Post by : Sam Jeet Rahman

Credit cards have become a common part of monthly financial management for salaried professionals, families, and young earners. From groceries and fuel to online shopping and bill payments, credit cards offer convenience, short-term liquidity, and reward benefits. However, their increasing use is also quietly reshaping how people manage monthly budgets, savings, and long-term financial stability. While credit cards can be powerful financial tools, misuse or overdependence can lead to stress, debt cycles, and reduced savings capacity.

Credit cards were originally designed to provide flexibility and emergency support, but over time they have evolved into everyday spending instruments. Easy approvals, attractive reward programs, cashback offers, and buy-now-pay-later features have encouraged higher usage across income groups. As a result, many households are experiencing changes in their monthly financial patterns, often without realising it. This article explains how credit card usage is impacting monthly finances, both positively and negatively, and highlights key factors every user should understand to maintain financial balance.

One of the biggest impacts of credit card usage is the change in how people perceive spending.

Key behavioural changes

• Reduced hesitation while spending

• Higher average transaction values

• Increased impulse purchases

Since payments are delayed, expenses feel less immediate, making it easier to overspend compared to cash or debit card usage. This often leads to higher monthly outflows than initially planned.

Credit cards create a temporary sense of increased purchasing power.

Why this happens

• Credit limits feel like available money

• Expenses are postponed to the next billing cycle

• Minimum payment options reduce short-term pressure

This illusion can distort budgeting decisions, causing people to commit to expenses that exceed their actual income capacity.

Credit card usage affects how monthly budgets are structured and followed.

Common budget-related issues

• Difficulty tracking actual expenses

• Overlapping billing cycles

• Underestimating total monthly outgo

When expenses are spread across different cards and billing dates, it becomes harder to maintain a clear picture of monthly spending.

Increased credit card reliance often impacts savings habits.

How savings are affected

• Reduced monthly surplus due to repayments

• Emergency funds replaced by credit usage

• Savings delayed due to outstanding balances

Many users rely on credit cards for emergencies instead of maintaining liquid savings, which can be risky during prolonged financial stress.

Interest charges are one of the most damaging aspects of improper credit card usage.

Key points to understand

• Interest rates are significantly higher than other loans

• Interest is charged on outstanding balances

• Minimum payments extend repayment duration

Even small unpaid balances can grow into large financial burdens over time, reducing disposable income month after month.

Paying only the minimum due has a direct impact on monthly finances.

Why it’s harmful

• Majority of payment goes toward interest

• Principal reduces very slowly

• Long-term repayment commitments increase

This traps users in a cycle where a fixed portion of monthly income is permanently allocated to credit card repayment.

Rewards and cashback programs influence purchasing decisions more than people realise.

Behavioural impact

• Spending increases to earn points

• Non-essential purchases justified by rewards

• Brand loyalty driven by offers, not necessity

While rewards can be beneficial, chasing them often results in higher overall spending than the rewards are worth.

Many users convert large purchases into monthly instalments.

Pros

• Reduces immediate financial pressure

• Makes big purchases feel affordable

Cons

• Increases fixed monthly obligations

• Reduces flexibility in future budgets

• Encourages lifestyle inflation

Multiple EMIs can silently consume a large portion of monthly income.

As income grows, credit card limits often increase.

Resulting impact

• Gradual rise in lifestyle expenses

• More dining out, shopping, and subscriptions

• Reduced focus on savings growth

This inflation happens slowly and often goes unnoticed until financial strain appears.

Monthly credit card repayments affect mental well-being.

Common stress factors

• Fear of missing due dates

• Anxiety over growing balances

• Guilt associated with overspending

Financial stress reduces productivity and impacts overall quality of life.

Outstanding credit card balances can delay important goals.

Affected goals

• Home purchase

• Long-term investments

• Retirement planning

• Education savings

High-interest debt reduces the ability to allocate funds toward future-oriented goals.

Despite risks, credit cards can positively impact monthly finances when managed well.

Responsible usage benefits

• Improved cash flow management

• Access to emergency funds

• Reward and cashback benefits

• Strong credit history

The key lies in discipline and awareness.

Simple habits can significantly reduce negative effects.

Practical steps

• Pay full balance every month

• Limit number of active cards

• Track expenses weekly

• Avoid unnecessary EMI conversions

• Use rewards strategically

These steps help keep credit cards as tools, not liabilities.

The effect of credit card usage varies by income stability.

Lower or irregular income

Credit cards can quickly create financial pressure if used excessively.

Stable income

Easier to manage repayments but risk of complacency remains.

Higher income

Higher limits increase the temptation for overspending.

Regardless of income, discipline is essential.

Debit cards create immediate spending awareness, while credit cards delay the financial impact.

Key difference

• Debit cards limit spending to available balance

• Credit cards allow future income dependency

Balancing both helps maintain control over monthly finances.

Certain patterns indicate unhealthy usage.

Warning indicators

• Paying minimum due regularly

• Using credit cards for essentials

• Frequently reaching credit limits

• Borrowing to pay credit card bills

Recognising these signs early prevents deeper financial trouble.

A structured approach ensures credit cards support financial goals.

Healthy strategy

• One primary card for controlled usage

• Full monthly repayment habit

• Separate emergency savings fund

• Regular review of statements

This approach keeps monthly finances predictable and stress-free.

Credit cards are not inherently bad. Lack of awareness and planning cause financial strain. Understanding how they impact monthly finances empowers users to make informed choices instead of reactive decisions.

Credit card usage has a powerful influence on monthly finances, shaping spending habits, savings behaviour, and financial stress levels. While credit cards offer convenience and flexibility, unchecked usage can lead to overspending, debt cycles, and reduced financial security. By using credit cards responsibly, paying balances in full, and aligning usage with income and goals, individuals can enjoy the benefits without damaging their monthly financial health. Awareness, discipline, and regular review are the keys to ensuring credit cards remain financial tools rather than financial burdens.

This article is for informational purposes only and does not constitute financial advice. Financial situations vary by individual, and readers should assess their own income, expenses, and risk tolerance or consult a qualified financial professional before making credit-related decisions.

Thousands March in Caracas, Demand Maduro’s Release

Thousands of Maduro supporters marched in Caracas, one month after a deadly US raid ousted him, dema

Sheikh Mohammed Visits WGS 2026 Media, Cybersecurity Centres

Sheikh Mohammed visited the WGS 2026 media and cybersecurity centres in Dubai, highlighting media’s

Sitharaman Meets World Bank President Ajay Banga on Viksit Bharat Plan

Finance Minister Nirmala Sitharaman met World Bank President Ajay Banga to discuss the new Country P

PM Shehbaz Meets WBG President Ajay Banga to Boost Pakistan Reforms

PM Shehbaz Sharif meets World Bank President Ajay Banga, discussing economic reforms, development pr

Italy’s Unemployment Hits Record Low of 5.6% in December

Italy’s unemployment fell to a historic 5.6% in December, the lowest since 2004, with employment at

Australian Open Champ Rybakina Headlines Dubai Tennis Elite Field

Fresh from her Australian Open triumph, Elena Rybakina returns to Dubai as a resident and WTA 1000 c

Deloitte Champions Enterprise & Public Sector Innovation at Web Summit Qatar

Deloitte leads masterclasses on in-country cloud, AI, and tech governance at Web Summit Qatar 2026,

Why Drinking Soaked Chia Seeds Water With Lemon and Honey Before Breakfast Matters

Drinking soaked chia seeds water with lemon and honey before breakfast may support digestion hydrati

Morning Walk vs Evening Walk: Which Helps You Lose More Weight?

Morning or evening walk Learn how both help with weight loss and which walking time suits your body

What Really Happens When You Drink Lemon Turmeric Water Daily

Discover what happens to your body when you drink lemon turmeric water daily including digestion imm

DXB News Network Presents “Ctrl+Alt+Wim”, A Bold New Satirical Series Starring Global Entertainer Wim Hoste

DXB News Network premieres Ctrl+Alt+Wim, a bold new satirical micro‑series starring global entertain

High Heart Rate? 10 Common Causes and 10 Natural Ways to Lower It

Learn why heart rate rises and how to lower it naturally with simple habits healthy food calm routin

10 Simple Natural Remedies That Bring Out Your Skin’s Natural Glow

Discover simple natural remedies for glowing skin Easy daily habits clean care and healthy living ti

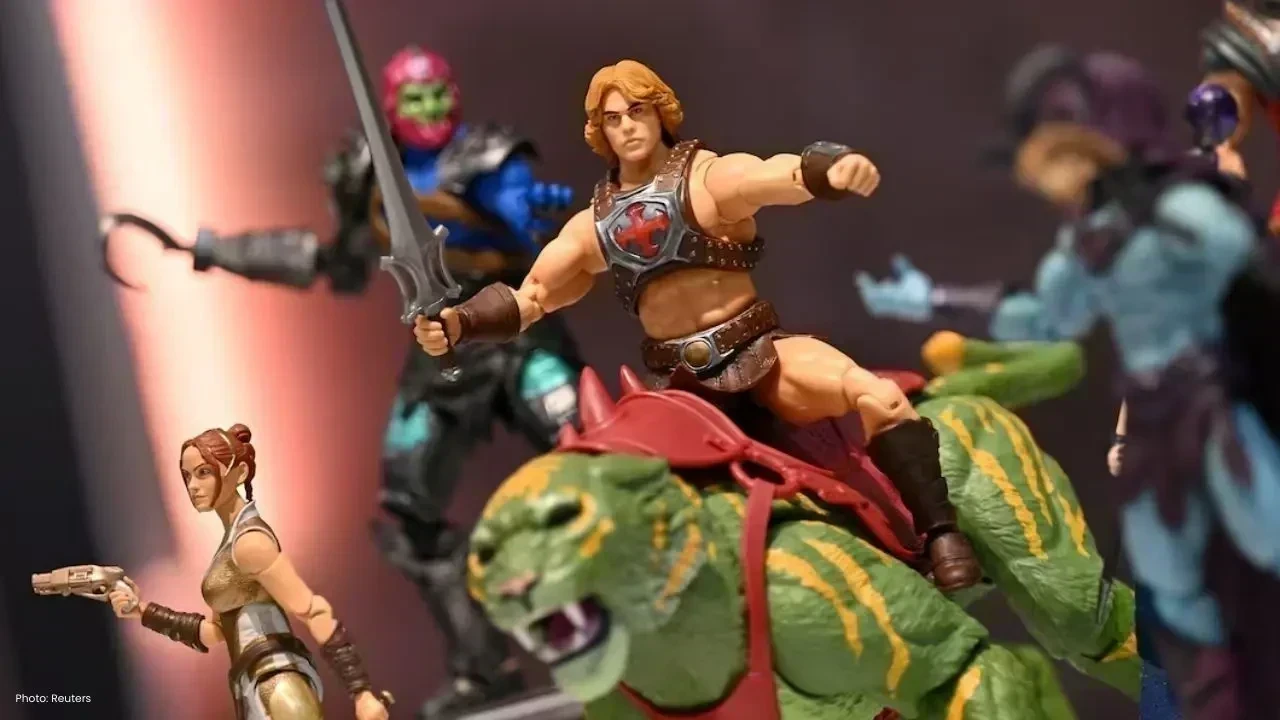

Mattel Revamps Masters of the Universe Action Figures for Upcoming Film

Mattel is set to revive Masters of the Universe action figures in sync with their new movie, ignitin

China Executes 11 Members of Infamous Ming Family Behind Myanmar Scam Operations

China has executed 11 Ming family members, linked to extensive scams and gambling in Myanmar, causin