The Ministry of Finance has issued Cabinet Decision No. 142 of 2024, introducing the Top-up Tax for Multinational Enterprises (MNEs). This announcement provides further information about the UAE Domestic Minimum Top-up Tax (UAE DMTT), which was first mentioned by the Ministry on December 9, 2024.

The UAE DMTT is designed to align with the GloBE Model Rules developed by the Organisation for Economic Co-operation and Development (OECD). It will apply to companies that are part of multinational groups operating in the UAE. Specifically, it will impact groups with annual global revenues of €750 million or more, as reported in the Consolidated Financial Statements of their Ultimate Parent Entity in at least two out of the four financial years before the year when the UAE DMTT becomes applicable.

Stay informed with the latest news. Follow DXB News Network on WhatsApp Channel

To ensure fairness, the UAE DMTT offers relief through a "Substance-based Income Exclusion." This means that companies can reduce the amount of income subject to tax by accounting for factors like payroll and the value of tangible assets. The exclusion reduces the net income subject to tax by deducting an amount tied to these elements, helping to determine what is considered "Excess Profit" for tax purposes.

In addition, the UAE DMTT includes a "de minimis exclusion." This allows companies to avoid the tax if they meet specific conditions. If an entity qualifies under these criteria, its UAE DMTT will be set to zero.

To support its status as a top global investment hub, the UAE has structured the UAE DMTT to exclude certain "Investment Entities." These are defined under the rules to protect investment activity and ensure a favorable environment for growth.

As part of the transition to this new tax, the UAE will not impose the DMTT during the early stages of an MNE Group’s international activity. This exemption applies as long as none of the UAE-based entities are owned by a parent company in another country that is subject to a Qualified Income Inclusion Rule.

The UAE DMTT has been crafted to align with the OECD’s guidelines. Its implementation and interpretation will follow the OECD’s Commentary and Administrative Guidance to maintain consistency with international standards.

This step reflects the UAE’s commitment to staying competitive on the global stage while meeting its obligations under international tax frameworks.

#trending #latest #UAEFinance #TopUpTax #MultinationalEnterprises #GlobalTaxRules #OECD #UAEtax #DomesticMinimumTopUpTax #InvestmentEntities #TaxExclusion #InternationalTax #FinancialRegulations #GlobalInvestmentHub #UAEtaxReform #OECDGuidelines #TaxFairness #ExcessProfit #PayrollExclusion #TaxRelief #CorporateTax #TaxCompliance #EconomicGrowth #headlines #topstories #globalUpdate #dxbnewsnetwork #dxbnews #dxbdnn #dxbnewsnetworkdnn #bestnewschanneldubai #bestnewschannelUAE #bestnewschannelabudhabi #bestnewschannelajman #bestnewschannelofdubai #popularnewschanneldubai

Discover natural fruit facials for glowing, fresh skin with simple, homemade ingredients...Read More.

Along with handling consumer complaints, ADRA inspected businesses across Abu Dhabi to check rule compliance...Read More.

Meta tests its first in-house chip designed for AI applications

Meta tests its first in-house chip designed for AI applications

Meta tests its first AI chip to cut reliance on Nvidia and reduce infrastructure costs

PSG defeats Liverpool in Champions League shootout, advances further

PSG defeats Liverpool in Champions League shootout, advances further

Paris St Germain won 4-1 in a penalty shootout after a thrilling 1-0 victory over Liverpool at Anfie

UAE President receives call from Uzbek President on strengthening ties

UAE President receives call from Uzbek President on strengthening ties

UAE and Uzbekistan presidents exchange Ramzan greetings, wishing prosperity and stability

Musk: Ukraine-based cyberattack may have caused X platform outage

Musk: Ukraine-based cyberattack may have caused X platform outage

Over 40,000 users reported X outage on March 10, with the platform down on web and app, per Downdete

Punjabi singer Sunanda reveals she attempted suicide, music producer held

Punjabi singer Sunanda reveals she attempted suicide, music producer held

Punjabi singer Sunanda Sharma accused producer Pinky Dhaliwal of fraud and exploitation

Homemade Fruit Facials for Fresh and Radiant Skin

Discover natural fruit facials for glowing, fresh skin with simple, homemade ingredients

Abu Dhabi boosts consumer rights, brand protection growth in 2024

Along with handling consumer complaints, ADRA inspected businesses across Abu Dhabi to check rule compliance

Saudi Arabia Declares Four-Day Eid Al Fitr Holiday for Private Sector

The holiday will start on March 30, and employees will return to work on April 3.

89 Abu Dhabi entities meet National Standard for Business Continuity

Since 2021, an audit checked 90 government entities and 3 private firms, led by the Centre’s team

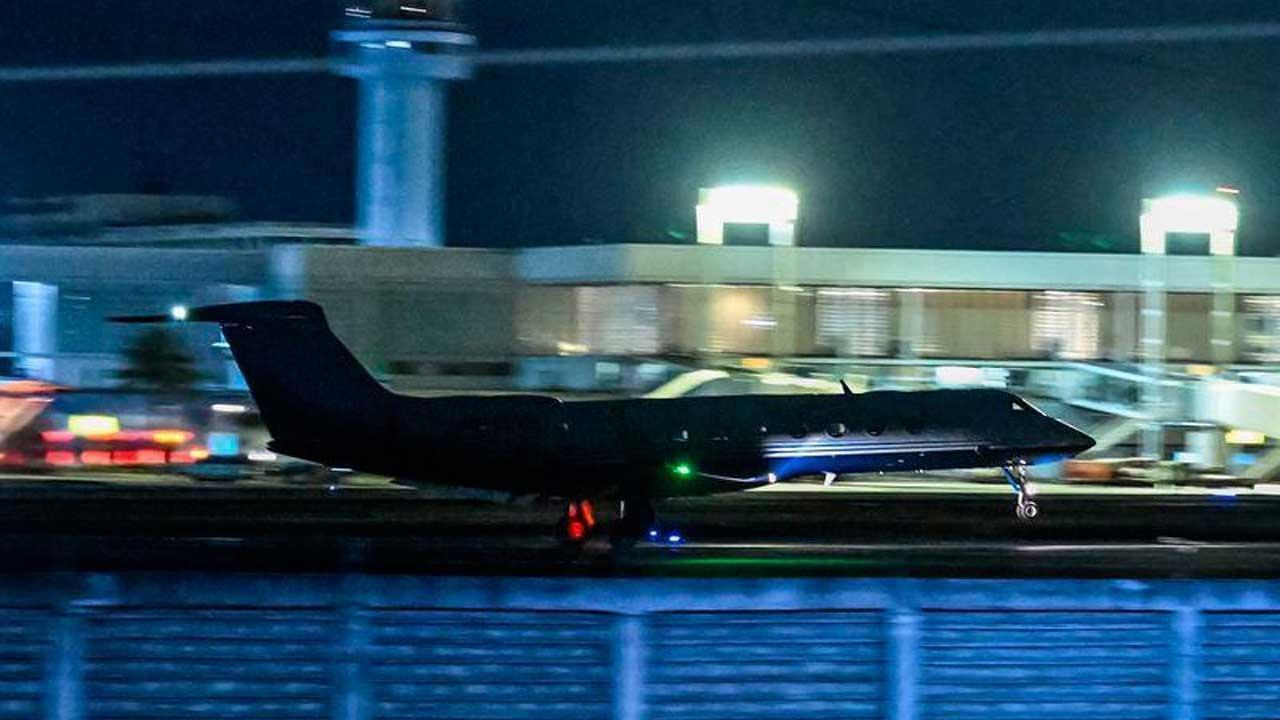

Plane Carrying Philippines' Rodrigo Duterte Departs from UAE

The Gulfstream G550 departed from Dubai's Al Maktoum International Airport, heading to Rotterdam.

Dubai Rents: More Signs Show Rent Increases Slowing Down

In certain areas, an increase in rental property listings is leading to softer asking rents.

5 Countries with the Cheapest Gold Prices – UAE Not on the List

Dubai is a top gold-buying destination, yet it ranks 6th among the world's cheapest gold markets.

Hijackers making Pakistan hostage rescue complicated: Source

Hijackers sitting beside many hostages after seizing a train in southwest Pakistan has made rescue efforts harder, security sources said Wednesday

UAE Launches BRIDGE: A Global Initiative to Transform Media Worldwide

UAE launches BRIDGE to empower media, drive innovation, and promote authentic journalism

Ship crash in UK: Captain arrested, owner confirms Russian nationality

The ship's captain, arrested for crashing into a US tanker near England, is Russian, the owner said

3001E, 30 Floor, Aspin Commercial Tower, Sheikh Zayed Road, Dubai, UAE

+971 52 602 2429

info@dxbnewsnetwork.com

© DNN. All Rights Reserved.