Post by: Vansh Kumar

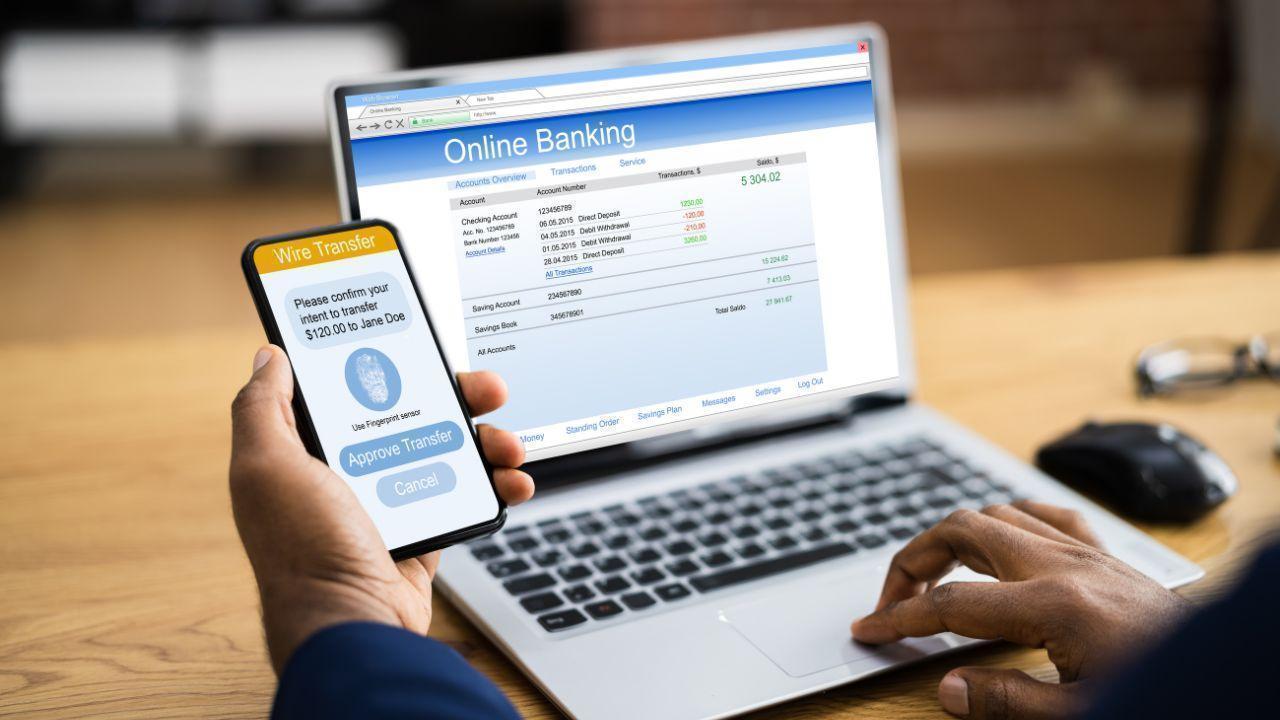

In today’s fast-paced digital world, sending money across borders has become quicker and easier than ever. For Non-Resident Indians (NRIs), Unified Payments Interface (UPI) has emerged as one of the most convenient and efficient ways to transfer money to India. UPI allows individuals to transfer funds in real-time, directly between bank accounts, using just a mobile phone number or UPI ID. This method has transformed the way NRIs send money back home, making it faster, secure, and cost-effective. If you're an NRI interested in using UPI for money transfers to India, understanding how it works can help make the process simpler and more efficient.

The Unified Payments Interface (UPI) is a real-time payment system developed by the National Payments Corporation of India (NPCI). It allows users to send money instantly between bank accounts, 24/7, using just their mobile devices. For NRIs, UPI has become a crucial tool for transferring funds to family and friends in India due to its speed, accessibility, and low fees. UPI is not restricted by banking hours or holidays, which means NRIs can initiate transfers anytime, from anywhere around the globe.

For those living abroad, using UPI to send money is both practical and reliable. It eliminates the need for traditional bank transfers or foreign exchange services, which often come with delays and high fees. UPI’s integration with various apps makes it accessible, and its user-friendly interface ensures that anyone can make a transfer without much hassle.

To use UPI for transferring money, NRIs can either use UPI-enabled mobile apps or leverage partner bank services that support UPI transactions. Both methods provide an efficient way to send money to India, ensuring that the process is quick and easy.

One of the easiest ways for NRIs to transfer money to India using UPI is through popular UPI-enabled mobile apps such as Google Pay, PhonePe, or Paytm. These apps allow NRIs to link their international bank accounts and initiate transfers to India. The process is simple and involves a few basic steps. First, download and install a UPI-enabled app of your choice on your mobile device. After setting up the app, you will need to link your international bank account or a debit card from your overseas bank. Once your account is linked, create a UPI ID, which will serve as your unique payment address.

Next, enter the recipient’s UPI ID, which is their virtual payment address. After entering the amount you wish to send, confirm the transaction. The app will prompt you to authenticate the payment using your UPI PIN. Once authenticated, the transaction will be processed instantly, and the funds will be transferred to the recipient's bank account in India. Both you and the recipient will receive a notification confirming the transfer.

Another option for NRIs is to use partner banks or international money transfer services that support UPI. Many banks and third-party services, like Western Union, Remitly, and Xoom, offer UPI-enabled transfer options. These services provide a simple way for NRIs to send money to their loved ones in India, especially if they are not familiar with UPI apps.

To use this method, the NRI would first choose a money transfer provider that supports UPI transactions. After signing up with the service and verifying their identity, the user can select UPI as the payment method when initiating a transfer. By entering the recipient's UPI ID or mobile number linked to their Indian bank account, the sender can complete the transfer process. The funds will then be delivered directly to the recipient’s bank account through UPI.

Using UPI for transferring money offers several advantages that make it a preferred choice for NRIs. First and foremost, UPI transactions are instantaneous, meaning that the recipient in India can access the funds within moments of the transfer being initiated. This is particularly beneficial for NRIs who need to send money in emergencies or for urgent needs.

Moreover, UPI transactions are generally free or come with minimal fees, unlike traditional wire transfers or services like Western Union, which can charge high fees for international transfers. This makes UPI a cost-effective option for regular remittances.

UPI also prioritizes security. Each transaction requires a UPI PIN, and the system is built with robust encryption to protect users from fraud. This ensures that money transfers are both safe and secure.

Additionally, UPI offers great convenience. There is no need for the sender to visit a bank or exchange offices to initiate a transfer. Everything can be done on a smartphone, whether it’s via a mobile app or a partner service, making UPI a hassle-free solution for NRIs.

While UPI offers many benefits, there are a few things to keep in mind to ensure that the process goes smoothly. First, make sure that your international bank supports UPI transactions. Some banks may have restrictions, so it's important to verify this before attempting a transfer.

Double-check the recipient's UPI ID before making a transaction. A small mistake in the ID can lead to funds being transferred to the wrong person, so it’s essential to ensure the details are accurate.

Enabling transaction notifications is another useful tip. This way, you’ll receive real-time updates about the status of your transfer, so you can track your money as it moves.

It’s also a good idea to use trusted and secure apps or money transfer services. Stick to well-known UPI-enabled apps like Google Pay, PhonePe, or Paytm, and avoid third-party services that seem unfamiliar or unverified.

How NRIs can use UPI to transfer money to India is a simple and fast way for people living outside India to send money home. UPI is a payment system that makes it easy for NRIs to send money directly to anyone in India, using just a mobile phone and the recipient’s UPI ID. How NRIs can use UPI to transfer money to India is very convenient, as it works 24/7 without the need for banks. The process is simple: you can use UPI apps like Google Pay or PhonePe to link your account and send money. With UPI, the money reaches the person in India right away. How NRIs can use UPI to transfer money to India is also safe because of the UPI PIN and secure encryption. Plus, it's cheaper than traditional bank transfers, making it a smart choice for anyone who wants to send money home quickly and easily. Remember to always check the UPI ID and double-check the details to avoid any mistakes. By using UPI, NRIs can easily help their families and friends in India with money transfers anytime and anywhere.

Disclaimer: The information provided in this article is for general informational purposes only. Readers are advised to verify the details with their respective financial institutions and transfer services. dxb news network does not endorse any particular service or method for transferring money and encourages readers to exercise caution when handling financial transactions.

NRIs, UPI, Transfer money to India, UPI apps, Money transfer, Bank transfer, Google Pay, PhonePe, UPI ID, Secure transfer, International money transfer, UPI PIN, Fast money transfer, Cost-effective transfer, UPI payment system, Money transfer apps, Instant transfer, Cross-border money transfer, Send money to India, Low fees transfer

#trending #latest #NRIs, #UPI, #TransferMoneyToIndia, #MoneyTransfer, #UPIApps, #GooglePay, #PhonePe, #SendMoneyToIndia, #UPITransfer, #SecureTransfer, #FastMoneyTransfer, #InternationalMoneyTransfer, #UPIPIN, #CrossBorderTransfer, #LowFeesTransfer, #InstantTransfer, #UPIPaymentSystem, #MoneyTransferApps #breakingnews #worldnews #headlines #topstories #globalUpdate #dxbnewsnetwork #dxbnews #dxbdnn #dxbnewsnetworkdnn #bestnewschanneldubai #bestnewschannelUAE #bestnewschannelabudhabi #bestnewschannelajman #bestnewschannelofdubai #popularnewschanneldubai

A man brutally murdered his wife & son in Jharkhand’s Saraikela district, using an iron pan. The accused was arrested after the shocking crime...Read More.

Natural Remedies to Boost Your Plant Care Routine...Read More.

7 Free Ghibli-Style AI Image Editors to Try Now

Transform your images into Ghibli-style art with these 7 free AI tools. From dreamy landscapes to an

China Conducts Military Drills Near Taiwan

China's coast guard conducted patrols, inspections, and drills near Taiwan as Beijing announced mili

Man City’s Haaland suffers ankle injury, awaits tests

Erling Haaland picked up an ankle injury in Man City’s FA Cup win. He will see a specialist to asses

New E-Skin Enables Touchless Control and Robot-Like Sensation

Revolutionary e-skin mimics human touch, allowing touchless control, aiding robots, and helping peop

UAE to Launch Digital Dirham CBDC by Year-End for Secure, Efficient Payments

The UAE will introduce its Digital Dirham CBDC by year-end, enhancing security, transparency, and ef