In a significant move to strengthen economic ties, the UAE and Qatar sign a double taxation avoidance agreement aimed at enhancing bilateral trade and investment. This agreement represents a vital step in promoting economic cooperation between the two Gulf nations, creating a favorable environment for businesses, and ensuring that taxpayers are not burdened with double taxation. In this article, we will explore the implications of this agreement, its benefits, and why it is an essential development for both countries.

Double taxation occurs when an individual or business is taxed on the same income in more than one jurisdiction. This situation can arise when countries do not have treaties in place to prevent taxing the same income. The UAE and Qatar sign a double taxation avoidance agreement to mitigate this issue, ensuring that businesses and individuals are not penalized for operating across borders.

The UAE and Qatar sign a double taxation avoidance agreement to promote investment and trade by providing clarity and certainty for businesses and investors. Here are some key highlights of the agreement:

Tax Exemptions: The agreement offers tax exemptions on various types of income, such as dividends, interest, and royalties. This ensures that businesses can operate efficiently without the fear of being taxed twice on the same income.

Reduced Tax Rates: The agreement establishes reduced tax rates on cross-border payments, making it more attractive for companies to invest in each other's markets. This can lead to increased foreign direct investment and improved economic growth.

Elimination of Double Taxation: The primary purpose of the agreement is to eliminate double taxation, allowing businesses to maximize their profits without the burden of excessive taxation. This encourages companies to expand their operations internationally.

Information Exchange: The agreement includes provisions for the exchange of information between tax authorities in the UAE and Qatar. This cooperation helps prevent tax evasion and ensures compliance with tax laws, promoting transparency in business operations.

Stability for Investors: By providing a clear framework for taxation, the agreement enhances the stability and predictability of the investment climate. Investors can make informed decisions, knowing they will not face unexpected tax liabilities.

The UAE and Qatar sign a double taxation avoidance agreement brings numerous benefits for businesses operating in both countries. Here are some of the advantages:

Increased Investment Opportunities: With reduced tax rates and exemptions, businesses can explore new investment opportunities in each other's markets. This can lead to enhanced economic growth and job creation.

Enhanced Trade Relations: The agreement fosters better trade relations between the UAE and Qatar, promoting the exchange of goods and services. This collaboration can lead to a more integrated economic landscape in the Gulf region.

Attracting Foreign Investors: The clear tax framework established by the agreement makes both countries more appealing to foreign investors. Companies are more likely to invest in nations with favorable tax conditions, driving economic development.

Greater Economic Cooperation: The agreement represents a commitment to strengthening economic ties between the UAE and Qatar. This cooperation can pave the way for future agreements and partnerships, benefiting both nations in the long run.

For taxpayers, the UAE and Qatar sign a double taxation avoidance agreement provides reassurance and clarity. Individuals and businesses can operate with confidence, knowing they will not be subject to double taxation on their income. Here are some implications for taxpayers:

Simplified Tax Compliance: The agreement simplifies tax compliance for individuals and businesses engaged in cross-border activities. Taxpayers can more easily understand their obligations and avoid potential pitfalls.

Increased Transparency: With provisions for information exchange, taxpayers can expect greater transparency in tax matters. This can help build trust in the tax system and reduce the likelihood of disputes between tax authorities.

Encouragement for Cross-Border Activities: The agreement encourages individuals and businesses to engage in cross-border activities, whether through investment, trade, or employment. This can lead to greater economic integration and collaboration in the region.

The UAE and Qatar sign a double taxation avoidance agreement is a promising development for both countries. As they continue to strengthen their economic ties, we can expect to see increased collaboration and opportunities for growth. This agreement sets a positive precedent for future agreements with other nations, fostering an environment conducive to international trade and investment.

The UAE and Qatar sign a double taxation avoidance agreement to help businesses and taxpayers. This important agreement makes it easier for people and companies in the UAE and Qatar to do business together. The UAE and Qatar sign a double taxation avoidance agreement so that they do not pay tax on the same income twice. This means that when someone earns money in one country and sends it to the other, they won’t get taxed again. The UAE and Qatar sign a double taxation avoidance agreement that provides clear rules about how taxes work. This helps families and businesses plan better. The UAE and Qatar sign a double taxation avoidance agreement encourages companies to invest and trade more, making it great for everyone. With the UAE and Qatar sign a double taxation avoidance agreement, both countries can work together to grow their economies and make things better for everyone involved.

This article about the UAE and Qatar sign a double taxation avoidance agreement is brought to you by DXB News Network. The purpose of discussing the UAE and Qatar sign a double taxation avoidance agreement is to provide helpful information that is easy for everyone, especially kids and children, to understand. The UAE and Qatar sign a double taxation avoidance agreement is important for businesses and families, and we want to make sure everyone knows how it works. The UAE and Qatar sign a double taxation avoidance agreement helps people plan their money better and supports growth in both countries. Please remember that rules can change, so it’s always a good idea to check for updates about the UAE and Qatar sign a double taxation avoidance agreement before making any decisions.

UAE, Qatar, double taxation avoidance agreement, economic cooperation, tax exemptions, cross-border investments, foreign direct investment, tax compliance, taxpayers, business operations, tax rates, bilateral trade, information exchange, investment opportunities, trade relations.

#trending #latest #UAE, #Qatar, #DoubleTaxationAvoidanceAgreement, #EconomicCooperation, #TaxExemptions, #CrossBorderInvestments, #ForeignDirectInvestment, #TaxCompliance, #Taxpayers, #BusinessOperations, #TaxRates, #BilateralTrade, #InformationExchange, #InvestmentOpportunities, #TradeRelations #breakingnews #worldnews #headlines #topstories #globalUpdate #dxbnewsnetwork #dxbnews #dxbdnn #dxbnewsnetworkdnn #bestnewschanneldubai #bestnewschannelUAE #bestnewschannelabudhabi #bestnewschannelajman #bestnewschannelofdubai #popularnewschanneldubai

Watch India vs Pakistan live in the Champions Trophy 2025 Group A match in Dubai...Read More.

Pakistan's Aaqib Javed brings in Mudassar Nazar to prep team for Champions Trophy vs India...Read More.

Sheikh Hamdan Shares Video of 31 Athletes Jumping from Burj Khalifa

Sheikh Hamdan Shares Video of 31 Athletes Jumping from Burj Khalifa

On February 18, 31 athletes jumped from Burj Khalifa, landing safely by Dubai Mall

Culture, history, and identity intertwine through Arab lenses at Xposure 2025

Culture, history, and identity intertwine through Arab lenses at Xposure 2025

The Road to Xposure unveils 108 works capturing the Arab world's journey and spirit

Join a Weekend of Discovery, Creativity & Family Fun at Xposure 2025

Join a Weekend of Discovery, Creativity & Family Fun at Xposure 2025

Enjoy interactive exhibits, tours, free portraits & coffee at Xposure 2025

Abu Dhabi’s Environment Agency wins Quality Award for 3rd year

Abu Dhabi’s Environment Agency wins Quality Award for 3rd year

The European Society for Quality Research honored EAD for the third year, praising its quality-focus

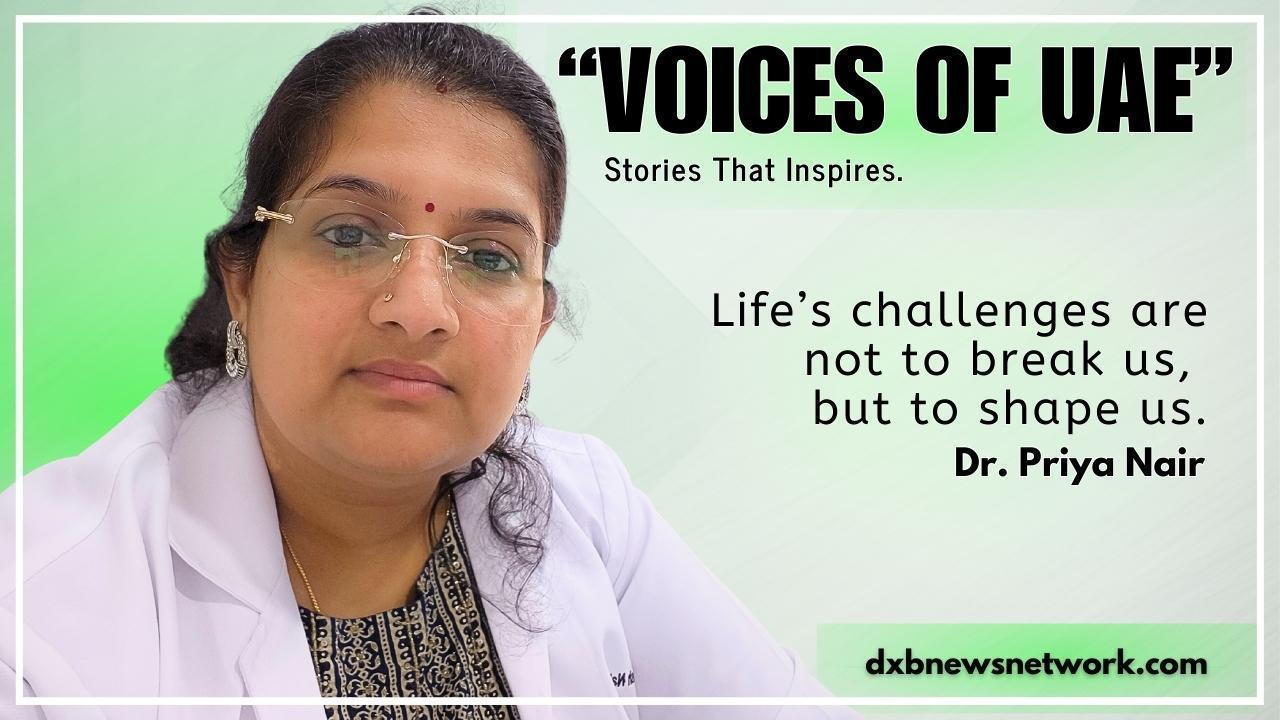

Voices of UAE: From Counting Her Final Days to Saving Lives – Dr. Priya Nair’s Heart-Stopping Battle and Second Birth.

Voices of UAE: From Counting Her Final Days to Saving Lives – Dr. Priya Nair’s Heart-Stopping Battle and Second Birth.

Dr. Priya Rathish Nair, a Specialist Gynecologist at Shifa Al Jazeera Medical Centre in Ras Al Khaim

Catch the live stream of India vs Pakistan ICC Champions Trophy 2025

Watch India vs Pakistan live in the Champions Trophy 2025 Group A match in Dubai

Pakistan's Secret Weapon for Champions Trophy 2025 to Defeat India Revealed

Pakistan's Aaqib Javed brings in Mudassar Nazar to prep team for Champions Trophy vs India

ITC Abu Dhabi & GIGATONS partner to drive net zero e-mobility solutions

ITC Abu Dhabi partners with GIGATONS to advance smart, zero-emission e-mobility

Dubai introduces new six-month multiple-entry visa for yacht crew

Visit GDRFA at the Dubai International Boat Show for yacht crew visa details

Understanding the Connection Between Mind and Body Health

Discover how mind and body health are deeply connected

Shura Council Speaker Leads Kingdom’s Delegation at Arab Parliament Meeting

Shura Speaker leads Kingdom’s delegation to 7th Arab Parliament Conference in Cairo

Jeddah Literary Club Hosts Events to Celebrate Saudi Arabia's Founding Day

Jeddah Literary Club marked Founding Day with plays on the First Saudi State

DEWA Youth Council Wins 2025 Best National Government Youth Council Award

DEWA Youth Council wins 2025 Best National Government Youth Council Award in UAE

The Role of Nutrition and Exercise in Good Health

Discover how nutrition and exercise shape a healthier lifestyle

Sharaf Group to Invest ₹5,000 Cr in Kerala’s Logistics & Shipping Sector

UAE’s Sharaf Group to invest ₹5,000 Cr in Kerala’s logistics & shipping sector

3001E, 30 Floor, Aspin Commercial Tower, Sheikh Zayed Road, Dubai, UAE

+971 52 602 2429

info@dxbnewsnetwork.com

© DNN. All Rights Reserved.