In the dynamic world of entrepreneurship, business loans play a crucial role in fueling growth and expansion. Whether you’re a startup or an established company, understanding business loans can significantly impact your financial strategy and overall success. This guide delves into the essentials of business loans, providing you with a comprehensive overview to help you make informed decisions.

Business loans are financial products provided by banks, credit unions, or other lending institutions designed to support business operations and growth. They offer a way for businesses to access capital, which can be used for various purposes such as purchasing equipment, expanding operations, or managing day-to-day expenses. Unlike personal loans, business loans are specifically tailored to meet the needs of business ventures.

Term Loans: These are traditional loans where you borrow a lump sum of money and repay it over a set period with interest. Term loans can be short-term (less than one year), medium-term (one to three years), or long-term (over three years).

SBA Loans: Offered by the U.S. Small Business Administration, these loans are partially guaranteed by the government, making them less risky for lenders. SBA loans often have favorable terms, such as lower interest rates and longer repayment periods.

Lines of Credit: A line of credit provides businesses with flexible access to funds up to a certain limit. Unlike term loans, you only pay interest on the amount you draw, making it ideal for managing cash flow and unexpected expenses.

Invoice Financing: This type of financing allows businesses to borrow money against their outstanding invoices. It’s particularly useful for companies with long payment cycles and immediate cash flow needs.

Equipment Financing: If you need to purchase or lease equipment, this loan is specifically designed for that purpose. The equipment itself often serves as collateral, reducing the lender’s risk.

Merchant Cash Advances: This form of financing provides a lump sum of cash in exchange for a portion of future credit card sales or daily bank deposits. It’s a quick way to obtain capital but often comes with higher costs.

Access to Capital: Business loans provide the necessary funds to invest in growth opportunities, purchase equipment, or cover operational costs, enabling you to scale your business effectively.

Flexible Use: Unlike some forms of financing, business loans offer flexibility in how you use the funds, allowing you to allocate resources according to your specific needs.

Improved Cash Flow: By securing a business loan, you can manage cash flow more efficiently, ensuring you have the funds to cover day-to-day expenses and avoid disruptions in operations.

Building Credit: Timely repayment of business loans can help build your business credit score, improving your chances of securing additional financing in the future.

Assess Your Needs: Determine the purpose of the loan and how much capital you need. Whether you’re looking for a long-term investment or short-term cash flow management, the type of loan you choose should align with your business goals.

Evaluate Terms and Conditions: Review the interest rates, repayment schedules, and any associated fees. Compare different business loans to find the best terms for your situation.

Consider Your Creditworthiness: Lenders will assess your credit score and financial health when considering your loan application. Ensure your business credit and personal credit scores are in good standing.

Understand the Lender’s Requirements: Each lender has different criteria for approving business loans. Make sure you understand the documentation and requirements needed for a successful application.

Seek Professional Advice: Consult with financial advisors or accountants to help you choose the right loan product and navigate the application process effectively.

Qualification Criteria: Securing a business loan can be challenging if your business has a limited credit history or insufficient financial documentation.

Interest Rates: Depending on the type of loan and your credit profile, interest rates can vary significantly. High-interest rates can impact your overall repayment cost.

Repayment Pressure: Regular loan repayments can place financial pressure on your business, especially if cash flow is inconsistent.

Collateral Requirements: Some business loans require collateral, which means you might need to pledge assets to secure the loan.

In this article, we explore the essential aspects of business loans, focusing on their significance, types, and benefits. Business loans are crucial for helping companies access capital for various needs, such as expanding operations or managing cash flow. The article details several types of business loans, including term loans, SBA loans, lines of credit, invoice financing, equipment financing, and merchant cash advances. Each type of business loan serves different purposes and comes with unique features. The benefits of business loans include improved cash flow, flexible use of funds, and the opportunity to build business credit. Choosing the right business loan involves assessing your needs, comparing terms, understanding lender requirements, and seeking professional advice. Challenges with business loans may include qualification criteria, interest rates, repayment pressure, and collateral requirements.

DXB News Network provides this article for informational purposes only. The content is designed to offer general guidance on business loans and should not be considered as professional financial advice. We recommend consulting with a financial advisor or lending professional to obtain personalized advice tailored to your specific business needs and circumstances. Business loans are complex financial products, and it is essential to thoroughly research and understand them before making any decisions.

Business Loans, Types of Business Loans, Benefits of Business Loans, Term Loans, SBA Loans, Lines of Credit, Invoice Financing, Equipment Financing, Merchant Cash Advances, Business Credit, Cash Flow Management, Loan Qualification, Interest Rates, Repayment Terms, Collateral Requirements, Financial Advice, Lending Professionals

#trending #latest #BusinessLoans, #TypesOfBusinessLoans, #BenefitsOfBusinessLoans, #TermLoans, #SBALoans, #LinesOfCredit, #InvoiceFinancing, #EquipmentFinancing, #MerchantCashAdvances, #BusinessCredit, #CashFlowManagement, #LoanQualification, #InterestRates, #RepaymentTerms, #CollateralRequirements, #FinancialAdvice, #LendingProfessionals #breakingnews #worldnews #headlines #topstories #globalUpdate #dxbnewsnetwork #dxbnews #dxbdnn #dxbnewsnetworkdnn #bestnewschanneldubai #bestnewschannelUAE #bestnewschannelabudhabi #bestnewschannelajman #bestnewschannelofdubai #popularnewschanneldubai

Saturday’s fight at Barclays Center, New York, ended in a majority draw as judges split scores...Read More.

Simple Daily Habits to Improve your Lifestyle and Boost Well-Being...Read More.

Cleveland Clinic Saves Vision for Patient with Rare Fungal Sinus Infection

Cleveland Clinic Saves Vision for Patient with Rare Fungal Sinus Infection

Cleveland Clinic Abu Dhabi saves woman’s eye from rare fungal sinusitis with surgery

India vs New Zealand Champions Trophy 2025: Varun's 5-for seals 51-run win

India vs New Zealand Champions Trophy 2025: Varun's 5-for seals 51-run win

IND vs NZ: Varun's maiden ODI five-for helps India bowl NZ out for 205, win by 51 runs

UP Woman Facing Death in UAE: Father Seeks MEA Help, Moves Delhi HC

UP Woman Facing Death in UAE: Father Seeks MEA Help, Moves Delhi HC

Shahzadi Khan, 33, from UP's Banda, faces execution in Abu Dhabi, UAE

Theyab bin Mohamed bin Zayed mourns the loss of Ahmed Mohamed Al Suwaidi

Theyab bin Mohamed bin Zayed mourns the loss of Ahmed Mohamed Al Suwaidi

Sheikh Theyab bin Mohamed bin Zayed offers condolences on Ahmed Al Suwaidi’s passing

India's Possible Playing XI vs New Zealand: Two Big Changes Expected

India's Possible Playing XI vs New Zealand: Two Big Changes Expected

India may make two changes in their XI for the final Group A game vs New Zealand

Gervonta Davis says hair product burned his eyes in fight vs Roach Jr.

Saturday’s fight at Barclays Center, New York, ended in a majority draw as judges split scores

10 Simple Ways to Improve Your Daily Lifestyle

Simple Daily Habits to Improve your Lifestyle and Boost Well-Being

KKR name new captain, vice-captain for IPL 2025: "We are confident..."

Kolkata Knight Riders named Ajinkya Rahane as captain and Venkatesh Iyer as vice-captain for IPL 2025

GEMS Education plans $300M investment to drive growth in the UAE

Dubai-based school group is exploring acquisitions to expand its education network

Dubai Police arrest 9 beggars on first day of Ramadan in crackdown effort

The arrest is part of Dubai Police’s ‘Fight Begging’ campaign to curb illegal begging

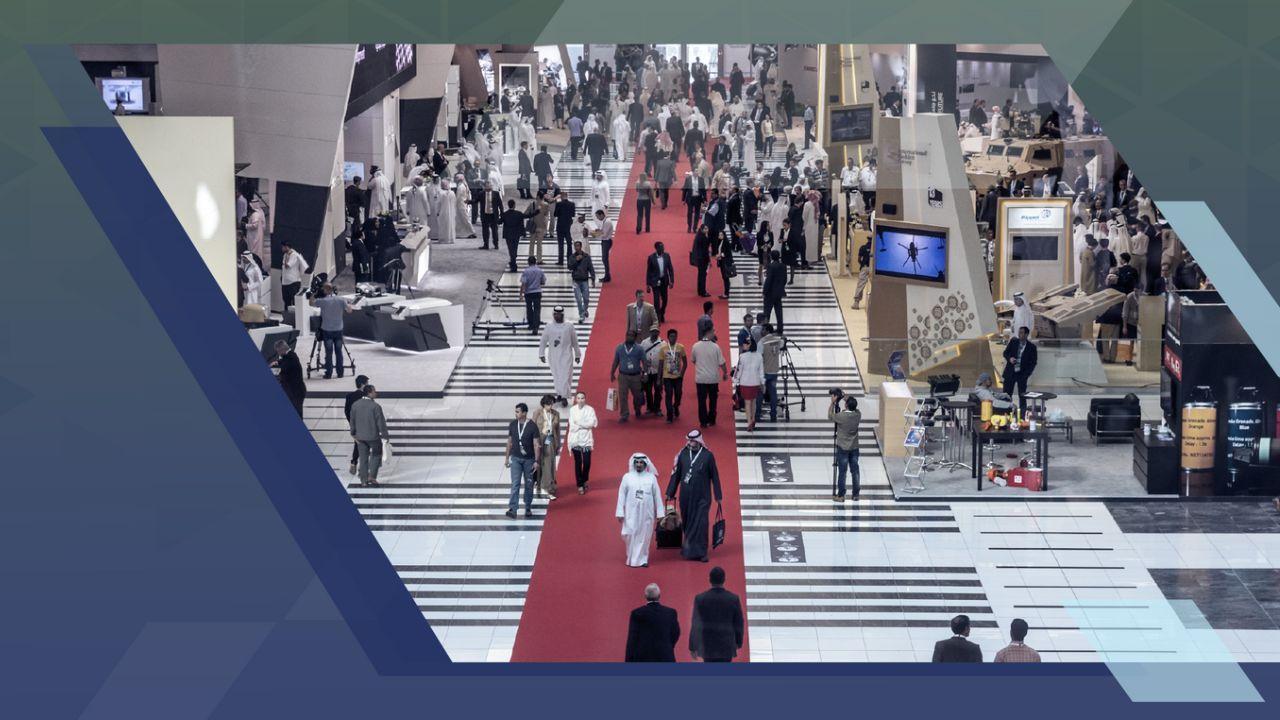

IDEX and NAVDEX 2025 set new records with highest visitor numbers

Major General Pilot Faris Khalaf Al Mazrouei said the strong participation at IDEX and NAVDEX 2025 highlights the UAE’s global reputation and progress in nation

UP woman on UAE death row executed on Feb 15, MEA tells Delhi HC

MEA said India will assist her family in traveling to Abu Dhabi for last rites on March 5

Cynthia Erivo misses EGOT title after Oscars 2025 loss; full details

Cynthia Erivo lost the Best Actress Oscar at the 97th Academy Awards, missing her chance to be the youngest EGOT winner at 38 as Mikey Madison won for Anora.

Renowned Kerala Doctor Found Dead at Farmhouse in Mysterious Circumstances

A 77-year-old top kidney transplant surgeon found hanging in his farmhouse

Joe Alwyn makes rare Oscars 2025 appearance after Taylor Swift split

Joe Alwyn surprised fans with a rare red carpet appearance at the 2025 Oscars. Read more details here

3001E, 30 Floor, Aspin Commercial Tower, Sheikh Zayed Road, Dubai, UAE

+971 52 602 2429

info@dxbnewsnetwork.com

© DNN. All Rights Reserved.