As the world becomes increasingly interconnected, the way governments approach taxation is evolving. One of the most significant developments on the global stage is the introduction of a global minimum tax. This new framework is set to impact various countries, including the UAE. But what exactly does this mean for residents and businesses? In this article, we’ll delve into the details of the global minimum tax, its implications for the UAE, and what individuals and companies need to know.

The global minimum tax is a coordinated effort among nations to ensure that multinational corporations pay a minimum level of tax, regardless of where they operate. The initiative, spearheaded by the Organisation for Economic Co-operation and Development (OECD), aims to curb tax avoidance and profit shifting by large companies that often relocate their earnings to low-tax jurisdictions. The agreed-upon minimum tax rate is set at 15%, but countries have the discretion to impose higher rates if they choose.

The concept behind this tax is simple yet powerful: by establishing a minimum threshold, governments can work together to ensure that corporations contribute fairly to the public finances of the countries in which they operate.

The UAE has long been recognized for its low tax environment, attracting businesses and investors worldwide. However, in a bid to align with international standards and promote a fair tax landscape, the UAE has announced its plans to adopt the global minimum tax. This decision reflects the UAE's commitment to economic diversification and sustainability while ensuring that it meets global tax obligations.

By embracing the global minimum tax, the UAE aims to maintain its competitive edge while contributing fairly to global tax revenues. This shift also helps the nation attract responsible investors who prioritize ethical business practices.

With the introduction of the global minimum tax, businesses operating in the UAE will need to comply with new regulations. This may require adjustments to their financial practices and reporting systems. Companies must ensure they meet the minimum tax rate and adapt their strategies accordingly. Smaller businesses may find this particularly challenging as they navigate the complexities of compliance.

The global minimum tax may also lead to changes in how multinational corporations allocate their profits. Companies will need to reassess their transfer pricing strategies to comply with the new tax framework. This could affect how businesses structure their operations and manage their financial reporting, potentially leading to increased operational costs.

While the global minimum tax establishes a baseline rate, it could spur competition among countries to offer additional incentives for businesses. The UAE may enhance its attractiveness by providing tax benefits or other incentives to offset the implications of the new tax framework. Businesses must stay informed about these developments to make strategic decisions that align with their goals.

At this stage, the global minimum tax primarily targets corporations. However, as the tax landscape evolves, the UAE could consider implementing personal income taxes in the future. If this occurs, individuals may need to prepare for changes that could impact their financial situations.

With the global minimum tax in place, the UAE could attract more foreign investment, leading to economic growth and job creation. This influx of investment can result in new employment opportunities for residents, enhancing overall quality of life.

One of the primary benefits of the global minimum tax is that it promotes fairness in taxation. By establishing a baseline tax rate, countries can ensure that multinational corporations contribute their fair share to public finances. This is particularly important for funding essential services such as healthcare, education, and infrastructure.

The global minimum tax aims to limit tax avoidance strategies used by multinational corporations to minimize their tax liabilities. By setting a minimum rate, governments can prevent profit shifting and ensure that companies contribute to the economies where they operate.

Implementing a global minimum tax can contribute to greater economic stability by providing governments with a reliable source of revenue. This helps fund public services and social programs, ultimately benefiting residents and businesses alike.

Both businesses and individuals must stay informed about developments related to the global minimum tax. Monitoring changes in tax regulations, compliance requirements, and potential impacts on personal finances is essential for making informed decisions.

As the new tax framework is implemented, seeking professional advice from tax consultants and financial advisors can provide valuable insights. Experts can help businesses navigate the complexities of compliance and optimize their financial strategies to align with the new regulations.

Participating in community discussions and forums can also be beneficial. Engaging with industry peers and tax experts can provide additional perspectives on how the global minimum tax may affect different sectors and communities within the UAE.

The article discusses the global minimum tax that the UAE plans to adopt. This new tax means that big companies will need to pay at least 15% tax, no matter where they operate. The aim of the global minimum tax is to make sure that all businesses pay a fair share, reducing tax avoidance. This change is important for the UAE, which has been known for its low taxes, as it helps attract responsible investors and ensures that the country can provide essential services like healthcare and education. Businesses will need to adjust their financial practices to comply with this new tax, while individuals should stay informed about any future changes that might affect personal income tax. Overall, the global minimum tax is designed to create a fairer tax system and promote economic stability.

The information provided in this article by DXB News Network is for educational purposes only. Readers should consult tax professionals or financial advisors for specific advice related to their individual circumstances and to stay updated on the latest regulations regarding the global minimum tax in the UAE.

global minimum tax, UAE, 15% tax, tax avoidance, businesses, fair share, responsible investors, healthcare, education, financial practices, personal income tax, economic stability, tax professionals, regulations

#trending #latest #GlobalMinimumTax #UAE #TaxReform #BusinessTax #FairTaxation #EconomicStability #TaxCompliance #ResponsibleInvesting #Finance #InvestmentOpportunities #TaxAdvisory #TaxAwareness #PersonalFinance #breakingnews #worldnews #headlines #topstories #globalUpdate #dxbnewsnetwork #dxbnews #dxbdnn #dxbnewsnetworkdnn #bestnewschanneldubai #bestnewschannelUAE #bestnewschannelabudhabi #bestnewschannelajman #bestnewschannelofdubai #popularnewschanneldubai

Watch India vs Pakistan live in the Champions Trophy 2025 Group A match in Dubai...Read More.

Pakistan's Aaqib Javed brings in Mudassar Nazar to prep team for Champions Trophy vs India...Read More.

Sheikh Hamdan Shares Video of 31 Athletes Jumping from Burj Khalifa

Sheikh Hamdan Shares Video of 31 Athletes Jumping from Burj Khalifa

On February 18, 31 athletes jumped from Burj Khalifa, landing safely by Dubai Mall

Culture, history, and identity intertwine through Arab lenses at Xposure 2025

Culture, history, and identity intertwine through Arab lenses at Xposure 2025

The Road to Xposure unveils 108 works capturing the Arab world's journey and spirit

Join a Weekend of Discovery, Creativity & Family Fun at Xposure 2025

Join a Weekend of Discovery, Creativity & Family Fun at Xposure 2025

Enjoy interactive exhibits, tours, free portraits & coffee at Xposure 2025

Abu Dhabi’s Environment Agency wins Quality Award for 3rd year

Abu Dhabi’s Environment Agency wins Quality Award for 3rd year

The European Society for Quality Research honored EAD for the third year, praising its quality-focus

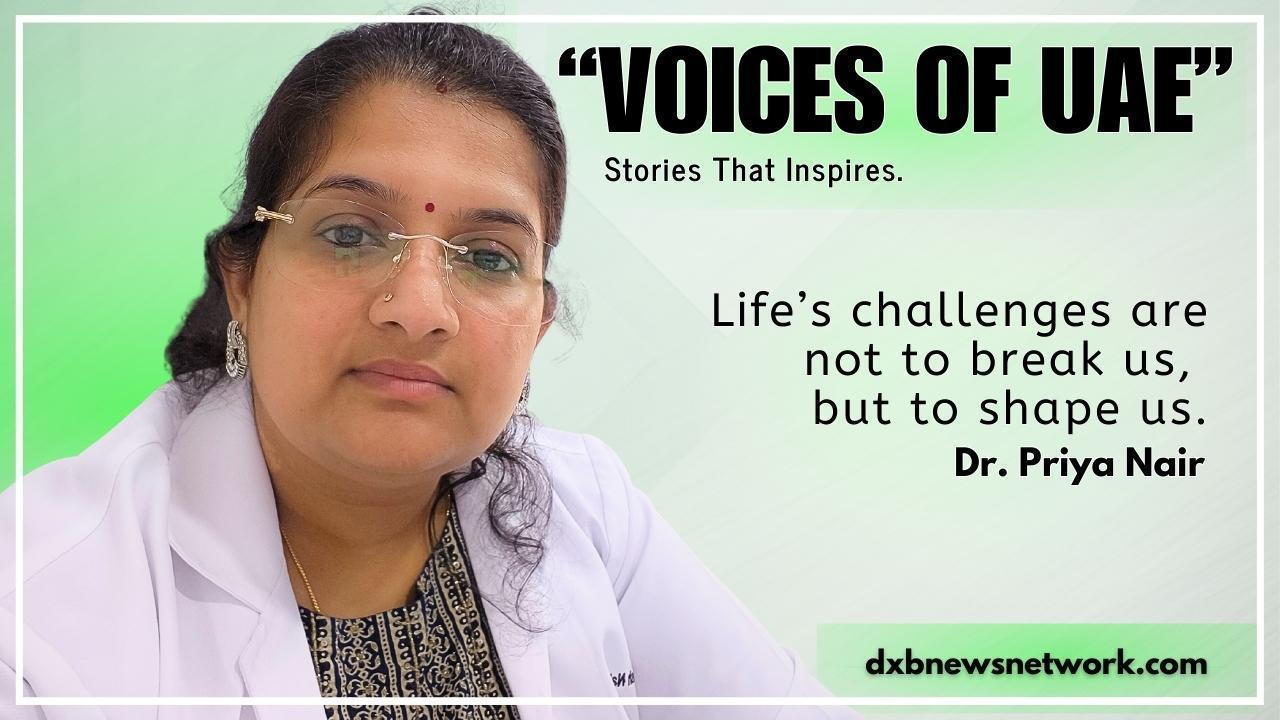

Voices of UAE: From Counting Her Final Days to Saving Lives – Dr. Priya Nair’s Heart-Stopping Battle and Second Birth.

Voices of UAE: From Counting Her Final Days to Saving Lives – Dr. Priya Nair’s Heart-Stopping Battle and Second Birth.

Dr. Priya Rathish Nair, a Specialist Gynecologist at Shifa Al Jazeera Medical Centre in Ras Al Khaim

Catch the live stream of India vs Pakistan ICC Champions Trophy 2025

Watch India vs Pakistan live in the Champions Trophy 2025 Group A match in Dubai

Pakistan's Secret Weapon for Champions Trophy 2025 to Defeat India Revealed

Pakistan's Aaqib Javed brings in Mudassar Nazar to prep team for Champions Trophy vs India

ITC Abu Dhabi & GIGATONS partner to drive net zero e-mobility solutions

ITC Abu Dhabi partners with GIGATONS to advance smart, zero-emission e-mobility

Dubai introduces new six-month multiple-entry visa for yacht crew

Visit GDRFA at the Dubai International Boat Show for yacht crew visa details

Understanding the Connection Between Mind and Body Health

Discover how mind and body health are deeply connected

Shura Council Speaker Leads Kingdom’s Delegation at Arab Parliament Meeting

Shura Speaker leads Kingdom’s delegation to 7th Arab Parliament Conference in Cairo

Jeddah Literary Club Hosts Events to Celebrate Saudi Arabia's Founding Day

Jeddah Literary Club marked Founding Day with plays on the First Saudi State

DEWA Youth Council Wins 2025 Best National Government Youth Council Award

DEWA Youth Council wins 2025 Best National Government Youth Council Award in UAE

The Role of Nutrition and Exercise in Good Health

Discover how nutrition and exercise shape a healthier lifestyle

Sharaf Group to Invest ₹5,000 Cr in Kerala’s Logistics & Shipping Sector

UAE’s Sharaf Group to invest ₹5,000 Cr in Kerala’s logistics & shipping sector

3001E, 30 Floor, Aspin Commercial Tower, Sheikh Zayed Road, Dubai, UAE

+971 52 602 2429

info@dxbnewsnetwork.com

© DNN. All Rights Reserved.