Post by : Michael Darzi

In today’s busy world, financial wellness is more than just earning money—it is about using money wisely, making smart choices, and planning for the future. For millennials, managing money can feel challenging. With student loans, high living costs, and career uncertainties, keeping finances in order can seem stressful. But the good news is that financial wellness is possible if smart habits are started early. By beginning today, millennials can take control of their money and build a life that is financially secure and stress-free.

Financial wellness means feeling confident about your money. It is knowing that you can handle your immediate expenses while also preparing for long-term goals. For millennials, this is very important because many are managing multiple responsibilities such as rent, loans, travel, and lifestyle expenses. Even a good salary may not lead to financial security if money is not managed properly. Being financially well allows you to live comfortably now and be ready for the future.

Budgeting is the first and most important step in financial wellness. By keeping track of income and expenses, you can see where your money is going each month. Start by noting all monthly earnings and subtracting fixed costs like rent, utilities, and groceries. The remaining money can then be used for savings, investments, or fun spending.

Budgeting does not have to be difficult. Using apps or simple spreadsheets can make it easier and even enjoyable. Millennials who budget properly are less likely to overspend, more likely to save, and better prepared for emergencies. Budgeting is not about limiting yourself—it is about making smart choices with your money.

Life is unpredictable. An emergency fund is a backup that protects you in unexpected situations. Ideally, millennials should try to save three to six months’ worth of living expenses in a separate account. Even saving small amounts regularly can grow into a significant fund. This fund can cover sudden events like medical bills, car repairs, or job loss, helping you avoid financial stress and stay on track with your goals.

Many millennials have debts from student loans, credit cards, or personal loans. Paying off high-interest debts first is a smart strategy. Two popular ways to manage debt are:

Debt Avalanche Method: Pay off debts with the highest interest first.

Debt Snowball Method: Pay off smaller debts first for motivation.

Reducing debt improves financial health, frees up money for savings and investments, and reduces stress.

Saving money is important, but investing is essential to grow wealth. Millennials have an advantage because they have time on their side. Small, regular investments in stocks, mutual funds, or retirement accounts like IRAs or 401(k)s can grow a lot over the years due to compounding. Start small, learn the basics, and gradually explore different types of investments. The sooner you begin, the more your money will grow.

Financial knowledge is power. Millennials should take time to read books, follow trustworthy financial blogs, or attend workshops about money management. Learning about budgeting, taxes, investments, and retirement planning helps you make smart decisions and avoid mistakes. The more you know, the better you can plan your financial future.

Without goals, money management can feel aimless. Set clear short-term goals, like saving for a trip or a new gadget, and long-term goals, like buying a home, starting a business, or preparing for retirement. Break each goal into smaller steps, track your progress, and celebrate achievements. Having clear goals makes financial planning easier and more effective.

Financial wellness is not about giving up what you enjoy—it is about spending carefully. Millennials should avoid impulse purchases, compare prices, and focus on getting value for their money. Using credit cards responsibly, avoiding unnecessary lifestyle upgrades, and prioritizing needs over wants helps balance enjoyment today with savings for tomorrow. Small, careful spending habits can make a big difference over time.

Retirement may seem far away, but early planning makes it easier. Contributing to employer retirement plans like 401(k)s or personal retirement accounts can help your money grow over time. Even small monthly contributions now can turn into a large retirement fund in the future. Planning early ensures financial independence and security later in life.

Today, technology makes managing money simpler. Millennials can use apps for budgeting, investing, and tracking expenses. These tools provide a clear view of spending patterns, automate savings, and help manage investments. Using technology wisely can make financial management easier and more efficient.

Financial wellness is not a one-time achievement—it is a lifelong journey. For millennials, developing habits like budgeting, saving, investing, learning about money, setting goals, and spending wisely can change their financial future. Consistency matters. It is not about how much money you earn, but how wisely you use, save, and grow it. By taking small, careful steps today, millennials can enjoy financial freedom, reduce stress, and secure a comfortable future.

Disclaimer

The information provided in this article is intended for educational and informational purposes only. It is not intended to serve as professional financial, investment, or legal advice. While every effort has been made to ensure the accuracy and reliability of the content, DXB News Network does not guarantee the completeness or correctness of the information. Readers should not make financial decisions solely based on the content of this article. It is strongly recommended that readers consult with qualified financial advisors, investment professionals, or legal experts before making any financial, investment, or money management decisions. DXB News Network will not be responsible for any losses, damages, or consequences arising from actions taken based on the information provided in this article.

Predictheon Wins WHX Xcelerate Innovation Champion 2026

Predictheon won WHX 2026 Xcelerate, earning US$12,000, WHX 2027 space and global exposure for its AI

Omantel Launches Otech to Drive Oman’s Future Tech Vision

Omantel launches Otech to accelerate Oman’s digital transformation, strengthen data sovereignty, exp

Daimler Truck MEA Honors Top Distributors at EliteClass 2025

Daimler Truck MEA hosted EliteClass Awards 2025 in Dubai, honoring top distributors across 19 catego

King Mohammed VI Launches Safran Landing Gear Plant in Morocco

Morocco strengthens its aerospace leadership as King Mohammed VI launches Safran’s €280M landing gea

Qatar Emir Sheikh Tamim Arrives in UAE on Fraternal Visit

Qatar’s Emir Sheikh Tamim bin Hamad Al Thani arrived in Abu Dhabi on Saturday. UAE President Sheikh

Shaidorov Wins Stunning Olympic Gold as Malinin Falters

Kazakhstan’s Mikhail Shaidorov won men’s figure skating gold after US star Ilia Malinin fell twice.

Shakira’s 5-Show El Salvador Residency Boosts Bukele Image

Shakira’s five sold-out concerts in San Salvador highlight El Salvador’s security shift under Bukele

Why Drinking Soaked Chia Seeds Water With Lemon and Honey Before Breakfast Matters

Drinking soaked chia seeds water with lemon and honey before breakfast may support digestion hydrati

Morning Walk vs Evening Walk: Which Helps You Lose More Weight?

Morning or evening walk Learn how both help with weight loss and which walking time suits your body

What Really Happens When You Drink Lemon Turmeric Water Daily

Discover what happens to your body when you drink lemon turmeric water daily including digestion imm

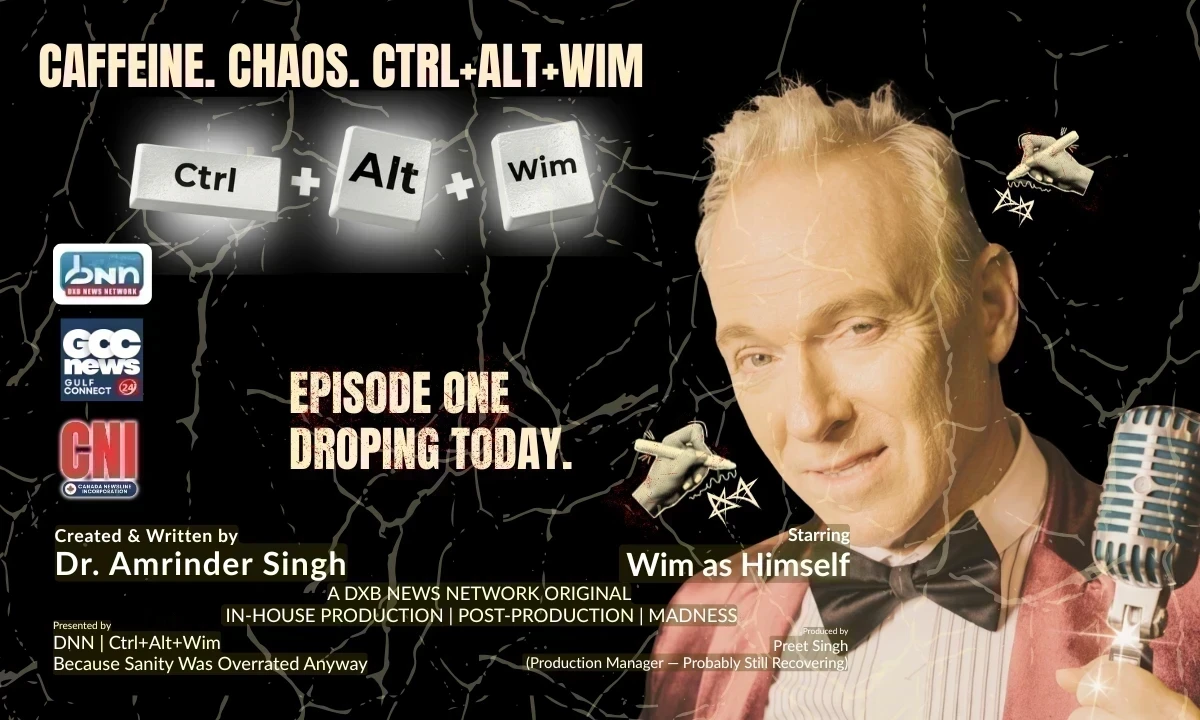

DXB News Network Presents “Ctrl+Alt+Wim”, A Bold New Satirical Series Starring Global Entertainer Wim Hoste

DXB News Network premieres Ctrl+Alt+Wim, a bold new satirical micro‑series starring global entertain

High Heart Rate? 10 Common Causes and 10 Natural Ways to Lower It

Learn why heart rate rises and how to lower it naturally with simple habits healthy food calm routin

10 Simple Natural Remedies That Bring Out Your Skin’s Natural Glow

Discover simple natural remedies for glowing skin Easy daily habits clean care and healthy living ti

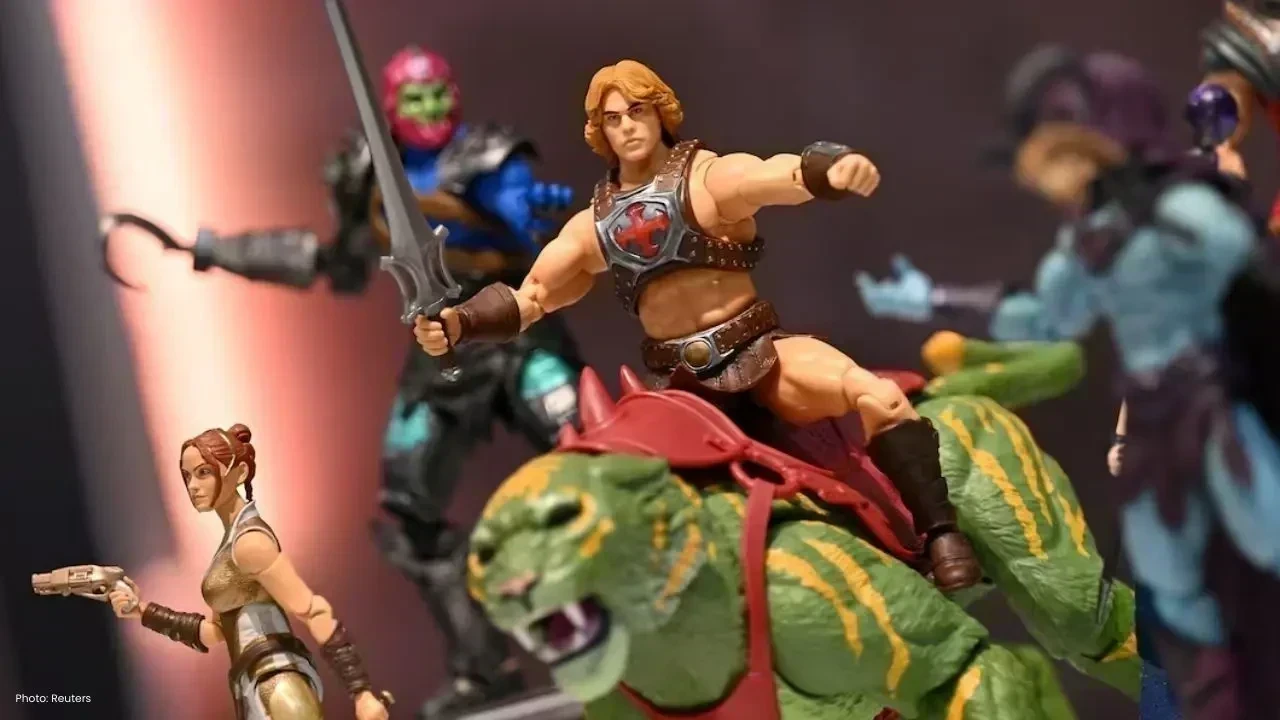

Mattel Revamps Masters of the Universe Action Figures for Upcoming Film

Mattel is set to revive Masters of the Universe action figures in sync with their new movie, ignitin

China Executes 11 Members of Infamous Ming Family Behind Myanmar Scam Operations

China has executed 11 Ming family members, linked to extensive scams and gambling in Myanmar, causin