In recent years, artificial intelligence (AI) has emerged as a game-changer across various industries, and the health insurance sector is no exception. With rising healthcare costs and the increasing complexity of patient needs, the demand for innovative solutions has never been greater. This article delves into how AI is set to transform the health insurance landscape, enhancing efficiency, reducing costs, and ultimately improving patient care.

Before exploring the transformative potential of AI, it’s essential to understand the current challenges facing health insurance providers. The industry grapples with high administrative costs, stemming from cumbersome processes, excessive paperwork, and the need for extensive customer support. Additionally, fraudulent claims continue to plague insurers, costing them billions each year. The traditional methods of identifying fraudulent activity can be slow and ineffective, making it difficult to combat this persistent issue. Furthermore, accurate risk assessment remains crucial for determining premiums and coverage options, but existing methods often rely on outdated data, leading to inefficiencies. Lastly, many insurance providers still utilize a one-size-fits-all approach, which fails to meet the growing demand for personalized medicine, leaving numerous patients dissatisfied with their coverage options.

One of the most immediate benefits of AI in health insurance is the automation of administrative tasks. Chatbots and virtual assistants can handle a significant portion of customer inquiries, providing instant support for policyholders. This not only reduces the workload for human agents but also enhances customer satisfaction by offering 24/7 assistance. Moreover, AI can streamline claims processing, with machine learning algorithms capable of analyzing claims data quickly and flagging discrepancies or unusual patterns that warrant further investigation. By significantly reducing the time taken to process claims, insurers can settle payments faster, leading to improved relationships with their clients.

Fraud detection is another area where AI excels. Traditional methods often rely on predefined rules and manual audits, making it challenging to identify new fraud tactics. In contrast, AI algorithms can learn from historical data, discerning patterns associated with fraudulent claims. By continuously adapting to new information, AI can help insurers stay one step ahead of fraudsters, ultimately saving the industry millions of dollars. This enhanced capability not only protects insurers from financial losses but also fosters a sense of security among policyholders, knowing that their claims are being processed with an advanced fraud detection system in place.

AI’s ability to analyze vast amounts of data makes it a powerful tool for risk assessment. Insurers can leverage predictive analytics to evaluate an individual’s health risk more accurately. By considering factors such as medical history, lifestyle choices, and even genetic information, AI can assist insurers in creating more personalized policies tailored to individual needs. Moreover, AI can help identify emerging health trends, enabling insurers to adjust their risk models proactively. For instance, if a new health crisis arises, AI can analyze data from various sources to predict its impact on policyholders, allowing insurers to make informed decisions quickly and effectively.

As healthcare shifts toward a more personalized approach, AI can play a pivotal role in helping insurers offer tailored health plans that align with individual needs. By analyzing patient data, AI can pinpoint the most relevant treatments and preventive measures for specific individuals. This not only improves patient outcomes but also fosters loyalty among policyholders who feel that their unique needs are being addressed. Additionally, AI can assist in creating wellness programs tailored to different demographic groups. By leveraging data insights, insurers can implement preventive care initiatives that resonate with specific populations, potentially reducing claims over time and leading to a healthier society overall.

The future looks promising as AI is set to transform the health insurance landscape. However, its successful integration requires careful consideration. Insurers must navigate regulatory hurdles and ensure data privacy and security to build trust among consumers. To fully harness the potential of AI, health insurers must collaborate with healthcare providers. By sharing data and insights, both parties can gain a comprehensive view of patient care, leading to better-informed decisions. This collaboration can enhance the overall healthcare ecosystem, ultimately benefiting patients and leading to more effective treatments.

As AI continues to evolve, health insurance companies must commit to continuous learning and adaptation. Investing in training and technology will ensure that staff are equipped to leverage AI effectively. This proactive approach not only enhances operational efficiency but also positions insurers as leaders in the industry, capable of adapting to the rapid changes that AI brings. Continuous learning also involves staying updated on the latest AI advancements, enabling insurers to refine their strategies and maintain a competitive edge in the marketplace.

With great power comes great responsibility, and insurers must prioritize ethical considerations when implementing AI. This includes transparency in data usage, addressing bias in algorithms, and ensuring that AI-driven decisions do not adversely affect vulnerable populations. Establishing ethical guidelines will not only enhance public trust in AI-driven systems but also foster an environment where innovation can thrive without compromising the principles of fairness and accountability.

In this article, we explore how AI is set to transform the health insurance landscape. AI helps make health insurance better by making processes faster and easier. It can handle customer questions through chatbots, which means people get help anytime they need it. AI is set to transform the health insurance landscape by stopping fraud, which is when someone tries to trick the system. It learns from past data to catch bad claims quickly. This means more trust and less money lost.

When it comes to figuring out how risky a person's health is, AI is set to transform the health insurance landscape by using lots of information to create personal health plans. This way, people can get the best care for their needs. With AI, health insurance can even create special wellness programs just for different groups of people.

The future is bright because AI is set to transform the health insurance landscape into something that helps everyone. It’s important to use AI responsibly and fairly to ensure everyone gets the best care possible.

This article is brought to you by DXB News Network. The content is intended for educational purposes and is suitable for all ages. We aim to provide clear and easy-to-understand information about how AI is set to transform the health insurance landscape. Always consult a healthcare professional for specific advice related to health insurance.

AI in health insurance, transform health insurance landscape, health insurance technology, fraud detection, risk assessment, personalized health plans, administrative efficiency, customer service automation, predictive analytics, healthcare innovation, wellness programs, data security, ethical AI use, health insurance benefits, insurance claims processing

#trending #latest #AIinHealthInsurance, #TransformHealthInsurance, #HealthInsuranceTechnology, #FraudDetection, #RiskAssessment, #PersonalizedHealthPlans, #AdministrativeEfficiency, #CustomerService, #PredictiveAnalytics, #HealthcareInnovation, #WellnessPrograms, #DataSecurity, #EthicalAI, #HealthInsuranceBenefits, #InsuranceClaimsProcessing #breakingnews #worldnews #headlines #topstories #globalUpdate #dxbnewsnetwork #dxbnews #dxbdnn #dxbnewsnetworkdnn #bestnewschanneldubai #bestnewschannelUAE #bestnewschannelabudhabi #bestnewschannelajman #bestnewschannelofdubai #popularnewschanneldubai

Sheikh Khaled bin Mohamed bin Zayed visits Nabdh Al Falah hub, boosting community ties...Read More.

Filmmakers explore storytelling vs. commerce at Xposure 2025, embracing global film...Read More.

Sheikh Hamdan Shares Video of 31 Athletes Jumping from Burj Khalifa

Sheikh Hamdan Shares Video of 31 Athletes Jumping from Burj Khalifa

On February 18, 31 athletes jumped from Burj Khalifa, landing safely by Dubai Mall

Culture, history, and identity intertwine through Arab lenses at Xposure 2025

Culture, history, and identity intertwine through Arab lenses at Xposure 2025

The Road to Xposure unveils 108 works capturing the Arab world's journey and spirit

Join a Weekend of Discovery, Creativity & Family Fun at Xposure 2025

Join a Weekend of Discovery, Creativity & Family Fun at Xposure 2025

Enjoy interactive exhibits, tours, free portraits & coffee at Xposure 2025

Abu Dhabi’s Environment Agency wins Quality Award for 3rd year

Abu Dhabi’s Environment Agency wins Quality Award for 3rd year

The European Society for Quality Research honored EAD for the third year, praising its quality-focus

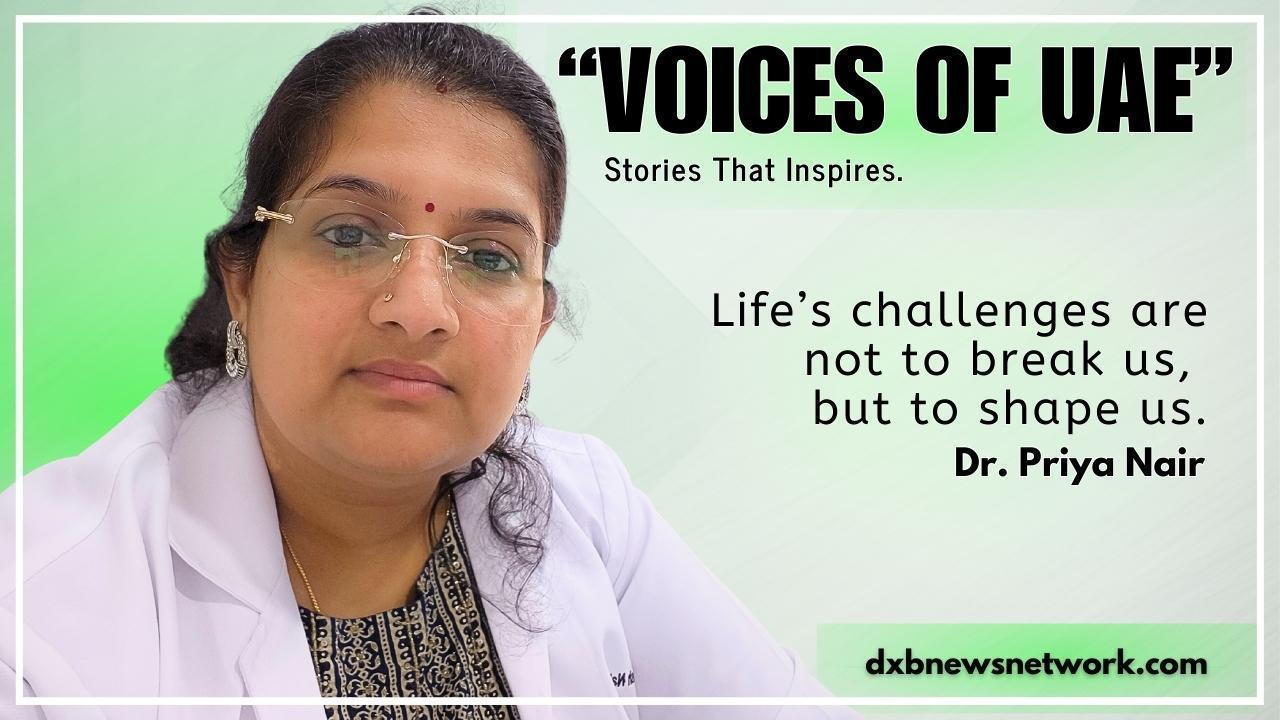

Voices of UAE: From Counting Her Final Days to Saving Lives – Dr. Priya Nair’s Heart-Stopping Battle and Second Birth.

Voices of UAE: From Counting Her Final Days to Saving Lives – Dr. Priya Nair’s Heart-Stopping Battle and Second Birth.

Dr. Priya Rathish Nair, a Specialist Gynecologist at Shifa Al Jazeera Medical Centre in Ras Al Khaim

Khaled bin Mohamed bin Zayed visits Nabdh Al Falah, orders hub expansion

Sheikh Khaled bin Mohamed bin Zayed visits Nabdh Al Falah hub, boosting community ties

Filmmakers discuss balancing creativity and commerce at Xposure 2025

Filmmakers explore storytelling vs. commerce at Xposure 2025, embracing global film

Pastry Chef for 2 Months, Rainforest Photographer for 10: Meet Dieter Schonlau

German explorers Dieter & Sandra Schonlau share rainforest adventures at Xposure 2025

A Travelers Paradise Exploring the Amazing Wonders of World Tourism

Discover breathtaking destinations and amazing wonders worldwide

An unlikely crew, an octopus’ trust, and an Oscar win: Makers at Xposure 2025

Xposure 2025 hosts Pippa Ehrlich, Roger Horrocks to reveal My Octopus Teacher's story

Aspiring pros challenge crisis photography stereotypes with Lys Arango’s lens

Lys Arango challenges stereotypes in humanitarian photography at Xposure 2025

The Benefits of Using Natural Products in Your Night Routine

How Natural Products in Your Night Routine Improve Skin Health

Lisa & Simon Thomas share two-wheeler adventures across 80+ countries at Xposure 2025

English bikers turned setbacks into a 507,000-mile adventure and a photo legacy

After the Storm" by Saud bin Sultan Al Qasimi Shows UAE’s Strongest Storm

After the Storm’ captures the UAE’s record rainfall and resilience in April 2024

Abu Dhabi Economic Delegation to China Signs Key Business Agreements

Abu Dhabi, China boost ties with key agreements, strengthening economic partnerships

3001E, 30 Floor, Aspin Commercial Tower, Sheikh Zayed Road, Dubai, UAE

+971 52 602 2429

info@dxbnewsnetwork.com

© DNN. All Rights Reserved.