Post by: Vansh Kumar

A Simple Path to Financial Freedom: Guide for Young Adults

Stepping into adulthood comes with excitement, freedom, and responsibility. One of the biggest responsibilities that young adults face today is handling money. Unfortunately, many are thrown into financial independence without any real-world money education. That’s why this Easy Financial Guide for Young Adults to Learn and Grow has been created—to give you the confidence and clarity you need to take control of your financial journey.

Why Financial Literacy Should Start Early

Financial literacy is not just a life skill—it’s a survival tool. Learning how to manage money early in life builds a foundation for independence, reduces future stress, and helps you avoid common traps like debt and overspending. This Easy Financial Guide for Young Adults to Learn and Grow simplifies complex financial topics so they’re easy to understand and apply to your everyday life, even if you’re new to budgeting, credit, or saving.

Understanding How to Budget Without Feeling Restricted

Budgeting doesn’t have to mean saying no to everything fun. It’s about understanding where your money comes from and where it’s going. In this Easy Financial Guide for Young Adults to Learn and Grow, you’ll learn that the first step to taking control of your money is creating a realistic plan. Start by calculating your monthly income and then listing your necessary expenses such as rent, food, and transportation. After that, figure out how much you can spend on things you enjoy and how much you can save. When you see it written out clearly, managing your money starts to feel empowering instead of limiting.

Learning the Power of Saving Early

Saving money might feel impossible when you have limited income, but even setting aside small amounts regularly can make a big difference over time. This Easy Financial Guide for Young Adults to Learn and Grow encourages you to treat saving as a habit, not just an occasional effort. Creating an emergency fund for unexpected expenses is one of the smartest first steps. Once that’s established, you can save for goals that make you excited about your future—whether it’s a trip, a car, or starting a business. Saving early helps you build a cushion that gives you freedom and peace of mind.

Credit Scores and How They Affect Your Life

Your credit score may not seem important now, but it has a huge impact on your future—from renting an apartment to getting approved for a car loan. In this Easy Financial Guide for Young Adults to Learn and Grow, you’ll understand that your credit score reflects how well you manage borrowed money. Keeping your credit healthy means paying bills on time, not maxing out your credit card, and avoiding unnecessary loans. A good credit score can save you money in the long run through better interest rates and more financial options.

Avoiding the Debt Trap Before It Starts

Debt can quickly become overwhelming if you’re not careful. This Easy Financial Guide for Young Adults to Learn and Grow emphasizes the importance of borrowing only what you truly need and making sure you have a plan to repay it. Student loans, credit cards, and "buy now, pay later" offers might seem convenient, but they can lead to long-term problems if used without caution. If you already have debt, don’t panic—start with a simple plan to pay it off gradually. The sooner you take control of debt, the better your financial future will look.

Creating Goals That Give Your Finances Purpose

Money becomes much easier to manage when you’re working toward something meaningful. This Easy Financial Guide for Young Adults to Learn and Grow helps you set both short-term and long-term financial goals. Whether it's saving for a new laptop, building a home deposit, or preparing for retirement, goals help you stay motivated and focused. When you have direction, spending becomes more intentional, and saving becomes more rewarding. Revisit your goals often to keep your financial plan on track.

Investing is Not Just for the Rich

You don’t need to be a millionaire to start investing. In fact, the earlier you start, the more time your money has to grow. This Easy Financial Guide for Young Adults to Learn and Grow introduces you to the basics of investing, explaining that even small investments in simple tools like index funds or apps can generate long-term results. Investing is all about patience and consistency. With a bit of research and time, you can start building wealth that supports your future dreams.

Using Digital Tools to Stay on Top of Finances

In today’s world, you don’t have to manage money on your own. There are hundreds of mobile apps and online tools designed to help you budget, track expenses, save automatically, and even start investing. As a young adult, you can use technology to your advantage. This Easy Financial Guide for Young Adults to Learn and Grow encourages you to explore free tools that simplify your financial journey. When you have the right support at your fingertips, managing money becomes much easier and more efficient.

Taking the First Step Toward Financial Independence

The biggest mistake you can make with money is ignoring it. Financial knowledge is the key to independence, and you don’t have to be an expert to make smart choices. This Easy Financial Guide for Young Adults to Learn and Grow reminds you that it’s okay to start small and learn as you go. What matters most is taking the first step—whether it’s setting a savings goal, checking your credit report, or building a monthly budget. With time, these small steps lead to lifelong confidence and financial freedom.

Disclaimer:

This article is published by DXB News Network and is intended for informational purposes only. Financial decisions should be based on your individual circumstances, and professional advice is recommended for specific guidance.

#trending #latest #FinancialLiteracy #YoungAdults #MoneyManagement #FinancialGrowth #BudgetingTips #SmartMoneyMoves #InvestingForBeginners #SaveAndGrow #FinancialIndependence #PersonalFinance #breakingnews #worldnews #headlines #topstories #globalUpdate #dxbnewsnetwork #dxbnews #dxbdnn #dxbnewsnetworkdnn #bestnewschanneldubai #bestnewschannelUAE #bestnewschannelabudhabi #bestnewschannelajman #bestnewschannelofdubai #popularnewschanneldubai

Learn money basics with this easy guide for financial success...Read More.

Father, son, and youth killed in West Bengal’s Murshidabad amid Waqf Bill protest clashes. Police arrest 138 as tensions rise...Read More.

Middle East’s Growing Influence in Formula 1 Recognized by FIA President Mohammed Ben Sulayem

Middle East’s Growing Influence in Formula 1 Recognized by FIA President Mohammed Ben Sulayem

'The Herds' starts journey from Africa to the Arctic Circle

‘The Herds,’ a cardboard animal show, starts in Congo to show how climate change pushes nature away.

Millie Bobby Brown explores Dubai in new campaign

Millie Bobby Brown stars in a fun Dubai film with Jake Bongiovi, sharing her journey through city st

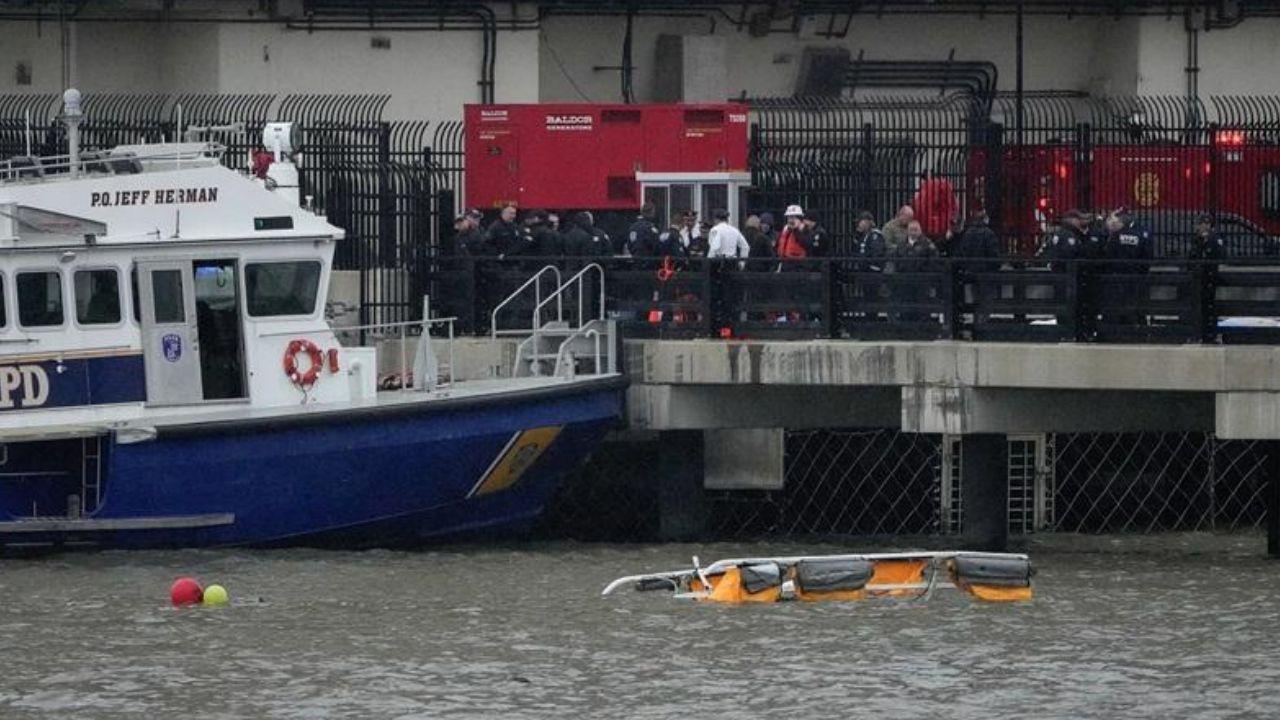

6 Killed in Helicopter Crash in Hudson River, NYC – Mayor Adams

A helicopter crash in NYC's Hudson River killed 6, including 3 kids. The victims were tourists from

Sheikh Hamdan Meets ICC Chief & Indian Cricketers in Mumbai

Sheikh Hamdan meets Jay Shah, Rohit Sharma & others in Mumbai, boosting UAE-India sports ties and cr