Adani Ports and Special Economic Zone Ltd made a significant financial announcement on December 12, revealing plans to raise a substantial amount of capital. The company, known for its extensive operations with 13 ports and terminals across India, including the prominent Mundra port in Gujarat, disclosed its intention to raise ₹5,250 crore through the issuance of non-convertible debentures (NCDs) and an additional ₹2.5 billion through non-cumulative redeemable preference shares.

This strategic move was unveiled as part of the company's broader financial strategy, and a majority of the funds generated are earmarked for the refinancing of existing debt. The Board of Directors of Adani Ports gave their in-principle approval for the issuance of NCDs for capital expenditure, refinancing existing debt, and general corporate purposes. The aggregate amount targeted for this purpose is set at ₹5,000 crore and will be executed in one or more tranches on a private placement basis.

In addition to NCDs, the company plans to issue non-cumulative redeemable preference shares on a private placement basis, aiming to generate an aggregate amount not exceeding ₹250.19 crore. This move further highlights Adani Ports' proactive financial approach to meet its corporate objectives and strategic initiatives.

The announcement clarified that the debentures to be issued will be listed on the stock exchanges, providing transparency and accessibility to investors. The specific details such as the tenure of the instrument, date of allotment, and date of maturity will be determined on a case-by-case basis at the time of issue, allowing flexibility to adapt to market conditions.

Concurrently, recent reports surfaced suggesting that Adani Ports is in preliminary discussions to acquire Gopalpur port in Odisha from the Shapoorji Pallonji Group's (SP Group) real-estate conglomerate. This potential acquisition is estimated to be valued at ₹11-12 billion ($132-$144 million), as reported by news agency Reuters. If materialized, this move would add another significant asset to Adani Ports' expansive portfolio, aligning with the company's strategic growth objectives.

Adani Group, as a whole, has embarked on an ambitious plan to raise funds for capital expenditure, aiming to invest seven trillion rupees over the next decade in various infrastructure projects. This financial commitment underscores the group's dedication to fostering economic development and contributing to the nation's infrastructure landscape.

As the news circulated, the market responded positively, with Adani Ports' shares settling 1.03% higher at ₹1,042.05 apiece on the Bombay Stock Exchange (BSE). The financial market's reception to Adani Ports' strategic financial decisions further emphasizes the company's prominent position and investor confidence in its growth trajectory.

#AdaniPorts #FinancialAnnouncement #CapitalExpenditure #InfrastructureInvestment #CorporateFinance #DebtRefinancing #MarketUpdate #StrategicInitiatives #InvestmentStrategies #StockMarket #NCDIssuance #PreferenceShares #AdaniGroup #PortAcquisition #EconomicDevelopment #InvestorConfidence #MarketResponse #CorporateGrowth #FinancialStrategy #BSETrading

Watch India vs Pakistan live in the Champions Trophy 2025 Group A match in Dubai...Read More.

Pakistan's Aaqib Javed brings in Mudassar Nazar to prep team for Champions Trophy vs India...Read More.

Sheikh Hamdan Shares Video of 31 Athletes Jumping from Burj Khalifa

Sheikh Hamdan Shares Video of 31 Athletes Jumping from Burj Khalifa

On February 18, 31 athletes jumped from Burj Khalifa, landing safely by Dubai Mall

Culture, history, and identity intertwine through Arab lenses at Xposure 2025

Culture, history, and identity intertwine through Arab lenses at Xposure 2025

The Road to Xposure unveils 108 works capturing the Arab world's journey and spirit

Join a Weekend of Discovery, Creativity & Family Fun at Xposure 2025

Join a Weekend of Discovery, Creativity & Family Fun at Xposure 2025

Enjoy interactive exhibits, tours, free portraits & coffee at Xposure 2025

Abu Dhabi’s Environment Agency wins Quality Award for 3rd year

Abu Dhabi’s Environment Agency wins Quality Award for 3rd year

The European Society for Quality Research honored EAD for the third year, praising its quality-focus

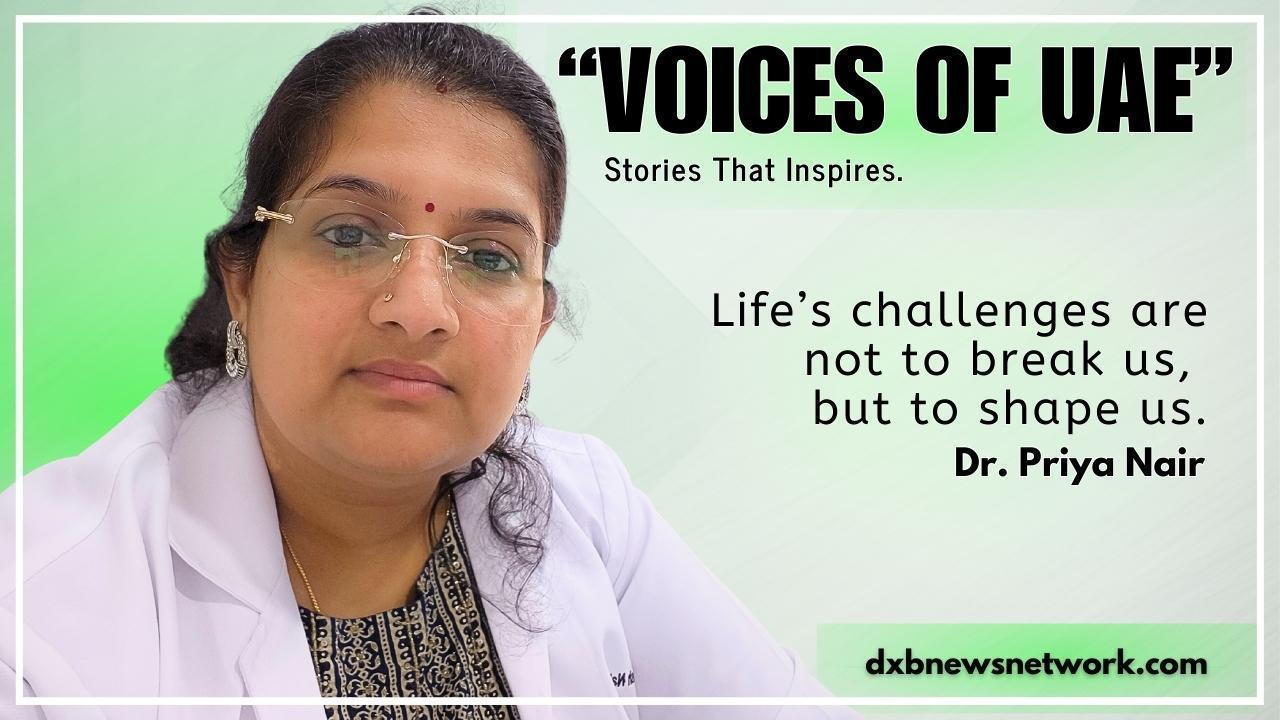

Voices of UAE: From Counting Her Final Days to Saving Lives – Dr. Priya Nair’s Heart-Stopping Battle and Second Birth.

Voices of UAE: From Counting Her Final Days to Saving Lives – Dr. Priya Nair’s Heart-Stopping Battle and Second Birth.

Dr. Priya Rathish Nair, a Specialist Gynecologist at Shifa Al Jazeera Medical Centre in Ras Al Khaim

Catch the live stream of India vs Pakistan ICC Champions Trophy 2025

Watch India vs Pakistan live in the Champions Trophy 2025 Group A match in Dubai

Pakistan's Secret Weapon for Champions Trophy 2025 to Defeat India Revealed

Pakistan's Aaqib Javed brings in Mudassar Nazar to prep team for Champions Trophy vs India

ITC Abu Dhabi & GIGATONS partner to drive net zero e-mobility solutions

ITC Abu Dhabi partners with GIGATONS to advance smart, zero-emission e-mobility

Dubai introduces new six-month multiple-entry visa for yacht crew

Visit GDRFA at the Dubai International Boat Show for yacht crew visa details

Understanding the Connection Between Mind and Body Health

Discover how mind and body health are deeply connected

Shura Council Speaker Leads Kingdom’s Delegation at Arab Parliament Meeting

Shura Speaker leads Kingdom’s delegation to 7th Arab Parliament Conference in Cairo

Jeddah Literary Club Hosts Events to Celebrate Saudi Arabia's Founding Day

Jeddah Literary Club marked Founding Day with plays on the First Saudi State

DEWA Youth Council Wins 2025 Best National Government Youth Council Award

DEWA Youth Council wins 2025 Best National Government Youth Council Award in UAE

The Role of Nutrition and Exercise in Good Health

Discover how nutrition and exercise shape a healthier lifestyle

Sharaf Group to Invest ₹5,000 Cr in Kerala’s Logistics & Shipping Sector

UAE’s Sharaf Group to invest ₹5,000 Cr in Kerala’s logistics & shipping sector

3001E, 30 Floor, Aspin Commercial Tower, Sheikh Zayed Road, Dubai, UAE

+971 52 602 2429

info@dxbnewsnetwork.com

© DNN. All Rights Reserved.