Post by: Vansh Kumar

Smart Money Management for Young Adults: A Guide

Your 20s are a time of exploration, growth, and new experiences, but they also come with the challenge of managing your finances. If you're feeling overwhelmed by student loans, rent, and the pressure to build a future, you're not alone. Learning how to manage money in your 20s without stress is essential for building financial security and a foundation for your future. Fortunately, with the right approach, it’s possible to take control of your finances and feel confident about your money decisions. Here’s how you can do just that!

1. Start With a Budget to Stay on Track

The first step to managing money in your 20s without stress is to create a budget. A budget helps you understand where your money is going each month and allows you to plan for expenses ahead of time. Start by tracking your income and identifying your fixed expenses, such as rent, utilities, and groceries. Then, allocate a portion of your income to savings and set aside money for leisure activities or unexpected expenses.

There are many budgeting methods you can choose from, but the key is to find one that works for you. The 50/30/20 rule is a popular method where you allocate 50% of your income to needs, 30% to wants, and 20% to savings. Sticking to a budget will give you more control over your finances and reduce the stress of wondering where your money is going.

2. Build an Emergency Fund for Financial Security

An emergency fund is one of the most important financial tools you can have. Life is full of surprises, and having an emergency fund will help you cover unexpected expenses, such as car repairs or medical bills, without going into debt. Experts recommend saving at least three to six months’ worth of living expenses in your emergency fund.

Even if it’s difficult to save large amounts at once, start small. Setting aside even $50 a month can help you gradually build your fund. The peace of mind knowing you have money set aside for emergencies will reduce financial stress and help you focus on your long-term goals.

3. Pay Off Debt Gradually

Many young adults are burdened by student loans, credit card debt, or personal loans. While paying off debt can seem overwhelming, taking it step-by-step will make the process more manageable. Start by making a list of your debts, noting the interest rates and minimum payments. Focus on paying off high-interest debt first, such as credit cards, while making the minimum payments on other debts.

Once you've tackled your high-interest debt, you can start paying off the others. Debt consolidation or refinancing options may also help lower your monthly payments and interest rates. By staying consistent and not ignoring your debt, you'll relieve the burden and build a stronger financial foundation for the future.

4. Save for Long-Term Goals

While it may seem like a luxury, saving for long-term goals—such as buying a house, traveling, or retirement—should be a priority in your 20s. The earlier you start saving, the more your money will grow thanks to compound interest.

Automating your savings is a simple way to ensure you save consistently without thinking about it. Set up automatic transfers from your checking account to a savings or investment account each month. Even saving a small percentage of your income can add up over time and provide you with more opportunities in the future.

Additionally, consider opening retirement accounts like a 401(k) or IRA if your employer offers one. The earlier you start investing in your retirement, the less stress you’ll feel about your financial future.

5. Avoid Lifestyle Inflation

As you progress in your career and your income increases, it can be tempting to increase your spending as well. However, this “lifestyle inflation” can lead to financial stress later on. Instead of spending your extra income on luxuries, try to save or invest the difference. By continuing to live below your means, you can achieve your financial goals faster and build wealth over time.

Making small lifestyle changes, such as cooking at home, cutting unnecessary subscriptions, and avoiding impulse purchases, can significantly reduce your living expenses. This will give you more money to save, pay off debt, and invest in your future, without increasing your financial stress.

6. Learn About Investing and Grow Your Wealth

Investing is one of the best ways to build wealth over time. While investing can seem intimidating, there are simple and low-cost ways for beginners to get started. Start by educating yourself on basic investment principles, such as stocks, bonds, and mutual funds. Once you’re familiar with the basics, consider opening an investment account and contributing regularly to a diversified portfolio.

Many platforms now offer automated investing, also known as robo-advisors, which can help you make smart investment choices with minimal effort. Starting early will allow your investments to grow and build wealth for your future, ultimately making managing money in your 20s less stressful in the long run.

7. Be Smart About Credit and Build Your Score

Building and maintaining good credit is an essential part of financial health. Your credit score can affect your ability to get loans, credit cards, and even rent an apartment. Start by paying your bills on time, keeping credit card balances low, and not applying for too much credit at once.

If you have no credit history, consider applying for a secured credit card or becoming an authorized user on a family member’s account to start building your credit. A good credit score can save you money on interest rates and loans, which will help you manage your finances with less stress.

Disclaimer:

The information and opinions presented in this article are for general informational purposes only. While we strive to provide accurate and up-to-date content, DXB News Network does not guarantee the completeness, accuracy, or reliability of the information. Readers should exercise discretion and, if necessary, consult a financial or professional advisor before making any financial or investment decisions. DXB News Network is not responsible for any consequences arising from the use of the information provided.

#trending #latest #MoneyManagement #FinancialPlanning #YoungAdults #PersonalFinance #MoneyTips #ManageMoney #FinancialFreedom #BudgetingTips #MoneyInYour20s #FinanceForYoungAdults #breakingnews #worldnews #headlines #topstories #globalUpdate #dxbnewsnetwork #dxbnews #dxbdnn #dxbnewsnetworkdnn #bestnewschanneldubai #bestnewschannelUAE #bestnewschannelabudhabi #bestnewschannelajman #bestnewschannelofdubai #popularnewschanneldubai

His Highness adds new job grades & adjusts service years, boosting careers & work environment for Sharjah Government employees...Read More.

Robotics shaping smarter living in everyday human life...Read More.

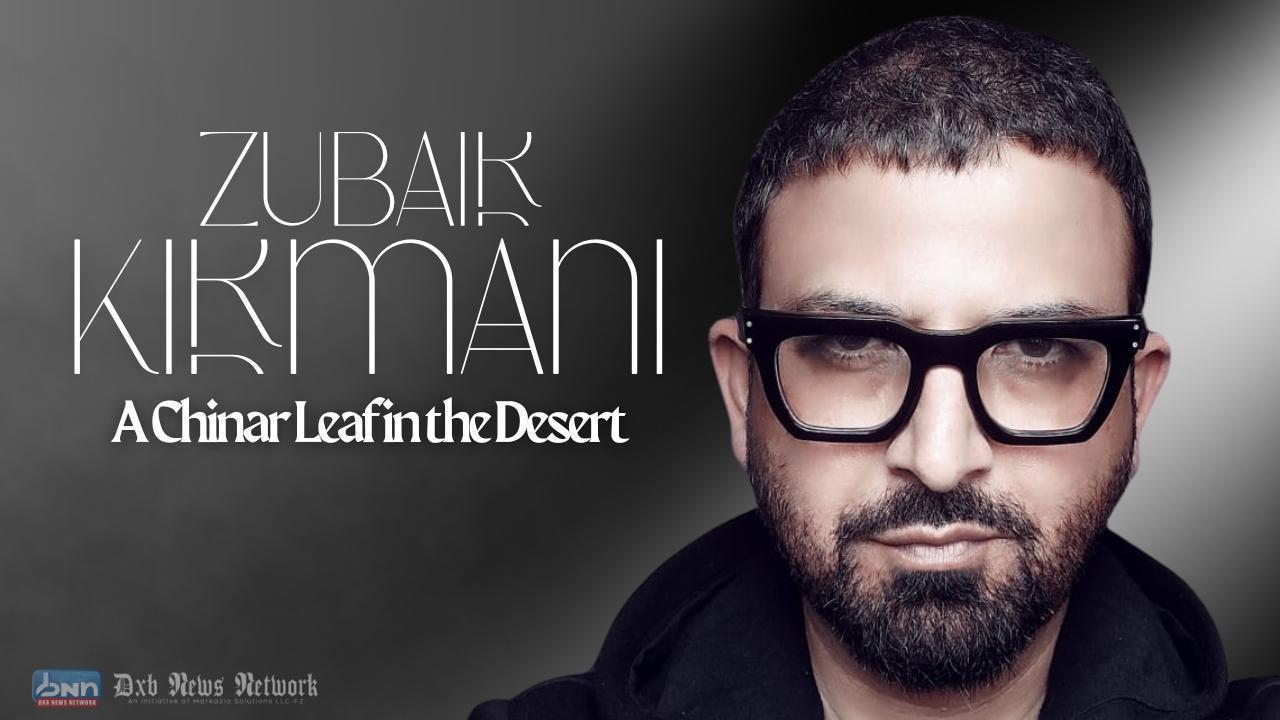

A Chinar Leaf in the Desert: Zubair Kirmani and the Journey of Kashmir at World Art Dubai

A Chinar Leaf in the Desert: Zubair Kirmani and the Journey of Kashmir at World Art Dubai

Carla Gía Brings the Language of Duality to World Art Dubai 2025

Carla Gía Brings the Language of Duality to World Art Dubai 2025

Not Just a Painting, It’s a Pulse: Deena Radhi at World Art Dubai 2025

Not Just a Painting, It’s a Pulse: Deena Radhi at World Art Dubai 2025

FSU Shooting: Police Officer's Son Kills 2, Injures 6 in Attack

A shooting at Florida State University leaves two dead and six injured. The suspect, Phoenix Ikner,

Khaled bin Mohamed Opens teamLab Phenomena in Saadiyat District

A stunning new art space just opened in Abu Dhabi! Explore light, sound & motion in teamLab Phenomen