Post by : Raina Mansoor

Photo :Abu Dhabi Media Office

Abu Dhabi Developmental Holding Company PJSC (ADQ) has announced the pricing of its second bond issuance, amounting to a substantial $2 billion. This new bond is set to be listed on the London Stock Exchange (LSE) and follows ADQ's successful debut in the debt capital markets in May 2024.

The issuance is designed to diversify ADQ's funding sources, which will help finance strategic growth initiatives within the group and establish a long-duration credit curve for investors. This move is reflective of ADQ’s robust credit profile and the financial resilience of Abu Dhabi's economy.

Notably, the bond offering was met with overwhelming interest, being oversubscribed by an impressive 4.1 times. It consists of a dual-tranche offering, which includes a $1 billion bond with a seven-year maturity due in 2031, and another $1 billion bond with a 30-year maturity due in 2054. The respective annual coupon rates for these bonds are 4.375% and 5.250%. The strong demand from a diverse range of institutional investors allowed the transaction to tighten by 30 basis points from the initial pricing thoughts to the final pricing.

Stay informed with the latest news. Follow DXB News Network on WhatsApp Channel

Marcos de Quadros, Group Chief Financial Officer at ADQ, expressed his satisfaction with the results, stating, "ADQ’s second bond issuance under its Global Medium Term Note Program reflects our commitment to forward-looking financial management and a strong capital structure. With this issuance, we now offer an expanded bond curve to investors. We appreciate the impressive market response, demonstrated in the oversubscription of 4.1 times across both tranches."

Earlier in 2024, ADQ also completed its inaugural $2.5 billion bond issuance, which has a primary listing on the LSE and a secondary listing on the Abu Dhabi Securities Exchange (ADX). That dual-tranche bond achieved an oversubscription of over 4.4 times, showcasing continued investor interest.

As of June 30, 2024, ADQ's total assets reached $225 billion, reflecting its significant role in the Abu Dhabi economy. The company holds shareholdings in over 25 portfolio companies, structured into seven economic clusters, covering critical sectors including utilities, transportation, healthcare, agriculture, and real estate. Through these strategic investments and bond issuances, ADQ aims to bolster its contributions to the economic landscape of Abu Dhabi while maintaining a robust financial foundation.

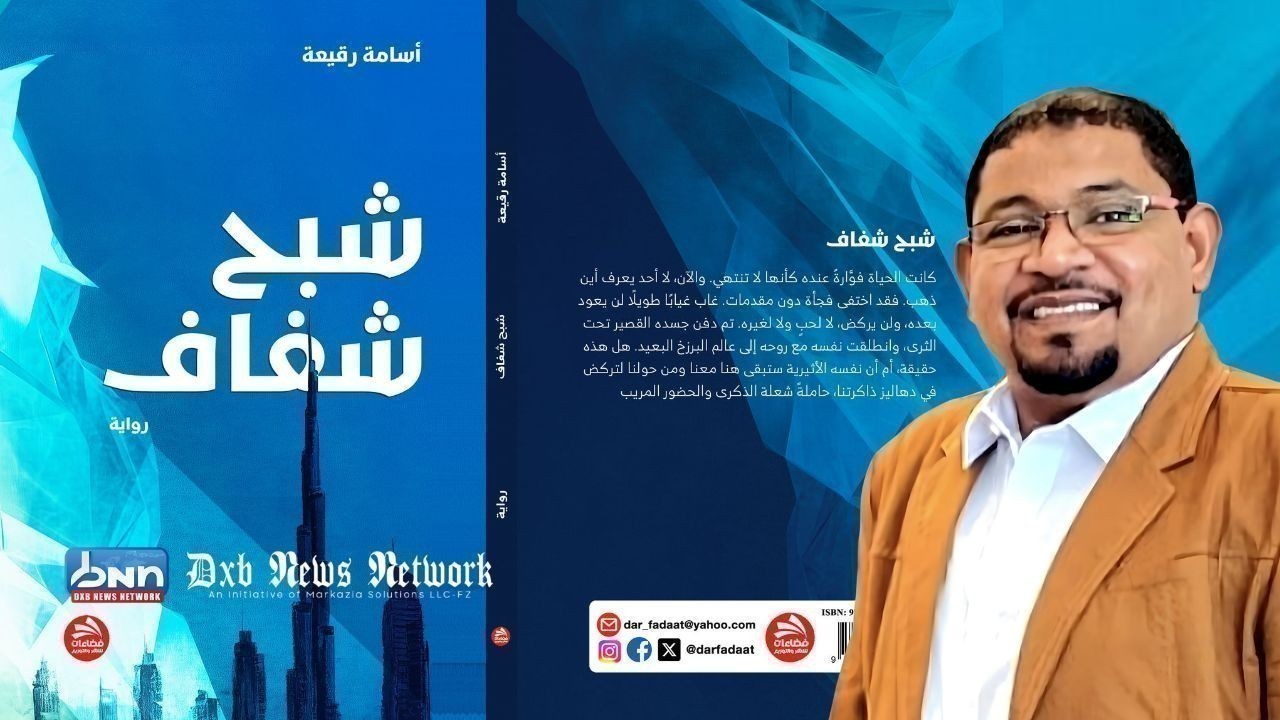

Transparent Ghost by Osama Regaah: A Philosophical Novel of Justice and the Afterlife

A concise overview of Transparent Ghost exploring justice, spirituality, narrative innovation, and i

California Avalanche Bodies of All 9 Victims Recovered

Authorities confirm recovery of all nine victims killed in a deadly avalanche during a guided ski tr

Bank of Baroda Faces Abu Dhabi Legal Battle over NMC Collapse

Bank of Baroda’s involvement in Abu Dhabi litigation tied to the NMC Healthcare collapse raises repu

Top Museum Openings of 2026 Set to Transform Global Tourism

From Los Angeles to Abu Dhabi and Brussels, 2026 brings major museum launches—Lucas Museum, Guggenhe

Fire Breaks Out at Warehouse in Abu Dhabi’s Al Muzoon Industrial Area

A major fire broke out at a warehouse in Abu Dhabi’s Al Muzoon industrial area emergency teams are t

UAE Reaffirms Solidarity with Kuwait Over Maritime Rights

UAE expresses full support for Kuwait’s sovereignty over maritime areas, urging Iraq to resolve disp

UAE Tour Highlights UAE’s Strength in Hosting Global Sports Events

Abu Dhabi Sports Council says the successful UAE Tour reflects the UAE’s leading role in hosting maj

Bank of Baroda Faces Abu Dhabi Legal Battle over NMC Collapse

Bank of Baroda’s involvement in Abu Dhabi litigation tied to the NMC Healthcare collapse raises repu

Top Museum Openings of 2026 Set to Transform Global Tourism

From Los Angeles to Abu Dhabi and Brussels, 2026 brings major museum launches—Lucas Museum, Guggenhe

UAE Tour Highlights UAE’s Strength in Hosting Global Sports Events

Abu Dhabi Sports Council says the successful UAE Tour reflects the UAE’s leading role in hosting maj

EU Seeks Clarity from US After Supreme Court IEEPA Ruling

European Commission urges full transparency from the US on steps after Supreme Court ruling, emphasi

SpaceX Launches 53 New Satellites for Expanding Starlink Network

SpaceX launches 53 Starlink satellites in two Falcon 9 missions, breaking reuse records and expandin

RTA Awards Contract for Phase II of Hessa Street Upgrade in Dubai

Phase II of Hessa Street Development to add bridges, tunnel, and upgraded intersections, doubling ca

UAE Gold Prices Today, Monday 16 February 2026: Dubai & Abu Dhabi Updated Rates

Gold prices in UAE on 16 Feb 2026 updated: 24K around AED 599.75/gm, 22K AED 555.25/gm, and 18K AED

Over 25 Ahmedabad Schools Receive Bomb Threat Email, Authorities Investigate

More than 25 schools in Ahmedabad evacuated after bomb threat emails mentioning Khalistan. Authoriti