Post by : Anis Karim

For property investors, rental yield is one of the most important metrics. It reflects how much return a property generates in rent relative to its purchase price. A higher yield means better income flow, especially important when evaluating affordability, expenses, and the long-term return on investment.

Several factors influence rental yield in Dubai in 2025:

The relative cost per square foot vs the rental rates in a given area

Demand from tenants (professions, families, short-term vs long-term renters)

Supply of new projects and property stock

Connectivity, amenities, and infrastructure

Running costs like service charges, maintenance

With those in mind, let’s examine the top areas in Dubai where investors are seeing the strongest returns in 2025.

Dubai Investments Park is widely recognized among investors for offering one of the highest rental yields in the city. It emerges as a top performer largely because of its balance of lower purchase price and steady rental demand.

Average Yield: Around 9.4% for apartments in 2025

What Drives the Yield: More affordable per square foot pricing compared to Downtown or Marina, combined with strong demand from families and workers who prefer quieter environments outside the core city center

Property Types: Studios, one-bedroom and two-bedroom apartments typically offer the highest yields; villas less so due to higher cost and maintenance

Connectivity & Infrastructure: Close to major highways, growing services, good road connectivity, making daily commuting feasible

For investors who want high yield and lower upfront costs, DIP is among the best options in 2025.

Dubai Silicon Oasis is another top-yield area thanks to its attractiveness to professionals, students, and middle-income families.

Average Yield: Approximately 8%-8.5% in many cases

Strengths: Offers modern amenities, relatively new developments, good infrastructure, and decent pricing for studios and mid-sized apartments

What Makes it Work: Education institutions, tech companies, and increasing demand for smart, value-for-money housing make DSO appealing

Considerations: Service charges and parking costs can eat into net yield, but gross yields remain attractive

DSO’s combination of modern lifestyle and affordability gives good returns especially for smaller units.

JVC remains a favourite for both investors and renters seeking a mix of affordability, facilities, and decent yield.

Average Yield: Around 7-8% for apartments, with villas/townhouses slightly lower

Key Advantages: Wide choice of apartment layouts, relatively lower purchase prices than prime districts, strong demand from families, and good amenities like parks, schools, shops

Risks / Trade-offs: Traffic during peak hours, some developments have older buildings, so newer or well-designed projects tend to perform better

JVC is ideal for investors who want stable yield with moderate risk and lower entry cost.

Dubai Sports City is known for affordability and lifestyle appeal, especially for tenants who value amenities like sports facilities and community services.

Average Yield: Around 7-8%, particularly for studios and small apartments

Appeal: Close to educational institutions and recreational facilities; attracts families and young renters

What to Check: Some buildings have older finishes or maintenance issues; service charges vary; proximity to transport can matter

For investors looking to cater to community-oriented tenants, Sports City is a smart yield pick in 2025.

Discovery Gardens is another area offering strong rental yields, particularly for smaller apartments.

Average Yield: Around 7-8%, in line with many of the more affordable communities

Why It Rents Well: Large numbers of reasonably priced studio and one-bedroom units; green spaces, landscaped surroundings; many tenants looking for cost-effective living not far from main routes

Trade-offs: Older buildings in some clusters may need maintenance; service fees and amenities vary by building

Discovery Gardens remains among the top choices for solid yields without premium price tag.

Here’s a side-by-side look at some of the common patterns seen in these top areas:

| Area | Typical Yield (Apartments) | Best Property Types | Entry Cost / Affordability | Key Amenities / Demand Drivers |

|---|---|---|---|---|

| Dubai Investments Park | ~9.4% | Studios, 1-2 beds | Lower per sqft; newer projects | Quiet residential, good connectivity |

| Dubai Silicon Oasis | ~8-8.5% | Studios, 1-2 beds | Moderately priced, modern finishes | Tech focus, education, family living |

| Jumeirah Village Circle | ~7-8% | Apartments and some townhouses | Budget-friendly in established area | Schools, parks, mall access |

| Dubai Sports City | ~7-8% | Studios, small 1-beds | Affordable especially in newer buildings | Recreation, community setup |

| Discovery Gardens | ~7-8% | Smaller units | Lower cost overall; larger stock | Green spaces, community services |

Gross yield is the number investors often see reported. But to understand actual returns, one must subtract:

Service charges

Maintenance costs

Vacancy periods (time when property is unoccupied)

Agent fees or marketing costs

In many of these areas, net yields after costs are somewhat lower, but remain attractive compared with premium areas where costs are very high.

Areas with high rental yields may not always offer the strongest capital appreciation. Often, more expensive central zones benefit from higher value growth over time. Investors should balance yield vs growth depending on their strategy (income vs capital gain).

If you are considering investing in one of these high yield areas, here are key criteria to assess:

Purchase Price vs Rental Price Ratio

You want low enough purchase prices but strong rents in the area to get good yield.

Demand & Tenant Profile

Areas with high demand from young professionals, families or students tend to have lower vacancy and better returns.

Infrastructure and Connectivity

Proximity to metro, highways, business districts, schools, and malls boosts appeal and rentability.

Service Charges and Building Quality

High service charges can erode returns. Good quality buildings reduce maintenance surprises.

Developer Reputation and Legal Approvals

Investing with established developers and in properly registered projects reduces risk.

Even in high-yield areas, there are challenges:

Oversupply in some precincts may lead to downward pressure on rents.

Maintenance and Upkeep of older buildings can eat into net returns.

Regulatory Changes or changes in leasing laws or tax policies might reduce profitability.

Economic Shocks or shifts in demand (for example, reduction in expatriate influx) could lead to vacancy or rental stagnation.

Being cautious, performing diligent research, and being conservative in yield estimates are essential.

For 2025, Dubai offers several communities that combine strong rental yields with relatively affordable entry points. Areas like Dubai Investments Park, Dubai Silicon Oasis, Jumeirah Village Circle, Dubai Sports City, and Discovery Gardens are leading the way for investors seeking income from property rentals.

While yields in premium areas remain moderate due to high purchase prices and extra costs, these affordable and mid-range areas offer solid income potential. Net returns will vary depending on maintenance, service charges, and market demand, but the top areas listed present compelling options for investors.

If your strategy is focused on rental income, these five areas are among the safest bets in 2025. Pair smart property selection with careful cost management, and you can achieve attractive returns in Dubai’s rental market.

This article is based on market reports and observed trends as of mid-2025. Rental yields vary based on specific property, building quality, location, and prevailing economic conditions. Investors should verify current data and consult real estate professionals before making decisions.

UAE Crown Prince Meets French President to Boost AI Ties

Abu Dhabi Crown Prince Sheikh Khaled meets France’s Macron in New Delhi, focusing on AI, tech cooper

US Forces Ready for Possible Strike on Iran Amid Rising Tensions

US military buildup near Iran is complete, with carriers, fighter jets, and 40,000 troops ready, whi

Filipina Skier Tallulah Proulx Makes Winter Olympics History

At 17, Tallulah Proulx becomes the first female Filipino skier at the Winter Olympics, inspiring a n

Priya Prakash Varrier Meets Ajith Kumar at Yas Marina Circuit

Malayalam actress Priya Prakash Varrier meets Tamil star Ajith Kumar at Yas Marina Circuit, praises

Karachi Building Blast: 16 Dead, Including Women and Children

At least 16 killed and 13 injured as a building collapses after an explosion in Karachi’s Soldier Ba

Prince Andrew Arrested Over Misconduct in Public Office

U.K. police arrested Prince Andrew on suspicion of misconduct in public office linked to Jeffrey Eps

Oman to Be Guest of Honour at 45th Sharjah Book Fair

Oman will be the Guest of Honour at Sharjah International Book Fair 45, showcasing its rich literatu

UAE Gold Prices Today, Monday 16 February 2026: Dubai & Abu Dhabi Updated Rates

Gold prices in UAE on 16 Feb 2026 updated: 24K around AED 599.75/gm, 22K AED 555.25/gm, and 18K AED

Over 25 Ahmedabad Schools Receive Bomb Threat Email, Authorities Investigate

More than 25 schools in Ahmedabad evacuated after bomb threat emails mentioning Khalistan. Authoriti

Ukraine Ex-Energy Minister Arrested in Corruption Case

Ukraine’s anti-corruption agency NABU arrested former Energy Minister German Galushchenko while he t

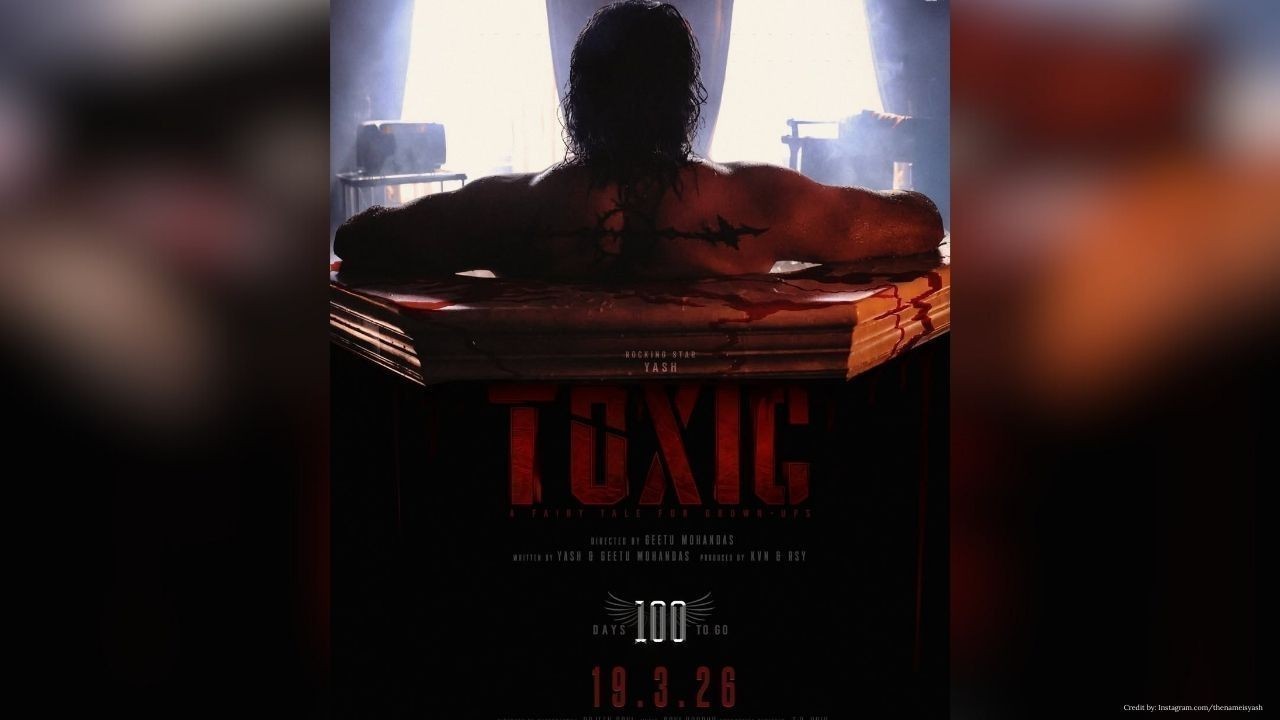

Toxic: A Fairy Tale for Grown-Ups set for worldwide release on March 19, 2026

Toxic: A Fairy Tale for Grown-Ups starring Yash releases worldwide on March 19, 2026, with festive t

Suryakumar Dedicates T20 World Cup Win as India Crush Pakistan by 61 Runs

India defeated Pakistan by 61 runs in the T20 World Cup. Suryakumar Yadav praised Ishan Kishan’s 77

Dhurandhar 2 set to storm theatres on March 19, 2026

Dhurandhar 2, titled Dhurandhar: The Revenge, releases in theatres on March 19, 2026 with a pan-Indi

Dubai Games 2026 Concludes Celebrating Teamwork and Triumph

Dubai Games 2026 ends with Ajman Government, F3, and Czarny Dunajec winning top titles as 1,600 athl

Sheikh Hamdan Honours Arab Hope Maker with AED3 Million Awards

Sheikh Hamdan crowns Fouzia Mahmoudi Arab Hope Maker, awarding AED3 million to top finalists for hum