Post by : Anis Karim

Countries worldwide are grappling with soaring debt levels due to various factors like economic instability, conflicts, climatic changes, rising interest rates, and increased welfare costs. While terms such as sovereign debt and fiscal deficit may seem distant, their effects ultimately reach the pockets of ordinary citizens.

As governments battle with escalating debt, they often seek to stabilize their revenue through tax adjustments—modifying rates, broadening tax bases, or introducing new charges on everyday essentials and services. Thus, international economic challenges resonate not just with finance ministers but also with families, workers, and consumers everywhere.

To comprehend the impact of these pressures on everyday taxes, it's vital to analyze the workings of global debt, the rising strains on economies, and the typical responses governments adopt when faced with fiscal challenges.

Over the last decade, governments have expended trillions to address:

economic downturns

healthcare emergencies

rising unemployment

supply chain issues

energy crises

climatic events

These circumstances have compelled nations to incur substantial debts to support citizens and sustain essential services.

With global interest rates increasing, governments face higher costs to repay existing loans, limiting available funds for essentials like infrastructure and welfare unless taxes are raised to compensate.

When a nation's currency weakens, repaying international debts becomes more expensive, thereby putting pressure on budgets and pushing policymakers to seek new tax revenues.

As developed and developing nations cope with aging demographics, the demand for:

healthcare resources

pension schemes

a dwindling number of taxpayers

This demographic shift often necessitates revisions in tax structures.

With increasing debts and tightening budgets, governments seek dependable income sources, typically through taxes—the most reliable option leading to potential:

increased personal income tax

higher goods and services taxes

new taxes on digital services, carbon output, or luxury items

revisions to property or wealth taxes

Governments often prefer adjusting indirect taxes to direct income taxes, which could meet public resistance:

fuel levies

utilities charges

food taxes

transportation fees

value-added tax increases

These indirect levies quietly elevate living costs for everyone.

Higher taxes on businesses can lead to consumers experiencing:

increased product prices

fewer discounts

higher service costs

Even if businesses bear the tax burden, the financial impact often flows down to consumers.

Global inflation combined with supply chain issues has inflated the prices of:

groceries

fuel

utility bills

household items

transportation costs

When new taxes are layered onto these issues, financial pressure on families mounts significantly.

Countries often introduce new minor levies, such as:

digital transaction fees

environmental charges

packaging fees

convenience taxes

Although individually small, these fees collectively shrink disposable income.

As global institutions urge responsible debt management, citizens may be called upon to shoulder greater tax responsibilities to ensure national stability.

International financial organizations often require countries to:

reduce deficits

boost revenue streams

eliminate ineffective subsidies

enhance tax compliance

Such demands push governments toward tax reforms.

A nation’s credit rating influences borrowing costs. If debt remains unmanageable:

credit ratings will decline

interest payments increase

governments seek more revenue

This cycle results in higher or more extensive tax increases.

Countries that adopt digital tax strategies, environmental regulations, and international trade standards frequently revise their domestic tax policies to remain compatible.

Governments may opt to:

alter rates for higher earners

minimize exemption thresholds

augment social contribution rates

create new tax brackets

These actions directly impact employees and professionals.

Value-added taxes may see increases as governments strive to capture revenues spanning all income demographics.

With growing climate-related expenses, governments may levy taxes on:

fossil fuel use

carbon outputs

plastic consumption

high-energy devices

These initiatives aim to alter behaviors while boosting revenue.

As commerce shifts online, many countries are considering taxes on:

digital offerings

e-commerce platforms

financial technology transactions

streaming services

Such measures align with global consumer behavior changes.

Heavy taxation can hinder investments. Thus, nations aim to equilibrate:

encouraging business expansion

funding public services

preventing economic stagnation

Striking this balance necessitates careful tax policy crafting.

Some governments initiate compensatory measures, such as:

subsidies

tax reliefs

adjustments to social programs

targeted support for basic necessities

These initiatives lessen the toll of tax hikes on vulnerable groups.

Enhancing tax collection effectiveness often yields more funds than increasing tax brackets.

Investments in:

digital tax monitoring systems

fraud oversight

streamlined filing procedures

elimination of loopholes

Improved compliance lessens the burden on diligent taxpayers.

Tax adjustments driven by debt often elevate living expenses, compelling families to reevaluate their financial plans amidst rising prices.

Changes in taxes can lead to:

diminished disposable income

altered investment preferences

hindered long-term savings

Consequently, families may delay significant purchases or cut back on investment contributions.

Governments may tighten public spending affecting:

employment in public sectors

social programs

infrastructure initiatives

Simultaneously, private enterprises may need to adapt to rising operating costs.

Small businesses often grapple with implementing new tax regulations, necessitating:

updating accounting practices

increased documentation

higher administrative expenses

Taxes on raw materials, energy, or services heighten operational costs, typically squeezing profit margins unless businesses raise prices.

As household budgets tighten due to inflated taxes, demand for goods and services may dip, directly impacting small enterprises.

Essential services like education, healthcare, and transportation depend on tax revenue. Insufficient funding may lead to a decline in service quality.

Unaddressed debt today could burden future taxpayers, restricting their financial liberty.

If tax hikes disproportionately impact lower to middle-income citizens, the economic disparity could widen further.

Cultivating a stronger savings foundation can mitigate the effects of rising costs and taxes.

Being well-informed can aid individuals in optimizing their tax liabilities.

Engaging in side jobs, freelance work, or upgrading skills might provide necessary additional income during uncertain periods.

Monitoring national budgets, policy shifts, and economic trends assists people in preparing for changes ahead.

Streamlining public spending could mitigate the need for sharp tax increases.

Investments in burgeoning sectors can elevate revenues through increased employment and business activity.

Improving trade revenues alleviates debt pressures.

New businesses can contribute significantly to tax revenues over time.

The global economy is interconnected. As countries face rising debt, citizens ultimately feel the strain through taxes and economic shifts.

Grasping these dynamics allows individuals to prepare financially for the future. Anticipating alterations in tax structures or policies may be crucial, but with awareness and adaptation, both individuals and businesses can effectively manage upcoming challenges.

Economic pressure reaches beyond governments; it influences day-to-day expenses, business operations, and long-term financial planning.

The information in this article is intended for general awareness and should not be taken as financial or tax advice. Each individual's tax circumstances can differ, and consulting professionals for tailored guidance is recommended.

Predictheon Wins WHX Xcelerate Innovation Champion 2026

Predictheon won WHX 2026 Xcelerate, earning US$12,000, WHX 2027 space and global exposure for its AI

Omantel Launches Otech to Drive Oman’s Future Tech Vision

Omantel launches Otech to accelerate Oman’s digital transformation, strengthen data sovereignty, exp

Daimler Truck MEA Honors Top Distributors at EliteClass 2025

Daimler Truck MEA hosted EliteClass Awards 2025 in Dubai, honoring top distributors across 19 catego

King Mohammed VI Launches Safran Landing Gear Plant in Morocco

Morocco strengthens its aerospace leadership as King Mohammed VI launches Safran’s €280M landing gea

Qatar Emir Sheikh Tamim Arrives in UAE on Fraternal Visit

Qatar’s Emir Sheikh Tamim bin Hamad Al Thani arrived in Abu Dhabi on Saturday. UAE President Sheikh

Shaidorov Wins Stunning Olympic Gold as Malinin Falters

Kazakhstan’s Mikhail Shaidorov won men’s figure skating gold after US star Ilia Malinin fell twice.

Shakira’s 5-Show El Salvador Residency Boosts Bukele Image

Shakira’s five sold-out concerts in San Salvador highlight El Salvador’s security shift under Bukele

Why Drinking Soaked Chia Seeds Water With Lemon and Honey Before Breakfast Matters

Drinking soaked chia seeds water with lemon and honey before breakfast may support digestion hydrati

Morning Walk vs Evening Walk: Which Helps You Lose More Weight?

Morning or evening walk Learn how both help with weight loss and which walking time suits your body

What Really Happens When You Drink Lemon Turmeric Water Daily

Discover what happens to your body when you drink lemon turmeric water daily including digestion imm

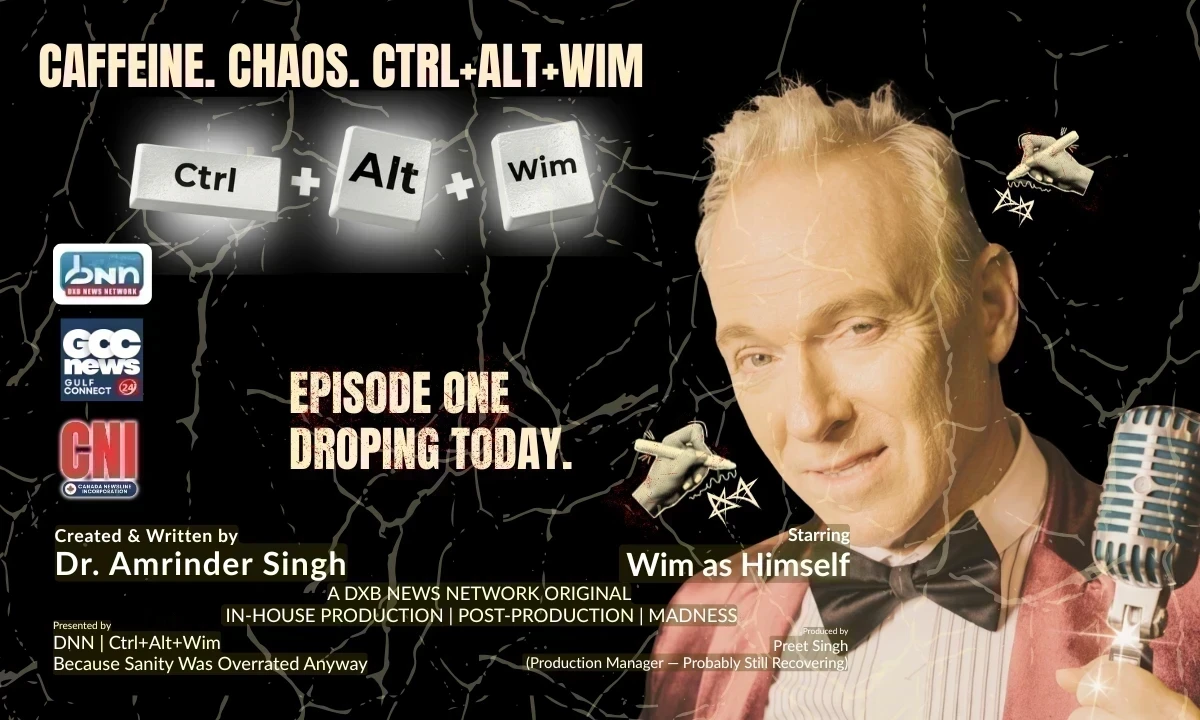

DXB News Network Presents “Ctrl+Alt+Wim”, A Bold New Satirical Series Starring Global Entertainer Wim Hoste

DXB News Network premieres Ctrl+Alt+Wim, a bold new satirical micro‑series starring global entertain

High Heart Rate? 10 Common Causes and 10 Natural Ways to Lower It

Learn why heart rate rises and how to lower it naturally with simple habits healthy food calm routin

10 Simple Natural Remedies That Bring Out Your Skin’s Natural Glow

Discover simple natural remedies for glowing skin Easy daily habits clean care and healthy living ti

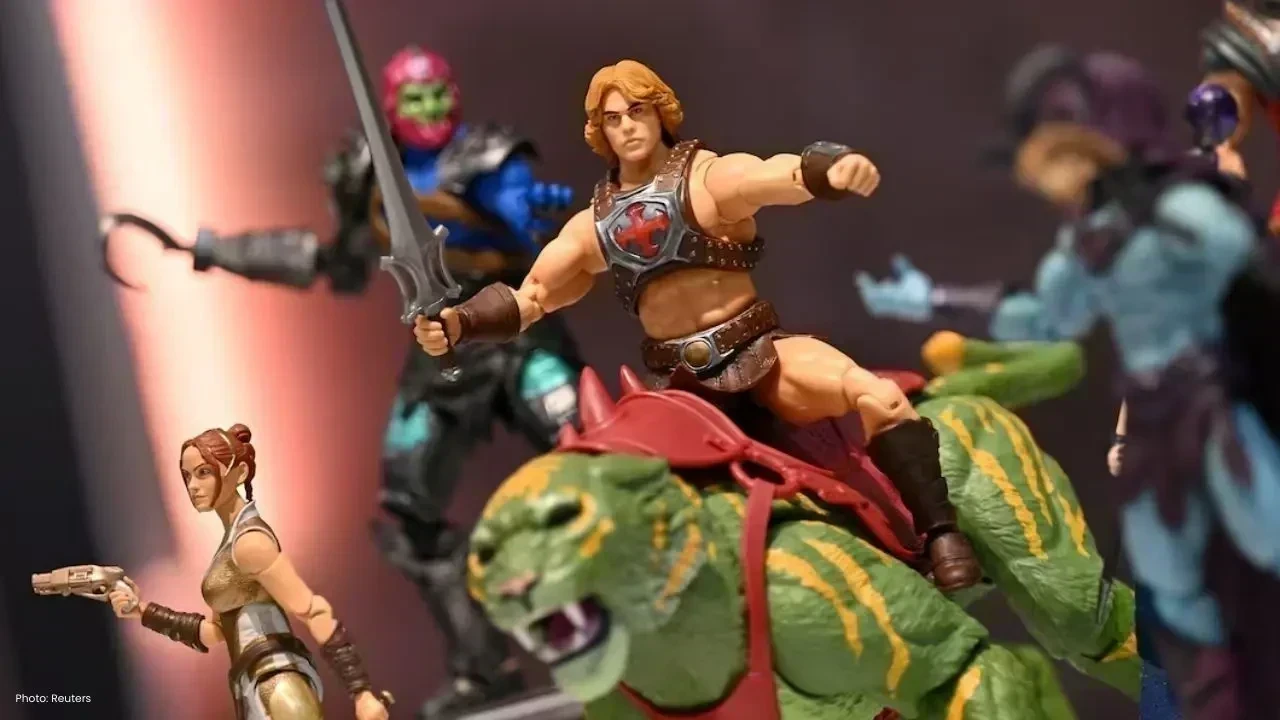

Mattel Revamps Masters of the Universe Action Figures for Upcoming Film

Mattel is set to revive Masters of the Universe action figures in sync with their new movie, ignitin

China Executes 11 Members of Infamous Ming Family Behind Myanmar Scam Operations

China has executed 11 Ming family members, linked to extensive scams and gambling in Myanmar, causin