Post by : Sam Haleem

For generations, individuals organized their finances based on patterns of predictability. Central banks would raise rates in response to inflation and reduce them when growth lagged. However, today’s economic environment is marked by ambiguity and chaos. Each announcement from financial policymakers introduces new layers of confusion.

In this climate, a pressing question emerges for households: How should we approach our EMIs, SIPs, and FDs when analysts themselves appear conflicted? This uncertainty extends beyond financial jargon; it impacts everyday choices such as purchasing a home, upping SIP investments, or opting for fixed deposits.

This article clarifies these issues in plain language, offering straightforward insights on how mixed messages from central banks impact real-world financial decisions.

Traditionally, central banks would modify interest rates based on growth metrics, inflation, and employment rates. Nowadays, however, these indicators fail to provide clear guidance. Some regions experience persistent inflation while others see a slowdown in growth. Employment statistics fluctuate dramatically month-to-month.

This dissonance leads central banks to issue cautious, sometimes contradictory statements. One week they may hint at potential rate reductions, and the next they reinforce inflation concerns.

A rate decision in any one area can ripple through international markets. If a major central bank leans towards cuts while another hints at increases, it generates a wave of confusion impacting everything from currencies to stock markets and household loan rates.

Geopolitical upheavals, energy cost spikes, supply chain disturbances, and climate-related agricultural challenges inject unpredictability into economic data. Central banks can no longer rely solely on historical models, and their reactive stance leads to guidance that often seems inconsistent.

Loan types, especially mortgages, are significantly influenced by interest rate changes. A single adjustment can drastically alter EMIs. As the direction of rates remains uncertain, borrowers must decide: should they lock in a fixed rate or continue with a floating one?

Floating interest rate loans tend to benefit borrowers during rate cuts by central banks. Yet, with the current mixed signals, forecasting future changes has become exceedingly difficult.

Borrowers anticipating rate cuts may feel hopeful, but if inflation surges and rate adjustments are postponed, high floating rates will persist, causing the greatest burden on long-term borrowers like homeowners.

While fixed-rate loans offer stability, they often come with higher initial costs. Locking in these rates can provide comfort during uncertain times, yet borrowers risk forgoing savings if economic decline comes faster than anticipated.

Households grappling with high grocery bills, rising tuition, and healthcare costs find the implications of rate changes to be harrowing. Even minor fluctuations can throw monthly financial plans into disarray.

Those transitioning loans, prepaying, or restructuring feel compelled to time their decisions, a nearly impossible task amid unclear central bank communication.

Systematic Investment Plans thrive in volatile markets, allowing investors to capitalize on varying market prices through rupee-cost averaging. However, the mixed central bank signals lead to increased market oscillations, which can either benefit long-term SIP investors or add to their anxiety.

Investors often panic during sharp market dips, cutting back or ceasing their SIP investments. Yet, historically, uncertain periods have been optimal for accumulating assets at lower prices.

Confused central bank messaging creates volatility that is often followed by recovery phases, rewarding investors who maintain consistent investment strategies.

Diverse central bank signals prompt investors to rotate between different sectors — from tech to consumer goods and energy. Consequently, SIP portfolios may show fluctuations that do not reflect underlying long-term potential.

The primary rule remains: SIP adjustments should be dictated by personal income security rather than transient market movements. If your salary remains stable and expenses are under control, consider extending or even increasing your SIPs in uncertain times.

Banks heavily depend on central bank signals to direct FD interest rates. When these signals are mixed, FD rates can behave erratically, with some banks raising rates while anticipating delays in easing, and others lowering them in expectation of potential future declines.

Given the unpredictable nature of rates, locking funds in long-term FDs carries risks if rates increase subsequently. Conversely, very short-term deposits might be ill-advised if rates decline sooner than expected.

In spite of fluctuating returns, FDs remain vital for risk-free savings, emergency reserves, and overall financial security. They provide stability amid the volatility of market-linked investments.

Individuals depending on FD interest for income experience significant strain due to unpredictable rates. Even slight drops can disrupt their monthly budgeting. Meanwhile, a sudden rise could benefit them, provided they lock in with timing.

Many households are postponing decisions on purchasing homes, vehicles, or business loans due to unclear rate forecasts, opting to wait and see if rates decrease.

Families are redistributing their funds across SIPs, FDs, and liquid instruments for adaptability. Committing solely to long-term deposits feels risky amidst potential rate hikes.

Unpredictability often drives investors towards safer options. Even those comfortable with equities are reevaluating their strategies and leaning towards balanced or hybrid investments.

As high or volatile EMIs dissuade them, individuals are steering clear of consumer loans for leisure, electronics, or celebrations. This behavioral shift has ramifications for multiple sectors and the broader economy.

Steer clear of funneling all your funds into FDs or withdrawing everything from SIPs. A diversified approach serves as a crucial buffer against economic vagueness.

This will shield you from surprises related to EMIs, job loss, or unexpected costs in unstable times.

Forgo switching entirely between fixed or floating rates; instead, consider partial prepayments to lower principal and ease EMI burdens, counteracting rate fluctuations.

Adjust your investments among equity, debt, and hybrid funds to balance risk. Uphold SIP discipline even in downturns.

Instead of concentrating all your capital in one long tenure, diversify deposits across various durations. This enables flexibility and allows benefit from potential rate changes.

Ultimately, inflation influences whether your actual returns expand or contract. Elevated FD rates can become futile if inflation retains its high levels.

Before committing to substantial loans, evaluate your job security, projected income, and overall household financial health instead of relying on anticipated rate decreases.

Uncertainty is unlikely to be fleeting; it could characterize the coming years. Factors such as climate disruptions, geopolitical conflicts, technological advancements, and heightened global connections will continually influence economic data in unpredictable ways.

As a result, central banks will likely adopt a more cautious communications approach, frequently updating projections and eschewing strong commitments.

For consumers, the essential takeaway is that flexibility in financial planning could supersede the need for impeccable timing.

In an environment flanked by uncertain central bank signals, the most effective approach is to simplify your financial structure. Whether dealing with EMIs, SIPs, or FDs, the focus should not solely be on forecasting the future but on spending resources wisely.

Enhance loans through partial prepayments, fortify SIPs with consistency, and balance FDs with a laddering strategy. This steady, reasoned approach can help shield your household from global economic unpredictability.

While clarity may not be imminent, your financial pathways can be.

Disclaimer:

This article is purely for informational purposes and does not constitute financial advice. Readers are encouraged to assess their own financial circumstances or consult a professional before making significant investment or borrowing decisions.

Predictheon Wins WHX Xcelerate Innovation Champion 2026

Predictheon won WHX 2026 Xcelerate, earning US$12,000, WHX 2027 space and global exposure for its AI

Omantel Launches Otech to Drive Oman’s Future Tech Vision

Omantel launches Otech to accelerate Oman’s digital transformation, strengthen data sovereignty, exp

Daimler Truck MEA Honors Top Distributors at EliteClass 2025

Daimler Truck MEA hosted EliteClass Awards 2025 in Dubai, honoring top distributors across 19 catego

King Mohammed VI Launches Safran Landing Gear Plant in Morocco

Morocco strengthens its aerospace leadership as King Mohammed VI launches Safran’s €280M landing gea

Qatar Emir Sheikh Tamim Arrives in UAE on Fraternal Visit

Qatar’s Emir Sheikh Tamim bin Hamad Al Thani arrived in Abu Dhabi on Saturday. UAE President Sheikh

Shaidorov Wins Stunning Olympic Gold as Malinin Falters

Kazakhstan’s Mikhail Shaidorov won men’s figure skating gold after US star Ilia Malinin fell twice.

Shakira’s 5-Show El Salvador Residency Boosts Bukele Image

Shakira’s five sold-out concerts in San Salvador highlight El Salvador’s security shift under Bukele

Why Drinking Soaked Chia Seeds Water With Lemon and Honey Before Breakfast Matters

Drinking soaked chia seeds water with lemon and honey before breakfast may support digestion hydrati

Morning Walk vs Evening Walk: Which Helps You Lose More Weight?

Morning or evening walk Learn how both help with weight loss and which walking time suits your body

What Really Happens When You Drink Lemon Turmeric Water Daily

Discover what happens to your body when you drink lemon turmeric water daily including digestion imm

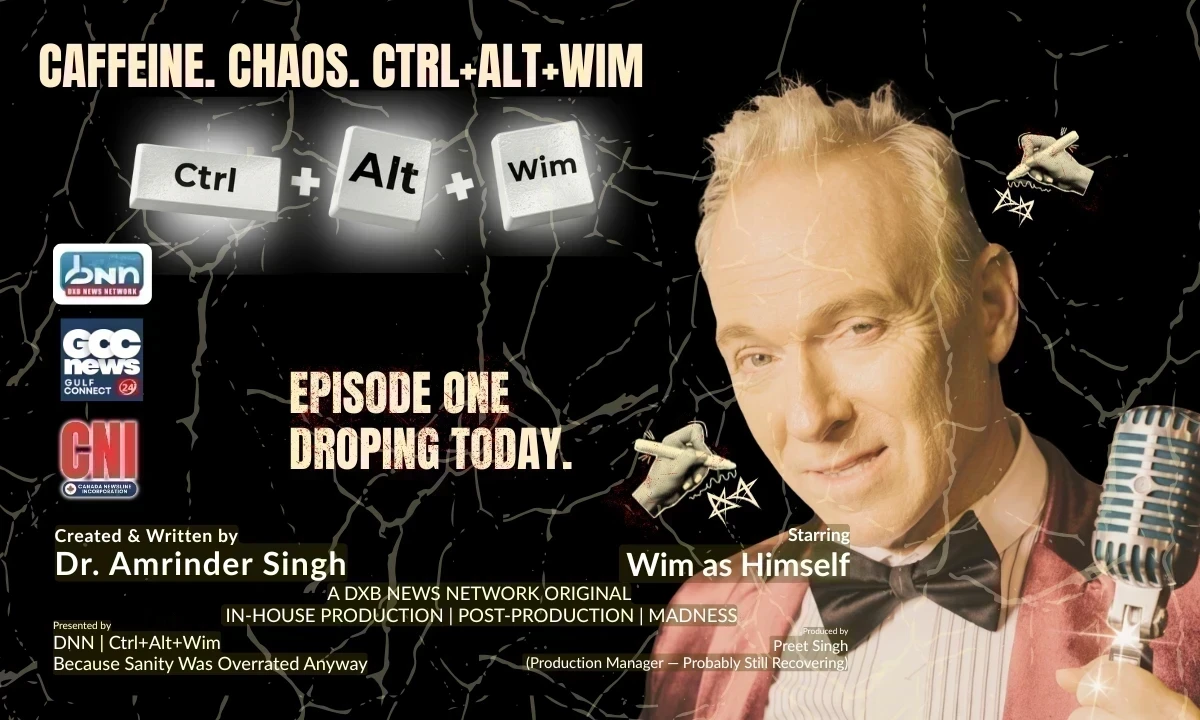

DXB News Network Presents “Ctrl+Alt+Wim”, A Bold New Satirical Series Starring Global Entertainer Wim Hoste

DXB News Network premieres Ctrl+Alt+Wim, a bold new satirical micro‑series starring global entertain

High Heart Rate? 10 Common Causes and 10 Natural Ways to Lower It

Learn why heart rate rises and how to lower it naturally with simple habits healthy food calm routin

10 Simple Natural Remedies That Bring Out Your Skin’s Natural Glow

Discover simple natural remedies for glowing skin Easy daily habits clean care and healthy living ti

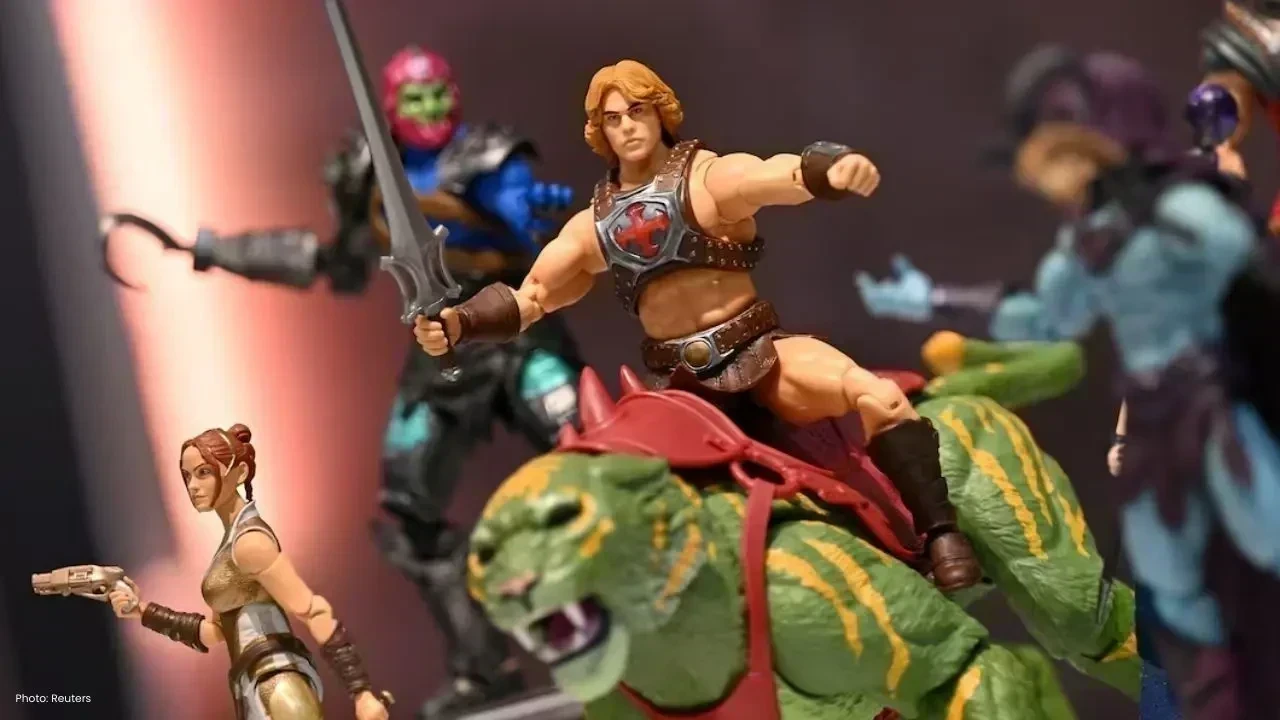

Mattel Revamps Masters of the Universe Action Figures for Upcoming Film

Mattel is set to revive Masters of the Universe action figures in sync with their new movie, ignitin

China Executes 11 Members of Infamous Ming Family Behind Myanmar Scam Operations

China has executed 11 Ming family members, linked to extensive scams and gambling in Myanmar, causin