Navigating the mortgage landscape in the UAE can be a daunting task for both first-time homebuyers and seasoned investors. The financial implications of purchasing a home are significant, making it crucial to have a thorough understanding of the mortgage process. This UAE mortgage guide: key questions to ask will equip you with the information you need to make informed decisions and ensure a smooth home-buying experience.

Before diving into specific questions, it's important to grasp the basics of mortgages in the UAE. A mortgage is essentially a loan provided by a bank or financial institution to help individuals purchase real estate. The property itself serves as collateral. Mortgages in the UAE typically come with varying terms, interest rates, and repayment plans. Knowing the fundamental concepts will allow you to engage more effectively in discussions with lenders and understand the various offers available.

One of the first questions to consider is about the different types of mortgages available in the UAE. The most common options include fixed-rate mortgages, where the interest rate remains the same throughout the loan period, and variable-rate mortgages, where the interest rate can fluctuate based on market conditions. Additionally, you may encounter Islamic mortgages, which comply with Sharia law and have unique features compared to traditional mortgages. Understanding these types will help you determine which option aligns best with your financial situation and long-term goals.

Eligibility criteria are vital when considering a mortgage. Different lenders have varying requirements, but common factors include your income level, credit score, age, and residency status. As a general rule, banks in the UAE prefer that your monthly mortgage payment does not exceed 30-40% of your monthly income. Additionally, foreign nationals might face stricter regulations, especially when it comes to property ownership and mortgage terms. Asking about eligibility requirements early in the process can save you time and help you set realistic expectations for your mortgage journey.

Understanding the costs associated with a mortgage is crucial for effective budgeting. In addition to the property price, you should consider additional expenses such as the down payment, which typically ranges from 20% to 25% of the property's value, and associated fees like valuation, registration, and legal charges. Furthermore, inquire about any ongoing costs, such as insurance and maintenance fees. A comprehensive understanding of these expenses will ensure you are financially prepared for homeownership and avoid any unpleasant surprises later on.

Determining how much you can borrow is a key component of the mortgage process. Lenders will assess your financial profile, including income, expenses, and credit history, to establish your borrowing capacity. It's advisable to ask your lender for a pre-approval, which provides a clearer picture of your budget and strengthens your position when negotiating with sellers. This step can also save you time by narrowing down your property search to homes within your financial reach.

Every mortgage comes with its own set of terms and conditions that can significantly impact your financial obligations. Important factors include the loan tenure, interest rate, and repayment options. For instance, while a longer loan tenure may lower your monthly payments, it can increase the total interest paid over time. Additionally, inquire about any penalties for early repayment or additional fees for late payments. Understanding these terms will help you make informed decisions and select a mortgage that best suits your financial needs.

The mortgage application process can vary significantly between lenders, so it's essential to ask about the steps involved. Typically, the process involves submitting your financial documents, undergoing a credit assessment, and providing details about the property you wish to purchase. Some lenders may require additional information, such as proof of employment or tax documents. Familiarizing yourself with the application process will help you prepare the necessary documents and streamline your experience.

With numerous banks and financial institutions offering mortgages in the UAE, comparing lenders is crucial. Start by asking potential lenders about their interest rates, loan terms, and any special offers they may have. It's also wise to consider customer service and the overall reputation of the lender. Online reviews, recommendations from friends or family, and consultations with mortgage brokers can provide valuable insights. A thorough comparison will empower you to choose a lender that aligns with your financial goals and offers a positive borrowing experience.

Mortgage insurance is another critical aspect to consider. In some cases, lenders may require you to purchase mortgage insurance if your down payment is below a certain threshold. This insurance protects the lender in case of default but can add to your overall monthly payment. Understanding whether you need mortgage insurance and how it affects your financial commitment is essential. Don't hesitate to ask lenders about their policies regarding mortgage insurance and how it can impact your mortgage costs.

In this UAE mortgage guide: key questions to ask, we learn about important things to think about when getting a mortgage in the UAE. First, it’s essential to know what types of mortgages are available, such as fixed-rate and variable-rate mortgages, as well as Islamic mortgages. Next, you need to understand your eligibility, which depends on things like your income and credit score. The UAE mortgage guide: key questions to ask reminds us to check all the costs involved, like down payments and extra fees, to make sure we can afford the mortgage.

Another key point is figuring out how much money you can borrow, which will help you find the right home for your budget. You should also pay attention to the terms and conditions of the mortgage, as they can affect your payments in the long run. Knowing the application process helps you prepare better, and comparing different lenders ensures you get the best deal. Lastly, the UAE mortgage guide: key questions to ask discusses mortgage insurance, which is sometimes needed if your down payment is low. Understanding all these aspects will make the home-buying process easier and more enjoyable.

The information provided in this UAE mortgage guide: key questions to ask is for educational purposes only. We want to help everyone understand how mortgages work in the UAE. However, it's essential to talk to a financial expert or mortgage advisor before making any decisions about buying a home. They can give you personalized advice based on your specific situation. Always make sure to do your own research and think carefully before signing any mortgage agreements.

UAE mortgage, mortgage guide, key questions to ask, mortgage eligibility, types of mortgages, fixed-rate mortgage, variable-rate mortgage, Islamic mortgage, mortgage costs, down payment, borrowing capacity, mortgage terms, mortgage application process, compare lenders, mortgage insurance, home buying process, financial advice, property ownership, mortgage offers, homeownership journey.

#trending #latest #UAEMortgage, #MortgageGuide, #KeyQuestions, #MortgageEligibility, #TypesOfMortgages, #FixedRateMortgage, #VariableRateMortgage, #IslamicMortgage, #MortgageCosts, #DownPayment, #BorrowingCapacity, #MortgageTerms, #MortgageApplication, #CompareLenders, #MortgageInsurance, #HomeBuying, #FinancialAdvice, #PropertyOwnership, #MortgageOffers, #HomeownershipJourney #breakingnews #worldnews #headlines #topstories #globalUpdate #dxbnewsnetwork #dxbnews #dxbdnn #dxbnewsnetworkdnn #bestnewschanneldubai #bestnewschannelUAE #bestnewschannelabudhabi #bestnewschannelajman #bestnewschannelofdubai #popularnewschanneldubai

Saturday’s fight at Barclays Center, New York, ended in a majority draw as judges split scores...Read More.

Simple Daily Habits to Improve your Lifestyle and Boost Well-Being...Read More.

Cleveland Clinic Saves Vision for Patient with Rare Fungal Sinus Infection

Cleveland Clinic Saves Vision for Patient with Rare Fungal Sinus Infection

Cleveland Clinic Abu Dhabi saves woman’s eye from rare fungal sinusitis with surgery

India vs New Zealand Champions Trophy 2025: Varun's 5-for seals 51-run win

India vs New Zealand Champions Trophy 2025: Varun's 5-for seals 51-run win

IND vs NZ: Varun's maiden ODI five-for helps India bowl NZ out for 205, win by 51 runs

UP Woman Facing Death in UAE: Father Seeks MEA Help, Moves Delhi HC

UP Woman Facing Death in UAE: Father Seeks MEA Help, Moves Delhi HC

Shahzadi Khan, 33, from UP's Banda, faces execution in Abu Dhabi, UAE

Theyab bin Mohamed bin Zayed mourns the loss of Ahmed Mohamed Al Suwaidi

Theyab bin Mohamed bin Zayed mourns the loss of Ahmed Mohamed Al Suwaidi

Sheikh Theyab bin Mohamed bin Zayed offers condolences on Ahmed Al Suwaidi’s passing

India's Possible Playing XI vs New Zealand: Two Big Changes Expected

India's Possible Playing XI vs New Zealand: Two Big Changes Expected

India may make two changes in their XI for the final Group A game vs New Zealand

Gervonta Davis says hair product burned his eyes in fight vs Roach Jr.

Saturday’s fight at Barclays Center, New York, ended in a majority draw as judges split scores

10 Simple Ways to Improve Your Daily Lifestyle

Simple Daily Habits to Improve your Lifestyle and Boost Well-Being

KKR name new captain, vice-captain for IPL 2025: "We are confident..."

Kolkata Knight Riders named Ajinkya Rahane as captain and Venkatesh Iyer as vice-captain for IPL 2025

GEMS Education plans $300M investment to drive growth in the UAE

Dubai-based school group is exploring acquisitions to expand its education network

Dubai Police arrest 9 beggars on first day of Ramadan in crackdown effort

The arrest is part of Dubai Police’s ‘Fight Begging’ campaign to curb illegal begging

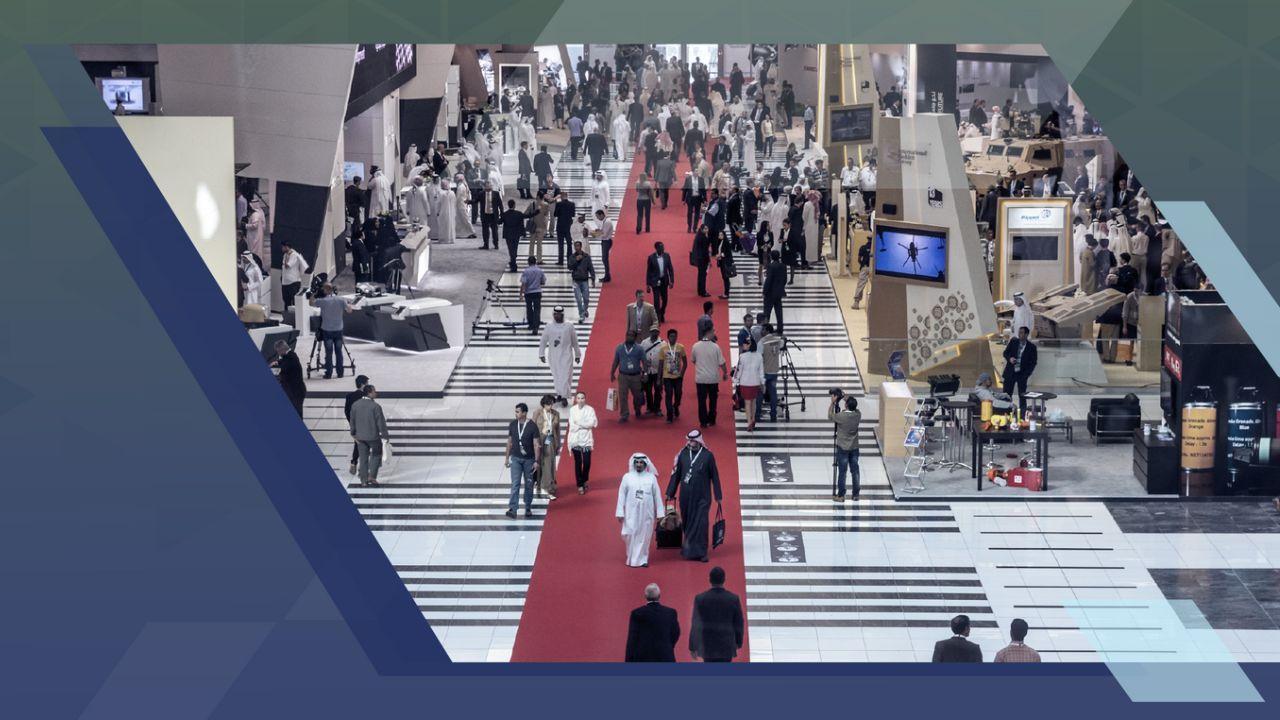

IDEX and NAVDEX 2025 set new records with highest visitor numbers

Major General Pilot Faris Khalaf Al Mazrouei said the strong participation at IDEX and NAVDEX 2025 highlights the UAE’s global reputation and progress in nation

UP woman on UAE death row executed on Feb 15, MEA tells Delhi HC

MEA said India will assist her family in traveling to Abu Dhabi for last rites on March 5

Cynthia Erivo misses EGOT title after Oscars 2025 loss; full details

Cynthia Erivo lost the Best Actress Oscar at the 97th Academy Awards, missing her chance to be the youngest EGOT winner at 38 as Mikey Madison won for Anora.

Renowned Kerala Doctor Found Dead at Farmhouse in Mysterious Circumstances

A 77-year-old top kidney transplant surgeon found hanging in his farmhouse

Joe Alwyn makes rare Oscars 2025 appearance after Taylor Swift split

Joe Alwyn surprised fans with a rare red carpet appearance at the 2025 Oscars. Read more details here

3001E, 30 Floor, Aspin Commercial Tower, Sheikh Zayed Road, Dubai, UAE

+971 52 602 2429

info@dxbnewsnetwork.com

© DNN. All Rights Reserved.