Post by : Anis Karim

Dubai’s real estate market has long been a central focus for investors, expatriates, and residents seeking long-term housing solutions. In 2025, the rental market is experiencing dynamic changes, influenced by economic conditions, evolving tenant preferences, and the continuous development of residential projects. While some neighborhoods are seeing steady rental growth, others are witnessing price adjustments downward. Understanding these trends is essential for tenants seeking affordable housing and investors aiming to optimize their property portfolios.

This analysis explores the key drivers behind rental price movements, identifies areas experiencing rises and declines, and provides insights for residents and investors on how to navigate the current market effectively.

The fluctuations in Dubai’s rental prices are shaped by several interrelated factors:

In 2025, Dubai continues to see an influx of new residential developments. The delivery of tens of thousands of new apartment units has expanded the available housing stock, which is gradually reducing pressure on previously oversaturated areas. This increase in supply has made rentals in certain districts more competitive, leading to price stabilization or slight declines in locations where supply has been abundant.

Tenant behavior is evolving in line with lifestyle trends and affordability concerns. Many renters are now prioritizing value-for-money properties, favoring mid-range apartments and villas over ultra-luxury units. Neighborhoods offering well-connected transport, amenities, and community facilities are attracting higher demand, often driving rental increases despite a broader market cooling.

Interest rates, inflation, and government policies continue to impact affordability. Adjustments to mortgage rates and economic initiatives supporting business growth indirectly influence rental demand. Tenants’ willingness and ability to pay higher rents are closely linked to broader economic confidence and disposable income levels, which in turn affect price movements in various areas.

While some regions are seeing price adjustments downward, several neighborhoods are experiencing upward rental trends due to strong demand, premium positioning, or limited supply.

Dubai Silicon Oasis has become a hub for technology professionals and young families. Its modern infrastructure, proximity to business centers, and lifestyle facilities have made it a desirable location. One-bedroom and two-bedroom apartments are particularly in demand, with rental prices steadily rising as more professionals choose this area for its combination of affordability and convenience.

Family-friendly communities such as DAMAC Hills 2 and Mirdif have seen consistent rental growth. The appeal of spacious villas and proximity to schools, parks, and shopping centers has attracted long-term tenants, resulting in rental increases. In some segments, rents have grown by nearly 8–10% compared to the previous year, reflecting sustained demand among mid to high-income households seeking community-oriented living.

High-end neighborhoods such as Palm Jumeirah and Downtown Dubai continue to witness rising rents for luxury villas and apartments. These areas attract affluent tenants and expatriates seeking prime locations with access to entertainment, leisure, and business hubs. The sustained interest in luxury properties ensures that rental prices remain strong despite broader market fluctuations.

Dynamic urban districts like Jumeirah Lakes Towers (JLT) and Dubai Marina have maintained upward rental trends due to their vibrant lifestyle offerings and proximity to the financial centers of Dubai. Apartments in these areas, particularly high-floor units with views of the skyline or waterfront, are commanding higher rents, reflecting strong investor and tenant interest.

Several areas have seen rental price adjustments, often due to increased supply, lower demand, or shifting tenant priorities.

Historically known as more affordable areas, Deira and Bur Dubai are now seeing rental declines. Older apartment buildings in these districts are being gradually replaced by modern developments in other parts of the city, reducing demand for certain units. As a result, rents have dropped by an average of 5–7%, making these neighborhoods attractive for budget-conscious tenants.

While JVC has traditionally offered affordable villas and apartments, recent adjustments in rental prices have created opportunities for tenants. Some three and four-bedroom villas have seen rent reductions of 6–8%, reflecting a combination of increased supply and shifting preferences toward more modern developments elsewhere.

Arjan, known for affordable apartments near Expo 2020 site developments, has also seen rental moderation. Apartments in this area have become more competitive as new options in other districts emerge, leading to slightly reduced rent levels. The area remains attractive for families and professionals looking for budget-friendly housing with access to emerging community amenities.

International City and Dubai Sports City, often popular among expatriates, have experienced softening rents due to oversupply in certain segments. While still offering affordable options, tenants are benefiting from increased negotiating power and the ability to secure more favorable lease terms.

Rental trends in Dubai are also segmented by property types:

One-Bedroom Apartments: These units continue to see strong demand in technology-focused communities and business-centric neighborhoods. Price growth in areas such as Dubai Silicon Oasis and Dubai Marina remains steady.

Two-Bedroom Apartments: Mid-sized units are attracting families and professional couples, with neighborhoods like JLT and Mirdif experiencing moderate rent increases.

Villas and Townhouses: Family-oriented communities such as DAMAC Hills 2, Arabian Ranches, and Meadows remain high-demand areas. Price trends for villas are generally upward in well-established communities but stable in areas with rising supply.

Luxury Units: High-end apartments and villas in Palm Jumeirah, Downtown Dubai, and Business Bay continue to command premium rents, reflecting sustained interest from affluent tenants.

The 2025 rental landscape in Dubai offers both opportunities and challenges for tenants:

Greater Choices: The increase in available units across various neighborhoods provides tenants with more options, allowing better selection based on budget, location, and amenities.

Affordability Management: While some premium locations have rising rents, more affordable districts are providing options for tenants to manage costs effectively.

Negotiation Opportunities: In areas where rents have declined, tenants have stronger leverage to negotiate favorable lease terms, including discounts or flexible payment options.

Long-Term Planning: Tenants may benefit from longer-term leases in stable neighborhoods to hedge against potential future increases in rental prices.

For property investors, understanding rental trends is crucial for maximizing returns:

Diversification Across Districts: Investing in a mix of high-demand, luxury, and affordable districts helps mitigate risks associated with localized market fluctuations.

Targeting Growth Areas: Communities experiencing rising rents, such as Dubai Silicon Oasis, DAMAC Hills 2, and Marina districts, offer strong potential for rental income growth.

Monitoring Economic Indicators: Investors should track market conditions, such as new project launches, population growth, and economic policy changes, to make informed acquisition or sale decisions.

Long-Term Strategy: Focusing on properties that appeal to both residents and expatriates can provide stable occupancy and consistent rental returns.

Dubai’s rental market in 2025 is expected to maintain a mixed trend:

Stability in Established Communities: Well-established neighborhoods with strong amenities and connectivity will likely see steady rental growth.

Moderation in Oversupplied Areas: Districts with a significant influx of new apartments and villas may experience moderate rental adjustments, creating tenant-friendly conditions.

Premium Market Resilience: Luxury neighborhoods are anticipated to continue commanding high rents due to sustained demand from expatriates and high-net-worth individuals.

Increased Competition: Tenants and investors alike will need to carefully evaluate neighborhoods, property types, and market conditions to make strategic decisions.

Overall, Dubai’s rental market reflects a balance between supply expansion, evolving tenant preferences, and economic conditions, creating opportunities for both renters and investors.

Dubai’s rental market in 2025 demonstrates a dynamic interplay between rising and falling rents across neighborhoods. Areas like Dubai Silicon Oasis, DAMAC Hills 2, and prime districts such as Palm Jumeirah and Downtown Dubai continue to experience growth, driven by high demand and strong amenities. Conversely, more affordable districts like Deira, Bur Dubai, JVC, and Arjan are seeing rental moderation due to increased supply and shifting tenant preferences.

Tenants have more choices and negotiating power in certain areas, while investors can benefit by targeting high-demand neighborhoods for long-term rental income growth. Understanding these trends is essential for navigating the evolving market and making informed decisions. Dubai’s rental market in 2025 presents a nuanced landscape that rewards careful research, strategic investment, and awareness of neighborhood-specific dynamics.

This article provides general information based on current observations of Dubai’s real estate market in 2025. Rental prices and market conditions are subject to change. Readers are advised to consult professional real estate advisors before making property-related decisions.

UAE Crown Prince Meets French President to Boost AI Ties

Abu Dhabi Crown Prince Sheikh Khaled meets France’s Macron in New Delhi, focusing on AI, tech cooper

US Forces Ready for Possible Strike on Iran Amid Rising Tensions

US military buildup near Iran is complete, with carriers, fighter jets, and 40,000 troops ready, whi

Filipina Skier Tallulah Proulx Makes Winter Olympics History

At 17, Tallulah Proulx becomes the first female Filipino skier at the Winter Olympics, inspiring a n

Priya Prakash Varrier Meets Ajith Kumar at Yas Marina Circuit

Malayalam actress Priya Prakash Varrier meets Tamil star Ajith Kumar at Yas Marina Circuit, praises

Karachi Building Blast: 16 Dead, Including Women and Children

At least 16 killed and 13 injured as a building collapses after an explosion in Karachi’s Soldier Ba

Prince Andrew Arrested Over Misconduct in Public Office

U.K. police arrested Prince Andrew on suspicion of misconduct in public office linked to Jeffrey Eps

Oman to Be Guest of Honour at 45th Sharjah Book Fair

Oman will be the Guest of Honour at Sharjah International Book Fair 45, showcasing its rich literatu

UAE Gold Prices Today, Monday 16 February 2026: Dubai & Abu Dhabi Updated Rates

Gold prices in UAE on 16 Feb 2026 updated: 24K around AED 599.75/gm, 22K AED 555.25/gm, and 18K AED

Over 25 Ahmedabad Schools Receive Bomb Threat Email, Authorities Investigate

More than 25 schools in Ahmedabad evacuated after bomb threat emails mentioning Khalistan. Authoriti

Ukraine Ex-Energy Minister Arrested in Corruption Case

Ukraine’s anti-corruption agency NABU arrested former Energy Minister German Galushchenko while he t

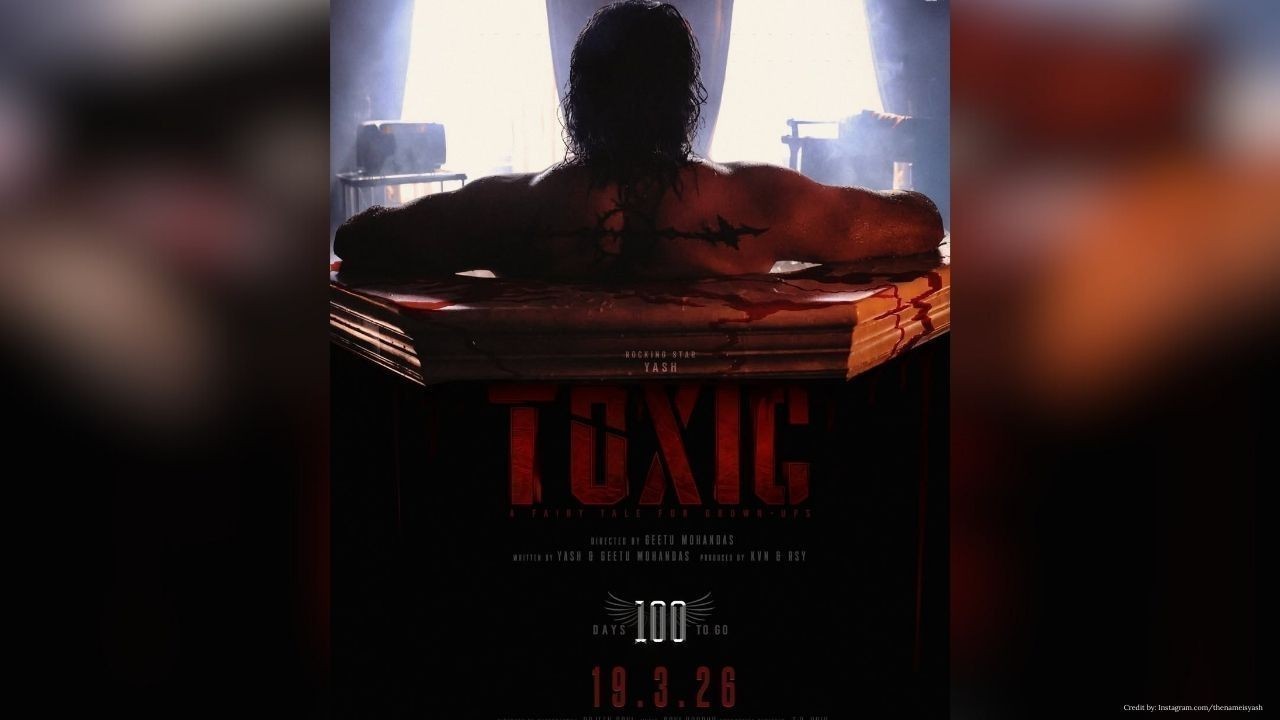

Toxic: A Fairy Tale for Grown-Ups set for worldwide release on March 19, 2026

Toxic: A Fairy Tale for Grown-Ups starring Yash releases worldwide on March 19, 2026, with festive t

Suryakumar Dedicates T20 World Cup Win as India Crush Pakistan by 61 Runs

India defeated Pakistan by 61 runs in the T20 World Cup. Suryakumar Yadav praised Ishan Kishan’s 77

Dhurandhar 2 set to storm theatres on March 19, 2026

Dhurandhar 2, titled Dhurandhar: The Revenge, releases in theatres on March 19, 2026 with a pan-Indi

Dubai Games 2026 Concludes Celebrating Teamwork and Triumph

Dubai Games 2026 ends with Ajman Government, F3, and Czarny Dunajec winning top titles as 1,600 athl

Sheikh Hamdan Honours Arab Hope Maker with AED3 Million Awards

Sheikh Hamdan crowns Fouzia Mahmoudi Arab Hope Maker, awarding AED3 million to top finalists for hum