The Securities and Exchange Board of India (SEBI) has taken a bold step by banning Anil Ambani and 24 other entities from the securities market. This action is significant and has grabbed everyone's attention in India's financial world.

Anil Ambani, a well-known businessman, along with 24 other entities, is now barred from trading or investing in the securities market. This means they can't buy or sell shares for five years, which is a big deal in the finance world.

The ban is due to serious issues related to market regulations. SEBI found that these entities were involved in activities that broke the rules, prompting this strong response to ensure fair play in the market.

Anil Ambani’s business operations will face restrictions because of this ban. Similarly, the 24 other entities will also have their market activities closely watched, affecting how they conduct business in the securities market.

This decision highlights SEBI’s commitment to keeping India’s securities market fair and transparent. By imposing such a ban, SEBI aims to prevent future rule-breaking and boost investor confidence in the market.

Anil Ambani and the other banned entities might appeal SEBI's decision, leading to potential legal proceedings. How this situation unfolds will be closely watched by everyone involved in the financial sector.

SEBI, which is the Securities and Exchange Board of India, has decided to ban Anil Ambani and 24 other entities from the securities market. This means they can't trade or invest in stocks and securities for five years. This ban is a serious step taken by SEBI to protect the market and ensure fairness.

The ban was imposed due to major issues found during investigations. Anil Ambani and the other entities were involved in activities that went against market rules. SEBI found that these actions were serious enough to need a big penalty like this ban.

For the next five years, Anil Ambani and the 24 entities cannot buy or sell any securities. This affects their ability to participate in the stock market. They won’t be able to make trades or investments in stocks, bonds, or other financial products.

This ban is important because it helps keep the securities market fair. By taking such strong actions, SEBI is showing that it will not tolerate rule-breaking. This helps keep the market safe for everyone who invests and trades.

Anil Ambani and the other banned entities might try to appeal the decision or take legal action. This could lead to more developments and changes in how the case is handled. The outcome will be important for understanding how SEBI's actions affect market participants.

Anil Ambani, one of India’s well-known business figures, faces major disruptions in his financial activities. Being barred from the securities market means he cannot buy or sell shares, bonds, or other investments. This could impact his business operations and limit his ability to raise funds through the stock market.

The ban will affect Anil Ambani's financial portfolio, potentially reducing his investment opportunities and altering his financial strategy. Without the ability to engage in securities trading, his ability to manage and grow his wealth through these avenues is significantly curtailed.

The 24 other entities affected by this ban include various companies and individuals. For these entities, the restrictions mean they will not be able to trade or invest in the securities market. This could impact their business operations, financial stability, and overall market presence.

Both Anil Ambani and the other banned entities might face legal and financial challenges as they navigate the implications of SEBI’s decision. They may need to find alternative ways to manage their investments and address any legal disputes that arise from the ban.

Anil Ambani’s absence from the market could influence investor sentiment and market dynamics. His notable role in the financial sector means his exclusion might affect market trends and investor confidence, at least in the short term.

The five-year ban means that Anil Ambani and the other entities will need to explore new opportunities outside the securities market. This might lead to shifts in their business strategies and a focus on different sectors or investment avenues.

SEBI's decision to ban Anil Ambani and 24 others is crucial for protecting fairness in the securities market. By taking action against those who break the rules, SEBI helps keep the trading environment level for everyone. This ban ensures that no one gains an unfair advantage, which is important for maintaining trust among all investors and market participants.

When SEBI takes strong measures against market rule-breakers, it helps build confidence among investors. Knowing that the regulators are watching and will act against misconduct makes investors feel safer and more secure. This trust is essential for the healthy growth of the financial markets and encourages more people to invest responsibly.

The ban serves as a clear warning to others in the market. It shows that SEBI is serious about enforcing its regulations and that violations will not be tolerated. This can discourage other individuals and entities from trying to manipulate or cheat in the market, leading to a more honest and transparent trading environment.

Ensuring that everyone follows the rules is key to keeping the securities market reliable and trustworthy. SEBI’s actions help uphold the integrity of the market, making sure that all trades and transactions are conducted properly and transparently. This helps in creating a stable and orderly market, which is beneficial for the entire economy.

The impact of this ban may be seen in how market participants behave in the future. With such a strong stance from SEBI, businesses and investors might be more careful and ethical in their trading practices. This could lead to a healthier market overall, where everyone plays by the same set of rules.

Anil Ambani and the 24 other entities affected by the ban might challenge SEBI’s decision. These appeals could lead to a series of legal proceedings that will determine if the ban remains in place or if adjustments are made. The outcome of these appeals will be closely followed, as it could impact how such cases are handled in the future.

The ban might influence how other businesses and investors operate in the securities market. Companies and individuals may become more cautious, ensuring they follow all regulations to avoid similar consequences. This shift could lead to improved compliance and transparency in market practices.

SEBI’s decision sets a precedent for how serious violations are handled. It emphasizes the importance of adhering to market regulations and could lead to stricter enforcement of rules. Other regulators might take note and adopt similar measures to maintain the integrity of financial markets.

While the ban aims to protect market integrity, it might initially cause some uncertainty among investors. However, in the long run, this decision could bolster investor confidence as it demonstrates that regulatory bodies are active and effective in addressing market misconduct.

SEBI will likely continue to monitor the affected entities closely. This oversight will ensure that the ban's terms are enforced and that there are no further violations. The ongoing monitoring will be crucial in maintaining the trust and fairness of the securities market.

SEBI Bans Anil Ambani and 24 Others from Securities Market for 5 Years

The Securities and Exchange Board of India (SEBI) has imposed a significant ban on Anil Ambani and 24 other entities, prohibiting them from participating in the securities market for five years. This decisive action is in response to serious regulatory breaches discovered during investigations. The ban affects their ability to trade or invest in stocks, bonds, and other financial instruments, impacting their business operations and financial strategies.

Key Points:

Disclaimer by DXB News Network:

The information provided in this article is based on the latest updates and reports available. Readers should note that developments may occur, and the details in this article could change over time. For the most current information and further updates, please refer to official sources or SEBI’s announcements. The DXB News Network strives to provide accurate and timely news but is not responsible for any decisions made based on this information.

SEBI banned Anil Ambani and 24 other entities due to serious violations of market regulations. These violations included activities that went against the rules governing the securities market, prompting SEBI to take strong action to ensure fairness and transparency.

The ban imposed by SEBI is for a period of five years. During this time, Anil Ambani and the 24 other entities are prohibited from trading or investing in the securities market.

The ban will significantly impact Anil Ambani and the other entities by restricting their ability to buy or sell shares, bonds, and other securities. This will affect their business operations and financial strategies, limiting their participation in the market.

Yes, Anil Ambani and the other banned entities have the option to appeal SEBI's decision. Such appeals could lead to further legal proceedings, which might affect the outcome of the ban.

SEBI’s decision is crucial for maintaining fairness and integrity in the securities market. By imposing the ban, SEBI demonstrates its commitment to enforcing regulations and preventing rule violations, which helps build investor trust and ensures a level playing field.

SEBI Ban, Anil Ambani Securities Ban, Market Regulation Enforcement, Securities Market Penalty, Financial Market Rules, SEBI Enforcement Actions, Entities Banned by SEBI, Securities Market Integrity, Investment Restrictions, SEBI Regulatory Measures, Financial Market Fairness, Business Impact of SEBI Ban, Market Trading Restrictions, Securities Market Compliance, Legal Appeals SEBI Ban

#trending #latest #SEBIBan #AnilAmbani #SecuritiesMarket #MarketRegulations #FinancialNews #IndiaFinance #MarketIntegrity #TradingBan #InvestingRules #FinanceUpdates #StockMarket #MarketFairness #RegulatoryActions #InvestorConfidence #FinancialRegulations #SEBIActions #MarketWatch #BusinessNews #FinancialIntegrity #SEBIUpdates #breakingnews #worldnews #headlines #topstories #globalUpdate #dxbnewsnetwork #dxbnews #dxbdnn #dxbnewsnetworkdnn #bestnewschanneldubai #bestnewschannelUAE #bestnewschannelabudhabi #bestnewschannelajman #bestnewschannelofdubai #popularnewschanneldubai

Sheikh Dr. Sultan bin Mohammed Al Qasimi, Ruler of Sharjah, has issued an Emiri Decree to establish and organize the Sharjah Creative Quarter (SCQ)...Read More.

Ruling BJP and allies proposed 23 changes to the Waqf Amendment Bill, while the opposition suggested 44, but none were accepted...Read More.

Taylor Swift Stuns in ₹4.5 Lakh Louis Vuitton Jacket at Travis Kelce's Match

Taylor Swift Stuns in ₹4.5 Lakh Louis Vuitton Jacket at Travis Kelce's Match

Taylor Swift's Louis Vuitton jacket stole the spotlight as she cheered for boyfriend Travis Kelce du

Gulf Giants Secure Six-Wicket Victory Over Sharjah Warriorz

Gulf Giants Secure Six-Wicket Victory Over Sharjah Warriorz

Tom Alsop played a brilliant knock, scoring an unbeaten 85 to lead Gulf Giants to a stunning six-wic

Dubai's Real Estate Market Stays Among the World’s Best: Hamdan bin Mohammed

Dubai's Real Estate Market Stays Among the World’s Best: Hamdan bin Mohammed

Dubai’s real estate sector sees AED761B in transactions and 2.78M procedures in 2024

Tamer Ashour & Adam to Perform at Al Majaz Amphitheatre on February 15

Tamer Ashour & Adam to Perform at Al Majaz Amphitheatre on February 15

Tamer Ashour & Adam to perform at Al Majaz Amphitheatre on Feb 15, promising a captivating night

Keys Stuns Sabalenka to Win First Grand Slam Title

Keys Stuns Sabalenka to Win First Grand Slam Title

Madison Keys defeated top seed Aryna Sabalenka 6-3, 2-6, 7-5 to win her first Grand Slam title at th

Sharjah Ruler Approves Creation of Sharjah Creative Quarter

Sheikh Dr. Sultan bin Mohammed Al Qasimi, Ruler of Sharjah, has issued an Emiri Decree to establish and organize the Sharjah Creative Quarter (SCQ)

2 Non-Muslim Members Among 14 Changes in Waqf Amendment Bill

Ruling BJP and allies proposed 23 changes to the Waqf Amendment Bill, while the opposition suggested 44, but none were accepted

Exploring Dubai's Art and Culture Beyond the Skyscrapers

Discover Dubai's vibrant art and culture beyond its famous skyline.

Drug Kingpin Arrested After Wife's Social Media Reveals Location

Rodriguez shared photos at landmarks like the Eiffel Tower and Trevi Fountain, attracting DEA agents monitoring the couple's online movements

Thousands Return to North Gaza for 1st Time Since War as Israel Opens Crossings

After news of open crossings, tens of thousands of Gazans started walking north on Monday morning, carrying their belongings

Taylor Swift Stuns in ₹4.5 Lakh Louis Vuitton Jacket at Travis Kelce's Match

Taylor Swift's Louis Vuitton jacket stole the spotlight as she cheered for boyfriend Travis Kelce during the AFC Championship game

Anushka Sharma Stuns in Yellow Lehenga Worth ₹1.6 Lakh

Anushka Sharma is radiating elegance in her yellow lehenga designed by Mahima Mahajan. The stunning outfit exudes royal charm and costs ₹1.6 lakh, leaving every

Palestinian Voices Shine at Sundance Film Festival 2025

Palestinian-American director Cherien Dabis, set to shoot her personal drama *All That’s Left Of You* in the West Bank, was forced to reconsider her plans after

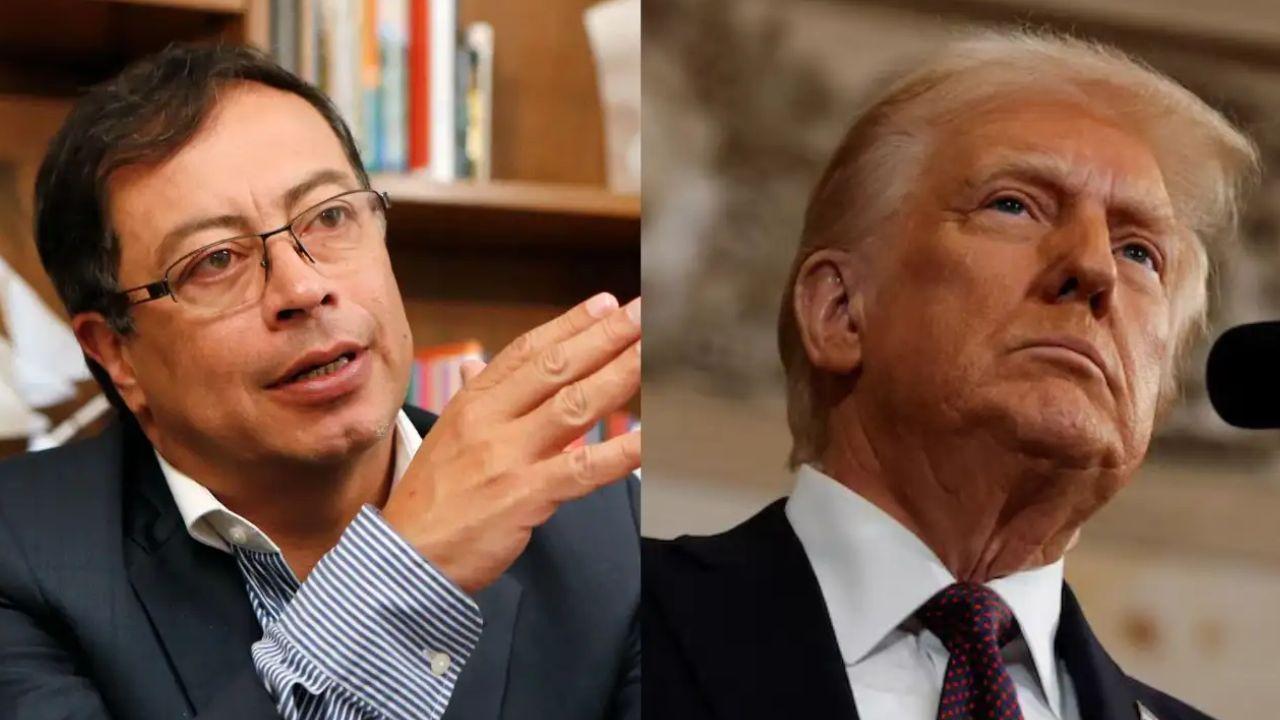

Colombia Reverses Deportation Decision After Trump’s Threats

Colombia agrees to accept deported citizens after Trump's tariff threat on Sunday, reversing defiance to US plans

From Underdogs to Winners: Amazing Comebacks in Sports

Discover inspiring sports comebacks where underdogs triumphed

3001E, 30 Floor, Aspin Commercial Tower, Sheikh Zayed Road, Dubai, UAE

+971 52 602 2429

info@dxbnewsnetwork.com

© DNN. All Rights Reserved.