Post by: Vansh Kumar

Your First Step Toward Financial Freedom Starts Here

Money plays a major role in everyday life, yet many people are never taught how to manage it properly. Whether you're a student stepping into adulthood or someone who just wants to take control of your finances, learning about money can be a game changer. That’s why A Simple Guide to Understanding Financial Literacy for Beginners is here—to walk you through the basics in a way that’s easy to understand and even easier to apply.

What Is Financial Literacy and Why Does It Matter?

At its core, financial literacy is the ability to understand and use financial knowledge to make informed money decisions. It includes skills like budgeting, saving, investing, and managing debt. A Simple Guide to Understanding Financial Literacy for Beginners explains these important areas step by step so that anyone, regardless of age or background, can develop a strong financial foundation.

Financial literacy empowers people to make choices that help them avoid debt, save for emergencies, plan for retirement, and achieve personal goals. Without it, even earning a decent income can lead to stress and mismanagement.

Understanding Income and Expenses

The first step in becoming financially literate is understanding how much money you earn and where it goes. This might sound obvious, but many people don’t track their income and expenses. A Simple Guide to Understanding Financial Literacy for Beginners starts here for a good reason—without knowing your money flow, you can’t control it.

Start by writing down all sources of income, such as salaries, freelance earnings, or allowances. Then list your monthly expenses—everything from rent to snacks. Seeing your financial picture clearly helps you understand what adjustments are needed to reach your financial goals.

Budgeting: Your Financial Roadmap

Budgeting is simply creating a plan for your money. It helps ensure you’re spending within your means and saving for what matters. A Simple Guide to Understanding Financial Literacy for Beginners emphasizes that budgeting doesn’t mean cutting out all fun—it just means being smart with your spending.

Use the 50/30/20 rule as a starting point: 50% of your income should go to needs (like rent and food), 30% to wants (like movies or eating out), and 20% to savings or debt repayment. Once you get into the habit of budgeting, you’ll feel more in control and less anxious about your finances.

Saving: Building a Safety Net

Unexpected costs can pop up at any time—a medical bill, car repair, or job loss. That’s why building an emergency fund is a critical part of financial literacy. In A Simple Guide to Understanding Financial Literacy for Beginners, you’ll learn that even small amounts saved regularly can make a big difference.

Aim to save at least three to six months’ worth of living expenses in a separate, easy-to-access account. Saving for emergencies gives you peace of mind and prevents you from relying on credit or loans when life throws you a curveball.

Credit and Debt: Use Wisely, Borrow Smart

Many beginners shy away from credit because they fear going into debt. But credit, when used responsibly, can be a useful tool. A Simple Guide to Understanding Financial Literacy for Beginners shows you how to build a good credit history without falling into financial traps.

Pay your bills on time, avoid maxing out your credit cards, and only borrow what you can repay comfortably. Keep an eye on your credit score, as it affects your ability to get loans, rent apartments, and sometimes even land a job.

If you're already in debt, focus on repaying it with strategies like the snowball method (paying off the smallest debts first) or avalanche method (tackling high-interest debts first). The key is consistency.

Introduction to Investing: Let Your Money Work for You

Once you’ve got the basics covered—budgeting, saving, and managing debt—investing is the next step toward financial growth. A Simple Guide to Understanding Financial Literacy for Beginners introduces you to the concept of investing in a simple way.

Investing is not just for the wealthy; anyone can do it. Start small with mutual funds, ETFs, or retirement accounts like a 401(k). The earlier you start, the more time your money has to grow through the power of compound interest. Remember, investing involves risks, so always research and consider talking to a financial advisor.

Planning for the Future

Being financially literate also means thinking long-term. What are your goals—buying a house, starting a business, traveling, or retiring comfortably? A Simple Guide to Understanding Financial Literacy for Beginners encourages you to set clear, achievable goals and create a timeline for reaching them.

Break down your goals into smaller steps. For example, if you want to buy a car in two years, calculate how much you need to save monthly. Planning gives you direction and motivation to keep your finances on track.

Avoiding Financial Pitfalls

Even the most financially savvy people can make mistakes, especially when faced with tempting offers like "buy now, pay later" schemes or high-interest loans. This is why A Simple Guide to Understanding Financial Literacy for Beginners includes common financial traps to avoid.

Stay cautious about impulse purchases, hidden fees, and too-good-to-be-true investment opportunities. Educate yourself continuously and seek advice when in doubt.

Disclaimer:

This article is published by DXB News Network for informational and educational purposes only. The content is not intended as financial advice and should not be considered a substitute for professional guidance. Readers are encouraged to consult with a certified financial advisor or relevant expert before making any financial decisions. DXB News Network does not take responsibility for any financial actions taken based on this content.

#trending #latest #FinancialLiteracy #MoneyManagement #SmartFinances #BeginnerFinanceGuide #BudgetingBasics #SaveSmart #FinanceForYoungAdults #MoneyTips #PersonalFinance #FinancialFreedom #LearnToBudget #InvestingForBeginners #FinanceMadeSimple #MoneyMatters #GrowYourWealth #breakingnews #worldnews #headlines #topstories #globalUpdate #dxbnewsnetwork #dxbnews #dxbdnn #dxbnewsnetworkdnn #bestnewschanneldubai #bestnewschannelUAE #bestnewschannelabudhabi #bestnewschannelajman #bestnewschannelofdubai #popularnewschanneldubai

Learn money basics with this easy guide for financial success...Read More.

Father, son, and youth killed in West Bengal’s Murshidabad amid Waqf Bill protest clashes. Police arrest 138 as tensions rise...Read More.

Middle East’s Growing Influence in Formula 1 Recognized by FIA President Mohammed Ben Sulayem

Middle East’s Growing Influence in Formula 1 Recognized by FIA President Mohammed Ben Sulayem

'The Herds' starts journey from Africa to the Arctic Circle

‘The Herds,’ a cardboard animal show, starts in Congo to show how climate change pushes nature away.

Millie Bobby Brown explores Dubai in new campaign

Millie Bobby Brown stars in a fun Dubai film with Jake Bongiovi, sharing her journey through city st

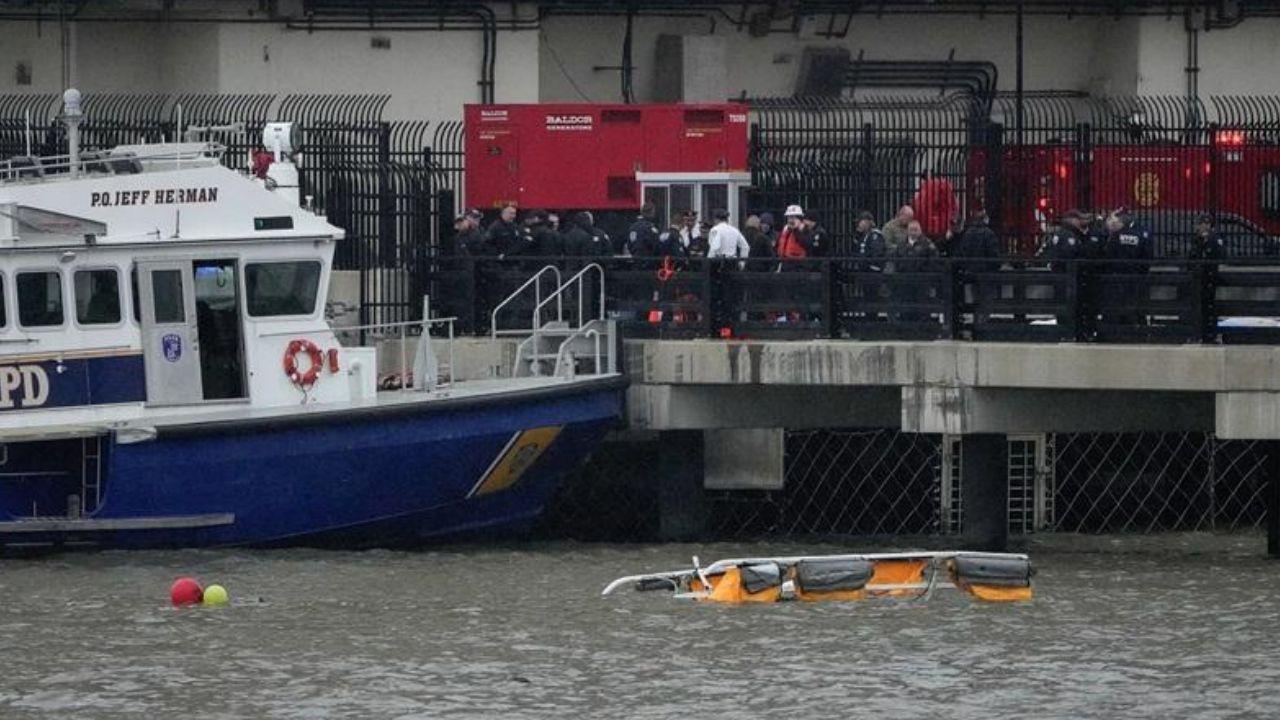

6 Killed in Helicopter Crash in Hudson River, NYC – Mayor Adams

A helicopter crash in NYC's Hudson River killed 6, including 3 kids. The victims were tourists from

Sheikh Hamdan Meets ICC Chief & Indian Cricketers in Mumbai

Sheikh Hamdan meets Jay Shah, Rohit Sharma & others in Mumbai, boosting UAE-India sports ties and cr