Tax planning is an essential part of personal finance, and when done effectively, it can help you maximize your savings with effective tax planning. Whether you’re an individual or a business owner, understanding the ins and outs of tax strategy can make a significant difference in your financial outlook. In this article, we’ll explore practical steps and tips to help you make the most of your money while reducing your taxable income.

Tax planning is more than just filing your taxes on time—it’s about making smart decisions throughout the year to minimize your tax burden. When you plan effectively, you can lower the amount of income that is subject to taxation, helping you keep more of your hard-earned money. This approach not only ensures that you are compliant with tax laws but also helps you retain more income, which can be directed into savings, investments, and future goals. Maximizing your savings with effective tax planning involves a strategy of careful, year-round attention to how your financial actions impact your tax obligations.

One of the most powerful tools in tax planning is the use of tax-advantaged accounts. These include options like 401(k)s, IRAs, and Health Savings Accounts (HSAs), which offer various tax benefits to help you reduce your taxable income. For instance, contributions to a 401(k) plan are typically made before tax, lowering your taxable income for the year. Similarly, traditional IRA contributions can be tax-deductible, which further reduces your taxable income. On the other hand, Roth IRAs offer tax-free withdrawals in retirement, although contributions are made with after-tax dollars. HSAs, meanwhile, allow you to save for medical expenses while benefiting from tax-free withdrawals when used for qualified medical costs. By strategically utilizing these accounts, you can maximize your savings with effective tax planning, allowing your money to grow more efficiently over time.

Tax deductions and credits are invaluable for reducing your tax liability. Deductions reduce the amount of income subject to taxation, while credits directly lower the amount of tax you owe. Common deductions include those for mortgage interest, student loan interest, and charitable donations. These deductions can substantially reduce your taxable income, making them a powerful tool in your overall tax strategy. In addition to deductions, tax credits are even more beneficial because they reduce your tax liability on a dollar-for-dollar basis. For example, the Earned Income Tax Credit (EITC) provides financial relief for low to moderate-income earners, and the Child Tax Credit offers savings for families with children. By carefully managing and tracking eligible deductions and credits, you can maximize your savings with effective tax planning and ensure you’re not overpaying on your taxes.

Capital gains are the profits you make from selling assets like stocks, bonds, or real estate. Depending on how long you hold these assets before selling, the tax rate on capital gains can vary. Long-term capital gains, for assets held over a year, are typically taxed at a lower rate than short-term capital gains, which are taxed as ordinary income. One effective strategy for maximizing your savings with effective tax planning is to hold onto investments for the long term, thereby qualifying for the more favorable tax rates. Additionally, if you’ve experienced losses on some of your investments, you can offset these losses against your gains in a strategy known as tax-loss harvesting. This allows you to reduce your taxable income, potentially lowering the amount of taxes you owe. By managing when and how you sell your investments, you can ensure that your capital gains are taxed at the most favorable rate possible.

Choosing the right investments can also play a crucial role in maximizing your savings with effective tax planning. Certain investments generate income that is taxed at a lower rate, which can significantly impact your overall tax strategy. For instance, municipal bonds are a tax-efficient investment, as the interest they generate is often exempt from federal taxes. Additionally, index funds are another tax-efficient choice, as they generally have lower turnover compared to actively managed funds. This results in fewer taxable events and less exposure to capital gains taxes. By carefully selecting investments that align with your tax strategy, you can minimize your taxable income and enhance your after-tax returns.

While many individuals can benefit from understanding the basics of tax planning, consulting a tax professional can provide significant advantages. A certified tax advisor can help you navigate the complexities of the tax code, ensuring that you are taking full advantage of deductions, credits, and other tax-saving opportunities. Moreover, tax professionals can offer tailored advice based on your unique financial situation, helping you make the most informed decisions throughout the year. Whether you are an individual taxpayer or a business owner, working with an expert can be a game-changer in maximizing your savings with effective tax planning and optimizing your overall financial plan.

For business owners, tax planning is even more critical. Business taxes are often more complicated than individual taxes, but with the right strategies, business owners can significantly reduce their tax burden. Deducting business-related expenses such as office supplies, travel, and equipment can lower your taxable income. Additionally, incorporating your business can provide opportunities to take advantage of tax-deferred growth in retirement accounts, potentially lowering your tax rate. A well-executed tax strategy for business owners ensures that you’re not only maximizing savings but also improving cash flow and enhancing the overall financial health of your business.

In conclusion, effective tax planning is an essential element of any successful financial strategy. By utilizing tax-advantaged accounts, making the most of deductions and credits, and choosing investments with favorable tax treatment, you can significantly reduce your tax burden. Whether you are an individual taxpayer or a business owner, the right tax planning can help you retain more of your income, allowing you to build savings faster and achieve long-term financial stability. By proactively managing your taxes, you can ensure that you are doing everything possible to maximize your savings with effective tax planning and secure a brighter financial future.

In this article, we learned how to maximize your savings with effective tax planning. By using tax-advantaged accounts like 401(k)s and IRAs, you can lower the amount of money taxed and keep more of your earnings. You can also reduce your tax bill with effective tax planning by taking advantage of tax deductions and credits like the Earned Income Tax Credit or Child Tax Credit. Smart investment choices like municipal bonds and holding assets for longer periods can also help you maximize your savings with effective tax planning. Additionally, understanding how capital gains work and making wise decisions about when to sell your investments can save you money. Working with a tax professional can also help you plan better and make the most of effective tax planning. Business owners can also benefit by using tax strategies to save more. In the end, maximizing your savings with effective tax planning helps you keep more of your money and build savings for the future.

Disclaimer: The information provided in this article is for general informational purposes only and is not intended as financial advice. Readers should consult with a tax professional or financial advisor to tailor a plan that suits their specific needs. The content is provided by dxb news network.

Maximize Your Savings with Effective Tax Planning, Tax Planning, Tax-Advantaged Accounts, 401(k), IRAs, Tax Deductions, Tax Credits, Capital Gains, Tax-Loss Harvesting, Tax-Efficient Investments, Municipal Bonds, Index Funds, Tax Professional, Tax Strategy, Business Owners

#trending #latest #MaximizeYourSavingsWithEffectiveTaxPlanning #TaxPlanning #TaxAdvantagedAccounts #401k #IRAs #TaxDeductions #TaxCredits #CapitalGains #TaxLossHarvesting #TaxEfficientInvestments #MunicipalBonds #IndexFunds #TaxProfessional #TaxStrategy #BusinessOwners #breakingnews #worldnews #headlines #topstories #globalUpdate #dxbnewsnetwork #dxbnews #dxbdnn #dxbnewsnetworkdnn #bestnewschanneldubai #bestnewschannelUAE #bestnewschannelabudhabi #bestnewschannelajman #bestnewschannelofdubai #popularnewschanneldubai

Saturday’s fight at Barclays Center, New York, ended in a majority draw as judges split scores...Read More.

Simple Daily Habits to Improve your Lifestyle and Boost Well-Being...Read More.

Cleveland Clinic Saves Vision for Patient with Rare Fungal Sinus Infection

Cleveland Clinic Saves Vision for Patient with Rare Fungal Sinus Infection

Cleveland Clinic Abu Dhabi saves woman’s eye from rare fungal sinusitis with surgery

India vs New Zealand Champions Trophy 2025: Varun's 5-for seals 51-run win

India vs New Zealand Champions Trophy 2025: Varun's 5-for seals 51-run win

IND vs NZ: Varun's maiden ODI five-for helps India bowl NZ out for 205, win by 51 runs

UP Woman Facing Death in UAE: Father Seeks MEA Help, Moves Delhi HC

UP Woman Facing Death in UAE: Father Seeks MEA Help, Moves Delhi HC

Shahzadi Khan, 33, from UP's Banda, faces execution in Abu Dhabi, UAE

Theyab bin Mohamed bin Zayed mourns the loss of Ahmed Mohamed Al Suwaidi

Theyab bin Mohamed bin Zayed mourns the loss of Ahmed Mohamed Al Suwaidi

Sheikh Theyab bin Mohamed bin Zayed offers condolences on Ahmed Al Suwaidi’s passing

India's Possible Playing XI vs New Zealand: Two Big Changes Expected

India's Possible Playing XI vs New Zealand: Two Big Changes Expected

India may make two changes in their XI for the final Group A game vs New Zealand

Gervonta Davis says hair product burned his eyes in fight vs Roach Jr.

Saturday’s fight at Barclays Center, New York, ended in a majority draw as judges split scores

10 Simple Ways to Improve Your Daily Lifestyle

Simple Daily Habits to Improve your Lifestyle and Boost Well-Being

KKR name new captain, vice-captain for IPL 2025: "We are confident..."

Kolkata Knight Riders named Ajinkya Rahane as captain and Venkatesh Iyer as vice-captain for IPL 2025

GEMS Education plans $300M investment to drive growth in the UAE

Dubai-based school group is exploring acquisitions to expand its education network

Dubai Police arrest 9 beggars on first day of Ramadan in crackdown effort

The arrest is part of Dubai Police’s ‘Fight Begging’ campaign to curb illegal begging

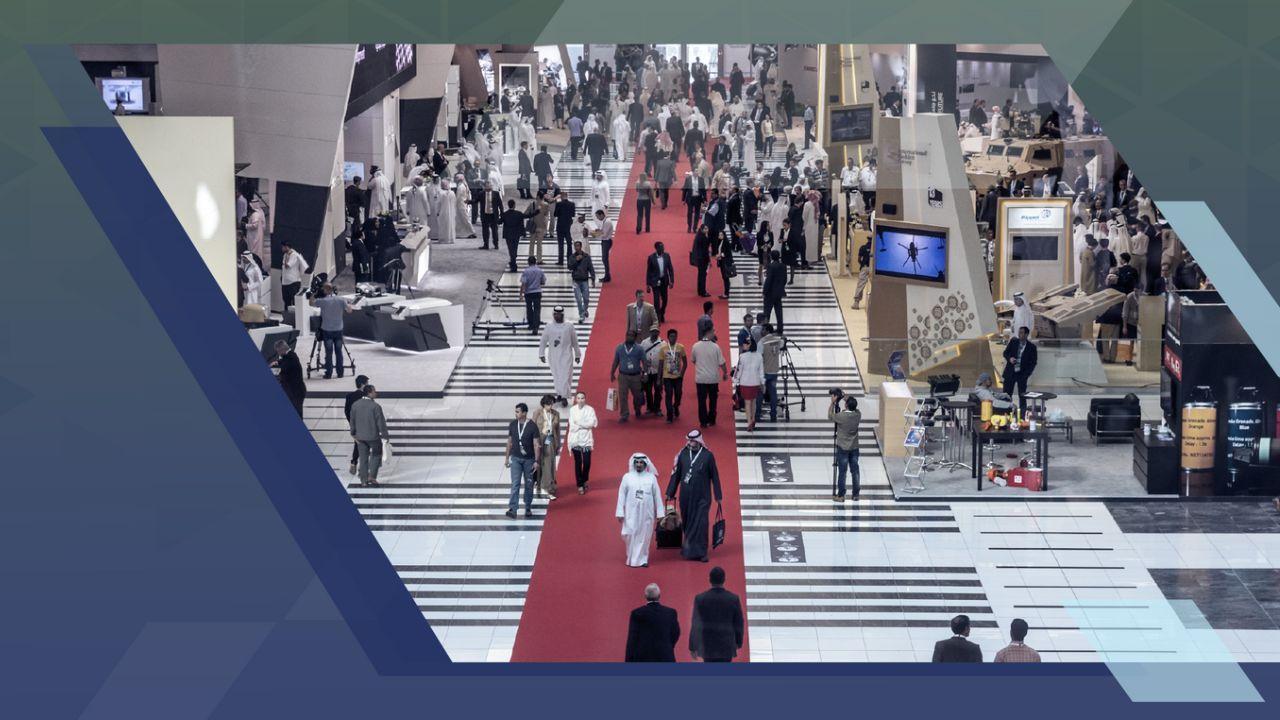

IDEX and NAVDEX 2025 set new records with highest visitor numbers

Major General Pilot Faris Khalaf Al Mazrouei said the strong participation at IDEX and NAVDEX 2025 highlights the UAE’s global reputation and progress in nation

UP woman on UAE death row executed on Feb 15, MEA tells Delhi HC

MEA said India will assist her family in traveling to Abu Dhabi for last rites on March 5

Cynthia Erivo misses EGOT title after Oscars 2025 loss; full details

Cynthia Erivo lost the Best Actress Oscar at the 97th Academy Awards, missing her chance to be the youngest EGOT winner at 38 as Mikey Madison won for Anora.

Renowned Kerala Doctor Found Dead at Farmhouse in Mysterious Circumstances

A 77-year-old top kidney transplant surgeon found hanging in his farmhouse

Joe Alwyn makes rare Oscars 2025 appearance after Taylor Swift split

Joe Alwyn surprised fans with a rare red carpet appearance at the 2025 Oscars. Read more details here

3001E, 30 Floor, Aspin Commercial Tower, Sheikh Zayed Road, Dubai, UAE

+971 52 602 2429

info@dxbnewsnetwork.com

© DNN. All Rights Reserved.