Post by: Vansh Kumar

A Comprehensive Guide to Diversifying Your Stock Portfolio in 2025

Diversification is one of the most effective strategies to reduce risk and increase your chances of steady returns, especially as the financial landscape in 2025 continues to evolve. Whether you are a seasoned investor or new to the stock market, understanding how to diversify your portfolio effectively is key to safeguarding your wealth and achieving long-term financial success. In this article, we will explore smart strategies to diversify your stock portfolio in 2025, ensuring that you can mitigate risk while positioning yourself for growth in a constantly changing market.

Why Diversification Is Crucial for 2025

In 2025, the global economy is still recovering from various shocks, and market volatility remains a real concern. The key to mitigating this risk lies in diversification. By spreading your investments across different sectors, asset classes, and geographical regions, you can ensure that your portfolio doesn't suffer significant losses if one investment performs poorly. Diversification helps buffer against sudden market downturns and positions you for gains, even during uncertain economic conditions. A well-diversified portfolio will give you greater financial stability, even when the markets are unpredictable.

Understand the Different Types of Diversification

Effective diversification in 2025 goes beyond simply investing in a few stocks. It’s about strategically spreading your investments across various types of assets to create a balanced, risk-adjusted portfolio. Sector diversification is one of the first steps. By investing in different sectors such as technology, healthcare, finance, and consumer goods, you protect yourself from the risk associated with a downturn in any one sector. Additionally, geographical diversification is key. International markets often perform differently from the U.S. market, offering an opportunity to invest in countries with higher growth potential, especially in emerging markets. Asset class diversification is another crucial component; by incorporating bonds, real estate, or commodities like gold, you can balance out the volatility of stocks with more stable investments.

Invest in Exchange-Traded Funds (ETFs) and Index Funds

One of the most efficient ways to diversify your stock portfolio in 2025 is by investing in Exchange-Traded Funds (ETFs) and Index Funds. These investment vehicles are designed to track a broad market index or sector, offering automatic diversification within a single investment. For example, an S&P 500 index fund provides exposure to 500 different companies, spanning across various sectors like technology, healthcare, and energy. Similarly, ETFs focused on global markets or specific sectors allow you to spread your risk and gain exposure to industries that you may not have considered before. ETFs and index funds are particularly attractive in 2025 because they offer low management fees and help investors achieve diversification without the need for picking individual stocks.

Embrace Thematic Investing for Long-Term Growth

Thematic investing focuses on investing in trends or industries that are poised to grow significantly in the future. In 2025, sectors like artificial intelligence, electric vehicles, and renewable energy are gaining momentum, and investing in these thematic trends can help diversify your portfolio while positioning you for long-term growth. Thematic investments allow you to tap into emerging markets and cutting-edge industries. However, it is essential to balance thematic investing with traditional sectors to ensure that your portfolio doesn’t become overly concentrated in one area. By focusing on long-term trends, you can future-proof your portfolio and gain exposure to high-growth opportunities.

Dollar-Cost Averaging for Consistent Diversification

Another effective way to diversify your stock portfolio in 2025 is through dollar-cost averaging (DCA). This strategy involves investing a fixed amount of money at regular intervals, such as monthly or quarterly, regardless of market conditions. By sticking to this routine, you avoid the temptation to time the market or make large, risky investments at inopportune times. Over time, DCA helps spread your investment across different market cycles, ensuring that you’re not overly exposed to short-term volatility. This strategy also allows you to buy more shares when prices are lower and fewer when prices are higher, leading to a more balanced investment approach.

Regular Rebalancing to Maintain Diversification

As markets fluctuate and certain investments outperform others, your portfolio may become unbalanced. Regularly rebalancing your portfolio is essential to ensure that your diversification strategy remains intact. For instance, if one sector or asset class has performed exceptionally well, it may make up a larger portion of your portfolio than you intended. By selling off some of those investments and reinvesting in other underperforming areas, you can maintain the desired level of diversification. In 2025, it’s important to set a schedule for rebalancing your portfolio—whether it’s quarterly or annually—based on your long-term goals and changing market conditions. Rebalancing also allows you to avoid becoming overly reliant on any single asset or sector.

Dividend Stocks for Stability and Growth

While growth stocks are often the focus of many portfolios, dividend-paying stocks provide both stability and income. In 2025, incorporating dividend stocks into your diversified portfolio can help provide a steady income stream while also offering the potential for long-term capital appreciation. Companies with strong dividend histories tend to be well-established, financially stable, and less prone to volatility compared to growth stocks. By investing in a mix of dividend stocks from various sectors, you can create a more balanced portfolio that provides reliable income while still offering opportunities for growth.

Geographic Diversification to Reduce Country-Specific Risks

In 2025, global diversification remains a crucial strategy to minimize country-specific risks. The performance of the stock market in the United States is often tied to domestic economic conditions, but international markets can behave differently. By investing in international stocks or global funds, you can reduce exposure to risks specific to one country or region, such as political instability or economic slowdowns. Emerging markets, in particular, offer exciting growth opportunities and have the potential to outperform developed markets in the coming years. Including international stocks in your portfolio helps ensure that you're not overly dependent on the performance of any single country's economy.

Disclaimer

The information provided in this article is for general informational purposes only. While we strive to ensure the accuracy of the content, DXB News Network makes no representations or warranties regarding the completeness, reliability, or accuracy of the information. Any action you take based on the information presented is strictly at your own risk. DXB News Network will not be liable for any losses or damages arising from the use of this content. Always conduct your own research or consult with a professional before making any financial, investment, or business decisions.

#trending #latest #StockMarketDiversification #InvestmentStrategies2025 #PortfolioManagement #FinancialPlanning #SmartInvesting #RiskManagement #AssetAllocation #WealthBuilding #FinancialFreedom #InvestmentTips #breakingnews #worldnews #headlines #topstories #globalUpdate #dxbnewsnetwork #dxbnews #dxbdnn #dxbnewsnetworkdnn #bestnewschanneldubai #bestnewschannelUAE #bestnewschannelabudhabi #bestnewschannelajman #bestnewschannelofdubai #popularnewschanneldubai

Ananya Panday stuns in a deep-hued baingani saree by Punit Balana at the Kesari 2 premiere, paired with a modern blouse and bold accessories...Read More.

Instagram’s Blend lets you share a personalised Reels feed with friends. Invite-only feature boosts interaction and brings fresh content to your DMs....Read More.

FSU Shooting: Police Officer's Son Kills 2, Injures 6 in Attack

A shooting at Florida State University leaves two dead and six injured. The suspect, Phoenix Ikner,

Khaled bin Mohamed Opens teamLab Phenomena in Saadiyat District

A stunning new art space just opened in Abu Dhabi! Explore light, sound & motion in teamLab Phenomen

Saudi Defense Minister Visits Tehran Ahead of Iran-US Talks

Saudi Minister Prince Khalid arrives in Tehran ahead of Iran-US nuclear talks.

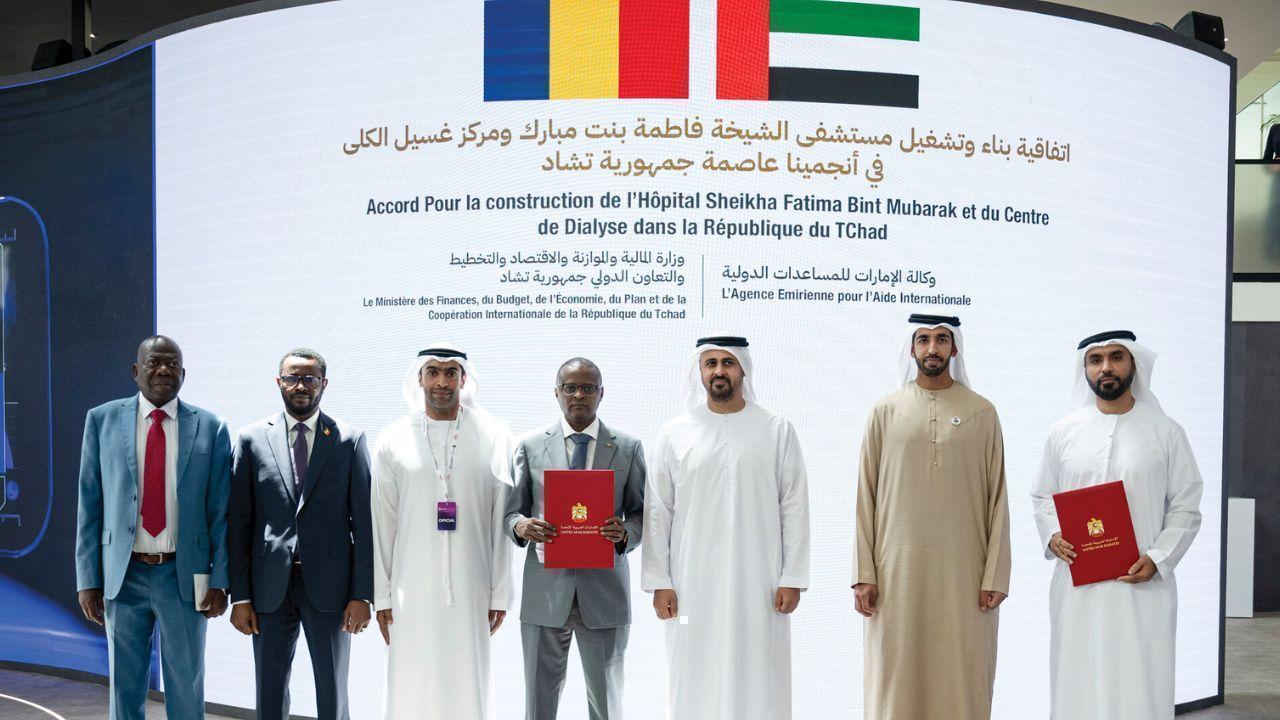

UAE, Chad Sign Agreement for Sheikha Fatima Bint Mubarak Hospital in N'Djamena

UAE and Chad sign an agreement to build the Sheikha Fatima bint Mubarak Hospital and dialysis centre

DoH Abu Dhabi signs 5 key healthcare deals with Russia

DoH Abu Dhabi joins hands with top Russian health bodies to boost research, trials, and education du