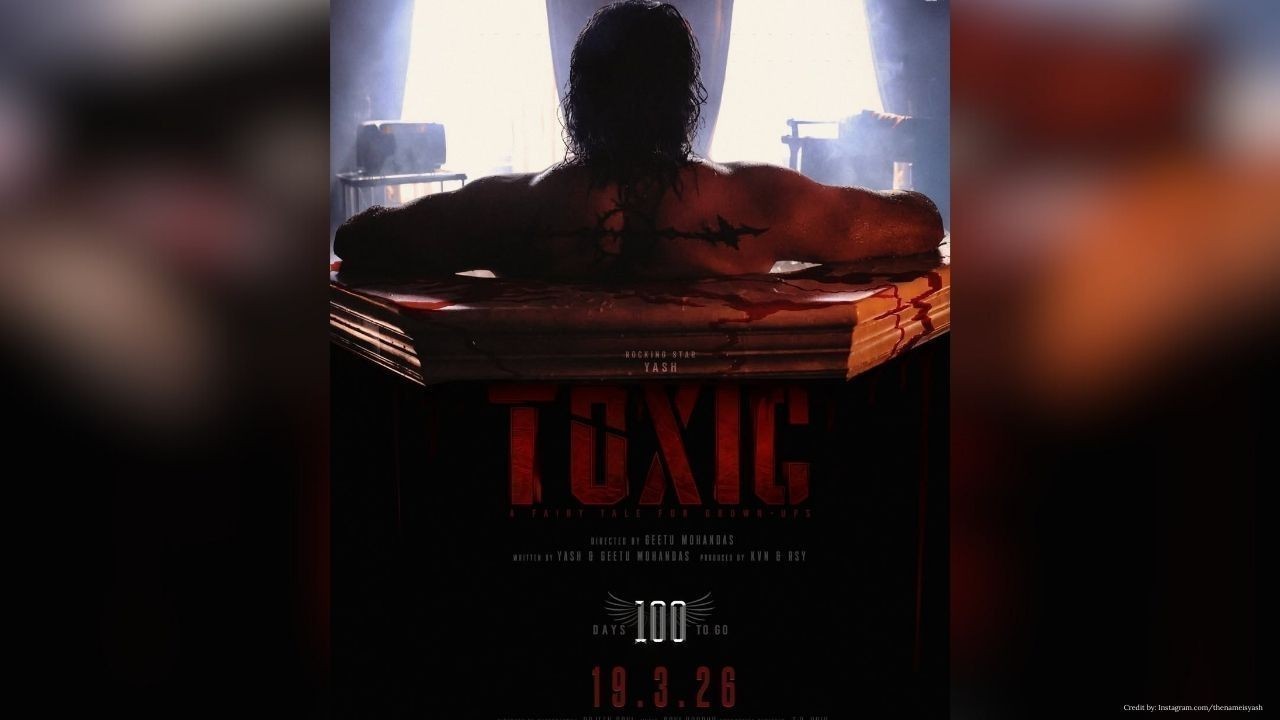

Toxic: A Fairy Tale for Grown-Ups set for worldwide release on March 19, 2026

Toxic: A Fairy Tale for Grown-Ups starring Yash releases worldwide on March 19, 2026, with festive t

Suryakumar Dedicates T20 World Cup Win as India Crush Pakistan by 61 Runs

India defeated Pakistan by 61 runs in the T20 World Cup. Suryakumar Yadav praised Ishan Kishan’s 77

Dhurandhar 2 set to storm theatres on March 19, 2026

Dhurandhar 2, titled Dhurandhar: The Revenge, releases in theatres on March 19, 2026 with a pan-Indi

Dubai Games 2026 Concludes Celebrating Teamwork and Triumph

Dubai Games 2026 ends with Ajman Government, F3, and Czarny Dunajec winning top titles as 1,600 athl

Sheikh Hamdan Honours Arab Hope Maker with AED3 Million Awards

Sheikh Hamdan crowns Fouzia Mahmoudi Arab Hope Maker, awarding AED3 million to top finalists for hum

Why Drinking Soaked Chia Seeds Water With Lemon and Honey Before Breakfast Matters

Drinking soaked chia seeds water with lemon and honey before breakfast may support digestion hydrati