Share Market vs Stock Market: Key Differences Explained

Investing can seem complex, especially with terms like "share market" and "stock market" frequently being used in financial discussions. Many investors, both beginners and experienced, find themselves wondering about the distinction between these two terms. Although they are often used interchangeably, the Share Market vs Stock Market represents different financial concepts. Understanding these differences is essential for anyone looking to invest, trade, or gain insights into the financial landscape.

In this article, we’ll explore the nuances of the share market and stock market, their key differences, their roles in investing, and why this distinction is crucial for financial decisions.

What is the Share Market?

The share market refers to a marketplace where shares of companies are bought and sold. These shares represent ownership in a company, meaning that when you buy a share, you are purchasing a small portion of that company. The share market is essentially a subset of the stock market and focuses specifically on shares and equity-based trading.

The primary function of the share market is to allow companies to raise capital by selling ownership to the public through Initial Public Offerings (IPOs) or further share offerings. Investors, in return, gain partial ownership in the company and the chance to profit if the company's stock price increases.

The share market operates through exchanges, which are regulated and well-established platforms. Examples of major share markets include the Bombay Stock Exchange (BSE) in India, the New York Stock Exchange (NYSE) in the United States, and the London Stock Exchange (LSE) in the UK.

What is the Stock Market?

The term "stock market" is a broader concept that encompasses all markets where shares, bonds, commodities, and other financial instruments are traded. Essentially, the stock market includes multiple platforms, exchanges, and trading opportunities, with the share market being a part of it. The stock market represents the entire financial ecosystem of equity, derivatives, and other financial instruments.

The stock market is a general term that includes indices like the S&P 500, Dow Jones, Nasdaq, and other investment vehicles beyond just shares. It covers all securities, such as stocks, bonds, mutual funds, ETFs (Exchange-Traded Funds), and other assets. The primary purpose of the stock market is to create opportunities for trading and investing across a wide variety of assets, helping investors diversify their portfolios.

Key Differences Between the Share Market vs Stock Market

While the share market and stock market are interconnected, there are distinct differences that investors must understand. The first key difference is their scope. The share market focuses solely on the trading of company shares or equity, while the stock market encompasses all other financial instruments like bonds, mutual funds, derivatives, and more.

Another point of distinction is their scale. The stock market refers to a much larger, global financial system that integrates multiple financial instruments and trading platforms. In contrast, the share market is limited to trading equity and shares.

To put it simply, the share market is a subset of the broader stock market. When you invest in individual company shares, you are engaging in share market transactions. However, when you trade other investment vehicles like ETFs or bonds, you are participating in the stock market.

Additionally, the purpose of the two markets differs. The share market primarily facilitates the buying and selling of company ownership shares to fund business growth. On the other hand, the stock market allows diversification for investors by offering numerous financial instruments and options, making it easier to hedge risks and create varied investment strategies.

Why Understanding the Difference Matters

Understanding the difference between the Share Market vs Stock Market is essential for new and experienced investors alike. By knowing these distinctions, you can approach investments with more clarity, understanding the financial instruments at your disposal and the risks and opportunities they bring.

When you invest in shares (through the share market), you are betting on the future performance of individual companies. However, when trading in the stock market, investors have a diversified range of options that can reduce risk through a mix of bonds, mutual funds, commodities, or other financial instruments. Understanding which market serves your goals better can provide financial stability and strategic diversification.

Furthermore, knowing the difference can help you with better financial planning. Investors aiming to focus on long-term growth might prefer shares, while those looking for diversified risk may gravitate toward broader stock market trading options. In short, a clear distinction can lead to more informed, calculated, and successful financial decisions.

How to Approach Investing in the Share Market and Stock Market

Both the share market and stock market offer lucrative opportunities, but they require a strategy, research, and understanding of market trends. If you want to explore the share market, you’ll need to research companies whose stocks align with your goals, whether through growth potential, dividends, or other performance metrics. Understanding financial reports, company strategies, and sector trends can provide a clearer path toward selecting profitable shares.

On the other hand, participating in the stock market means focusing on a mix of financial instruments. Diversification is key in this space, and investors should weigh the risk-reward ratio of bonds, commodities, ETFs, and other trading vehicles. Trading strategies like index funds or mutual funds can help mitigate risks by spreading investments across multiple assets.

Investing in either market also requires continuous learning, monitoring market trends, and adapting strategies based on market performance. Both the share market and stock market are influenced by global events, economic trends, and geopolitical shifts. Knowledge, timely decision-making, and a well-structured financial plan are vital in achieving success in either of these markets.

Final Thoughts: Share Market vs Stock Market

The terms Share Market vs Stock Market might seem confusing at first, but once you understand their differences, they can become powerful tools in your financial journey. While the share market focuses on buying and selling ownership shares, the stock market represents a much larger, more diversified financial space that incorporates other investment vehicles like bonds, commodities, and ETFs.

Both markets provide opportunities for wealth creation, but knowing their distinct features allows investors to choose the right path based on financial goals, risk appetite, and investment timelines. Whether you choose equity trading or diversified trading strategies, the key is to educate yourself, plan thoroughly, and adapt to market changes.

By approaching both markets with knowledge and strategic planning, you can set the foundation for long-term financial growth and success.

Summary

This article explores the key differences between the share market vs stock market, two financial terms often used interchangeably but representing distinct concepts. The share market focuses on the trading of company shares, representing ownership in a business, while the stock market is a broader financial ecosystem that includes shares, bonds, ETFs, mutual funds, and other financial instruments.

The article breaks down their individual purposes, structures, and functions, emphasizing that the share market is a subset of the stock market. Understanding this difference can help investors make informed financial decisions and strategic choices. It also provides insights into investment opportunities and the benefits of diversification when trading within the broader stock market.

The comparison between these markets allows readers to determine the financial strategies that align with their goals, risk tolerance, and investment objectives. By educating yourself about these differences, you can make smarter and more strategic investment decisions.

Disclaimer

The information provided in this article is for general informational purposes only and does not constitute financial advice. Readers are encouraged to do their own research or consult financial experts before making any investment decisions. The financial terms, strategies, and concepts discussed are subject to market risks, and past performance does not guarantee future results.

DXB News Network does not ensure the accuracy, completeness, or applicability of the information. Readers are advised to consult financial institutions or experts before proceeding with any financial decisions.

#trending #latest #ShareMarket #StockMarket #InvestmentTips #FinancialEducation #TradingIdeas #MarketComparison #WealthBuilding #InvestmentStrategy #StockTrading #EquityMarket #EconomicGrowth #FinancialPlanning #InvestmentJourney #DiversifyPortfolio #MoneyManagement #TradingOpportunities #breakingnews #worldnews #headlines #topstories #globalUpdate #dxbnewsnetwork #dxbnews #dxbdnn #dxbnewsnetworkdnn #bestnewschanneldubai #bestnewschannelUAE #bestnewschannelabudhabi #bestnewschannelajman #bestnewschannelofdubai #popularnewschanneldubai

Saturday’s fight at Barclays Center, New York, ended in a majority draw as judges split scores...Read More.

Simple Daily Habits to Improve your Lifestyle and Boost Well-Being...Read More.

Cleveland Clinic Saves Vision for Patient with Rare Fungal Sinus Infection

Cleveland Clinic Saves Vision for Patient with Rare Fungal Sinus Infection

Cleveland Clinic Abu Dhabi saves woman’s eye from rare fungal sinusitis with surgery

India vs New Zealand Champions Trophy 2025: Varun's 5-for seals 51-run win

India vs New Zealand Champions Trophy 2025: Varun's 5-for seals 51-run win

IND vs NZ: Varun's maiden ODI five-for helps India bowl NZ out for 205, win by 51 runs

UP Woman Facing Death in UAE: Father Seeks MEA Help, Moves Delhi HC

UP Woman Facing Death in UAE: Father Seeks MEA Help, Moves Delhi HC

Shahzadi Khan, 33, from UP's Banda, faces execution in Abu Dhabi, UAE

Theyab bin Mohamed bin Zayed mourns the loss of Ahmed Mohamed Al Suwaidi

Theyab bin Mohamed bin Zayed mourns the loss of Ahmed Mohamed Al Suwaidi

Sheikh Theyab bin Mohamed bin Zayed offers condolences on Ahmed Al Suwaidi’s passing

India's Possible Playing XI vs New Zealand: Two Big Changes Expected

India's Possible Playing XI vs New Zealand: Two Big Changes Expected

India may make two changes in their XI for the final Group A game vs New Zealand

Gervonta Davis says hair product burned his eyes in fight vs Roach Jr.

Saturday’s fight at Barclays Center, New York, ended in a majority draw as judges split scores

10 Simple Ways to Improve Your Daily Lifestyle

Simple Daily Habits to Improve your Lifestyle and Boost Well-Being

KKR name new captain, vice-captain for IPL 2025: "We are confident..."

Kolkata Knight Riders named Ajinkya Rahane as captain and Venkatesh Iyer as vice-captain for IPL 2025

GEMS Education plans $300M investment to drive growth in the UAE

Dubai-based school group is exploring acquisitions to expand its education network

Dubai Police arrest 9 beggars on first day of Ramadan in crackdown effort

The arrest is part of Dubai Police’s ‘Fight Begging’ campaign to curb illegal begging

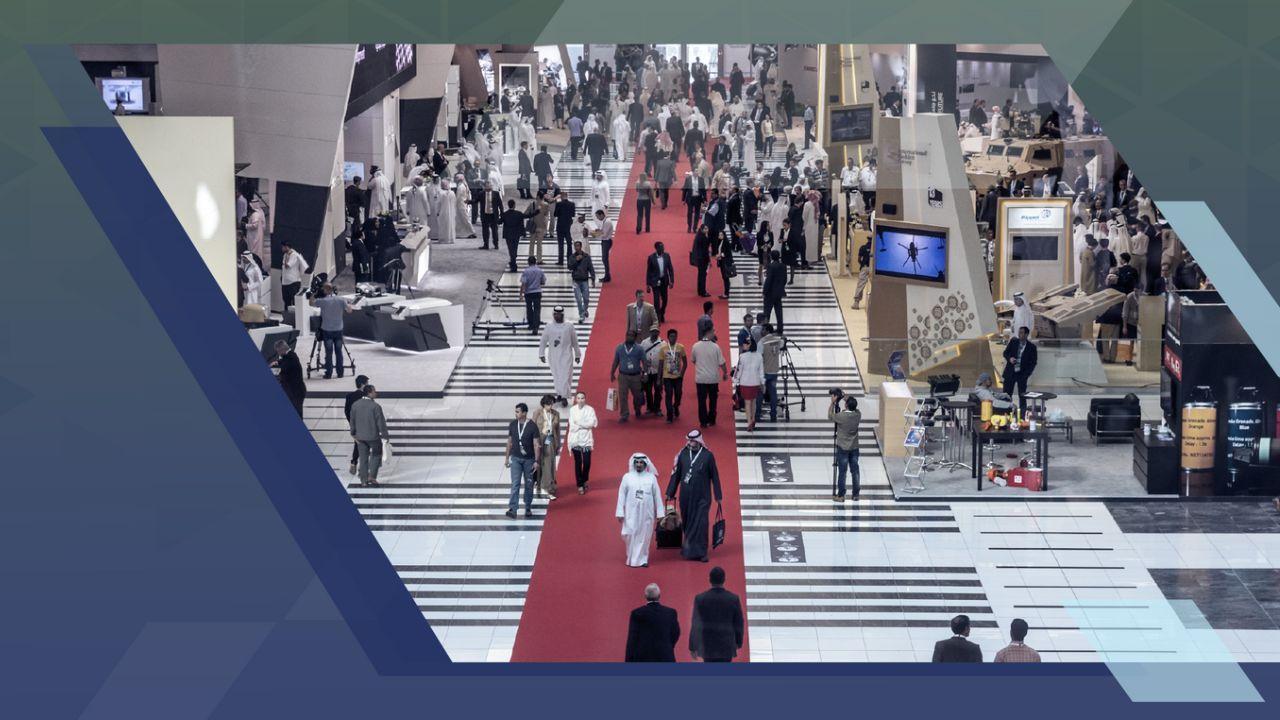

IDEX and NAVDEX 2025 set new records with highest visitor numbers

Major General Pilot Faris Khalaf Al Mazrouei said the strong participation at IDEX and NAVDEX 2025 highlights the UAE’s global reputation and progress in nation

UP woman on UAE death row executed on Feb 15, MEA tells Delhi HC

MEA said India will assist her family in traveling to Abu Dhabi for last rites on March 5

Cynthia Erivo misses EGOT title after Oscars 2025 loss; full details

Cynthia Erivo lost the Best Actress Oscar at the 97th Academy Awards, missing her chance to be the youngest EGOT winner at 38 as Mikey Madison won for Anora.

Renowned Kerala Doctor Found Dead at Farmhouse in Mysterious Circumstances

A 77-year-old top kidney transplant surgeon found hanging in his farmhouse

Joe Alwyn makes rare Oscars 2025 appearance after Taylor Swift split

Joe Alwyn surprised fans with a rare red carpet appearance at the 2025 Oscars. Read more details here

3001E, 30 Floor, Aspin Commercial Tower, Sheikh Zayed Road, Dubai, UAE

+971 52 602 2429

info@dxbnewsnetwork.com

© DNN. All Rights Reserved.