Starting and growing a business is an exciting journey, but financial challenges can often stand in the way of success. While passion and creativity are vital, funding is often the driving force behind the success of any business. This is where Small Business Loans prove invaluable. These financial tools allow entrepreneurs to transform their visions into reality by offering the necessary support for various operational and growth needs.

Access to adequate capital can make all the difference, whether you’re launching your business, expanding operations, or upgrading essential tools and equipment. These financial opportunities empower business owners to scale, expand, and maintain stability, driving innovation and creating opportunities for economic growth. With the support of financing options, achieving business goals becomes much more achievable, transforming challenges into opportunities.

Financial hurdles can often prevent even the most promising ideas from reaching their potential. Many business owners find themselves needing financial assistance to overcome initial expenses, manage operational costs, or invest in expansion plans. This is where financing options like Small Business Loans step in to provide a lifeline. These financial packages offer small businesses the ability to invest in growth opportunities and overcome seasonal fluctuations or unexpected challenges.

From covering startup costs to purchasing equipment or hiring employees, funding options are designed to support every stage of a business’s journey. They provide entrepreneurs with the ability to adapt to market changes and explore opportunities, all while maintaining day-to-day operations. With financial resources in place, business owners can focus on strategy, innovation, and execution rather than constantly worrying about meeting expenses.

Many financial solutions are available for small business owners, each catering to specific needs and goals. Understanding these options can make it easier to find the right financial tool for your business journey. A term loan, for instance, is one of the most common financing options available. It involves borrowing a lump sum amount that is repaid in fixed installments over a certain period. Term loans are versatile and can be used for a variety of purposes, such as expanding operations, buying inventory, or investing in long-term assets.

Another popular option is SBA loans, backed by government support. These loans are a reliable choice due to their low-interest rates and longer repayment periods, making them an attractive option for growing enterprises. Equipment financing is another great financial choice for business owners needing vehicles, machinery, or other specialized tools. It allows entrepreneurs to purchase assets without tying up cash flow for extended periods.

Working capital loans also offer flexible support during cash flow gaps, especially during seasonal lulls or unforeseen expenses. Business owners can also explore options like business credit lines, which offer revolving credit limits that can be borrowed and repaid as needed. Invoice financing is another financial solution that allows businesses to borrow against unpaid invoices, ensuring cash flow stability even when clients are late with payments.

These financing solutions act as powerful tools for business owners, providing access to funds at crucial times and helping businesses grow while managing financial hurdles.

The benefits of these financial tools extend well beyond just addressing immediate expenses. With access to funding, small business owners can pursue new growth opportunities, enter new markets, or implement innovative business strategies. Entrepreneurs can invest in marketing campaigns to boost brand visibility or expand operations into underserved areas. They can also hire skilled professionals, upgrade technology, or expand inventory to meet increasing customer demand—all with financial tools at their disposal.

Moreover, financial solutions like Small Business Loans provide stability. Businesses often experience ups and downs due to market changes or economic cycles. These financial options allow companies to weather the storm during slow periods or unexpected challenges without disrupting operations. Entrepreneurs can focus on strategic planning, innovation, and customer needs rather than worrying about meeting their immediate financial obligations.

Additionally, making timely loan repayments can positively impact a business’s credit score, building financial credibility. This creates opportunities for more affordable credit terms and better financial options in the future. With the right financial strategy in place, business owners can establish a strong foundation for long-term success.

Choosing the ideal financial option can seem overwhelming, but with proper research and strategic planning, business owners can find the perfect fit. The first step is determining your business needs and understanding how you plan to use the funds. Whether it’s to manage seasonal expenses, hire employees, purchase equipment, or scale into new markets, knowing your goals will make it easier to narrow your financial options.

It’s also essential to evaluate your financial history and repayment ability. Lenders often analyze credit scores, monthly revenue, and debt-to-income ratios when approving financial assistance. This is why taking time to prepare for a loan application is crucial. Compare lenders, loan terms, and repayment options to find competitive rates and favorable conditions.

Business owners should also pay attention to the repayment period, fees, and other financial obligations attached to their options. Seeking guidance from financial experts can provide clarity and help select the financing path that aligns with both short- and long-term business goals. With a strategic approach, selecting the right financial tool becomes much simpler and far less stressful.

Every successful business begins with planning, innovation, and financial resources. With the help of financing opportunities like Small Business Loans, entrepreneurs can tackle challenges, innovate, and unlock opportunities for growth and stability. Financial tools provide the foundation for success by offering the capital necessary to invest in strategies, infrastructure, and operations.

The ability to manage cash flow, overcome seasonal challenges, and invest in business upgrades can determine whether a company thrives or struggles. With strategic financial solutions, businesses gain the flexibility to take on risks, invest in opportunities, and stay competitive in a dynamic marketplace.

Whether it’s a startup or an established enterprise, finding the right financial strategy can be the key to achieving long-term goals. Entrepreneurs should take full advantage of available options, ensuring that financial planning serves as a catalyst for growth and innovation. With careful use of resources and the right financial tools, the path to success becomes much more attainable.

Summary

The article explores the role of Small Business Loans in empowering entrepreneurs by providing financial support to overcome challenges and unlock growth opportunities. It explains how these financial tools serve as essential resources for businesses at every stage, from startups to expansions. By addressing common financial hurdles such as startup costs, cash flow gaps, equipment purchases, and market expansion, these loans help entrepreneurs stay competitive and innovative.

The article also highlights various types of financial options, including term loans, SBA loans, equipment financing, working capital loans, business credit lines, and invoice financing. Each type has unique benefits and flexibility, catering to different business needs. Furthermore, the article discusses how these financial tools provide stability, improve creditworthiness, and foster opportunities for long-term growth.

Business owners are guided to choose the right financial options by evaluating their needs, financial situation, and repayment capabilities. The article emphasizes the importance of strategic planning and research to ensure the most suitable financial solution is selected. Ultimately, access to these financial resources can empower businesses to navigate challenges, embrace innovation, and achieve long-term success.

The information provided in this article is for general informational purposes only and does not constitute financial or professional advice. Readers are encouraged to conduct their own research or consult a financial advisor before making any decisions regarding financial tools, loan applications, or business planning. The strategies and financial solutions mentioned are subject to individual circumstances, creditworthiness, and lender policies.

DXB News Network does not guarantee the accuracy, completeness, or applicability of the information presented. Readers are advised to verify any financial options and terms directly with lenders or financial institutions before proceeding.

#trending #latest #SmallBusinessLoans #EntrepreneurSuccess #BusinessFunding #StartupFinance #FinancialGrowth #EntrepreneurJourney #BusinessOpportunity #LoanSolutions #CashFlowManagement #GrowYourBusiness #FinanceSupport #StartupSuccess #BusinessGoals #EconomicGrowth #SmartFinancing #BusinessDreams #breakingnews #worldnews #headlines #topstories #globalUpdate #dxbnewsnetwork #dxbnews #dxbdnn #dxbnewsnetworkdnn #bestnewschanneldubai #bestnewschannelUAE #bestnewschannelabudhabi #bestnewschannelajman #bestnewschannelofdubai #popularnewschanneldubai

Saturday’s fight at Barclays Center, New York, ended in a majority draw as judges split scores...Read More.

Simple Daily Habits to Improve your Lifestyle and Boost Well-Being...Read More.

Cleveland Clinic Saves Vision for Patient with Rare Fungal Sinus Infection

Cleveland Clinic Saves Vision for Patient with Rare Fungal Sinus Infection

Cleveland Clinic Abu Dhabi saves woman’s eye from rare fungal sinusitis with surgery

India vs New Zealand Champions Trophy 2025: Varun's 5-for seals 51-run win

India vs New Zealand Champions Trophy 2025: Varun's 5-for seals 51-run win

IND vs NZ: Varun's maiden ODI five-for helps India bowl NZ out for 205, win by 51 runs

UP Woman Facing Death in UAE: Father Seeks MEA Help, Moves Delhi HC

UP Woman Facing Death in UAE: Father Seeks MEA Help, Moves Delhi HC

Shahzadi Khan, 33, from UP's Banda, faces execution in Abu Dhabi, UAE

Theyab bin Mohamed bin Zayed mourns the loss of Ahmed Mohamed Al Suwaidi

Theyab bin Mohamed bin Zayed mourns the loss of Ahmed Mohamed Al Suwaidi

Sheikh Theyab bin Mohamed bin Zayed offers condolences on Ahmed Al Suwaidi’s passing

India's Possible Playing XI vs New Zealand: Two Big Changes Expected

India's Possible Playing XI vs New Zealand: Two Big Changes Expected

India may make two changes in their XI for the final Group A game vs New Zealand

Gervonta Davis says hair product burned his eyes in fight vs Roach Jr.

Saturday’s fight at Barclays Center, New York, ended in a majority draw as judges split scores

10 Simple Ways to Improve Your Daily Lifestyle

Simple Daily Habits to Improve your Lifestyle and Boost Well-Being

KKR name new captain, vice-captain for IPL 2025: "We are confident..."

Kolkata Knight Riders named Ajinkya Rahane as captain and Venkatesh Iyer as vice-captain for IPL 2025

GEMS Education plans $300M investment to drive growth in the UAE

Dubai-based school group is exploring acquisitions to expand its education network

Dubai Police arrest 9 beggars on first day of Ramadan in crackdown effort

The arrest is part of Dubai Police’s ‘Fight Begging’ campaign to curb illegal begging

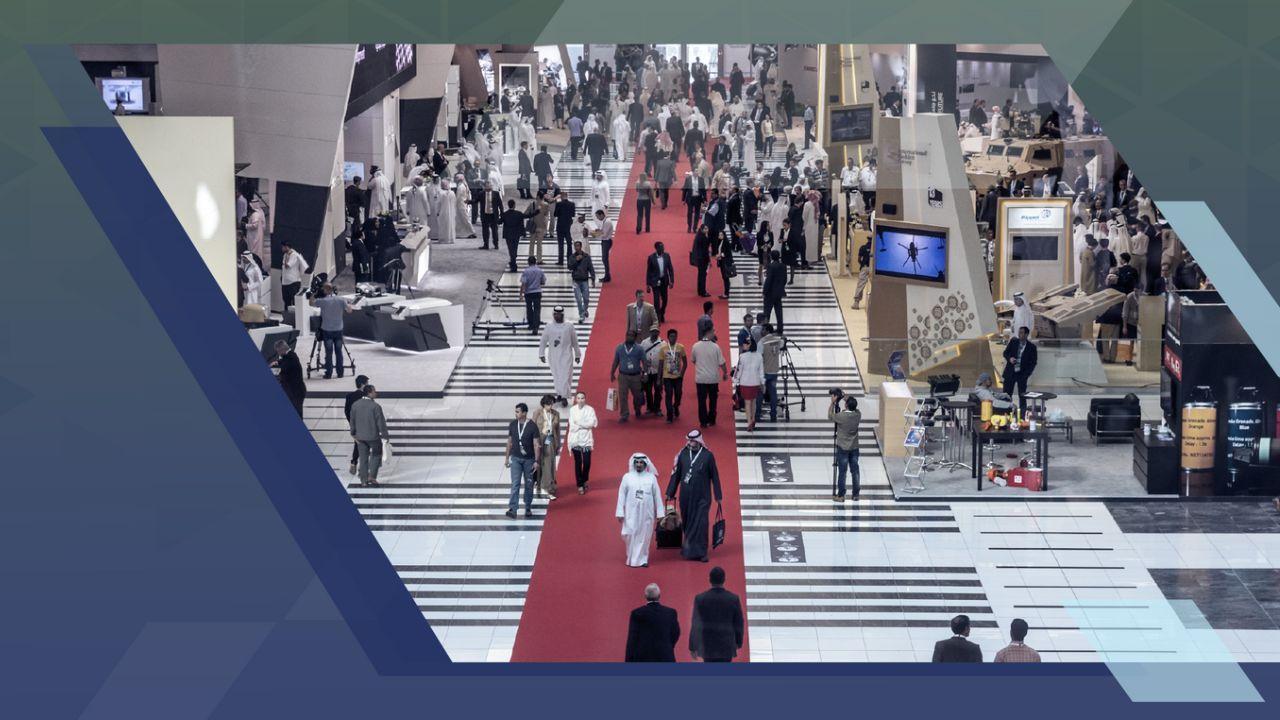

IDEX and NAVDEX 2025 set new records with highest visitor numbers

Major General Pilot Faris Khalaf Al Mazrouei said the strong participation at IDEX and NAVDEX 2025 highlights the UAE’s global reputation and progress in nation

UP woman on UAE death row executed on Feb 15, MEA tells Delhi HC

MEA said India will assist her family in traveling to Abu Dhabi for last rites on March 5

Cynthia Erivo misses EGOT title after Oscars 2025 loss; full details

Cynthia Erivo lost the Best Actress Oscar at the 97th Academy Awards, missing her chance to be the youngest EGOT winner at 38 as Mikey Madison won for Anora.

Renowned Kerala Doctor Found Dead at Farmhouse in Mysterious Circumstances

A 77-year-old top kidney transplant surgeon found hanging in his farmhouse

Joe Alwyn makes rare Oscars 2025 appearance after Taylor Swift split

Joe Alwyn surprised fans with a rare red carpet appearance at the 2025 Oscars. Read more details here

3001E, 30 Floor, Aspin Commercial Tower, Sheikh Zayed Road, Dubai, UAE

+971 52 602 2429

info@dxbnewsnetwork.com

© DNN. All Rights Reserved.