Post by: Vansh Kumar

In today's fast-paced world, mastering the art of budgeting is crucial for achieving financial stability and reaching your long-term goals. Whether you’re looking to save for a vacation, buy a home, or prepare for retirement, effective budgeting lays the foundation for smart financial planning. This comprehensive guide will explore essential techniques to help you create a budget that works for you, ensuring you stay on track and achieve your financial aspirations.

Budgeting is more than just tracking expenses; it’s about understanding where your money goes and making informed decisions that align with your financial goals. By creating a budget, you can identify spending habits, prioritize needs versus wants, and ultimately gain control over your finances. This process can also reduce financial stress, allowing you to feel more secure and confident in your financial situation. When you have a well-structured budget in place, you can navigate unexpected expenses with ease, which can significantly enhance your overall quality of life.

The first step in mastering the art of budgeting is to set clear, achievable financial goals. Start by defining what you want to accomplish in the short term (within a year) and long term (five years or more). Short-term goals might include saving for a vacation or paying off credit card debt, while long-term goals could involve buying a house or saving for retirement. By outlining your objectives, you can tailor your budget to meet these specific needs, which will serve as a roadmap for your financial journey.

To create an effective budget, you need to have a clear picture of your income and expenses. Begin by listing all sources of income, including salaries, side hustles, and any passive income streams. Then, track your monthly expenses by reviewing bank statements, credit card statements, and receipts. It’s essential to categorize your expenses into fixed costs (like rent and utilities) and variable costs (like groceries and entertainment). This categorization will help you identify areas where you can cut back and allocate more towards your savings or investments. Understanding your spending patterns is the key to making informed financial decisions.

Once you have a grasp on your income and expenses, it’s time to choose a budgeting method that suits your lifestyle. One popular approach is zero-based budgeting, which involves assigning every dollar of your income to a specific category, ensuring that your income minus your expenses equals zero. This approach encourages mindful spending and helps you prioritize your financial goals. Alternatively, the 50/30/20 rule divides your after-tax income into three categories: 50% for needs (essentials), 30% for wants (discretionary spending), and 20% for savings and debt repayment. This method provides a clear framework for managing your money while still allowing for some flexibility. Another effective technique is the envelope system, which allocates cash for specific spending categories. Once the cash in a particular envelope is gone, you can no longer spend in that category until the next budgeting period, helping curb overspending and encourage discipline.

Your budget is not set in stone. Life circumstances and financial goals change, so it's important to review and adjust your budget regularly. Set aside time each month to assess your spending, savings, and progress towards your financial goals. If you notice you’re consistently overspending in one area, consider making adjustments to either your budget or your spending habits. Flexibility is key to effective budgeting. Adapting your budget to reflect your current situation and financial objectives will help you stay motivated and on track.

In the digital age, numerous budgeting tools and apps can simplify the process and enhance your financial planning efforts. Applications like Mint, YNAB (You Need A Budget), and PocketGuard allow you to track your expenses, set goals, and receive alerts when you're approaching your budget limits. These tools provide real-time insights into your spending habits and help you stay accountable to your financial goals. Embracing technology can make budgeting more accessible and enjoyable, empowering you to take control of your financial future.

An essential aspect of budgeting is preparing for the unexpected. An emergency fund acts as a financial safety net, helping you cover unplanned expenses such as medical emergencies, car repairs, or job loss. Aim to save three to six months’ worth of living expenses in a separate savings account. This cushion will give you peace of mind and prevent you from derailing your budget during unforeseen circumstances. Knowing that you have funds available for emergencies can significantly reduce stress and enhance your overall financial well-being.

Budgeting can sometimes feel overwhelming, but staying motivated is crucial for long-term success. Celebrate your milestones, no matter how small. Whether it’s paying off a credit card or reaching a savings goal, acknowledging your achievements can boost your morale and encourage you to keep pushing towards your financial objectives. Consider visualizing your goals through charts or graphs to track your progress and stay inspired. Surrounding yourself with a supportive community or sharing your goals with friends can also help keep you accountable and motivated on your budgeting journey.

In the article, The Art of Budgeting: Essential Techniques for Smart Financial Planning, we learn about the important steps for making a good budget. First, we find out that budgeting helps us understand where our money goes, which is a key part of smart financial planning. Setting clear goals is a big step in the art of budgeting, as it guides us in what we want to save for or pay off. Next, tracking our income and expenses helps us see how much we earn and spend each month. Choosing the right budgeting method is also essential; some methods help us spend wisely and save more. Adjusting our budget regularly ensures it fits our needs and changes. Using technology can make budgeting easier, and saving for emergencies is smart for any financial plan. Staying motivated and celebrating our successes is also a fun way to keep budgeting exciting. By learning about the art of budgeting, we can become better at smart financial planning.

The information provided in this article about the art of budgeting and essential techniques for smart financial planning is for educational purposes only. Readers are encouraged to seek personalized advice from financial professionals to tailor financial strategies to their unique situations.

Budgeting, Smart Financial Planning, Financial Goals, Income Tracking, Expense Tracking, Budgeting Methods, Zero-Based Budgeting, 50/30/20 Rule, Envelope System, Emergency Fund, Financial Stability, Spending Habits, Financial Management, Savings Goals, Budget Review, Technology for Budgeting, Financial Literacy, Personal Finance, Debt Management, Financial Awareness

#trending #latest #Budgeting, #SmartFinancialPlanning, #FinancialGoals, #IncomeTracking, #ExpenseTracking, #BudgetingMethods, #ZeroBasedBudgeting, #50/30/20Rule, #EnvelopeSystem, #EmergencyFund, #FinancialStability, #SpendingHabits, #FinancialManagement, #SavingsGoals, #BudgetReview, #FinancialLiteracy, #PersonalFinance, #DebtManagement, #FinancialAwareness #breakingnews #worldnews #headlines #topstories #globalUpdate #dxbnewsnetwork #dxbnews #dxbdnn #dxbnewsnetworkdnn #bestnewschanneldubai #bestnewschannelUAE #bestnewschannelabudhabi #bestnewschannelajman #bestnewschannelofdubai #popularnewschanneldubai

Guardians of the Ocean and the Role of Marine Creatures...Read More.

Shilpa Shetty dazzles in a statement gown with a bold slit, floral top, and luxe accessories—priced at ₹1.25 lakh! Check out her stunning look...Read More.

Abu Dhabi Introduces CASGEVY: First Gene-Editing Therapy

DoH Abu Dhabi launches CASGEVY, the UAE’s first CRISPR gene therapy, revolutionizing treatment for s

Chelsea Eliminate Man City to Reach Women’s Champions League Semis

Chelsea beat Man City 3-0, overturning a two-goal deficit to reach the Women’s Champions League semi

UAE Unveils New Dirham Symbol for Physical & Digital Currency

UAE Unveils New Dirham Symbol for Physical & Digital Currency

Create Studio Ghibli-Style Images with ChatGPT's New Tool

ChatGPT's new image generator is making waves online! Learn how to create Studio Ghibli-style images

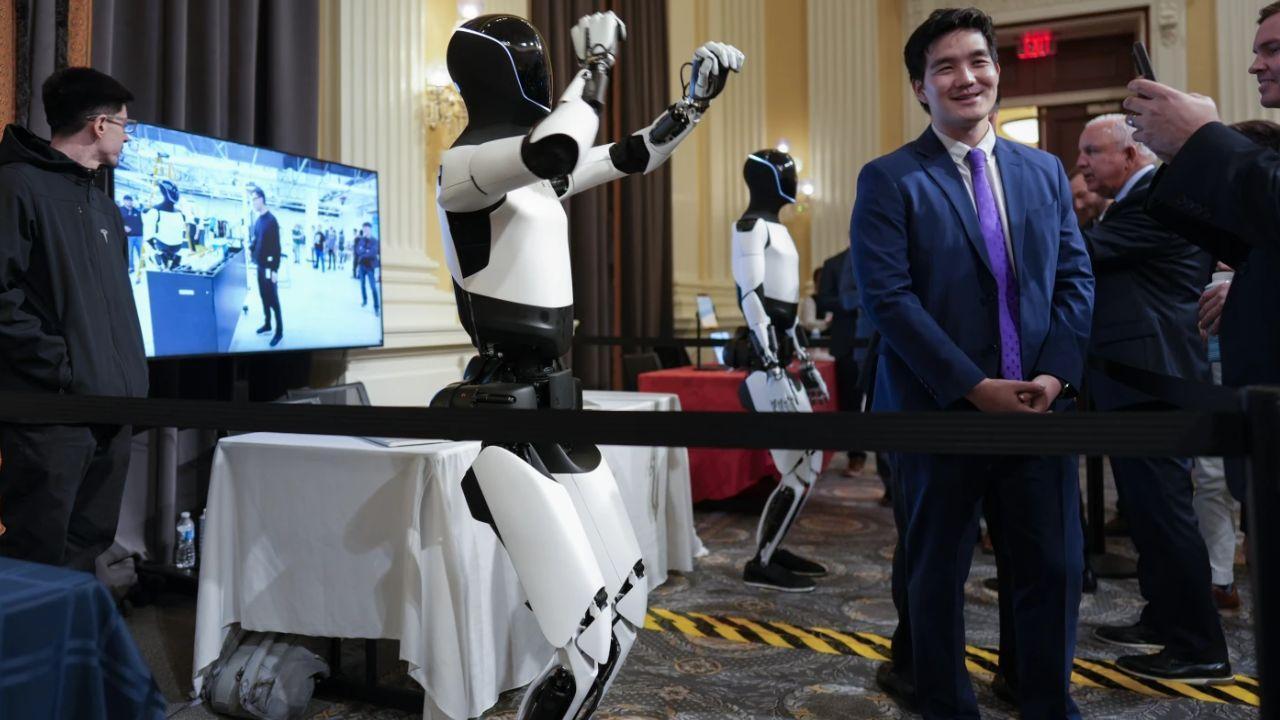

US Robotics Firms Push for National Strategy – China Competition

US robotics companies call for a national strategy, tax breaks, and funding to compete with China in