Post by : Sam Jeet Rahman

Middle-class families are often the most financially disciplined. They budget carefully, save regularly, avoid unnecessary risks, and plan for long-term goals like education, home ownership, and retirement. Yet, when major economic shifts occur—such as inflation spikes, recessions, job market slowdowns, or interest rate changes—it is the middle class that feels the maximum financial strain.

This is not because middle-class families are careless with money. It is because traditional financial planning models are not built to handle rapid economic change. This article explains, in a clear and practical way, why middle-class financial plans break down during economic shifts and what structural gaps make them vulnerable.

Most middle-class financial plans are built around predictability.

Middle-class households typically rely on:

One or two stable salaries

Predictable monthly income

Annual increments rather than rapid income growth

When the economy shifts, income does not adjust quickly, but expenses do.

A large portion of income is locked into:

Home loans or rent

School or college fees

Insurance premiums

EMIs and long-term commitments

These expenses cannot be easily reduced when conditions change.

This rigidity leaves very little room to absorb financial shocks.

One of the biggest weaknesses in middle-class planning is the assumption that stability will continue.

Job security will remain intact

Salaries will grow consistently

Inflation will stay moderate

Expenses will increase gradually

Economic shifts break these assumptions suddenly, not gradually.

When stability disappears, plans built on it collapse.

Most middle-class families do have emergency funds, but they are often insufficient for modern economic realities.

Based on outdated cost estimates

Cover only 2–3 months of expenses

Not adjusted for inflation

Ignored after initial setup

During economic downturns, job searches take longer and costs remain high, making small emergency funds ineffective.

Middle-class families are taught that safety equals security.

Excess savings in low-return instruments

Returns fail to beat inflation

Long-term purchasing power declines

Real wealth growth stagnates

When inflation rises, conservative savings silently lose value, weakening future plans.

Debt is often used as a tool for progress.

Home loans

Vehicle loans

Education loans

Personal loans for lifestyle needs

During economic shifts:

Interest rates may rise

EMIs consume larger income portions

Cash flow becomes strained

Debt reduces flexibility at the exact moment flexibility is most needed.

Most middle-class plans are product-driven.

Buy insurance

Open fixed deposits

Invest in mutual funds

Take loans

What gets ignored is monthly cash flow resilience.

When income reduces or expenses rise, the plan looks good on paper but fails in real life.

Inflation does not create panic immediately, which makes it dangerous.

Education costs rise faster than income

Healthcare expenses escalate sharply

Household budgets stretch silently

Retirement goals become underfunded

Middle-class plans often assume long-term averages, not real-time inflation pressure.

Most middle-class families rely on one primary income source.

Job loss affects entire household

Business slowdown impacts savings

Salary growth lags inflation

Without alternative income streams, any economic disruption directly hits lifestyle and savings.

Middle-class families often delay action.

Postponing budget reviews

Ignoring rising expenses

Avoiding difficult financial conversations

Waiting for “things to normalize”

Economic shifts punish delay. Early adjustments preserve control; late reactions force compromise.

Middle-class lifestyles are carefully built over years.

Fixed standards of living

Social pressure to maintain appearances

Emotional resistance to downsizing

When income pressure increases, emotional attachment delays necessary financial correction.

Retirement plans often assume:

Stable employment till retirement

Moderate healthcare costs

Predictable market growth

Economic shifts increase:

Healthcare inflation

Career instability

Longevity risks

This makes traditional retirement projections unrealistic.

Middle-class families rely heavily on generic advice.

Does not account for personal risk capacity

Ignores cash flow realities

Focuses on averages, not volatility

During economic shifts, averages become irrelevant.

Economic uncertainty increases anxiety.

Panic selling investments

Avoiding necessary changes

Short-term thinking

Fear-based decisions

Stress reduces clarity at the exact moment strategic thinking is needed.

The biggest reason middle-class financial plans fail is the lack of flexibility.

Adjustable expenses

Liquid savings

Multiple income sources

Scalable investments

Realistic buffers

Without flexibility, even disciplined plans break under pressure.

Strong cash flow absorbs shocks better than high paper wealth.

Target at least 6 months of essential expenses, adjusted annually.

Avoid extreme conservatism that erodes purchasing power.

Lower fixed commitments increase adaptability.

Even small alternative income sources add resilience.

Economic conditions change faster than long-term assumptions.

The wealthy have buffers. The poor adapt through necessity. The middle class sits in between—exposed, structured, and rigid. Without redesigning financial plans for volatility, middle-class households remain vulnerable despite discipline and effort.

Middle-class financial failure during economic shifts is not caused by lack of effort—it is caused by outdated planning frameworks. The future belongs to those who plan for uncertainty, not stability.

Financial strength today is not about perfection. It is about adaptability, awareness, and continuous adjustment.

This article is intended for general informational and educational purposes only and does not constitute financial, legal, or investment advice. Financial outcomes depend on individual income, expenses, market conditions, and personal circumstances. Readers should consult a qualified financial advisor before making significant financial decisions or restructuring long-term plans.

Predictheon Wins WHX Xcelerate Innovation Champion 2026

Predictheon won WHX 2026 Xcelerate, earning US$12,000, WHX 2027 space and global exposure for its AI

Omantel Launches Otech to Drive Oman’s Future Tech Vision

Omantel launches Otech to accelerate Oman’s digital transformation, strengthen data sovereignty, exp

Daimler Truck MEA Honors Top Distributors at EliteClass 2025

Daimler Truck MEA hosted EliteClass Awards 2025 in Dubai, honoring top distributors across 19 catego

King Mohammed VI Launches Safran Landing Gear Plant in Morocco

Morocco strengthens its aerospace leadership as King Mohammed VI launches Safran’s €280M landing gea

Qatar Emir Sheikh Tamim Arrives in UAE on Fraternal Visit

Qatar’s Emir Sheikh Tamim bin Hamad Al Thani arrived in Abu Dhabi on Saturday. UAE President Sheikh

Shaidorov Wins Stunning Olympic Gold as Malinin Falters

Kazakhstan’s Mikhail Shaidorov won men’s figure skating gold after US star Ilia Malinin fell twice.

Shakira’s 5-Show El Salvador Residency Boosts Bukele Image

Shakira’s five sold-out concerts in San Salvador highlight El Salvador’s security shift under Bukele

Why Drinking Soaked Chia Seeds Water With Lemon and Honey Before Breakfast Matters

Drinking soaked chia seeds water with lemon and honey before breakfast may support digestion hydrati

Morning Walk vs Evening Walk: Which Helps You Lose More Weight?

Morning or evening walk Learn how both help with weight loss and which walking time suits your body

What Really Happens When You Drink Lemon Turmeric Water Daily

Discover what happens to your body when you drink lemon turmeric water daily including digestion imm

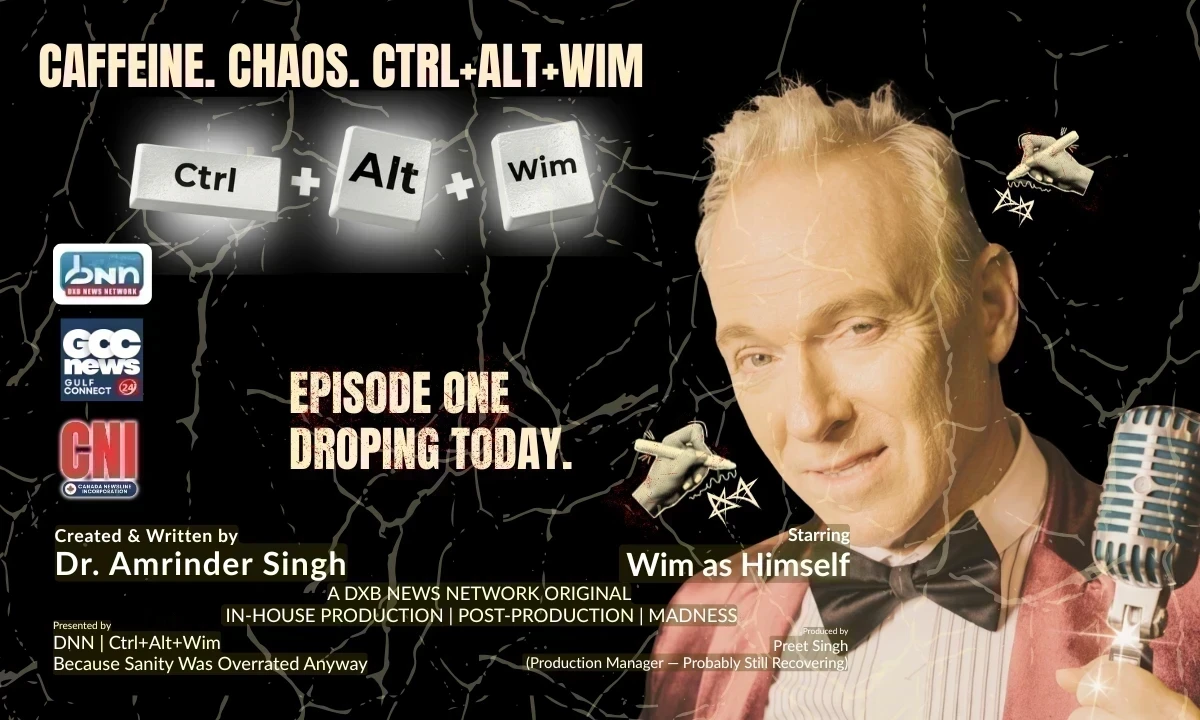

DXB News Network Presents “Ctrl+Alt+Wim”, A Bold New Satirical Series Starring Global Entertainer Wim Hoste

DXB News Network premieres Ctrl+Alt+Wim, a bold new satirical micro‑series starring global entertain

High Heart Rate? 10 Common Causes and 10 Natural Ways to Lower It

Learn why heart rate rises and how to lower it naturally with simple habits healthy food calm routin

10 Simple Natural Remedies That Bring Out Your Skin’s Natural Glow

Discover simple natural remedies for glowing skin Easy daily habits clean care and healthy living ti

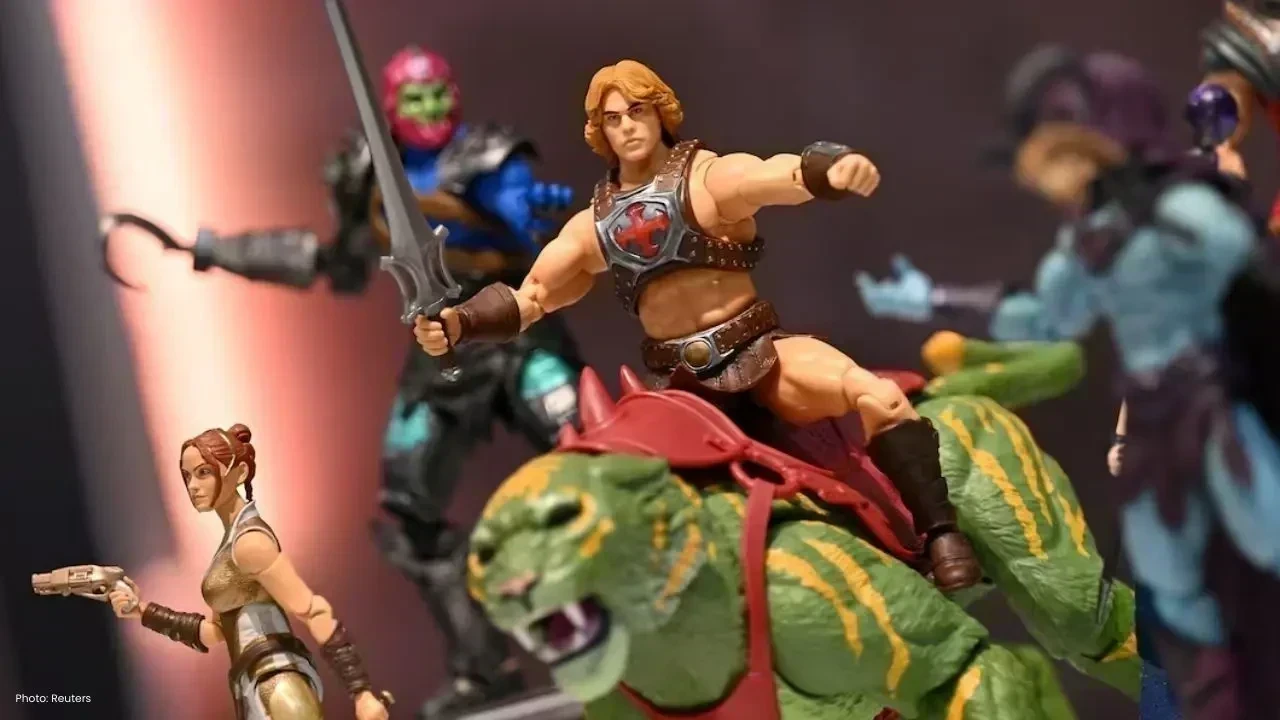

Mattel Revamps Masters of the Universe Action Figures for Upcoming Film

Mattel is set to revive Masters of the Universe action figures in sync with their new movie, ignitin

China Executes 11 Members of Infamous Ming Family Behind Myanmar Scam Operations

China has executed 11 Ming family members, linked to extensive scams and gambling in Myanmar, causin