Managing your money effectively is essential for developing a strong and secure financial future. However, even tiny financial mistakes can have long-term consequences. Many people, particularly those who are new to managing their finances, make mistakes that can prevent them from reaching their financial objectives. Everyone should think about avoiding financial mistakes in order to have a better financial future. Whether you're just getting started or looking to better your existing financial status, avoiding these mistakes can help you save more money, decrease stress, and plan for a more secure future.

In this article, we’ll explore some of the most common financial mistakes people make and provide tips on how to avoid them. By understanding these mistakes, you can make better choices and set yourself on the right path for financial success.

One of the most common financial mistakes people make is not creating a budget. A budget helps you track your income and costs, allowing you to know where your money is going and avoid overspending. Without a budget, it's simple to spend more than you make, leading to debt and financial hardship.

Start by tracking your income and expenses for a month. Make sure to include all your regular payments, such as rent, utilities, and groceries, as well as occasional costs, like entertainment or dining out. Then, set limits for each category and stick to them. Use a simple budgeting app or spreadsheet to help you stay on track.

Another typical mistake is not saving money for emergencies. Emergencies can occur at any time, such as an unexpected auto repair, medical bills, or job loss. If you don't have an emergency fund, you may have to use credit cards or loans to meet these costs, which can lead to further debt.

Aim to save at least three to six months' worth of living expenses in an easily accessible savings account. This will give you peace of mind knowing that you have a safety net in case of an emergency. Start small and gradually build your emergency fund over time.

Many people make the mistake of carrying high-interest debt, like credit card debt, for an extended length of time. Credit cards frequently have high interest rates, and if you only make the minimal payments, your debt will soon accumulate. This can make it more difficult to meet other financial goals, such as saving for retirement or purchasing a home.

If you have credit card debt, make it a goal to repay it as soon as possible. Pay off the loan with the highest interest rate first, while making minimal payments on the others. Once that is paid off, proceed to the next one. Avoid using credit cards for things that you cannot afford to repay in full each month.

Many people make the mistake of waiting too long to start saving for retirement. The earlier you start saving for retirement, the more time your money has to grow through compound interest. If you wait until later in life to start, you may find it harder to catch up.

Start saving for retirement as soon as you can, even if it’s just a small amount each month. Take advantage of employer-sponsored retirement plans, like a 401(k), if available. If your employer offers a match, try to contribute enough to get the full match—it’s essentially free money for your retirement. If you don’t have access to a 401(k), consider opening an IRA (Individual Retirement Account).

Living beyond your means is a financial mistake that can quickly lead to financial trouble. This happens when you spend more money than you earn, relying on credit cards or loans to cover the gap. It might feel good in the short term, but it can lead to long-term debt and financial stress.

Live within your means by keeping your expenses lower than your income. Avoid unnecessary purchases and focus on what truly matters. Be mindful of your spending and make sure you're saving for both short-term goals (like vacations or a new car) and long-term goals (like buying a home or retirement).

Some people make the mistake of failing to check their finances on a regular basis. It is easy to overlook your financial status until a problem emerges, but doing so can result in missed opportunities to enhance your financial health.

Make a habit of checking your accounts on a frequent basis. Check your budget, savings, and investments to make sure you're on track. Set financial objectives and track your progress towards them. If something isn't working, make changes to keep on track. Regularly monitoring your money will keep you in control and prevent surprises.

Failing to plan for taxes is another financial mistake that can catch people off guard. If you don’t understand how much you’ll owe in taxes, it can lead to financial surprises and stress during tax season. This is especially true for people who are self-employed or have multiple sources of income.

Set aside money for taxes throughout the year so you’re not left scrambling when it’s time to file your tax return. Consider working with a tax professional to ensure you’re paying the right amount and taking advantage of any available tax deductions or credits. If you’re self-employed, make sure to keep track of your income and expenses for tax purposes.

This article discusses the financial mistakes to avoid for a stronger financial future. It covers essential topics like budgeting, building an emergency fund, avoiding high-interest debt, and starting retirement savings early. The article emphasizes the importance of living within your means, tracking your financial progress, and planning for taxes. By avoiding these common financial errors, you can set yourself up for financial success and create a secure future for yourself. Simple changes in your financial habits today can have a significant positive impact on your future.

The content provided by DXB News Network is for general informational purposes only. It is not intended to serve as financial advice or guidance. Always consult with a professional financial advisor or expert before making any decisions related to your personal finances. DXB News Network does not guarantee the accuracy or completeness of the information and is not responsible for any actions taken based on this content.

#trending #latest #FinancialMistakes #BudgetingTips #PersonalFinance #FinancialSuccess #MoneyManagement #RetirementPlanning #DebtManagement #SaveMoney #FinancialGoals #SmartMoneyMoves #FinancialPlanning #WealthBuilding #FinancialAdvice #FinancialFreedom #breakingnews #worldnews #headlines #topstories #globalUpdate #dxbnewsnetwork #dxbnews #dxbdnn #dxbnewsnetworkdnn #bestnewschanneldubai #bestnewschannelUAE #bestnewschannelabudhabi #bestnewschannelajman #bestnewschannelofdubai #popularnewschanneldubai

Saturday’s fight at Barclays Center, New York, ended in a majority draw as judges split scores...Read More.

Simple Daily Habits to Improve your Lifestyle and Boost Well-Being...Read More.

Cleveland Clinic Saves Vision for Patient with Rare Fungal Sinus Infection

Cleveland Clinic Saves Vision for Patient with Rare Fungal Sinus Infection

Cleveland Clinic Abu Dhabi saves woman’s eye from rare fungal sinusitis with surgery

India vs New Zealand Champions Trophy 2025: Varun's 5-for seals 51-run win

India vs New Zealand Champions Trophy 2025: Varun's 5-for seals 51-run win

IND vs NZ: Varun's maiden ODI five-for helps India bowl NZ out for 205, win by 51 runs

UP Woman Facing Death in UAE: Father Seeks MEA Help, Moves Delhi HC

UP Woman Facing Death in UAE: Father Seeks MEA Help, Moves Delhi HC

Shahzadi Khan, 33, from UP's Banda, faces execution in Abu Dhabi, UAE

Theyab bin Mohamed bin Zayed mourns the loss of Ahmed Mohamed Al Suwaidi

Theyab bin Mohamed bin Zayed mourns the loss of Ahmed Mohamed Al Suwaidi

Sheikh Theyab bin Mohamed bin Zayed offers condolences on Ahmed Al Suwaidi’s passing

India's Possible Playing XI vs New Zealand: Two Big Changes Expected

India's Possible Playing XI vs New Zealand: Two Big Changes Expected

India may make two changes in their XI for the final Group A game vs New Zealand

Gervonta Davis says hair product burned his eyes in fight vs Roach Jr.

Saturday’s fight at Barclays Center, New York, ended in a majority draw as judges split scores

10 Simple Ways to Improve Your Daily Lifestyle

Simple Daily Habits to Improve your Lifestyle and Boost Well-Being

KKR name new captain, vice-captain for IPL 2025: "We are confident..."

Kolkata Knight Riders named Ajinkya Rahane as captain and Venkatesh Iyer as vice-captain for IPL 2025

GEMS Education plans $300M investment to drive growth in the UAE

Dubai-based school group is exploring acquisitions to expand its education network

Dubai Police arrest 9 beggars on first day of Ramadan in crackdown effort

The arrest is part of Dubai Police’s ‘Fight Begging’ campaign to curb illegal begging

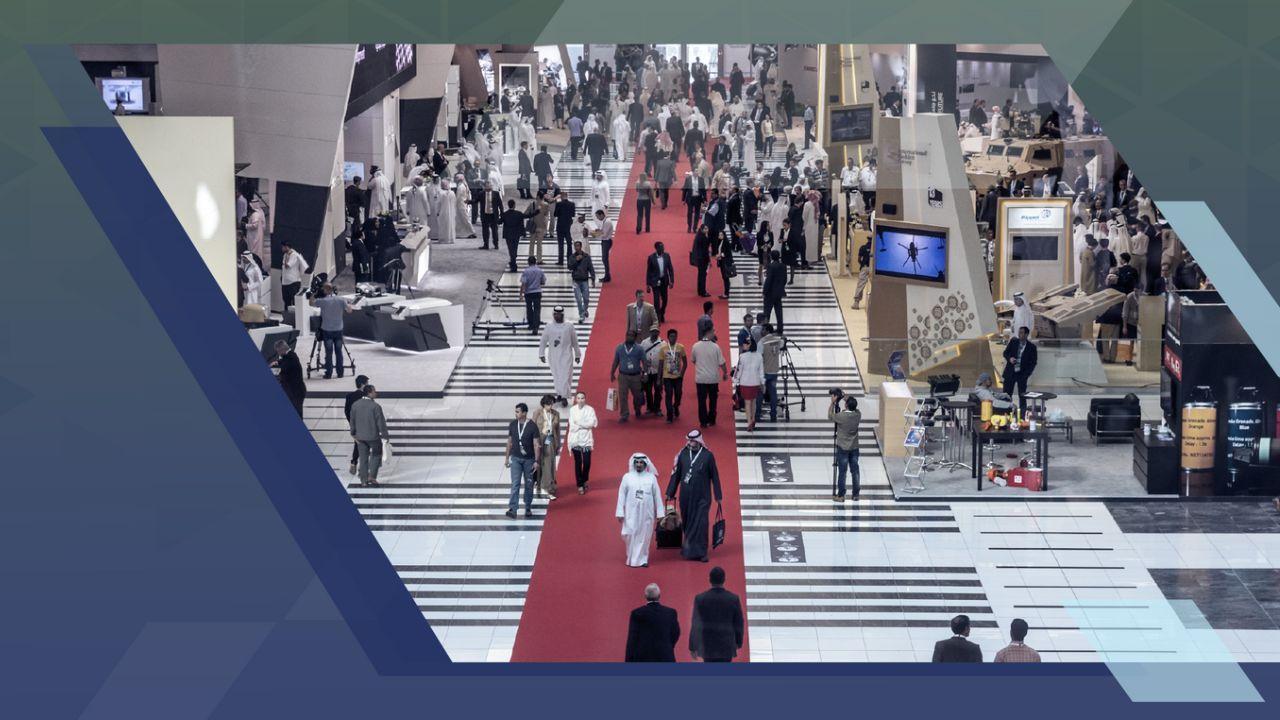

IDEX and NAVDEX 2025 set new records with highest visitor numbers

Major General Pilot Faris Khalaf Al Mazrouei said the strong participation at IDEX and NAVDEX 2025 highlights the UAE’s global reputation and progress in nation

UP woman on UAE death row executed on Feb 15, MEA tells Delhi HC

MEA said India will assist her family in traveling to Abu Dhabi for last rites on March 5

Cynthia Erivo misses EGOT title after Oscars 2025 loss; full details

Cynthia Erivo lost the Best Actress Oscar at the 97th Academy Awards, missing her chance to be the youngest EGOT winner at 38 as Mikey Madison won for Anora.

Renowned Kerala Doctor Found Dead at Farmhouse in Mysterious Circumstances

A 77-year-old top kidney transplant surgeon found hanging in his farmhouse

Joe Alwyn makes rare Oscars 2025 appearance after Taylor Swift split

Joe Alwyn surprised fans with a rare red carpet appearance at the 2025 Oscars. Read more details here

3001E, 30 Floor, Aspin Commercial Tower, Sheikh Zayed Road, Dubai, UAE

+971 52 602 2429

info@dxbnewsnetwork.com

© DNN. All Rights Reserved.