When it comes to securing your financial future, planning for retirement is one of the most important steps you can take. Many people wait until their 40s or 50s to start thinking about retirement, but the earlier you begin, the better off you’ll be. Retirement planning made easy isn’t about putting aside large sums of money all at once—it’s about starting early, making small adjustments, and taking strategic steps that can lead to financial security later in life. Here’s how you can plan for retirement effectively, starting today.

Starting your retirement planning early can make all the difference in ensuring you have enough money to live comfortably once you stop working. The main advantage of beginning early is the power of compound interest. When you start saving and investing at a young age, your money has a longer time to grow, and you benefit from earning interest on both your contributions and the interest that accumulates over time. This can result in exponential growth, giving you a much larger nest egg when it’s time to retire. The earlier you start, the less pressure you’ll feel to save larger amounts later in life. On the other hand, delaying your retirement savings could mean that you’ll need to save significantly more each month to reach your goals.

One of the most important aspects of retirement planning made easy is setting clear, achievable goals. Without a goal in mind, it can be difficult to know how much to save or what steps to take. The first step in goal-setting is defining what you want your retirement to look like. Do you envision a quiet life in a cozy home, or do you plan on traveling and living in multiple countries? Understanding what you want to achieve during retirement will help you determine how much money you’ll need. For example, if you plan to travel extensively, you’ll likely need a larger retirement fund than someone who plans to live simply. Once you have a clear picture of your retirement goals, you can begin estimating how much you’ll need to save and how much you should contribute each year.

Another essential element of retirement planning made easy is utilizing retirement accounts. These accounts offer valuable tax benefits that can help your savings grow faster. The two most common retirement accounts are the 401(k) and the IRA. A 401(k) plan, often provided by employers, allows employees to contribute a portion of their paycheck to retirement savings, with many employers offering matching contributions. This is essentially free money, which can greatly accelerate your savings. An IRA, or Individual Retirement Account, allows you to contribute a set amount each year. With a traditional IRA, contributions are tax-deductible, while a Roth IRA allows your investments to grow tax-free, as long as you meet certain criteria. Regardless of which retirement account you choose, consistently contributing to it can make a huge difference over time.

An important strategy for retirement planning made easy is diversifying your investments. This means spreading your money across different types of assets, such as stocks, bonds, and real estate, to reduce risk and maximize potential returns. While stocks may offer high returns, they also come with a greater degree of risk, while bonds provide more stability and lower returns. By having a mix of both in your portfolio, you can balance risk and reward. In addition to stocks and bonds, real estate can also be a valuable part of a diversified retirement portfolio. Rental properties, for example, can generate steady income and appreciate over time. Mutual funds and exchange-traded funds (ETFs) are also great ways to diversify your investments, as they provide exposure to a wide range of assets with a single investment. It’s important to assess your risk tolerance when diversifying, ensuring that your portfolio aligns with your retirement goals and comfort level.

An essential part of retirement planning made easy is living within your means and managing your debt. If you’re able to save a portion of your income and invest it for retirement, you’ll be much better prepared for the future. However, to maximize your savings potential, it’s crucial to reduce high-interest debt, such as credit card balances, as quickly as possible. Once high-interest debt is eliminated, you’ll have more money to contribute to your retirement accounts. Creating a budget can help you track your income and expenses, ensuring that you’re saving enough each month. Additionally, cutting unnecessary expenses, such as subscription services you don’t use, can free up more money for saving. The less debt you have, the more you’ll be able to focus on growing your retirement fund.

Even after you’ve established your retirement plan, it’s important to regularly evaluate your progress. Life circumstances can change, and your goals may evolve as well. As such, it’s important to review your retirement plan on a regular basis to ensure that you’re on track. For example, if your income increases or your living expenses change, you might want to adjust your savings rate accordingly. Likewise, if you experience a major life event, such as buying a home or starting a family, you may need to adjust your retirement goals to reflect new priorities. Regularly reviewing your investments and making changes to your portfolio will also help you stay aligned with your retirement objectives.

The article "Retirement Planning Made Easy: How to Secure Your Future Early" offers practical strategies to help individuals secure a financially stable retirement. Starting early is emphasized as the key to benefiting from compound interest, which leads to substantial growth over time. The article covers setting realistic retirement goals, utilizing retirement accounts like 401(k)s and IRAs, diversifying investments to balance risk, and budgeting effectively to reduce debt. Regularly reviewing and adjusting your plan is also vital to stay on track for achieving retirement success. By implementing these strategies, individuals can ensure a more comfortable, stress-free retirement.

This article is published by DXB News Network for informational purposes only. The content is not intended as a substitute for professional financial advice, investment strategies, or retirement planning. Readers are encouraged to consult with a certified financial advisor to tailor retirement plans to their individual needs. DXB News Network does not take responsibility for any actions or decisions based on the information provided.

#trending #latest #RetirementPlanning #SecureYourFuture #FinancialFreedom #EarlyPlanning #RetirementGoals #FinancialSecurity #Investing #WealthBuilding #FutureReady #SmartMoney #breakingnews #worldnews #headlines #topstories #globalUpdate #dxbnewsnetwork #dxbnews #dxbdnn #dxbnewsnetworkdnn #bestnewschanneldubai #bestnewschannelUAE #bestnewschannelabudhabi #bestnewschannelajman #bestnewschannelofdubai #popularnewschanneldubai

Learn How Teachers Shape the Future Generation and Impact Society...Read More.

A January poll found 56% of Greenlanders support independence from Denmark...Read More.

IND vs NZ Playing 11: Latest Updates on Complete XI for Champions Trophy Final

IND vs NZ Playing 11: Latest Updates on Complete XI for Champions Trophy Final

With a sluggish pitch, India may opt for four spinners and two pacers, including Hardik

Katrina Kaif is Barbie, Vicky Kaushal is Ken at friend's wedding reception

Katrina Kaif is Barbie, Vicky Kaushal is Ken at friend's wedding reception

Katrina Kaif and Vicky Kaushal spotted leaving together after attending Mumbai wedding

UAE stocks drop amid uncertainty over tariffs and market concerns

UAE stocks drop amid uncertainty over tariffs and market concerns

UAE stocks fell Friday as U.S. tariff uncertainty hit global markets, dragging equities

Cavaliers Rally Past Hornets 118-117 for 13th Straight Victory

Cavaliers Rally Past Hornets 118-117 for 13th Straight Victory

Donovan Mitchell scores 24 as NBA-leading Cavaliers rally past Hornets 118-117 for 13th win

Doncic and James Lead Lakers to 113-109 OT Win Over Knicks

Doncic and James Lead Lakers to 113-109 OT Win Over Knicks

Luka Doncic scored 32 points, LeBron James added 31, and the Los Angeles Lakers won their eighth str

The Role of Teachers in Shaping the Future Generation

Learn How Teachers Shape the Future Generation and Impact Society

Greenland's Path to Independence: Key Steps and Challenges Explained

A January poll found 56% of Greenlanders support independence from Denmark

France considers welcoming researchers fleeing the US

Trump cuts funding for vital research, dismissing experts in health and climate

Why Investing in Stocks Can Lead to Financial Success

Understand How Investing in Stocks can Bring Long-term Financial Growth

Saudi Arabia arrests 20,749 for residency, labor violations; deports 10,000+

Saudi Arabia arrests 20,749 in a crackdown on residency, labor, and border violations

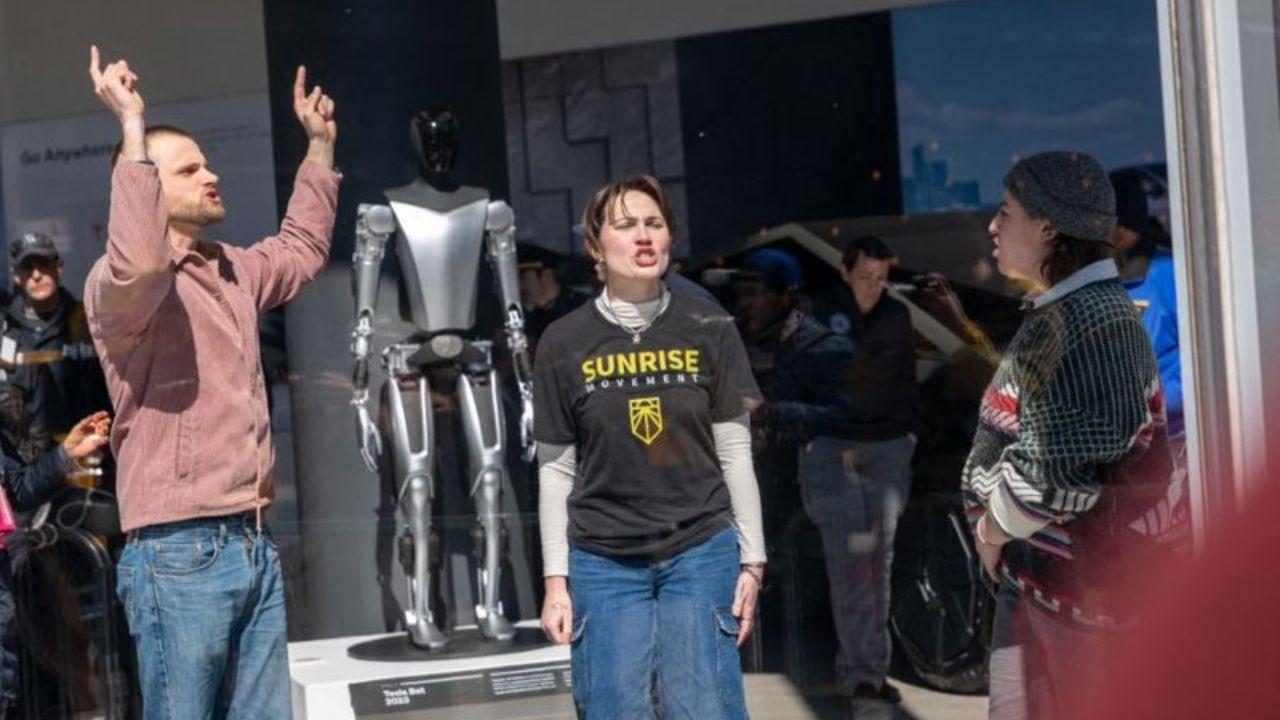

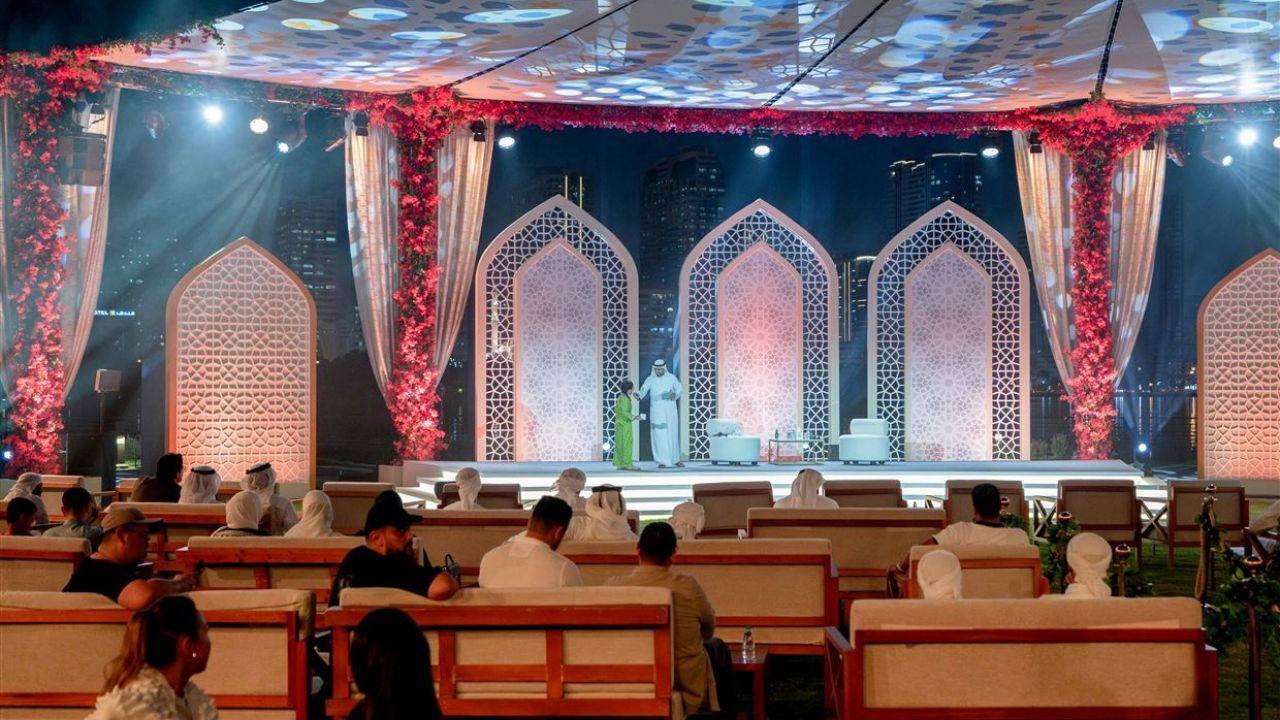

SPC 14th Ramadan Majlis to Begin Tomorrow in Aljada

SPC's 14th Ramadan Majlis begins tomorrow in Aljada, Sharjah, running until March 17

4 Labourers Suffocate to Death While Cleaning Water Tank in Mumbai

The incident occurred at Bismillah Space, Dimtimkar Road, Nagpada, around 12:30 PM

Pope Francis has a calm night as his condition improves, says Vatican

Head of Catholic Church faced respiratory crises since hospital admission weeks ago

Chinese Man Pricked by Needle on Flight Suffers Depression, Seeks Compensation

A Chinese man demanded compensation after a needle prick on a flight caused depression

3001E, 30 Floor, Aspin Commercial Tower, Sheikh Zayed Road, Dubai, UAE

+971 52 602 2429

info@dxbnewsnetwork.com

© DNN. All Rights Reserved.