Post by : Bianca Qureshi

Dubai, UAE – September 2, 2025: Nasdaq Dubai, the region’s international financial exchange, has officially welcomed the listing of a USD 500 million Sukuk issued by Binghatti Holding, one of Dubai’s leading property developers. This listing highlights both the growing popularity of Islamic finance instruments and the confidence investors have in Dubai-based companies.

The Sukuk was issued under Binghatti Holding’s USD 1.5 billion Trust Certificate Issuance Programme. With a maturity set for 2030, this latest issuance drew significant attention from both regional and international investors. In fact, it was oversubscribed by five times, meaning that the total orders received from investors reached more than USD 2.5 billion. This strong interest allowed Binghatti to price the Sukuk at a profit rate of 8.125%, which is notably tighter than the initial guidance offered to investors.

Stay informed with the latest news. Follow DXB News Network on WhatsApp Channel

Marking the Occasion

The listing was celebrated in a traditional market opening ceremony. Muhammad BinGhatti, Chairman of Binghatti Holding, rang the opening bell at Nasdaq Dubai. He was joined by Hamed Ali, CEO of Nasdaq Dubai and Dubai Financial Market (DFM), reflecting the importance of this milestone. The Sukuk is also listed on the London Stock Exchange, giving it further global exposure.

Muhammad BinGhatti expressed his satisfaction, saying, “The successful listing of our USD 500 million Sukuk on Nasdaq Dubai marks another important milestone in Binghatti’s growth journey. The strong demand for our latest Sukuk shows the confidence that both regional and international investors place in our financial strength and long-term vision.”

Hamed Ali, CEO of Nasdaq Dubai and DFM, added, “We are pleased to welcome Binghatti’s latest Sukuk listing on Nasdaq Dubai. This listing highlights the sustained global demand for Islamic finance instruments and the strong appeal of Dubai as a capital markets hub. At Nasdaq Dubai, we remain committed to providing issuers with a platform to connect with a diverse investor base.”

The Importance of Sukuk in Islamic Finance

Sukuk are financial certificates similar to bonds but compliant with Islamic law, which prohibits the payment or receipt of interest. Instead, Sukuk provide returns to investors through profit-sharing arrangements. This makes them a popular choice for investors in the Middle East and globally, as they offer a Shariah-compliant way to invest in projects or companies.

The listing of Binghatti’s Sukuk further strengthens Nasdaq Dubai’s position as a global hub for Islamic finance. With this latest addition, Binghatti’s total Sukuk listings on Nasdaq Dubai have now reached USD 1 billion, reflecting the company’s confidence in the exchange and its ability to attract a wide range of investors.

Record Demand for Binghatti’s Sukuk

The USD 500 million Sukuk issued by Binghatti Holding attracted more than USD 2.5 billion in orders, which is five times the initial amount offered. Oversubscription like this is a clear sign that investors are highly confident in the company’s growth and stability. It also indicates the strong appeal of Dubai-based investments in the global financial market.

Pricing the Sukuk at a profit rate of 8.125% shows that Binghatti was able to meet investor expectations while successfully raising the capital it sought. This competitive profit rate demonstrates the balance between offering attractive returns to investors and ensuring financial efficiency for the company.

Dubai as a Global Finance Hub

Dubai continues to strengthen its reputation as a leading financial hub in the Middle East. Nasdaq Dubai plays a critical role in this ecosystem by offering a platform where both regional and international investors can participate in Shariah-compliant investment opportunities.

Currently, Nasdaq Dubai’s total Sukuk listings amount to USD 98.6 billion across 108 different listings. This makes it one of the world’s leading exchanges for Sukuk and Islamic finance instruments. The sustained growth of the Sukuk market in Dubai reflects not only investor confidence but also the region’s increasing influence in global financial markets.

Binghatti Holding’s Growth Journey

Binghatti Holding is known for its innovative and high-quality property developments in Dubai. The company’s successful issuance of multiple Sukuk shows that it is gaining strong support from the financial community. With total Sukuk listings now reaching USD 1 billion, Binghatti is clearly demonstrating its ability to manage large-scale financial projects and attract substantial investment.

This latest Sukuk issuance is part of Binghatti’s broader Trust Certificate Issuance Programme, which aims to raise funds for ongoing and future developments. By listing its Sukuk on both Nasdaq Dubai and the London Stock Exchange, Binghatti ensures that it reaches a diverse investor base, increasing visibility and enhancing trust.

The Role of Investors

The oversubscription of the Sukuk indicates that investors are increasingly seeking stable, Shariah-compliant investment opportunities. Regional and international investors alike were eager to participate, showing strong confidence in Binghatti’s financial management and the company’s future projects.

Such investor interest benefits both the company and the financial market. For Binghatti, it means access to necessary capital to expand operations and develop new projects. For Nasdaq Dubai, it strengthens its reputation as a reliable and global platform for Islamic finance.

Future Prospects

The successful listing of this Sukuk demonstrates that Dubai remains a highly attractive destination for capital investment. With ongoing support from strong companies like Binghatti Holding and a vibrant investor base, Nasdaq Dubai is expected to continue playing a central role in the growth of Islamic finance globally.

In addition, the rising demand for Shariah-compliant financial instruments signals a promising future for Sukuk and other Islamic investment products. Companies in Dubai and the broader Middle East can leverage this growing market to fund projects and foster economic growth while maintaining compliance with Islamic financial principles.

The listing of Binghatti Holding’s USD 500 million Sukuk on Nasdaq Dubai is more than just a financial milestone. It reflects investor confidence in Dubai’s economy, the growing appeal of Islamic finance, and the strong position of Nasdaq Dubai as a global exchange.

With strong demand, a profitable issuance rate, and dual listing on both Nasdaq Dubai and the London Stock Exchange, this Sukuk showcases the continued growth and potential of Dubai-based companies in the global market. As Binghatti continues its growth journey, investors and market watchers will be closely following future developments, confident in the company’s vision and Dubai’s thriving financial landscape.

Singapore Imposes SAF Levy to Boost Sustainable Aviation Fuel

Singapore will charge a new levy on flights to fund sustainable aviation fuel, supporting cleaner ai

Trump Blames Maryland Governor Over Potomac Sewage Spill

Trump criticizes Maryland Gov. Wes Moore for slow response to Potomac River sewage spill, while fede

Sheikh Mohamed bin Zayed Wishes Peace for Lunar New Year

UAE President Sheikh Mohamed bin Zayed wishes peace and prosperity for Lunar New Year, with celebrat

UAE Makes Winter Olympics Debut with Astridge & Hudson

Alex Astridge and Piera Hudson became the first UAE athletes at Winter Olympics 2026, inspiring the

Elana Meyers Taylor Wins Olympic Gold, Makes History at 41

Elana Meyers Taylor becomes the oldest U.S. woman to win Olympic gold in monobob, securing her sixth

Gold Dips as Dollar Gains After Strong Previous Session

Gold slips 0.4% to $5,020 amid dollar strength after a 2.5% gain. Silver, platinum fall, while palla

Nasdaq Dubai Hits Record Sukuk Listings, $146B Outstanding

Nasdaq Dubai saw record Sukuk listings in 2025, with $146B outstanding and $30.6B in new debt, stren

UAE Gold Prices Today, Monday 16 February 2026: Dubai & Abu Dhabi Updated Rates

Gold prices in UAE on 16 Feb 2026 updated: 24K around AED 599.75/gm, 22K AED 555.25/gm, and 18K AED

Over 25 Ahmedabad Schools Receive Bomb Threat Email, Authorities Investigate

More than 25 schools in Ahmedabad evacuated after bomb threat emails mentioning Khalistan. Authoriti

Ukraine Ex-Energy Minister Arrested in Corruption Case

Ukraine’s anti-corruption agency NABU arrested former Energy Minister German Galushchenko while he t

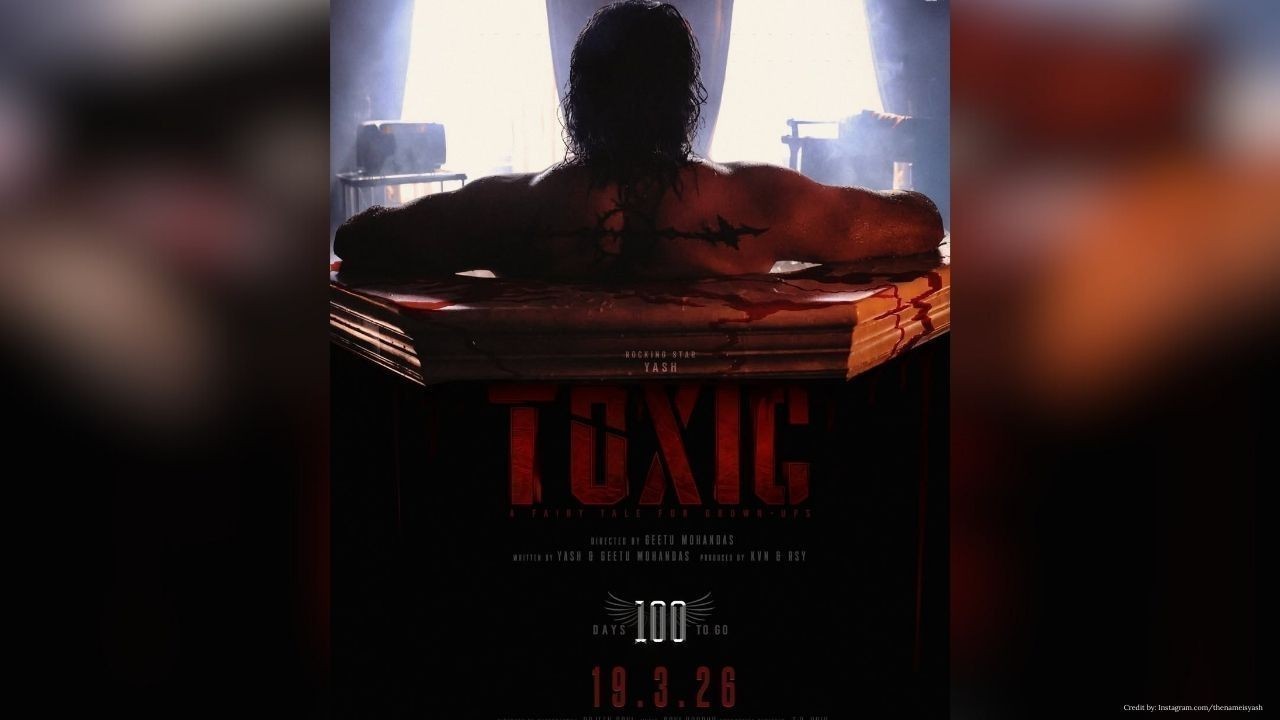

Toxic: A Fairy Tale for Grown-Ups set for worldwide release on March 19, 2026

Toxic: A Fairy Tale for Grown-Ups starring Yash releases worldwide on March 19, 2026, with festive t

Suryakumar Dedicates T20 World Cup Win as India Crush Pakistan by 61 Runs

India defeated Pakistan by 61 runs in the T20 World Cup. Suryakumar Yadav praised Ishan Kishan’s 77

Dhurandhar 2 set to storm theatres on March 19, 2026

Dhurandhar 2, titled Dhurandhar: The Revenge, releases in theatres on March 19, 2026 with a pan-Indi

Dubai Games 2026 Concludes Celebrating Teamwork and Triumph

Dubai Games 2026 ends with Ajman Government, F3, and Czarny Dunajec winning top titles as 1,600 athl

Sheikh Hamdan Honours Arab Hope Maker with AED3 Million Awards

Sheikh Hamdan crowns Fouzia Mahmoudi Arab Hope Maker, awarding AED3 million to top finalists for hum