Post by : Anis Karim

Vodafone Idea, also referred to as Vi, has become a focal point for investors and traders alike. The stock experiences intensive movements that are often swayed by emotional reactions and headlines. While some retail investors see it as a high-risk opportunity, for others, it serves as a reminder of the unpredictability inherent in India’s telecom market.

Despite being among the top telecom operators in India, Vodafone Idea has been navigating through financial turbulence. Its stock price reflects a kaleidoscope of survival hopes, anticipated government support, along with deep-rooted concerns regarding its debt and profitability.

Recent trading sessions indicate that Vodafone Idea shares have been prone to volatility, with sharp gains typically followed by quick downturns, revealing speculative trading behavior. Developments around fundraising or regulatory updates often incite immediate market reactions.

Such fluctuations show that the stock’s current performance is driven more by market sentiment than by fundamental analysis. While traders are quick to act on momentum, long-term shareholders remain cautious of the uncertainties involved.

In the broader perspective, Vodafone Idea’s stock has struggled to maintain positive growth. Although there have been brief upticks, they are frequently disrupted by worries surrounding cash flow, debt obligations, and stiff competition from more robust players.

Operating in one of the most competitive telecom arenas, Vodafone Idea faces daunting challenges. Aggressive pricing strategies, hefty capital outlays, and ongoing technological upgrades require substantial financial resources for survival.

Over the years, the company has lost significant market share due to fierce competition and its struggle to match the infrastructure investments of reliable rivals. This has had a detrimental effect on revenue generation and subscriber retention.

Despite serving millions, Vodafone Idea's average revenue per user continues to be squeezed. Price hikes have provided some temporary relief, but have not substantially bolstered the financial standing of the firm. Subscriber churn remains a persistent issue.

Vodafone Idea’s declining share performance is largely due to its enormous debt burden. The company is obligated to pay substantial amounts associated with spectrum fees, adjusted gross revenue, and loans from banks.

These heavy liabilities severely constrain financial maneuverability and restrict aggressive investment in technology upgrades and network expansion.

The high debt level raises valid concerns over the firm's long-term viability. Even promising indicators, such as potential funding initiatives, are often met with skepticism regarding their adequacy to tackle the scale of financial issues.

Government measures, including the conversion of outstanding dues into company shares, have been vital in stabilizing Vodafone Idea for the time being. These actions have alleviated immediate cash pressures and granted temporary relief.

Nevertheless, while these interventions assist in the short run, they do not resolve the core issues plaguing the company. The market is still engaged in discussions on the extent of government support required.

Announcements regarding telecom reforms, spectrum fees, or payment timelines significantly influence Vi’s share performance. Investors remain vigilant for governmental cues that hint at further supportive actions.

Vodafone Idea has consistently articulated its necessity for new capital to fortify its operations. News about potential equity investments or new strategic partners can stimulate interest in the stock.

However, delays or unclear execution can lead to market letdowns, resulting in sharp downturns.

Despite the generally positive outlook surrounding fundraising initiatives, the market is cautious about the company’s ability to secure the necessary capital without unfavorable dilution of existing shares.

Vodafone Idea is confronted by formidable competition from better-capitalized rivals, who consistently invest in network enhancements and innovative technologies. This competitive weakness hampers Vi’s ability to draw in premium customers.

While the recent price hikes across the sector provided some relief, Vodafone Idea's pricing options remain limited due to the pressing need to retain subscribers, which restricts the opportunity for aggressive rate increases.

Vodafone Idea continues its investments in extending its 4G networks, but resource limitations hamper progress. Additionally, the transition to 5G represents an even greater challenge owing to the significant capital outlay required.

Network reliability is pivotal for customer retention. Any lag in technological advancement can negatively impact the user experience, affecting subscriber turnover and overall revenue.

Vodafone Idea attracts a considerable number of retail investors, many of whom view it as a turnaround opportunity, culminating in high trading volumes during periods of news-driven excitement.

Institutional involvement remains hesitant, primarily due to concerns about the company's financial condition and long-term growth prospects. This contrast between retail fervor and institutional caution leads to pronounced market fluctuations.

From a technical outlook, shares of Vodafone Idea often demonstrate defined trading ranges. Breakouts or breakdowns tend to coincide with significant news events rather than evolving trends.

Technical indicators often showcase dramatic spikes in momentum following announcements, though sustaining such movements has proven challenging, reinforcing the stock's identity as sentiment-driven.

The company’s debt and liquidity issues represent significant risks. Negative developments can swiftly affect share prices.

A substantial portion of Vi's sustainability hinges on supportive regulatory frameworks. Fluctuations in policy can notably impact investor morale.

Future funding pursuits may necessitate equity dilution, potentially undermining the value of current holdings.

Securing significant funding could enhance investor confidence and facilitate network enhancements.

Sector-wide tariff increases leading to improved revenues could pave the way for a gradual recovery.

Clear and supportive telecommunications policies have the potential to minimize uncertainties and enhance long-term projections.

Traders can find volatility-driven opportunities in Vodafone Idea shares, but disciplined risk management is crucial due to potential abrupt changes.

Long-term investors should approach this stock cautiously, fully aware of the inherent risks involved, as it hasn’t emerged as a conventional growth or value investment.

Investing in such high-risk stocks should be limited, balanced with more fundamentally solid options in one’s portfolio.

Vodafone Idea’s ongoing challenges highlight the capital-intensive requirements of the telecom industry, emphasizing the necessity for sustainable pricing strategies, stable policies, and diligent financial management to achieve long-term viability.

The firm’s ongoing journey exemplifies how governmental regulations and market dynamics can fundamentally alter entire industries.

Vodafone Idea’s stock price embodies a narrative of resilience in challenging circumstances. While the prospect of recovery maintains investor interest, the weight of financial difficulties and market competition looms large. The stock’s future hinges on timely funding, supportive policies, and the firm’s capability to stabilize its operations.

Currently, Vi stands as a high-stakes investment, exhibiting rapid fluctuations but necessitating careful evaluation. Investors should consider the balance between hope and reality before participating.

Disclaimer:

This article serves informational purposes and does not constitute investment advice. Stock market investments carry risks, and readers should seek guidance from a qualified financial advisor prior to making any decisions.

Predictheon Wins WHX Xcelerate Innovation Champion 2026

Predictheon won WHX 2026 Xcelerate, earning US$12,000, WHX 2027 space and global exposure for its AI

Omantel Launches Otech to Drive Oman’s Future Tech Vision

Omantel launches Otech to accelerate Oman’s digital transformation, strengthen data sovereignty, exp

Daimler Truck MEA Honors Top Distributors at EliteClass 2025

Daimler Truck MEA hosted EliteClass Awards 2025 in Dubai, honoring top distributors across 19 catego

King Mohammed VI Launches Safran Landing Gear Plant in Morocco

Morocco strengthens its aerospace leadership as King Mohammed VI launches Safran’s €280M landing gea

Qatar Emir Sheikh Tamim Arrives in UAE on Fraternal Visit

Qatar’s Emir Sheikh Tamim bin Hamad Al Thani arrived in Abu Dhabi on Saturday. UAE President Sheikh

Shaidorov Wins Stunning Olympic Gold as Malinin Falters

Kazakhstan’s Mikhail Shaidorov won men’s figure skating gold after US star Ilia Malinin fell twice.

Shakira’s 5-Show El Salvador Residency Boosts Bukele Image

Shakira’s five sold-out concerts in San Salvador highlight El Salvador’s security shift under Bukele

Why Drinking Soaked Chia Seeds Water With Lemon and Honey Before Breakfast Matters

Drinking soaked chia seeds water with lemon and honey before breakfast may support digestion hydrati

Morning Walk vs Evening Walk: Which Helps You Lose More Weight?

Morning or evening walk Learn how both help with weight loss and which walking time suits your body

What Really Happens When You Drink Lemon Turmeric Water Daily

Discover what happens to your body when you drink lemon turmeric water daily including digestion imm

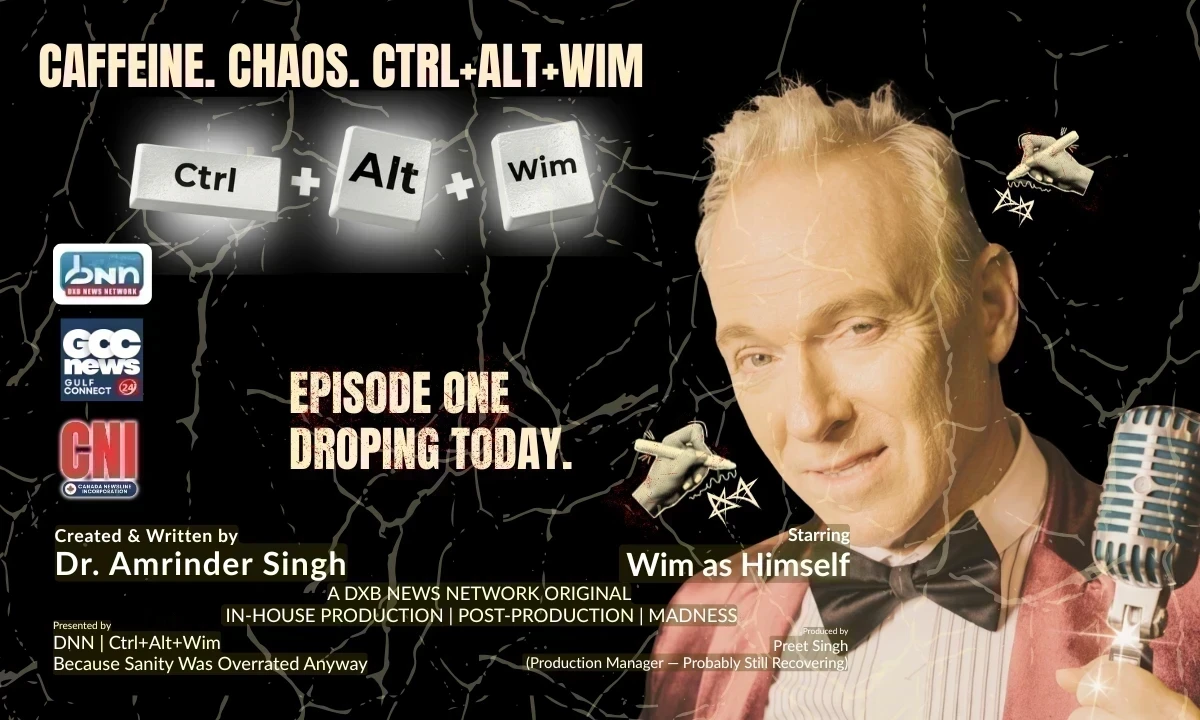

DXB News Network Presents “Ctrl+Alt+Wim”, A Bold New Satirical Series Starring Global Entertainer Wim Hoste

DXB News Network premieres Ctrl+Alt+Wim, a bold new satirical micro‑series starring global entertain

High Heart Rate? 10 Common Causes and 10 Natural Ways to Lower It

Learn why heart rate rises and how to lower it naturally with simple habits healthy food calm routin

10 Simple Natural Remedies That Bring Out Your Skin’s Natural Glow

Discover simple natural remedies for glowing skin Easy daily habits clean care and healthy living ti

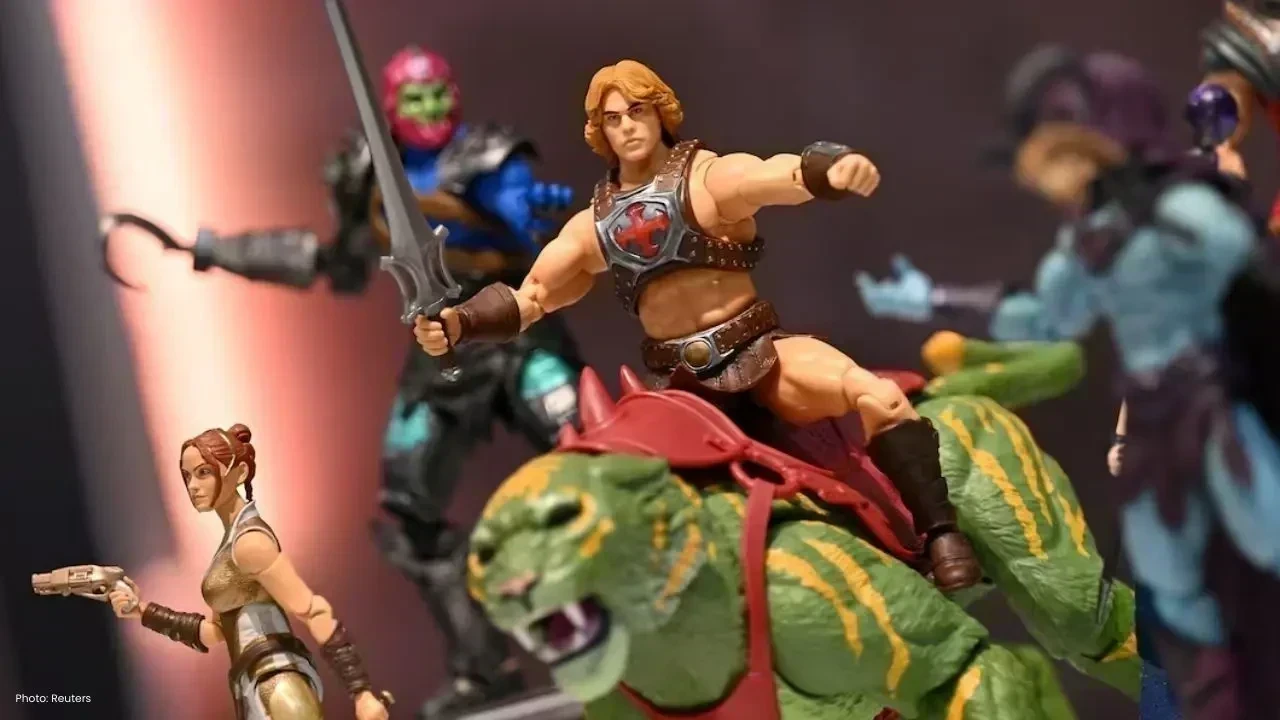

Mattel Revamps Masters of the Universe Action Figures for Upcoming Film

Mattel is set to revive Masters of the Universe action figures in sync with their new movie, ignitin

China Executes 11 Members of Infamous Ming Family Behind Myanmar Scam Operations

China has executed 11 Ming family members, linked to extensive scams and gambling in Myanmar, causin