Dubai and the UAE have become global business hubs, attracting entrepreneurs from around the world. With a strategic location, state-of-the-art infrastructure, and business-friendly policies, the UAE offers a myriad of opportunities for foreign investors. This guide provides an in-depth look at the essential aspects of starting a business in Dubai and the broader UAE.

The UAE comprises seven emirates:

Each emirate has its own set of rules and regulations, particularly regarding business setup, which can vary significantly.

Rules and Regulations for Starting a Business in the UAE

Rules and Regulations for Starting a Business in the UAE

Starting a business in the UAE involves navigating various rules and regulations, which can differ based on the emirate and the type of business. However, several general guidelines apply nationwide. Understanding these regulations is crucial for ensuring a smooth and compliant business setup process.

Obtaining the right licence is the first and most crucial step in setting up a business in the UAE. The type of licence required depends on the nature of the business activity:

The process of obtaining a licence involves submitting the required documents, paying the relevant fees, and getting approval from the respective Department of Economic Development (DED) or the free zone authority. It's important to ensure that the chosen business activity aligns with the allowed activities for the selected licence.

One of the most significant reforms in the UAE's business regulations is the allowance of 100% foreign ownership in many sectors. This reform has made it easier for foreign investors to establish and fully own their businesses without the need for a local partner or sponsor. However, some strategic sectors still require a local sponsor or partner, especially in industries related to defence, oil and gas, and certain other regulated sectors.

Compliance with local laws and regulations is critical for operating a business in the UAE. Key areas of compliance include:

Starting a business in the UAE involves various costs and investments that can vary significantly based on the business type, location, and specific requirements. Understanding these costs is crucial for effective financial planning and ensuring a smooth setup process.

Starting a business in the UAE involves various costs and investments that can vary significantly based on the business type, location, and specific requirements. Understanding these costs is crucial for effective financial planning and ensuring a smooth setup process.

Obtaining a business licence is one of the primary steps in setting up a business in the UAE. The cost of a business licence can vary widely depending on the type of business activity, the chosen jurisdiction (mainland or free zone), and the specific emirate.

Renting office space is another significant expense for businesses in the UAE. The cost can vary based on the location, type of office, and the free zone or mainland jurisdiction.

Certain business activities in the UAE have minimum capital requirements that must be met to obtain a licence. These requirements can vary based on the type of business and the jurisdiction.

The UAE offers two main types of business jurisdictions: Free Zones and Mainland. Each has distinct benefits and drawbacks, catering to different business needs and objectives. Here’s a comprehensive comparison to help you decide which jurisdiction is best for your business.

The UAE offers two main types of business jurisdictions: Free Zones and Mainland. Each has distinct benefits and drawbacks, catering to different business needs and objectives. Here’s a comprehensive comparison to help you decide which jurisdiction is best for your business.

Free zones are designated areas that provide special incentives and regulatory frameworks to attract foreign investors. These zones are tailored to specific industries, offering unique advantages to businesses operating within them.

Number of Free Zones: There are over 45 free zones in the UAE, each with its own focus and benefits. Some of the most popular free zones include:

Benefits of Free Zones:

Drawbacks of Free Zones:

Mainland companies are licensed by the Department of Economic Development (DED) in the respective emirate. These companies can operate across the UAE without restrictions and engage directly with the local market.

Benefits of Mainland:

Drawbacks of Mainland:

Setting up a business in the UAE involves several crucial steps. This guide elaborates on each step, ensuring you understand the requirements and processes involved in starting your venture in Dubai or any other emirate. These steps are optimised for maximum search relevance and visibility.

Choosing a Business Activity is the first and most critical step in setting up a business in the UAE. The type of business activity you select determines the kind of business licence you need and the jurisdiction where you can operate. Common business activities include:

Each emirate and free zone has a list of permitted activities, so ensure your chosen activity aligns with the allowed categories.

Deciding between a Free Zone and Mainland jurisdiction depends on your business needs and objectives:

Registering a Trade Name is a vital step in the business setup process. The trade name should be unique, reflect the nature of your business, and comply with the UAE's naming conventions. Steps to register a trade name include:

Applying for a Business License involves submitting the necessary documents and paying the relevant fees. The type of licence depends on the business activity and jurisdiction. Key licences include:

Required documents typically include:

Securing Office Space is a mandatory requirement for obtaining a business licence in the UAE. The type and location of the office space depend on the jurisdiction and business activity:

Leasing agreements typically need to be submitted as part of the licence application process.

Visa Processing is essential for business owners, employees, and their dependents. The number of visas you can apply for depends on the size of your office space and the nature of your business. The visa application process involves:

Visa quotas and requirements can vary based on the free zone or mainland regulations.

Choosing the right Legal Structure is crucial. Common structures include:

Understanding Sponsorship and Ownership regulations is essential:

The UAE's diversified economy offers a wealth of opportunities across various sectors. Here’s a detailed look at some of the most thriving industries, enhanced with the most searched keywords for better visibility:

Keywords: UAE tourism, Dubai tourism, UAE hospitality industry, tourist attractions in UAE

The UAE is renowned for its luxury tourism and world-class hospitality sector. Key factors include:

Keywords: UAE real estate, Dubai property market, construction companies in UAE, real estate investment in UAE

The UAE's real estate and construction sectors are dynamic and continue to grow:

Keywords: UAE tech industry, Dubai tech startups, innovation in UAE, Abu Dhabi Hub71

The UAE is at the forefront of technological advancement and innovation:

Keywords: UAE healthcare industry, healthcare services in Dubai, medical tourism in UAE, hospitals in UAE

The healthcare sector in the UAE is expanding rapidly to meet growing demand:

Keywords: UAE retail market, shopping malls in Dubai, e-commerce in UAE, consumer spending in UAE

The retail industry in the UAE is one of the most vibrant sectors:

Keywords: UAE logistics industry, Dubai ports, UAE trade hub, logistics companies in UAE

The UAE’s strategic location makes it a global hub for logistics and trade:

The UAE is renowned for its lucrative business environment, which is bolstered by several key factors that contribute to its profitability and market demand. Here’s a detailed look at these factors:

The UAE boasts one of the highest per capita incomes globally, thanks to its wealthy population with significant disposable income. This wealth translates into high consumer spending power, creating vast opportunities for businesses across various sectors, including luxury goods, high-end services, and innovative products.

Key Points:

The UAE’s geographical position serves as a gateway between the East and West, making it an ideal hub for trade and logistics. This strategic location provides businesses with easy access to markets in Europe, Asia, and Africa, facilitating efficient import and export operations.

Key Points:

The UAE government actively supports business growth through numerous initiatives and incentives designed to attract and retain investors. These policies aim to foster a conducive business environment and promote economic diversification.

Key Points:

The UAE is home to a diverse expatriate population from around the world, creating a multicultural consumer base with varied tastes and preferences. This diversity opens up opportunities for businesses to cater to different market segments.

The UAE offers an exceptional environment for starting and growing a business, attracting entrepreneurs and investors with its strategic location, advanced infrastructure, and business-friendly policies. Each of the seven emirates—Abu Dhabi, Dubai, Sharjah, Ajman, Umm Al-Quwain, Ras Al Khaimah, and Fujairah—provides unique opportunities and regulations, making it essential for prospective business owners to understand the specifics of their chosen location.

Navigating the rules and regulations of business setup in the UAE involves obtaining the appropriate licenses, understanding ownership structures, and ensuring compliance with local laws. The costs and investments required vary, with significant expenses including license fees, office space, and potential minimum capital requirements.

The choice between setting up in a free zone or on the mainland depends on the business’s objectives and needs. Free zones offer benefits like 100% foreign ownership and tax exemptions, while mainland businesses can trade directly with the local market and enjoy more diverse business opportunities.

The UAE’s diverse and thriving economy presents lucrative opportunities across various sectors, including tourism and hospitality, real estate and construction, technology and innovation, healthcare, retail, and logistics. The high disposable income of residents, strategic location as a global trade hub, robust government support, and a diverse expatriate population contribute to a profitable business environment.

By thoroughly researching and understanding the UAE’s business landscape, entrepreneurs can capitalize on the myriad opportunities available and navigate the setup process effectively. With its dynamic economy and supportive ecosystem, the UAE continues to be a prime destination for business ventures, promising growth and success for those who choose to invest in this vibrant region.

This guide provides an overview of the essential aspects of starting a business in Dubai and the broader UAE, including information on the regulatory environment, costs, and market opportunities. It is intended for informational purposes only and does not constitute legal, financial, or professional advice.

DNN or Markazia Solutions LLC-FZ does not accept any inquiries, directly or indirectly, related to the services discussed in this guide. We are not licensed to offer business setup services or any related consultancy. For assistance with business setup and related services, we recommend seeking professional advice from licensed agencies and consultants specialized in these areas.

Clients are encouraged to conduct additional research and consult with qualified service providers to ensure they receive accurate and up-to-date information tailored to their specific needs and circumstances.

This comprehensive guide aims to help entrepreneurs and investors make informed decisions about starting a business in the UAE, leveraging the region's strategic advantages and vibrant economy.

Related Keywords :

Starting a business in Dubai, Business setup in UAE, Dubai business guide, UAE business regulations, Dubai free zones, UAE mainland business, Global business hub Dubai, Foreign investment in UAE, Dubai strategic location, UAE infrastructure for business, Business-friendly policies UAE, Emirates of UAE, Abu Dhabi business opportunities, Dubai business environment, Sharjah cultural heritage, Ajman business setup, Umm Al-Quwain tourism sector, Ras Al Khaimah manufacturing, Fujairah maritime industry, UAE business licensing, Commercial license UAE, Industrial license UAE, Professional license UAE, Tourism license UAE, UAE business ownership rules, UAE compliance regulations, UAE business license fees, Dubai office space rental, UAE minimum capital requirements, Free zone costs UAE, UAE visa costs for business, Corporate bank account UAE, Legal fees UAE business, UAE free zone benefits, Dubai free zone companies, Mainland business UAE, Free zone vs mainland UAE, UAE 100% foreign ownership, Free zone tax exemptions UAE, UAE local sponsor requirement, Choose business activity UAE, UAE jurisdiction selection, UAE trade name registration, UAE business license application, Office space UAE business, UAE visa processing, UAE legal structure for business, UAE tourism and hospitality, Dubai real estate market, UAE tech industry, UAE healthcare sector, UAE retail market, UAE logistics and trade, High disposable income UAE, UAE affluent consumers, Dubai luxury market, UAE strategic trade hub, UAE government business support, UAE expatriate market, Best businesses to start in Dubai, Dubai business setup cost, Free zones in Dubai, UAE business visa requirements, Investment opportunities in UAE, UAE business environment 2024

#StartingABusinessInDubai, #BusinessSetupInUAE, #DubaiBusinessGuide, #UAEBusinessRegulations, #DubaiFreeZones, #UAEMainlandBusiness, #GlobalBusinessHubDubai, #ForeignInvestmentInUAE, #DubaiStrategicLocation, #UAEInfrastructureForBusiness, #BusinessFriendlyPoliciesUAE, #EmiratesOfUAE, #AbuDhabiBusinessOpportunities, #DubaiBusinessEnvironment, #SharjahCulturalHeritage, #AjmanBusinessSetup, #UmmAlQuwainTourismSector, #RasAlKhaimahManufacturing, #FujairahMaritimeIndustry, #UAEBusinessLicensing, #CommercialLicenseUAE, #IndustrialLicenseUAE, #ProfessionalLicenseUAE, #TourismLicenseUAE, #UAEBusinessOwnershipRules, #UAEComplianceRegulations, #UAEBusinessLicenseFees, #DubaiOfficeSpaceRental, #UAEMinimumCapitalRequirements, #FreeZoneCostsUAE, #UAEVisaCostsForBusiness, #CorporateBankAccountUAE, #LegalFeesUAEBusiness, #UAEFreeZoneBenefits, #DubaiFreeZoneCompanies, #MainlandBusinessUAE, #FreeZoneVsMainlandUAE, #UAE100ForeignOwnership, #FreeZoneTaxExemptionsUAE, #UAELocalSponsorRequirement, #ChooseBusinessActivityUAE, #UAEJurisdictionSelection, #UAETradeNameRegistration, #UAEBusinessLicenseApplication, #OfficeSpaceUAEBusiness, #UAEVisaProcessing, #UAELegalStructureForBusiness, #UAETourismAndHospitality, #DubaiRealEstateMarket, #UAETechIndustry, #UAEHealthcareSector, #UAERetailMarket, #UAELogisticsAndTrade, #HighDisposableIncomeUAE, #UAEAffluentConsumers, #DubaiLuxuryMarket, #UAEStrategicTradeHub, #UAEStrategicTradeHub, #UAEGovernmentBusinessSupport, #UAEExpatriateMarket, #BestBusinessesToStartInDubai, #DubaiBusinessSetupCost, #FreeZonesInDubai, #UAEBusinessVisaRequirements, #InvestmentOpportunitiesInUAE, #UAEBusinessEnvironment2024 #bestnewschanneldubai #bestnewschannelUAE #bestnewschannelabudhabi #bestnewschannelajman #bestnewschannelofdubai #popularnewschanneldubai

Arab Parliament for the Child elects leaders in first session of fourth term...Read More.

Tim Merlier claims back-to-back UAE Tour wins with a dominant Stage 6 sprint...Read More.

Arab Parliament for Child elects President and Vice Presidents

Arab Parliament for Child elects President and Vice Presidents

Arab Parliament for the Child elects leaders in first session of fourth term

Sheikh Hamdan Shares Video of 31 Athletes Jumping from Burj Khalifa

Sheikh Hamdan Shares Video of 31 Athletes Jumping from Burj Khalifa

On February 18, 31 athletes jumped from Burj Khalifa, landing safely by Dubai Mall

Culture, history, and identity intertwine through Arab lenses at Xposure 2025

Culture, history, and identity intertwine through Arab lenses at Xposure 2025

The Road to Xposure unveils 108 works capturing the Arab world's journey and spirit

Join a Weekend of Discovery, Creativity & Family Fun at Xposure 2025

Join a Weekend of Discovery, Creativity & Family Fun at Xposure 2025

Enjoy interactive exhibits, tours, free portraits & coffee at Xposure 2025

Abu Dhabi’s Environment Agency wins Quality Award for 3rd year

Abu Dhabi’s Environment Agency wins Quality Award for 3rd year

The European Society for Quality Research honored EAD for the third year, praising its quality-focus

Arab Parliament for Child elects President and Vice Presidents

Arab Parliament for the Child elects leaders in first session of fourth term

Tim Merlier sprints to consecutive stage victories at UAE Tour 2025

Tim Merlier claims back-to-back UAE Tour wins with a dominant Stage 6 sprint

Sustainable Travel: Easy Ways to Explore the World Responsibly

Eco-friendly tips for responsible and sustainable world travel

Khaled bin Mohamed bin Zayed visits Nabdh Al Falah, orders hub expansion

Sheikh Khaled bin Mohamed bin Zayed visits Nabdh Al Falah hub, boosting community ties

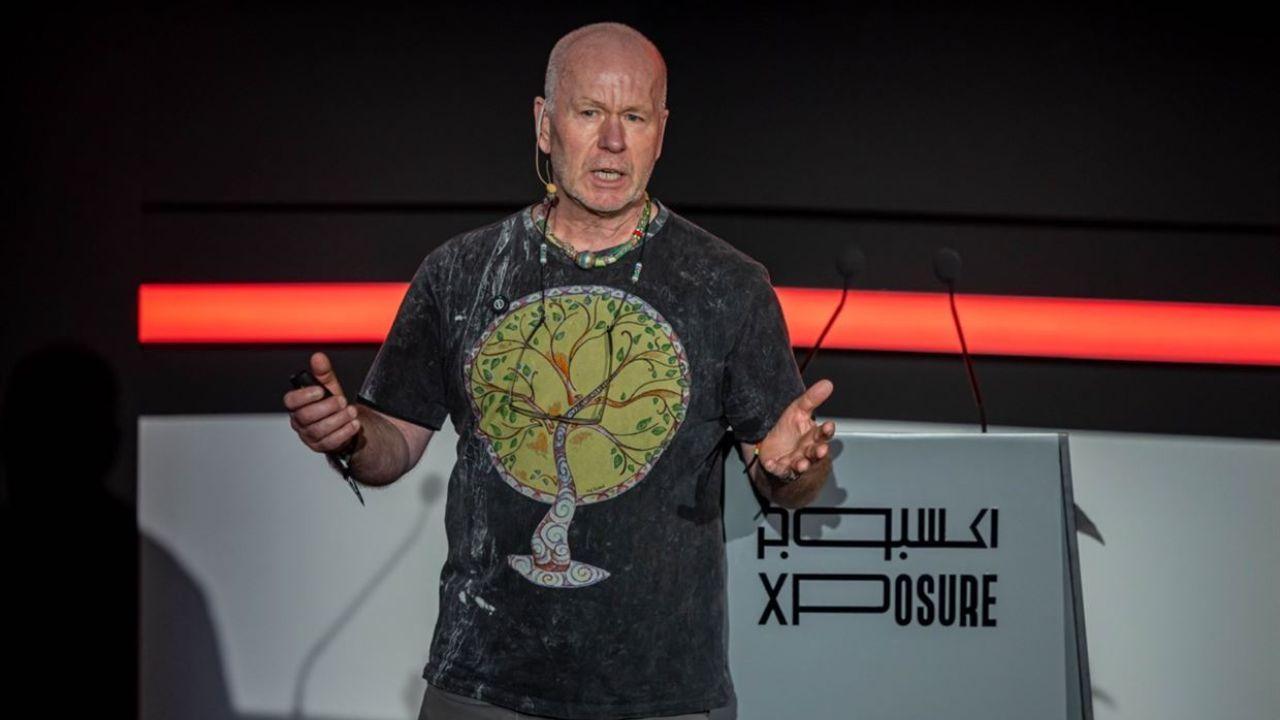

Filmmakers discuss balancing creativity and commerce at Xposure 2025

Filmmakers explore storytelling vs. commerce at Xposure 2025, embracing global film

Pastry Chef for 2 Months, Rainforest Photographer for 10: Meet Dieter Schonlau

German explorers Dieter & Sandra Schonlau share rainforest adventures at Xposure 2025

A Travelers Paradise Exploring the Amazing Wonders of World Tourism

Discover breathtaking destinations and amazing wonders worldwide

An unlikely crew, an octopus’ trust, and an Oscar win: Makers at Xposure 2025

Xposure 2025 hosts Pippa Ehrlich, Roger Horrocks to reveal My Octopus Teacher's story

Aspiring pros challenge crisis photography stereotypes with Lys Arango’s lens

Lys Arango challenges stereotypes in humanitarian photography at Xposure 2025

The Benefits of Using Natural Products in Your Night Routine

How Natural Products in Your Night Routine Improve Skin Health

3001E, 30 Floor, Aspin Commercial Tower, Sheikh Zayed Road, Dubai, UAE

+971 52 602 2429

info@dxbnewsnetwork.com

© DNN. All Rights Reserved.