Post by : Kanchan Chandel

Rules and Regulations for Starting a Business in the UAE

In the bustling economic hub of the United Arab Emirates (UAE), entrepreneurs are lured by the allure of boundless opportunities and the prospect of turning their business dreams into reality. Yet, beneath the glittering facade lies a labyrinth of rules and regulations that aspiring business owners must navigate with finesse. Before embarking on the journey of business ownership, it's imperative to decipher the intricacies of establishing a company in the UAE.

- Choosing the Right Path: Free Zones vs. Mainland

The first crossroads on the entrepreneurial journey in the UAE is the choice between setting up in a free zone or on the mainland. Free zones offer enticing incentives like full foreign ownership and tax exemptions but may restrict business activities outside the zone. On the other hand, mainland companies require a local sponsor but provide access to a broader market.

- Crafting the Blueprint: Legal Structures and Business Licenses

With the path chosen, entrepreneurs must delve into the realm of legal structures and licenses. Determining the appropriate license type—be it commercial, industrial, or professional—is crucial, as each aligns with specific business activities. Additionally, drafting a Memorandum of Association (MOA) for mainland businesses or adhering to free zone regulations sets the foundation for company registration.

- Clearing the Regulatory Hurdles: Obtaining Permits and Approvals

Entrepreneurs must surmount a series of regulatory hurdles before their business can take flight. Securing approvals from various government departments and regulatory bodies is essential, covering aspects like health and safety, environmental compliance, and sector-specific regulations. Furthermore, obtaining residency visas for entrepreneurs and employees is often a prerequisite for business setup.

- Navigating Financial Waters: Taxation and Financial Obligations

While the UAE boasts a tax-friendly environment with no federal income tax on corporate profits, businesses still encounter financial obligations. Understanding the taxation regime, including VAT and customs duties, is imperative. Moreover, maintaining accurate financial records and submitting annual audits are essential to comply with regulatory requirements.

- Safeguarding Intellectual Assets: Intellectual Property Protection

Protecting intellectual property rights is paramount in the competitive business landscape. Registering trademarks, patents, and copyrights ensures legal protection against infringement and unauthorized use, safeguarding the fruits of entrepreneurial innovation.

- Upholding Employment Standards: Labour Laws and Employee Regulations

Compliance with UAE's labour laws and regulations is non-negotiable for business owners. Adhering to provisions regarding employment contracts, working hours, wages, and termination procedures ensures a harmonious and legally sound working environment. Additionally, procuring residency visas and work permits for employees is essential for their legal employment status.

- Sustaining Compliance: Ongoing Obligations and Renewals

Establishing a business in the UAE is not a one-time affair; it's an ongoing commitment to compliance and renewal. Annual license renewals necessitate adherence to regulatory standards and financial obligations. Staying abreast of regulatory changes and updates is crucial to avoid penalties and disruptions to business operations.

In the tapestry of UAE's business landscape, understanding and adhering to rules and regulations are the threads that weave the fabric of entrepreneurial success. By navigating the intricate regulatory maze with diligence and foresight, entrepreneurs can unlock the gateway to prosperity in this thriving economic oasis.

Understanding Legal Structures

In the dynamic landscape of business formation in the United Arab Emirates (UAE), understanding the intricate web of legal structures is akin to deciphering a roadmap to entrepreneurial success. Let's embark on a journey to unravel the nuances of legal frameworks, guiding aspiring business owners through the maze of options available.

- Navigating the Legal Landscape

Before setting sail on the entrepreneurial voyage, entrepreneurs must navigate through the diverse legal structures offered in the UAE. From the simplicity of sole proprietorship to the flexibility of partnership and the robustness of a limited liability company (LLC), each structure presents a unique set of opportunities and challenges.

- Sole Proprietorship: A Lone Venture

Embarking on a solo expedition, entrepreneurs opting for sole proprietorship assume full responsibility for their business endeavors. Operating under their personal name, they enjoy autonomy in decision-making but bear unlimited liability for business debts and obligations. This straightforward structure suits small-scale enterprises seeking simplicity and control.

- Partnership: Strength in Unity

For those inclined towards collaboration, partnership emerges as an enticing option. Joining forces with like-minded individuals, partners pool their resources, expertise, and efforts towards a common goal. Whether in the form of a general partnership with shared liabilities or a limited partnership with designated roles and responsibilities, partnerships foster synergy and mutual support.

- Limited Liability Company (LLC): Balancing Risk and Reward

Navigating the middle ground, entrepreneurs often gravitate towards the limited liability company (LLC) structure. Offering a blend of personal liability protection and operational flexibility, LLCs shield owners from personal liability while allowing them to retain control over business operations. With customizable ownership structures and clear delineation of responsibilities, LLCs strike a balance between risk management and entrepreneurial autonomy.

- Free Zone Company: Gateway to Global Markets

Venturing into the realm of international trade and investment, entrepreneurs may opt for a free zone company. Nestled within designated economic zones, these entities enjoy tax incentives, foreign ownership rights, and streamlined regulatory procedures. Catering to diverse industries such as technology, media, and logistics, free zone companies serve as gateways to global markets, facilitating cross-border commerce and innovation.

Licensing Requirements

Embarking on a business venture in the United Arab Emirates (UAE) is an exciting journey filled with promise and potential. However, before entrepreneurs can set sail on their entrepreneurial voyage, they must navigate through the intricate web of licensing requirements that govern business operations in the UAE.

- Understanding the Landscape

The UAE boasts a diverse economy and offers a multitude of business opportunities across various industries. However, each business activity comes with its own set of licensing requirements, dictated by federal and local authorities. Entrepreneurs must carefully assess their business activities and select the appropriate licensing category to ensure compliance with regulations.

- Choosing the Right License

Selecting the right type of license is crucial for entrepreneurs setting up their businesses in the UAE. The most common types of licenses include commercial licenses for trading activities, professional licenses for service-oriented businesses, industrial licenses for manufacturing operations, and tourism licenses for tourism-related activities. Entrepreneurs must evaluate their business objectives, activities, and legal structure to determine the most suitable licensing category.

- Navigating Federal and Local Authorities

Navigating the licensing process involves interacting with both federal and local authorities in the UAE. Federal authorities oversee specific business activities and issue licenses based on industry regulations and guidelines. On the other hand, local authorities, such as economic departments and free zone authorities, regulate business activities within their respective jurisdictions and issue licenses accordingly. Entrepreneurs must liaise with the relevant authorities and adhere to their specific requirements and procedures to obtain the necessary licenses.

- Completing Documentation and Paperwork

Securing a business license in the UAE entails completing a myriad of documentation and paperwork. Entrepreneurs must prepare and submit various documents, including business plans, lease agreements, passport copies, visa documents, and NOC (No Objection Certificate) from sponsors, depending on the nature of their business and the licensing authority. Ensuring the accuracy and completeness of these documents is essential to expedite the licensing process and avoid delays.

- Navigating Free Zones

Free zones in the UAE offer attractive incentives and benefits for businesses, including 100% foreign ownership, tax exemptions, and streamlined licensing procedures. Entrepreneurs keen on setting up their ventures in free zones must navigate through the specific regulations and requirements of each free zone authority. While free zones offer a conducive environment for business setup, entrepreneurs must carefully assess the suitability of the free zone for their business activities and objectives.

- Seeking Professional Assistance

Navigating the licensing requirements in the UAE can be a complex and daunting task for entrepreneurs, especially those unfamiliar with the local regulations and procedures. Seeking professional assistance from business consultants, legal advisors, or PRO (Public Relations Officer) services can provide invaluable support and guidance throughout the licensing process. These experts can help entrepreneurs understand the intricacies of licensing requirements, streamline the application process, and ensure compliance with regulations.

Corporate Governance and Compliance

In the bustling business landscape of the United Arab Emirates (UAE), corporate governance and compliance serve as the bedrock of organizational integrity and transparency. Let's delve deeper into the intricacies of these vital aspects, shedding light on their significance and practical implications for businesses operating in the UAE.

- Defining Corporate Governance

Corporate governance encompasses the framework of rules, practices, and processes by which businesses are directed, controlled, and managed. At its core, it revolves around ensuring accountability, transparency, and fairness in the decision-making processes of organizations. Key stakeholders, including shareholders, directors, management, and regulators, play crucial roles in upholding good governance practices, fostering trust and confidence in the business environment.

- Principles of Corporate Governance

In the UAE, corporate governance is guided by internationally recognized principles aimed at promoting ethical conduct, risk management, and stakeholder engagement. Principles such as accountability, transparency, fairness, and responsibility serve as guiding lights for businesses striving to uphold high standards of governance. By adhering to these principles, businesses can enhance their reputation, attract investment, and mitigate risks associated with corporate misconduct.

- Board of Directors' Role

Central to effective corporate governance is the role of the board of directors, entrusted with oversight and strategic guidance of the organization. Boards are tasked with setting the company's strategic direction, monitoring performance, and safeguarding shareholder interests. In the UAE, boards are expected to operate with diligence, independence, and integrity, ensuring alignment with corporate objectives and regulatory requirements.

- Regulatory Framework

The UAE boasts a robust regulatory framework governing corporate governance practices, drawing from both local legislation and international standards. Regulatory bodies such as the Securities and Commodities Authority (SCA) and the Dubai Financial Services Authority (DFSA) oversee compliance with governance requirements, issuing guidelines and directives to promote best practices. Businesses are subject to disclosure and reporting obligations, providing stakeholders with insights into the company's financial performance and governance practices.

- Compliance Requirements

Compliance forms the cornerstone of corporate governance, ensuring adherence to laws, regulations, and internal policies. Businesses operating in the UAE must comply with a myriad of legal and regulatory requirements, spanning areas such as company law, labor law, taxation, and environmental regulations. Compliance efforts encompass establishing internal controls, conducting regular audits, and training employees on relevant laws and policies to mitigate risks and ensure legal conformity.

- Corporate Social Responsibility (CSR)

Beyond regulatory compliance, businesses in the UAE are increasingly embracing corporate social responsibility (CSR) as an integral part of their governance framework. CSR initiatives encompass philanthropy, environmental sustainability, and community engagement, reflecting businesses' commitment to making positive social and environmental impacts. By integrating CSR into their governance practices, businesses can enhance their reputation, foster goodwill, and contribute to sustainable development in the UAE.

Employment Laws and Regulations

In the dynamic landscape of the United Arab Emirates (UAE), where business thrives amidst a diverse workforce, understanding the intricacies of employment laws is crucial for both employers and employees alike. Let's delve deeper into the key regulations governing the employment landscape in the UAE.

- Recruitment Practices:

Employers must adhere to fair and transparent recruitment practices, ensuring equal opportunities for all candidates. Discrimination based on race, gender, religion, nationality, or disability is strictly prohibited. Additionally, job advertisements must accurately reflect the requirements of the position, and recruitment agencies must be licensed to operate legally.

- Employment Contracts:

Employment contracts serve as the cornerstone of the employer-employee relationship in the UAE. These contracts must clearly outline the terms and conditions of employment, including job responsibilities, working hours, compensation, benefits, and termination procedures. It's essential for both parties to review and understand the terms before signing the contract.

- Working Hours and Overtime:

The UAE Labor Law stipulates standard working hours for employees, typically not exceeding 8 hours per day or 48 hours per week. Employees are entitled to overtime pay for work exceeding the standard hours, calculated at a premium rate. Employers must ensure compliance with these regulations to avoid legal repercussions.

- Leave Entitlements:

Employees in the UAE are entitled to various types of leave, including annual leave, sick leave, maternity leave, and public holidays. Annual leave accrues based on the length of service, with a minimum of 30 days per year for employees who have completed one year of service. Maternity leave provisions include paid time off for expectant mothers, ensuring their well-being and that of their newborn.

- Termination Procedures:

Termination of employment must adhere to the provisions outlined in the labor contract and UAE Labor Law. Both employers and employees have rights and obligations regarding notice periods, severance pay, and reasons for termination. Unlawful dismissal without valid cause can result in legal consequences for employers.

- Health and Safety Regulations:

Employers are responsible for providing a safe and healthy work environment for their employees, complying with health and safety regulations set forth by relevant authorities. This includes implementing measures to prevent workplace accidents, providing necessary training, and maintaining proper sanitation and hygiene standards.

- Wages and Benefits:

Employers must ensure timely payment of wages to employees, with salaries typically paid monthly. The UAE Labor Law establishes minimum wage requirements, and employers are prohibited from withholding or deducting wages unlawfully. Additionally, employees may be entitled to various benefits such as housing allowances, transportation allowances, and health insurance coverage.

- Dispute Resolution Mechanisms:

In the event of disputes between employers and employees, mechanisms for dispute resolution are available, including labor dispute committees and labor courts. Employers and employees are encouraged to resolve disputes amicably through negotiation and mediation before resorting to formal legal proceedings.

Intellectual Property Protection

In the dynamic landscape of business innovation, safeguarding intellectual property (IP) is akin to protecting the heart and soul of a venture. In the United Arab Emirates (UAE), where creativity thrives and ideas abound, understanding the nuances of IP protection is essential for businesses looking to carve out their niche and thrive in a competitive market.

- Understanding Intellectual Property

At its core, intellectual property encompasses a diverse range of intangible assets, including inventions, trademarks, copyrights, and trade secrets. These assets are the lifeblood of innovation, representing the fruits of human ingenuity and creativity. Whether it's a groundbreaking invention, a captivating brand logo, or a compelling piece of music, intellectual property rights provide creators and innovators with legal protection and exclusive rights over their creations.

- Navigating IP Laws and Regulations

In the UAE, intellectual property protection is governed by a comprehensive legal framework comprising laws, regulations, and international treaties. Entrepreneurs and businesses must familiarize themselves with these laws, which include the Federal Law No. 37 of 1992 on Trademarks, Federal Law No. 31 of 2006 on Copyrights, and Federal Law No. 17 of 2002 on Patents. Additionally, the UAE is a signatory to various international agreements such as the Paris Convention for the Protection of Industrial Property and the Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPS), further bolstering IP protection.

- Securing Trademarks

For businesses, trademarks serve as valuable assets that distinguish their products and services from competitors and foster brand recognition and loyalty. Entrepreneurs must register their trademarks with the UAE Ministry of Economy to obtain exclusive rights to use them in connection with their goods and services. By securing trademarks, businesses can prevent unauthorized use and infringement, safeguarding their brand identity and reputation.

- Protecting Copyrights

Copyright protection extends to original literary, artistic, and creative works, including books, music, films, and software. In the UAE, copyright protection arises automatically upon the creation of a work, but businesses and creators can enhance their rights by registering their copyrights with the UAE Ministry of Economy. Registering copyrights provides additional evidence of ownership and facilitates enforcement actions against infringement.

- Preserving Patents

Patents are vital for protecting inventions and technological innovations, granting inventors exclusive rights to manufacture, use, and sell their inventions for a specified period. Entrepreneurs seeking patent protection must file patent applications with the UAE Ministry of Economy, demonstrating the novelty, inventiveness, and industrial applicability of their inventions. Securing patents enables businesses to monetize their inventions and maintain a competitive edge in the market.

- Guarding Trade Secrets

Trade secrets encompass confidential information, such as formulas, processes, and customer lists, that provide businesses with a competitive advantage. While trade secrets are not registered like other forms of IP, businesses can safeguard them through contractual agreements, non-disclosure agreements (NDAs), and robust internal policies and procedures. Protecting trade secrets is essential for preserving proprietary information and preventing unauthorized disclosure or use by competitors.

Taxation and Financial Obligations

Navigating the financial terrain of the United Arab Emirates (UAE) is akin to sailing through a sea of opportunities, but it's essential to steer clear of hidden reefs by understanding taxation and financial obligations.

- Understanding Taxation Dynamics: Unlike many countries, the UAE boasts a tax-friendly environment with no corporate or income taxes in most jurisdictions. However, businesses engaged in taxable activities must adhere to Value Added Tax (VAT) regulations. This 5% levy applies to the majority of goods and services, requiring businesses to register for VAT, collect taxes from customers, and file periodic returns with the Federal Tax Authority (FTA).

- Managing Financial Records: Keeping meticulous financial records is the anchor that holds a business steady amidst turbulent waters. Entrepreneurs must maintain accurate books, documenting transactions, expenses, and revenues in accordance with international accounting standards. Whether it's through manual record-keeping or utilizing digital accounting software, maintaining financial transparency is paramount for regulatory compliance and informed decision-making.

Navigating Auditing Requirements: In the UAE, auditing isn't just a legal obligation; it's a compass that ensures financial integrity and accountability. Businesses, particularly those operating as LLCs, must appoint auditors annually to review their financial statements and ensure compliance with statutory requirements. These audits provide stakeholders, including shareholders, investors, and regulatory authorities, with assurance regarding the accuracy and reliability of financial information.

- Embracing Financial Planning: Charting a course for financial success requires astute financial planning and budgeting. Entrepreneurs must forecast revenues, anticipate expenses, and allocate resources judiciously to achieve long-term sustainability and growth. Whether it's managing cash flow, securing financing, or optimizing tax strategies, effective financial planning lays the groundwork for strategic decision-making and resilience in the face of economic challenges.

- Leveraging Technology for Financial Management: In today's digital age, technology serves as the wind in the sails of financial management. Entrepreneurs can harness the power of digital tools and platforms to streamline accounting processes, automate financial reporting, and gain real-time insights into their business performance. From cloud-based accounting software to mobile payment solutions, embracing technology enables businesses to navigate financial waters with agility and efficiency.

Summary

In the bustling economic landscape of the United Arab Emirates (UAE), aspiring entrepreneurs are drawn to the promise of limitless opportunities. However, before embarking on the journey of business ownership, it's essential to understand the intricacies of establishing a company in the UAE. This comprehensive guide navigates through the maze of rules and regulations, covering crucial aspects such as choosing between free zones and the mainland, crafting legal structures, obtaining permits and approvals, managing taxation and financial obligations, safeguarding intellectual property, upholding employment standards, and sustaining compliance through ongoing obligations and renewals. By unraveling the complexities of starting a business in the UAE, entrepreneurs can pave the way for success in this thriving economic oasis.

Disclaimer

The information provided in this article is intended for general informational purposes only and does not constitute legal, financial, or professional advice. Readers are advised to consult with qualified professionals or legal advisors to obtain tailored guidance and ensure compliance with applicable laws and regulations. DXB News Network does not endorse or guarantee the accuracy, completeness, or reliability of any information provided in this article. Readers are encouraged to conduct independent research and verify the information before making any business decisions or taking any actions based on the content herein. DXB News Network disclaims any liability for any loss or damage arising from reliance on the information presented in this article.

Mesh Museum Debuts in UAE, Merging Industry with Artful Design

Mesh Museum launches in Dubai, showcasing woven metal meshes as art, architecture, and design, blend

BHM Capital Expands GCC Presence with MSX Market Operations

BHM Capital begins market making and brokerage on Muscat Stock Exchange, boosting liquidity, investo

Arzan Wealth Advises Successful Partial Exit from U.S. Healthcare Assets

Arzan Wealth completes partial exit from Long Island radiology centers, achieving 29.7% IRR while ma

Emirates Hospitals Group Forms Strategic Alliance with Nice University

Emirates Hospitals Group partners with Nice University Hospital, France, to advance clinical care, r

PPDS Launches Philips LED Configurator for Seamless Video Walls

PPDS unveils the Philips LED Configurator at ISE 2026, enabling partners to design, visualize, and o

Explore Curated Collections and Win AED 100,000 This Ramadan

Jashanmal invites families to celebrate Ramadan with curated home, gifting, and lifestyle collection

Valentine’s Day at Nalu & Ilios: Waves, Romance, and Flavors

Nalu & Ilios at Surf Abu Dhabi offer two unique Valentine’s Day experiences—relaxed wave-side dining

Winter Skin Care: 10 Hydrating Drinks That Give Natural Glass Skin Glow

Learn how simple winter drinks keep your skin hydrated reduce dryness and support a natural glass sk

Why Drinking Soaked Chia Seeds Water With Lemon and Honey Before Breakfast Matters

Drinking soaked chia seeds water with lemon and honey before breakfast may support digestion hydrati

Morning Walk vs Evening Walk: Which Helps You Lose More Weight?

Morning or evening walk Learn how both help with weight loss and which walking time suits your body

What Really Happens When You Drink Lemon Turmeric Water Daily

Discover what happens to your body when you drink lemon turmeric water daily including digestion imm

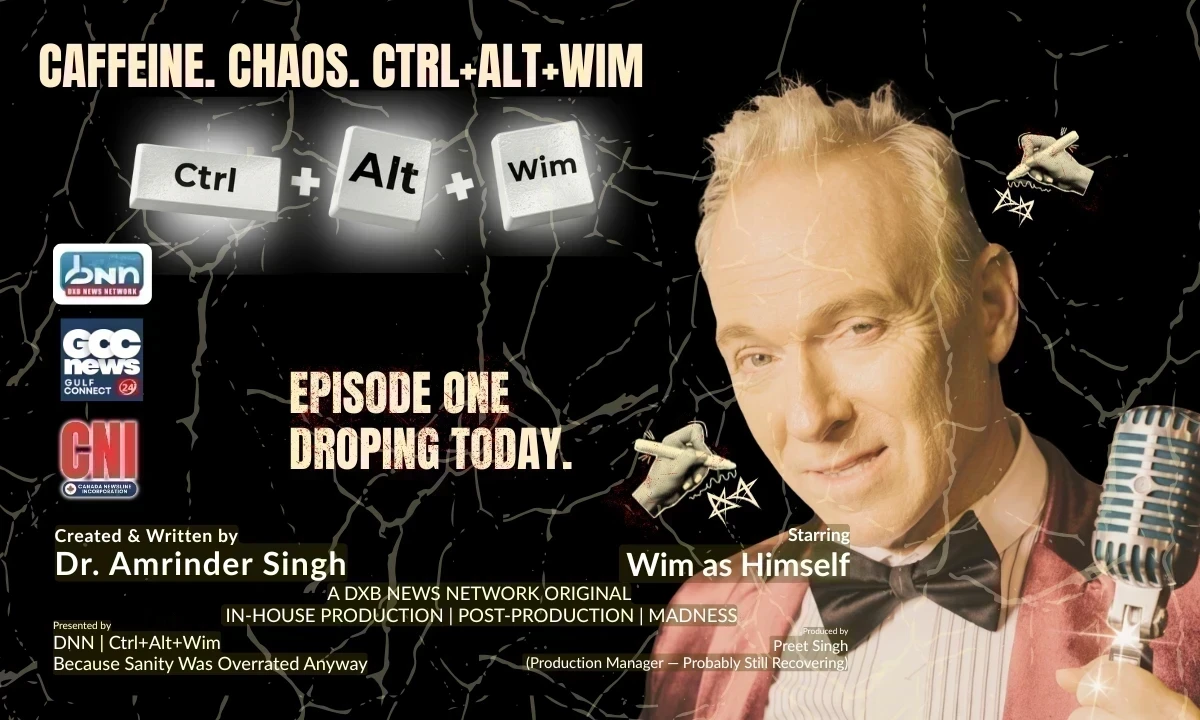

DXB News Network Presents “Ctrl+Alt+Wim”, A Bold New Satirical Series Starring Global Entertainer Wim Hoste

DXB News Network premieres Ctrl+Alt+Wim, a bold new satirical micro‑series starring global entertain

High Heart Rate? 10 Common Causes and 10 Natural Ways to Lower It

Learn why heart rate rises and how to lower it naturally with simple habits healthy food calm routin

10 Simple Natural Remedies That Bring Out Your Skin’s Natural Glow

Discover simple natural remedies for glowing skin Easy daily habits clean care and healthy living ti

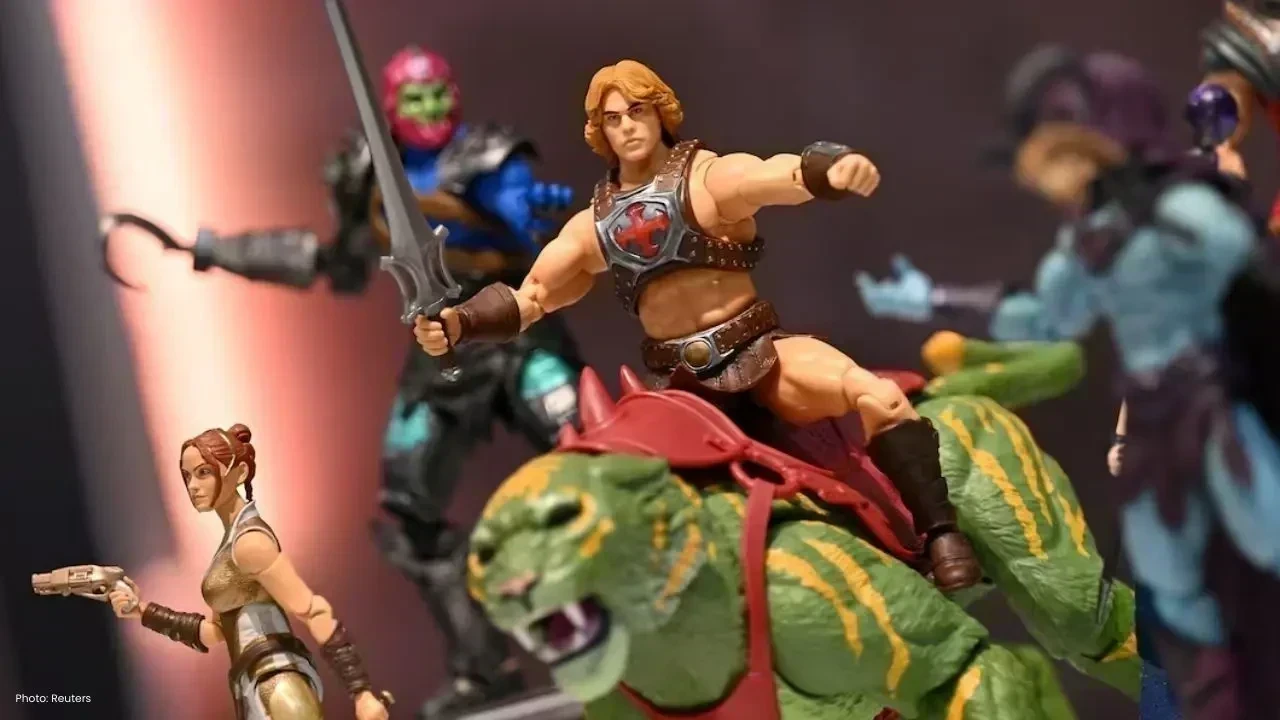

Mattel Revamps Masters of the Universe Action Figures for Upcoming Film

Mattel is set to revive Masters of the Universe action figures in sync with their new movie, ignitin