Post by: Raman Preet

Photo : AFP

Investors are currently keeping a close eye on the awaited US jobless claims data, slated for release later today. This data is expected to offer crucial insights into the vigor of the labor market. Concurrently, the Indian rupee has experienced a modest uptick on Thursday, bolstered by potential dollar inflows. This positive movement contrasts with a general decline observed in most Asian currencies, attributed in part to a surge in US bond yields.

As of 10:15 AM, the South Asian currency stands at 83.49 against the US dollar (equivalent to 22.75 against the UAE dirham), a slight improvement from its previous close at 83.5175 (22.76). Amidst these fluctuations, the dollar index holds steady at 105.5, while several Asian currencies, notably the Korean won, have dipped, with a 0.3 percent decline leading the losses. This trend coincides with a rise in the 10-year US Treasury yield, surpassing 4.5 percent during Asian trading hours following a modest increase on Wednesday.

Stay informed with the latest news. Follow DXB News Network on WhatsApp Channel

Commenting on the currency movement, a trader at a foreign bank noted, "It seems like there are some mild inflows but given sufficient (dollar) buying interest at these levels, don't think we see a rise above 83.40." The Indian rupee has largely oscillated between the 83.40 and 83.50 marks throughout the week, driven by dollar demand from importers, particularly local oil companies. Additionally, anticipation of central bank intervention has restrained traders from pushing the rupee towards its record low.

On April 19, the currency had reached an all-time low of 83.5750. Amit Pabari, managing director at FX advisory firm CR Forex, emphasized, "India's economic fundamentals and substantial foreign exchange reserves serve as a safety net, empowering the RBI (Reserve Bank of India) to counter downward pressure on the rupee."

In parallel developments, Susan Collins, president of the Federal Reserve Bank of Boston, remarked on Wednesday regarding the recent surge in economic activity data and heightened inflation levels. She suggested that maintaining the current policy level may be necessary until there is greater confidence in inflation sustainably moving towards the targeted 2 percent.

With anticipation building, investors are eagerly awaiting the US jobless claims data release, expected later today. This data follows last week's revelation of fewer-than-expected job additions in April, underscoring the significance of the upcoming report in gauging labor market strength.

#trending #latest #CurrencyMarket #AsianEconomy #USJoblessClaims #LaborMarket #IndianRupee #USDollar #UAE #ForexTrading #FederalReserve #EconomicData #Inflation #FXMarket #CentralBank #RBI #FinancialNews #dnn #breakingnews #worldnews #headlines #topstories #globalUpdate #dxbnewsnetwork #dxbnews #dxbdnn #dxbnewsnetworkdnn

New Zealand posted 264-8 in rain-shortened third ODI. Pakistan needs 265 runs to win after Akif Javed’s 4 wickets. Can they salvage pride....Read More.

UK police charge comedian Russell Brand with rape and assault over multiple allegations from 1999 to 2005. Investigation is ongoing....Read More.

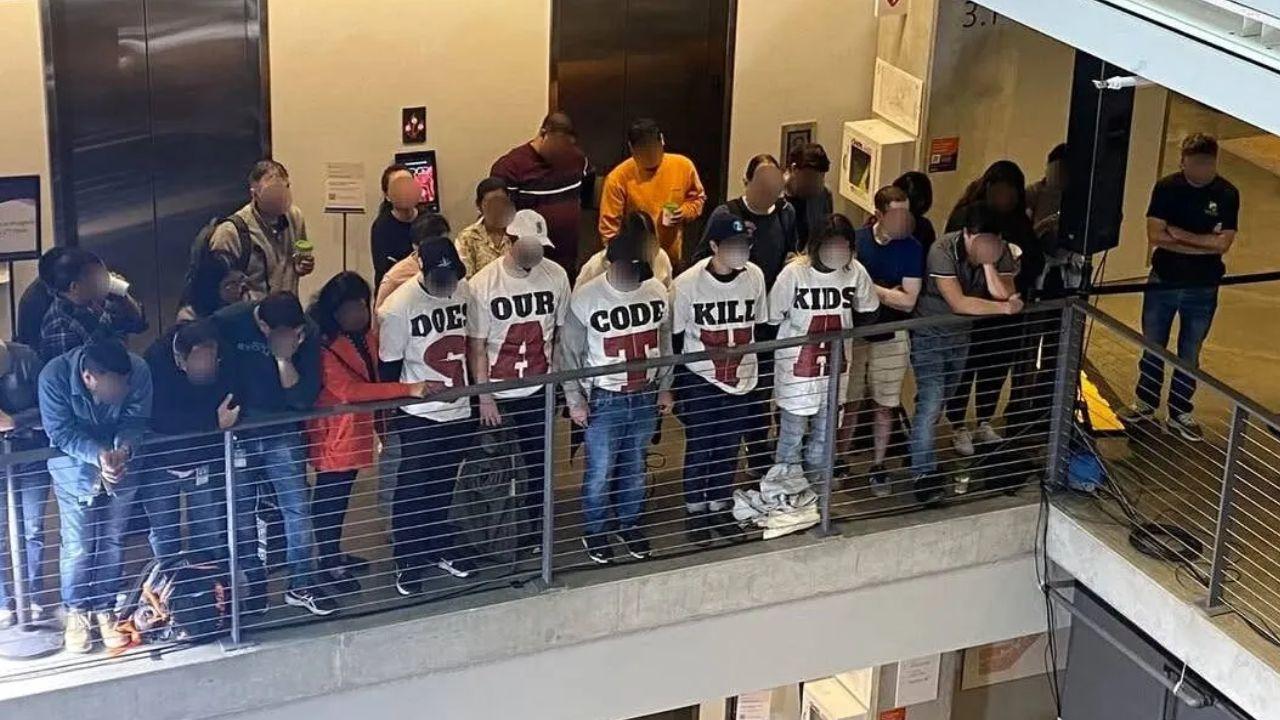

Microsoft Employees Protest Over Israel Military Contract

Microsoft employees protest at the company’s 50th anniversary over its AI contracts with Israel, lea

Supreme Court Halts Deforestation in Kancha Gachibowli

SC stops Telangana from cutting trees near UoH after protests and shocking reports on alarming defor

Avatar 3 to unveil new enemies on Pandora in Fire and Ash chapter

James Cameron reveals Avatar: Fire and Ash brings new enemies, the Ash people, and peaceful wind tra

Dubai Introduces New Variable Parking Fees from Thursday

Dubai’s new parking fees start Thursday, with premium spots in busy areas costing AED 6 per hour dur

Chelsea Edge Spurs 1-0 as Enzo Fernandez Secures Win

Enzo Fernandez’s header sealed Chelsea’s 1-0 win over Spurs, pushing them back into the top four. VA