Post by: Zayd Kamal

A CIBIL score plays a crucial role in determining your financial health and eligibility for loans, credit cards, and even rental agreements. If you're aiming to improve your CIBIL score quickly, there are specific strategies you can follow to see positive changes in a short period. Whether you're preparing for a major purchase or simply want to ensure you're in good standing with financial institutions, boosting your CIBIL score is achievable with the right steps.

Before diving into the strategies, let’s first understand what a CIBIL score is. CIBIL, short for Credit Information Bureau (India) Limited, is one of the primary credit bureaus in India. It assigns a score to individuals based on their credit history and repayment behavior. The score typically ranges from 300 to 900, with higher scores indicating better creditworthiness.

A good CIBIL score is essential for securing favorable loan terms, lower interest rates, and even higher credit limits. For many financial institutions, a score above 750 is often considered excellent, whereas scores below 650 may raise concerns.

One of the first steps in improving your CIBIL score quickly is to regularly monitor your credit report. You are entitled to a free credit report once a year from CIBIL, and it’s essential to keep track of your score’s fluctuations.

Why does this matter? Checking your CIBIL report will help you spot any inaccuracies, such as wrongly reported missed payments or fraudulent activity. These discrepancies can negatively impact your score, but once identified, they can be disputed and corrected, giving your CIBIL score a boost.

The most critical factor in determining your CIBIL score is your payment history. If you want to increase your score quickly, ensure that all your bills—whether it's credit card payments, personal loans, or utility bills—are paid on time. Late payments, even if they're a day or two overdue, can negatively affect your score.

To avoid missing payments, set reminders on your phone or automate payments through your bank. This proactive approach ensures that you consistently meet deadlines and maintain a healthy credit history. Remember, payment history makes up a significant portion of your credit score calculation.

Your credit utilization ratio is the percentage of your total available credit that you are using. A high credit utilization ratio can harm your CIBIL score. Experts suggest keeping your credit utilization ratio below 30%, meaning if you have a credit card with a limit of ₹100,000, you should aim to keep your outstanding balance below ₹30,000.

To reduce your credit utilization ratio quickly, consider paying off part of your outstanding balances. Additionally, request a higher credit limit from your bank, which can help lower your utilization ratio if your spending remains the same.

Opening multiple credit accounts in a short period may appear risky to lenders. When you apply for new credit, an inquiry is made on your report, which can result in a temporary drop in your CIBIL score. These inquiries are recorded as hard inquiries and can negatively impact your creditworthiness.

To avoid this, refrain from applying for multiple credit cards or loans within a short span. Instead, focus on maintaining existing accounts responsibly. If you already have too many open accounts, consider closing some, but be mindful that closing the oldest accounts could reduce your credit history length, which may also affect your score.

Your credit mix—which includes a variety of credit types like credit cards, home loans, and personal loans—plays a role in determining your CIBIL score. Having a diverse credit mix shows that you can manage different types of credit responsibly. Lenders prefer individuals who can handle both revolving credit (such as credit cards) and installment loans (like car or home loans).

If you have only one type of credit, consider taking on a new loan, but be sure to do so carefully. Avoid taking loans you don’t need, as it could lead to unnecessary debt. The key is to have a well-rounded mix while avoiding overextending your credit.

Improving your CIBIL score is crucial for better financial opportunities, such as securing loans, credit cards, and rental agreements. A CIBIL score, ranging from 300 to 900, is determined based on your credit history and repayment behavior. To boost your score quickly, follow these essential tips: regularly check your CIBIL report to spot inaccuracies, pay bills on time to avoid negative impacts, reduce your credit utilization ratio by paying off balances or requesting higher limits, avoid opening too many credit accounts at once, and diversify your credit mix to show lenders you can manage different types of credit responsibly. By taking these steps, you can improve your creditworthiness and access better financial options.

#trending #latest #CIBILScore #FinancialHealth #CreditScore #BoostCIBILScore #CreditReport #PayBillsOnTime #CreditUtilization #CreditMix #ImproveCreditScore #FinancialTips #PersonalFinance #LoanEligibility #FinancialPlanning #Creditworthiness #FinancialFreedom #CreditManagement #CreditHistory #CIBILReport #CreditCardTips #LoanApproval #breakingnews #worldnews #headlines #topstories #globalUpdate #dxbnewsnetwork #dxbnews #dxbdnn #dxbnewsnetworkdnn #bestnewschanneldubai #bestnewschannelUAE #bestnewschannelabudhabi #bestnewschannelajman #bestnewschannelofdubai #popularnewschanneldubai

Vikrant Karyakarte: The Artist Who Paints the Rhythm of Life....Read More.

PM Modi will visit Jeddah to meet Crown Prince MBS. Talks will cover strong ties, strategy, and new MoUs. This is his first visit in his third term....Read More.

Humanoid Robots Race with Humans at Half-Marathon in China

21 humanoid robots raced alongside runners in the Yizhuang half-marathon, showcasing robotic enginee

Woman Brain-Dead After Paris Cryotherapy Accident

A woman is brain-dead after a fatal cryotherapy accident in Paris that also claimed a gym worker’s l

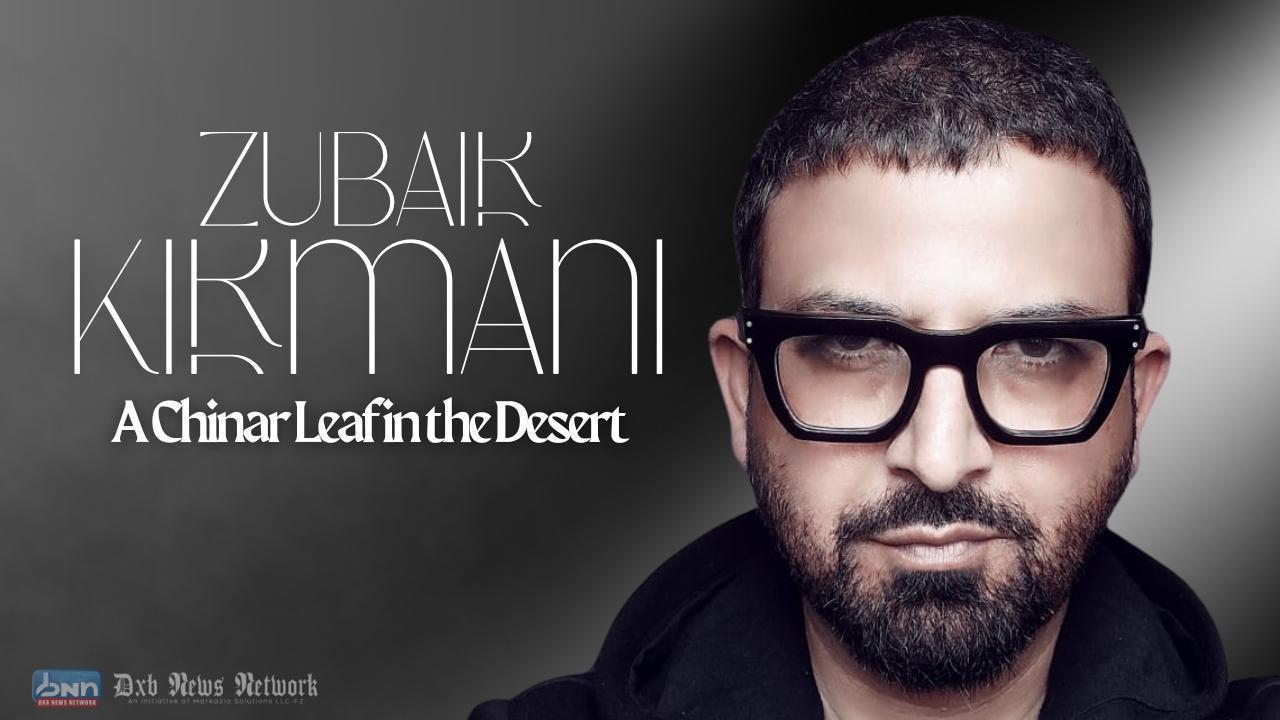

A Chinar Leaf in the Desert: Zubair Kirmani and the Journey of Kashmir at World Art Dubai

A Chinar Leaf in the Desert: Zubair Kirmani and the Journey of Kashmir at World Art Dubai

Carla Gía Brings the Language of Duality to World Art Dubai 2025

Carla Gía Brings the Language of Duality to World Art Dubai 2025

Not Just a Painting, It’s a Pulse: Deena Radhi at World Art Dubai 2025

Not Just a Painting, It’s a Pulse: Deena Radhi at World Art Dubai 2025