In an increasingly interconnected world, geopolitical events significantly impact global markets, influencing investor sentiment and behavior. From trade wars to political unrest, these developments can create ripple effects that affect everything from stock prices to commodity values. This article explores how recent geopolitical events are reshaping investor confidence and what trends we can expect moving forward.

Geopolitical risk refers to the potential for political events to affect economic stability. Factors such as government policies, international relations, and regional conflicts can create uncertainty in the markets. Investors must continuously monitor these risks to make informed decisions about where to allocate their resources, as geopolitical developments can lead to swift market reactions.

Recent trade tensions, particularly between the United States and China, have led to increased volatility in the stock market. Tariffs and trade restrictions affect supply chains, raise production costs, and ultimately impact consumer prices. This uncertainty causes investors to reassess their strategies, often leading to cautious approaches that prioritize stability over growth. As companies navigate these challenges, investor confidence can wane, prompting a shift in market dynamics.

Regions experiencing political instability can see significant fluctuations in their markets. For example, conflicts in the Middle East often lead to spikes in oil prices, affecting energy stocks globally. Investors typically react by diversifying their portfolios or moving assets into safe havens, such as gold or government bonds. The reactions to political unrest highlight how interconnected global markets are, as investor sentiment can shift rapidly based on unfolding events.

Environmental, Social, and Governance (ESG) factors are becoming increasingly important to investors. Geopolitical events that highlight social injustices or environmental crises can drive investor interest toward companies with strong ESG practices. As more investors prioritize sustainability, businesses that align with these values may experience enhanced confidence and market performance. This shift towards responsible investing underscores the changing landscape of global finance.

The COVID-19 pandemic exposed vulnerabilities in global supply chains, causing businesses to rethink their operations. Geopolitical tensions further exacerbate these issues, as companies face challenges in sourcing materials from politically unstable regions. Investors are now more cautious, favoring companies that demonstrate resilience and adaptability in their supply chains. This trend toward diversifying supply sources is essential for maintaining investor confidence amid uncertainty.

Geopolitical events can lead to currency fluctuations, influencing investor confidence in specific markets. For instance, a strengthening dollar can make U.S. exports more expensive, impacting companies that rely on international sales. Investors must remain vigilant, adjusting their strategies based on currency trends and potential economic fallout. Awareness of these fluctuations is crucial for making informed investment decisions.

This article explores the significant impact of geopolitical events on global market dynamics and investor confidence. It delves into various aspects of geopolitical risk, including the effects of trade wars, political instability, and the rise of Environmental, Social, and Governance (ESG) investing. The piece highlights how currency fluctuations and global supply chain disruptions influence investor behavior, urging investors to remain adaptable in the face of uncertainty. By understanding these trends, investors can make informed decisions and better navigate the complexities of today's financial landscape.

The information provided in this article is for informational purposes only and does not constitute financial advice. While efforts have been made to ensure the accuracy of the content, the author and publisher do not guarantee its completeness or reliability. Investors are encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions. The author is not responsible for any financial losses or damages arising from the use of this information.

Geopolitical risk, global market trends, investor confidence, trade wars, political instability, ESG investing, currency fluctuations, global supply chain disruptions, stock market volatility, economic stability, investment strategies, safe havens, sustainable investing, economic uncertainty, financial markets, diversifying portfolios, international relations, market dynamics, risk assessment, financial advisory

#trending #latest #GeopoliticalRisk, #GlobalMarketTrends, #InvestorConfidence, #TradeWars, #PoliticalInstability, #ESGInvesting, #CurrencyFluctuations, #SupplyChainDisruptions, #StockMarketVolatility, #EconomicStability, #InvestmentStrategies, #SustainableInvesting, #EconomicUncertainty, #FinancialMarkets, #DiversifyYourPortfolio, #InternationalRelations, #MarketDynamics, #RiskAssessment, #FinancialAdvisory #dxbnewsnetwork #dxbnews #dxbdnn #dxbnewsnetworkdnn #bestnewschanneldubai #bestnewschannelUAE #bestnewschannelabudhabi #bestnewschannelajman #bestnewschannelofdubai #popularnewschanneldubai

His Highness Sheikh Dr Sultan bin Mohammed Al Qasimi attended the 34th Sharjah Theatre Days closing...Read More.

The Role of Jewelry in Empowering Women...Read More.

Cleveland Clinic Abu Dhabi sees 35% rise in international patients in 2024

Cleveland Clinic Abu Dhabi sees 35% rise in international patients in 2024

The hospital saw more demand for heart, eye, nerve, and kidney care, with patients from Kuwait, Saud

Michelle Trachtenberg, Buffy the Vampire Slayer Star, Passes Away

Michelle Trachtenberg, Buffy the Vampire Slayer Star, Passes Away

Michelle Trachtenberg, known for Buffy the Vampire Slayer and Gossip Girl, has passed away at 39

Louvre Abu Dhabi launches 5th Art Here & Richard Mille Art Prize

Louvre Abu Dhabi launches 5th Art Here & Richard Mille Art Prize

Louvre Abu Dhabi's Art Here 2025 explores light, shadow, and shared Gulf-Japan traditions

Chelsea Crush Southampton, Aston Villa Lose to Crystal Palace in CL Race

Chelsea Crush Southampton, Aston Villa Lose to Crystal Palace in CL Race

Chelsea secured a 3-0 lead in the first half with goals from Nkunku, Neto, and Colwill, marking thei

Sharjah Crown Prince presides over Executive Council meeting

Sharjah Crown Prince presides over Executive Council meeting

HH Sheikh Sultan bin Mohammed chaired Sharjah's Executive Council meeting Tuesday

Sultan Al Qasimi attends 34th Sharjah Theatre Days closing ceremony

His Highness Sheikh Dr Sultan bin Mohammed Al Qasimi attended the 34th Sharjah Theatre Days closing

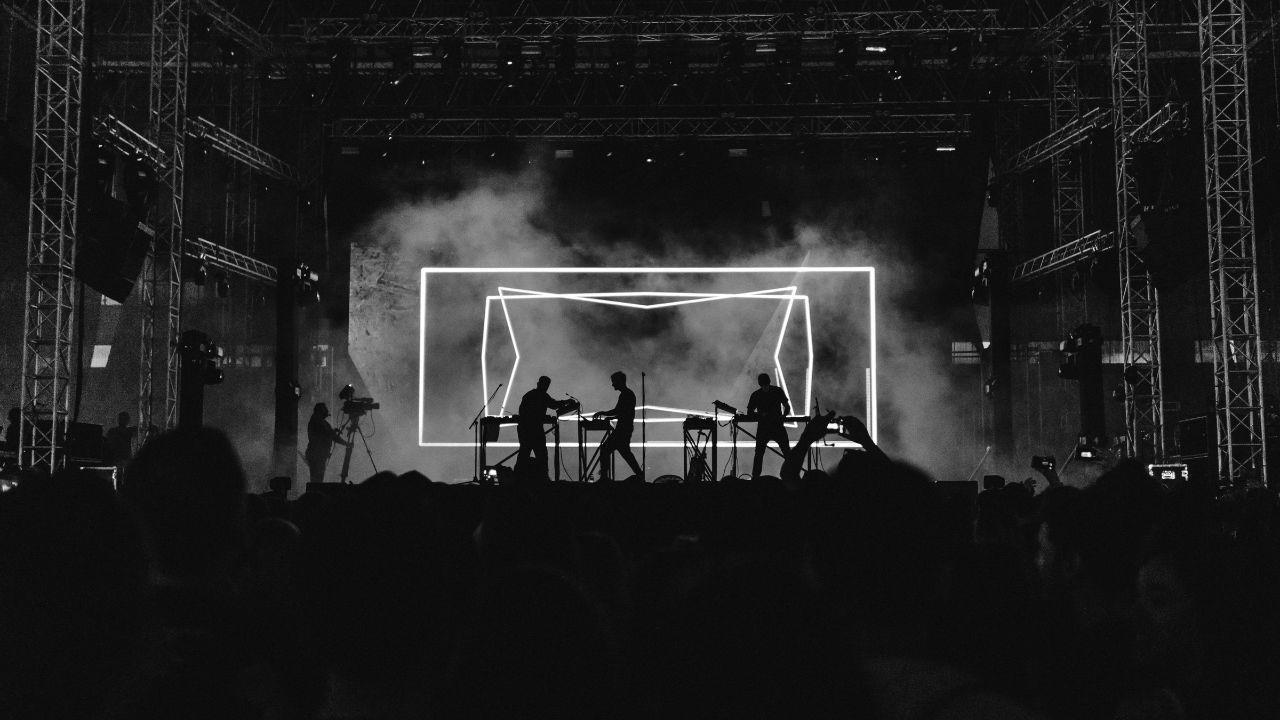

Discover the hottest artists redefining music in 2025

Cleveland Clinic Abu Dhabi sees 35% rise in international patients in 2024

The hospital saw more demand for heart, eye, nerve, and kidney care, with patients from Kuwait, Saudi Arabia, Pakistan, Bahrain, and the USA traveling to Abu Dh

Sultan bin Ahmed Al Qasimi attends Xposure International closing

His Highness Sheikh Sultan bin Ahmed Al Qasimi attended the closing of Xposure’s 9th edition, a global event that welcomed over 30,000 attendees, celebrating ph

Top Music Releases and Tours Happening Right Now

Discover the hottest music releases and must-see tours today

Wizz Air to launch nonstop flights from London to Madinah soon

Starting August 2, Wizz Air will run seven weekly flights using A321 XLR aircraft with 239 seats

Competitive Sports Trends That Athletes Should Know in 2025

Key sports trends in 2025 to help athletes improve performance

Dubai real estate prices fall for the first time in two years

Property Monitor's monthly report shows a 4.6% drop in sales volume compared to December 2024

Israel refuses Gaza pullout, putting ceasefire deal at risk

Hamas stated that Israel can only secure the release of remaining hostages through talks and truce

3001E, 30 Floor, Aspin Commercial Tower, Sheikh Zayed Road, Dubai, UAE

+971 52 602 2429

info@dxbnewsnetwork.com

© DNN. All Rights Reserved.